Generating Income By Harnessing Volatility

Summary

- Interview with an institutional money manager of actively managed, income-focused ETFs on the need to develop the right mindset to address a VUCA investment environment.

- Discussion challenges traditional investment thinking and outlines an income-generating approach by applying different perspectives to topics like volatility and options.

- Explaining their portfolio construction and option overlay strategy decisions and how it is a way of harnessing volatility as an untapped asset class versus being fearful of it.

DNY59

[The current VUCA environment (Volatility, Uncertainty, Complexity, and Ambiguity) is presenting a growing challenge to the investment management industry. This acronym - used to describe the challenges of operating in a rapidly changing, turbulent environment - outlines a concept that applies particularly well to our financial services business environment and investment reality. The development of the right mindset to address this environment has been of growing importance to investment managers and has been shaping many investment strategies.

This environment requires investors to challenge their thinking as strategic reflection can only be achieved by consciously battling embedded biases and set patterns of thought. We are often blinded by the knowledge we have acquired and cannot "see" or accept different opportunities. Our expectation of how things are "supposed to be" gets in our way. Sometimes though, slight shifts in perspective can be all that is needed.

As an example of challenging traditional investment concepts and methodologies, and to better understand applying different perspectives to topics like volatility and options, we were introduced to David Gilreath , Managing Director and Chief Investment Officer and Ron Brock, Managing Director of Innovative Portfolios - an institutional money management firm offering actively managed, income-focused ETFs and separately managed account (SMA) portfolios to financial professionals, RIAs, consultants, and institutional investors. We explored their perspectives on volatility and their option strategies that are geared toward generating income in return for additional risk. This is a revealing discussion at a time when investors are seeking to incorporate more defensive income-generating and diversification strategies.]

Hortz: How does your approach to money management challenge some traditional assumptions about investing?

Gilreath: When advisors' clients think of volatility, many see only risk, not opportunity. In response, many RIAs look for ways to mitigate volatility on a portfolio.

From our perspective, we do not view volatility as the same as risk. Volatility is simply the price of admission to enter investment markets. In the most general sense, we embrace and even harness volatility in an attempt to add return to an underlying portfolio.

We feel it is a more rational approach for equity investors to harness volatility for potential gain through a disciplined, long-term options overlay strategy to exploit the nature of the market. Some advisors might regard a long-term options strategy as an unattractive choice for their individual clients as the word "options" remains a fear trigger, owing to its association with Wall Street speculators, the inclusion of options in the derivatives category (with derivatives generally being considered "high risk"), and the presumption that option writing is a messy process.

Hortz: How exactly do you utilize volatility for its potential to enhance returns?

Brock: Historically, market participants purchasing options for protection against downside price movements are willing to pay a premium to compensate counterparties for the protection they provide. Investors' risk aversion and a tendency to overestimate volatility in the market drives higher demand and, therefore, can provide a higher price for this protection, or insurance. This means, in theory, an option buyer is willing to pay more than they should for the protection they are purchasing.

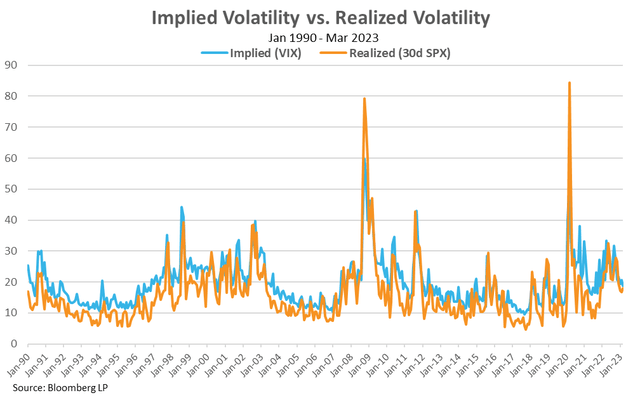

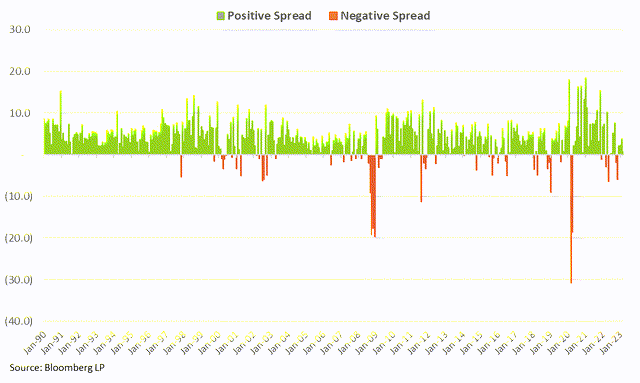

Gilreath: In our experience, opportunities to harness volatility are available through capturing the Volatility Risk Premium (VRP). The VRP is calculated as the difference between the expected 30-day volatility, or implied volatility, and the subsequent 30-day realized volatility. This can be captured several ways, including selling a put (naked or cash-secured) or a vertical put spread.

