SHV: If There's A Free Lunch On Wall Street, This Is It

Summary

- They say there's no free lunch on Wall Street, that every return comes with a commensurate level of risk of loss. In investing and life, that's true.

- However, since everything in investing is relative, when I look at SHV, I see the closest thing I've seen to a free lunch.

- SHV remains a Strong Buy, a stalwart in my own portfolio, and a potential oasis at a frenetic time for markets in general, and US Treasuries in particular.

Thinglass

The iShares Short Treasury Bond ETF (NASDAQ:SHV) remains one of my favorite ETFs. I originally assigned it a Strong Buy rating back on January 1 of this year. And the case for owning it is as strong as it was 4 months ago. That has less to do with the fluctuation in the T-Bill (1 year to maturity and under) portion of the US Treasury yield curve, and more to do with the absence of meaningful alternatives to accepting a 4.5%-5.0% yield on the alleged "risk-free" investment that is T-Bills.

T-Bill Yields: Not A Transposition Error!

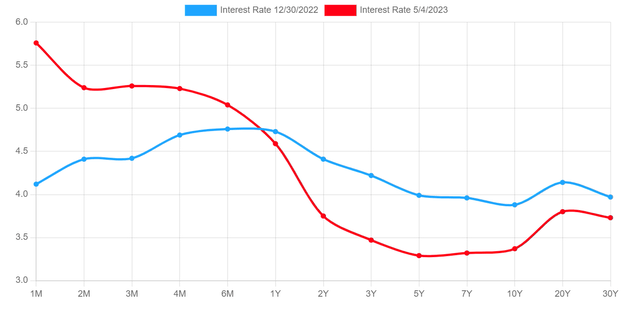

Here's what the yield curve looked like at the start of the year, and what it looks like now. SHV made a lot of sense back then because short-term rates with the backing of the country that possesses the world reserve currency (US Dollar) had climbed from about 0.4% to 4.0%. That "not a transposition error" move was a game-changer for investors. And little did we know that approaching the mid-way point of 2023, not much has changed.

As many including strategist Jim Bianco have commented recently, the S&P 500 has 8 stocks that have pushed that index up this year, and the other 492 have done nothing, net-net. In fact, the S&P 500 is about where it was 2 years ago. Small caps are not providing an enthusiastic alternative, and the US Dollar is strong, and non-US economies weak enough, to prevent international stocks from rivaling the "take your 5% and sit down" attitude that many investors have increasingly adopted as this year has gone on.

Fast forward to the past 2 weeks, and we can see that there's even more going on that creates historic levels of skittishness on the part of investors.

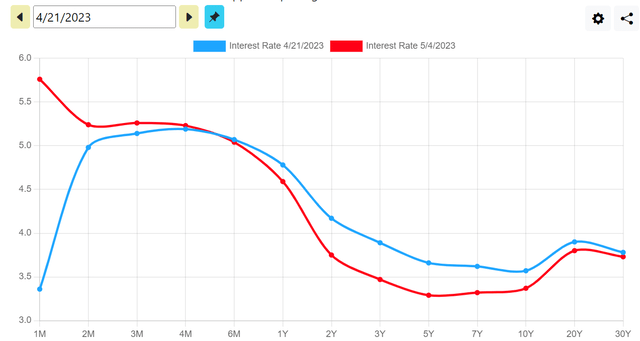

Above is that same current yield curve in red. But now the blue line is the curve as of just 2 weeks ago. The medium to long-end of the curve has dipped a bit, in what could be a way of investors saying they'd rather take their chances with intermediate-to-long-term Treasuries, rather than be heavily invested in stocks. Regardless of the reason, a sluggish stock market, fears of stagflation and a lack of closure regarding Fed policy are just some of the reasons that the "free lunch" of getting a mid-single digit return sounds pretty good right now.

SHV is a comprehensive allocation across that 0-1 year part of the Treasury yield curve. It currently holds 49 different Treasury issues, most of which are T-Bills and others are previously issued coupon bonds that are very close to maturity. SHV's portfolio yield sits around 4.6%, but that number is a moving target, especially lately.

