Wheaton Precious Metals Soon To Become Red Hot

Summary

- An operating cash flow of $135 million, a cash balance of $800 million and no debt, what's not to like.

- A streamer that is well placed to take full advantage of the developing bull market in precious metals.

- Revenue is derived from their asset base consisting of 20 contracts on operating mines and 12 development projects.

- For those investors wanting exposure to the precious metals sector rather than a mix of underlying commodities, WPM is the place to be.

Wirestock/iStock via Getty Images

Introduction

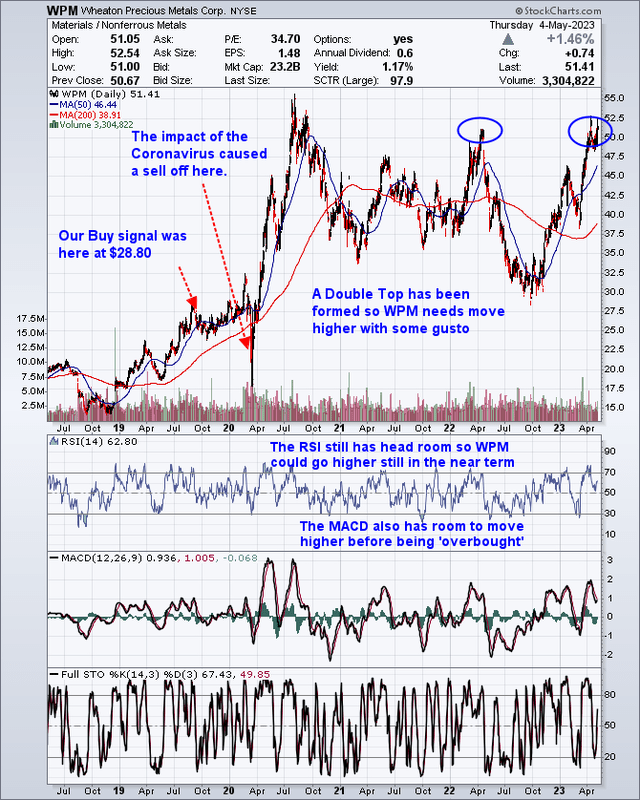

Back in September 2019, we penned an article on Wheaton Precious Metals Corporation (NYSE:WPM) complete with a Buy signal and a target price of $100.00. We paid the princely sum of $28.80 which I thought was fair value at the time. Today, WPM stock trades at around $51.00, registering a gain of 77% which is not too shabby, but nowhere near my target price of $100.00.

Today, we will a quick look at WPM's recently published Q1 Financial Results.

Wheaton Precious Metals Corporation Financials

We will start with Randy Smallwood, President and Chief Executive Officer of Wheaton Precious Metals who stated:

Wheaton's high-quality portfolio of long-life, low-cost assets delivered a solid performance to start the year, resulting in revenue of $214 million and robust cash operating margins,"

Operating cash flow was $135 million, cash balance $800 million and no debt, and a declared quarterly dividend of $0.15 per common share for Q1. The dividend payment has remained fairly stable over the last quarter or so, but it is not exactly earth shattering. It should be noted their revenue of $214 million missed expectations by $19.86 million, which is not something that I am overly bothered about, however, analysts may take a dim view of it.

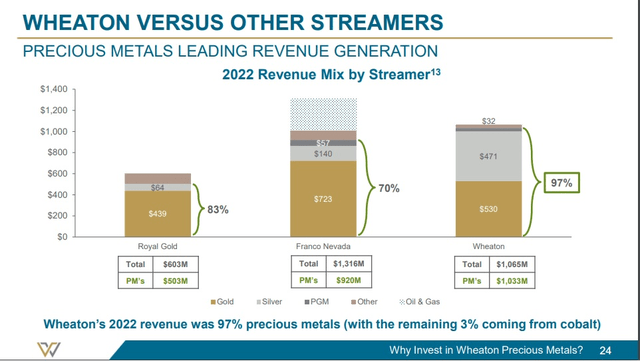

Revenue is derived from their asset base consisting of 20 contracts on operating mines and 12 development projects. For those investors wanting exposure to the precious metals sector rather than a mix of underlying commodities, WPM is the place to be. The chart below depicts the leading precious metals revenue generators for comparison purposes between Royal Gold Inc (RGLD), at 83%, Franco-Nevada Corp (FNV) at 70%, and Wheaton Precious metals Corp at 97%.

Wheaton Compared to Franco-Nevada and Royal Gold (WPM May 2023 Corporate Presentation)

As a gold and silver bug at heart I want the maximum exposure possible to these two metals as the other commodities are of little interest to me, rightly or wrongly.

This company has a market capitalization of $23.53B, an EPS of $1.48 and a P/E ratio of 34.74 and pays regular dividends. The average volume of shares traded on a daily basis is 2,466,472 so nimble traders can trade in and out of this stock on a daily basis. The 52-week trading range has been from a low of $28.62 to a high of $52.76 so wide swings in the stock price ought to be expected. Having established a fixed delivery price for gold and silver any increase in the price of the metals will add some sparkle to turnover and profit.

A Quick Look At The Chart Of Wheaton Precious Metals Corporation

The Double Top formed recently needs to hold and this stock needs to move to higher ground preferably above the $55.00 mark and establish a new all-time high. Then we would be in unchartered waters allowing for a spectacular rally to ensue.

Wheaton Progress Chart (StockCharts)

Conclusion

The Streaming sector is expanding and some of these companies are maturing and becoming major players in the precious metals space and in Wheaton Precious Metals we have a star performer.

If the bull market for gold and silver develops as I expect it to, then this company is well positioned to deliver excellent returns and is well worth some due diligence time on your part.

A word of caution though as I have been a big fan since the days when they were Silver Wheaton and it was one of my best performing stocks, so I am long and biased towards them.

For the record, I have been long physical gold and silver for a number of years and also own a portfolio of stocks in the precious metals sector including Sandstorm Gold Ltd (SAND), Wheaton Precious Metals Corp, Agnico Eagle Mines Limited (AEM) and SSR Mining Inc (SSRM).

You must have a comment so please add it to the commentary and I will do my best to address each and every one of them as the discussion is such a benefit for all concerned in these endeavors.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of WPM, SAND, SSRM, AEM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

gold-prices.biz makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents our views and replicates trades that we are making but nothing more than that. Always consult your registered adviser to assist you with your investments. We accept no liability for any loss arising from the use of the data contained on this letter. Options contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. Past performance is neither a guide nor guarantee of future success.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.