Hortz: What are the benefits of options in client portfolios? Why is it a core tenant of your investment strategy?

Gilreath: Clients are looking to add some incremental income to their underlying portfolios - a synthetic market dividend is how it can be looked at. The premiums may also be tax-advantaged (60% long-term/40% short-term) depending on the contracts that are used. While we utilize options in many of our portfolios, this style of options writing should always be used in combination with an overall investment strategy, not as a core tenant of an investment strategy. This strategy can be additive and layers market risk on top of other investments with the objective of providing incremental returns.

This strategy also presents clients with low-cost basis or concentrated positions an opportunity to generate potential additional return without a large tax burden from having to liquidate their positions, creating almost a synthetic dividend. Options may be written on stocks, bonds, preferreds, ETFs, mutual funds, and most other investment instruments.

Hortz: How do you explain harnessing volatility to retail clients who may only see risk? What key myths or misconceptions about options and option writing strategies need to be addressed?

Brock: We like to view volatility as a bit of an untapped asset class. If people look, they will find some reason to be concerned about the market - wars, inflation, political fallout, terrorist attacks, economic data, etc. Nonetheless, we demonstrate how a long-term chart of the S&P 500 goes from the bottom left to the top right because over time the market has gone up regardless of what is going on in the world.

When it comes to option writing, the first step is to get them to understand that using options may be a way to harness the volatility they fear rather than lose sleep over it. It comes down to effective education on both topics.

Many investors believe that options are exotic, only used for speculation, and that they carry far higher risks than trading regular stocks. There are certainly investors who use them in a speculative and risky manner. However, as professional investment advisors, we see the risk profile as far more similar to the overall stock market when proper risk measures are employed. Because of this, we will continue to sell option buyers - who are willing to pay more than they should for the protection they are purchasing - the protection they seek and collect the premiums they are willing to pay.

Hortz: Are the chances for incremental additional returns worth the additional exposure to volatility?

Gilreath: Of course, we believe the chance for incremental return is worth the risk.

Historically, we observed the VRP on the S&P 500 Index, as measured by the VIX Index minus the subsequent 30-day realized volatility on the S&P 500 Index, generate positive returns most of the time. Over the last 33 years, the referenced VRP on the S&P 500 Index was positive in 345 out of 399 measured occurrences, or 86.5% of the time. The charts below illustrate the historical performance of the VRP on the S&P 500 since the inception of the VIX Index through March 2023. This means selling volatility through options has been profitable the vast majority of the time since 1990.

Hortz: Can you share with us your underlying portfolio selection process and how you employ your option overlay strategies?

Gilreath: The equities in our dividend-driven portfolio are a subset of the NASDAQ US Broad Dividend Achievers® Index constituents, companies that have raised their dividend each year for at least ten years. We own fifty of those stocks with the lowest downside risk, according to the quantitative metrics we use.

Our preferred stock portfolio is comprised of retail, $25-par preferreds as the core position, and an option overlay. As for the employment of the option overlay strategies, we use a long-term time-decay, premium capture put credit spread on the S&P 500 or a similarly situated ETF. We sell a short out-of-the-money put option typically 3-5% below current levels of the S&P 500, while simultaneously purchasing a long out-of-the-money put option, typically 15% below the short put option strike price at the same expiration, which creates a put credit spread.

Hortz: Why have you described option writing strategies as a messy process and was that a motivation to create your mutual funds, then later your ETFs?

Brock: Writing short options in client accounts can be difficult for the clients to follow. Cash is deposited when the short option is written but not realized until it's closed. There is a negative liability associated with a short option that can be difficult for clients to understand as well. There are also numerous trades a month which may complicate matters. Additionally, we cannot always control the collateral that a client may have supplied, and if it is underperforming the market then it may affect the ability to write options in general.

Using mutual funds, and later our ETFs, took most if not all these pains away. Clients see an NAV, not a liability and trades that they may not understand. Additionally, we control the underlying collateral in the funds. An ETF can also provide a similar layer of tax advantages as the options contracts themselves can, as indicated above.

Hortz: Can you offer any recommendations for advisors on how to characterize volatility and option strategies for client portfolios?

Gilreath: Educate clients that volatility and risk are two different things. If a client can look past the short-term, day-to-day volatility and focus on the potential for higher long-term potential income and growth, then we might be a good solution for them. Selling puts as a strategy can reduce risk when used to enter equity positions. We use this concept and expand upon it by systematically selling put spreads with no intention of actually entering the underlying position. This strategy can be used to incrementally generate income over long periods of time. Over the short term however, it can increase volatility of the underlying portfolio. If a client is a long-term investor, we believe they should try to profit from volatility instead of hiding from it.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

The Institute is a business innovation platform and educational effort with financial services firms to openly share their unique perspectives and activities to build awareness and stimulate open thought leadership discussions on new or evolving industry approaches and thinking.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.