1-Month T-Bills at 5.7%?! Smells like fear of the debt ceiling

Referring back to that chart immediately above, look at the dramatic change in the very short end of the Treasury yield curve. 1-month T-Bills, which were finally fading down into the mid-3% range, vaulted up to about 5.7% in just 2 weeks!

The culprit for such a radical move in a typically quiet part of the curve seems pretty simple: the debt ceiling debate. Or, shall I say, the lack of a debate, which makes the possibility of a US default...I can't believe I'm writing this...on the table, and soon. As investors, we can't control the politics of this, but we can control how we respond to any risk that comes our way. And, that creates the strangest decision for T-Bill investors, maybe in history. Do you risk being one of those who don't get paid when T-Bills mature, even though that should be temporary? At this point, I'm taking that risk. Because frankly, if we can't count on T-Bills, the global markets have much, much bigger troubles.

What kind of trouble? How about a recession?

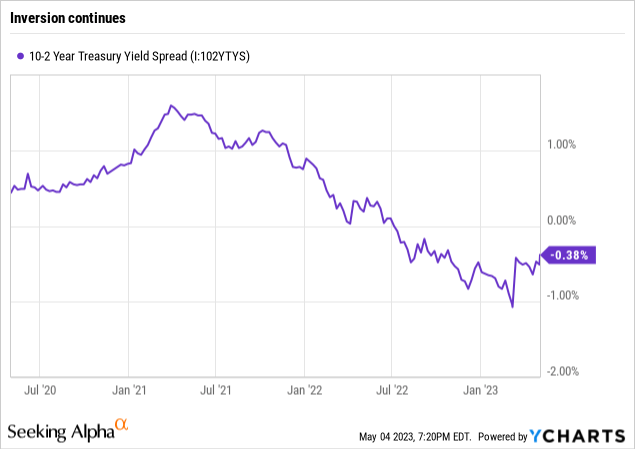

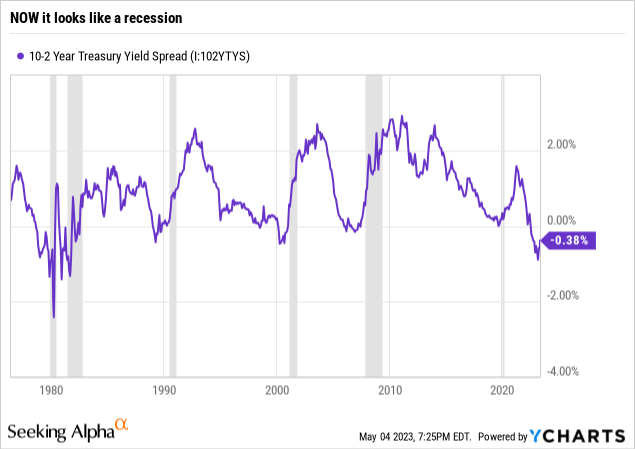

Here is the 10-2 Year Treasury yield spread, which has been as reliable a recession indicator as anything over the decades. The first chart shows how the spread is finally starting to recover rapidly from being "inverted" to a historical level. At 38 basis points, it is within striking distance of the zero line.

It is often misunderstood by investors that recessions come shortly after the curve inverts, with 2-year bonds yielding more than 10-year bonds. Look at the second chart below, which shows the pattern I just mentioned. The curve un-inverts, and then the recession begins. And, while the timing of a recession is more of a media talking point than a concern for investors (we just care about making money and not losing it), it goes back to my main thesis of this article: the investment markets are not offering much, and ETFs like SHV continue to be in the sweet spot, at least until an investable trend emerges elsewhere.

SHV continues to be a key cog in my income and preservation oriented personal portfolio. My number one investment rule is to "avoid big loss." The markets continue to frustrate most attempts to actually invest in something and earn a sustainable profit, rendering little more than swing-trading potential. And with the credit markets skittish across the board, I'm looking for some anchor positions in my portfolio. SHV is one for now, and it remains a Strong Buy for me. Sometimes, the best investing is the most straightforward. And in a year which offers a lot of difficult conditions to digest, SHV looks like the closest thing to a free lunch I expect to find.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SHV either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.