Preferreds Weekly Review: Agency mREIT Preferreds Kick Off Earnings

Summary

- We take a look at the action in preferreds and baby bonds through the last week of April and highlight some of the key themes we are watching.

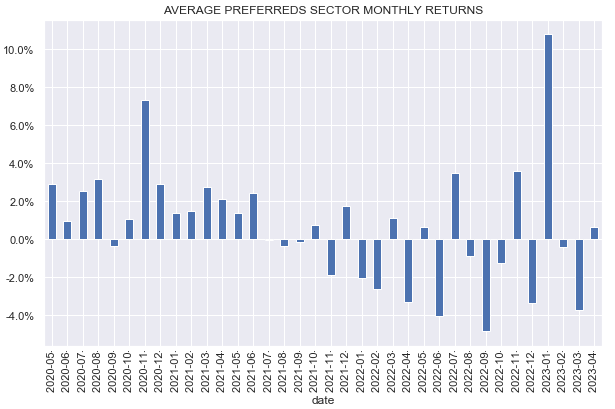

- Preferreds gained over April as risk sentiment turned positive in the absence of further bank tremors.

- Agency mortgage REITs kicked off earnings with mixed reports.

- We're about to raise prices at my private investing ideas service, Systematic Income, where members get access to portfolios, market alerts, real-time chat, and more. Learn More »

Darren415

This article was first released to Systematic Income subscribers and free trials on May. 1

Welcome to another installment of our Preferreds Market Weekly Review, where we discuss preferred stock and baby bond market activity from both the bottom-up, highlighting individual news and events, as well as top-down, providing an overview of the broader market. We also try to add some historical context as well as relevant themes that look to be driving markets or that investors ought to be mindful of. This update covers the period through the last week of April.

Be sure to check out our other weekly updates covering the business development company ("BDC") as well as the closed-end fund ("CEF") markets for perspectives across the broader income space.

Market Action

Preferreds eked out a positive return over April as the bank tantrum appeared to fizzle out (First Republic limbo situation notwithstanding) and the broader income space rallied.

Systematic Income

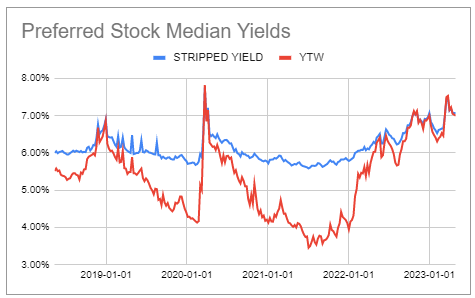

Preferreds yields continued to fall from a very attractive 7.5% level towards a decent, if less appealing, 7%.

Systematic Income Preferreds Tool

The rally in yields was achieved primarily through tighter credit spreads which are now closer to their longer-term average.

Systematic Income Preferreds Tool

Market Themes

Agency-focused mortgage REITs kicked off the Q1 earnings season.

Dynex Capital (DX) book value unusually underperformed in a difficult market, with a 6% drop in book value. It looks like DX mistimed the leverage increase - they didn’t catch as much of the Q4 uplift due to low leverage and then boosted leverage just as Q1 delivered a lot of rate volatility and pushed book values lower.

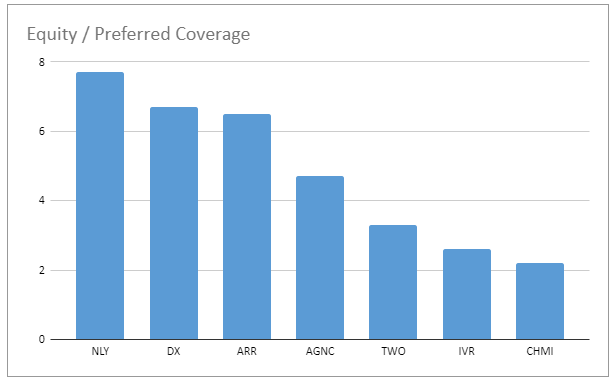

The drop in book values over Q1 was mitigated somewhat by additional common share issuance - a welcome theme in the sector which supported the equity / preferred coverage ratio.

AGNC Investment Corp. (AGNC) book value fell around 4%, however it also issued additional common shares, which caused the equity / preferred coverage ratio to fall only marginally.

Annaly Capital Management (NLY) reported very good results. Book value was basically flat - a very strong outcome in the sector with falling book values in Q1. Moreover, NLY has continued to issue equity so at quarter end equity coverage rose to 7.7x from 7.4x. This pattern highlights why our Income Portfolios are much more tilted to NLY preferreds than any other Agency mREIT.

NLY tends to run at a relatively low leverage in the sector and also tends to issue a lot of equity. This means its equity coverage ratio remains well supported.

Amazingly, its equity coverage ratio is the same as it was in December 2019 despite a very challenging environment for Agency mREITs since then. This is the strongest result outside of DX (which redeemed a preferred so it’s not really comparable).

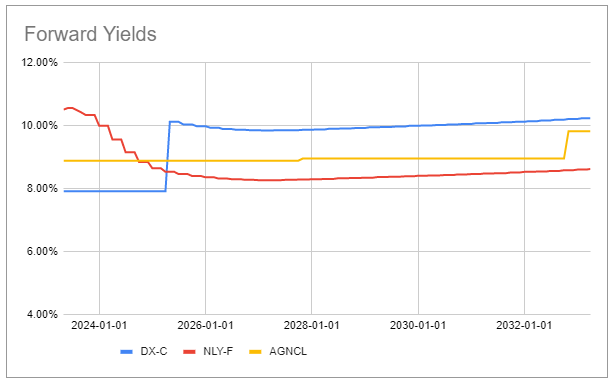

We continue to tilt to higher-quality agency-focused mREIT preferreds such as DX.PC and NLY.PF, trading at 7.9% and 10.5% yields. These companies have seen consistently less book value erosion over time in the sector, a key factor which protects the preferreds.

Systematic Income

DX.PC is expected to reset to a double-digit yield of around 10.1% in 2025 based on today's interest rate forwards. We like the profile of the AGNC Series G (AGNCL), trading at a 8.9% stripped yield given its link to the 5Y Treasury yield when it floats.

Systematic Income Preferreds Tool

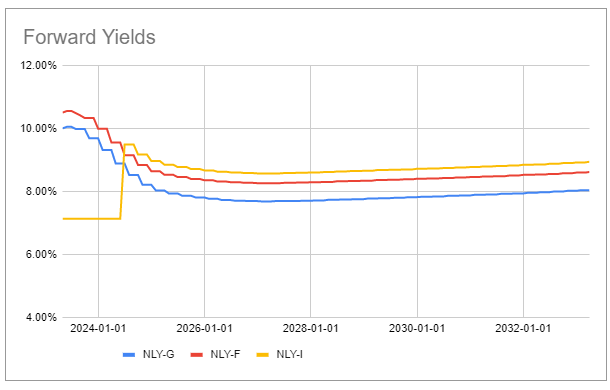

We are also eyeing an opportune time to rotate to (NLY.PI) from NLY.PF as its yield is expected to move above that of NLY.PF on its first call date in mid-2024, unless redeemed.

Systematic Income Preferreds Tool

This article was written by

At Systematic Income our aim is to build robust Income Portfolios with mid-to-high single digit yields and provide investors with unique Interactive Tools to cut through the wealth of different investment options across BDCs, CEFs, ETFs, mutual funds, preferred stocks and more. Join us on our Marketplace service Systematic Income.

Our background is in research and trading at several bulge-bracket global investment banks along with technical savvy which helps to round out our service.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NLY.PF, DX.PC, AGNCL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.