IJS: Value ETF Outperforming Competitors In The Last 12 Months

Summary

- iShares S&P Small-Cap 600 Value ETF holds almost 500 small caps with value characteristics.

- The IJS ETF is well-diversified across sectors and holdings.

- Performance since 2000 is similar to the small cap benchmark S&P 600.

- IJS has outperformed competitors in the last 12 months.

- Two weaknesses of value indexes discussed.

- Quantitative Risk & Value members get exclusive access to our real-world portfolio. See all our investments here »

Vladimir Zakharov

This article series aims at evaluating ETFs (exchange-traded funds) regarding the relative past performance of their strategies and metrics of their current portfolios. Reviews with updated data are posted when necessary.

Strategy and portfolio

iShares S&P Small-Cap 600 Value ETF (NYSEARCA:IJS) has been tracking the S&P SmallCap 600 Value Index since July 2000. It is the second small-cap value ETF regarding assets under management, after Vanguard Small-Cap Value ETF (VBR) ($6.6B vs $23B). IJS has 495 holdings, a 12-month trailing yield of 1.47% and a total expense ratio of 0.18%. SPDR S&P 600 Small Cap Value ETF (SLYV) and Vanguard S&P Small-Cap 600 Value Index Fund (VIOV) have the same underlying index and a similar expense ratio (0.15%).

As described by S&P Dow Jones Indices, S&P 600 constituents are ranked in Value and Growth styles using three valuation ratios and three growth metrics. The valuation ratios are book value to price, earnings to price and sales to price. By construction, 33% of the parent index constituents exclusively belongs to each style, and 34% belongs to both styles. The Value subset serves as S&P 600 Value Index and is rebalanced annually. It is capital-weighted, with an adjustment for constituents belonging to both styles. For example, a company with a Value rank better than its Growth rank is given a larger weight in the Value Index than in the Growth Index.

As expected, aggregate valuation ratios are lower than for the parent index S&P SmallCap 600, represented in the next table by the iShares Core S&P Small-Cap ETF (IJR). It is cheaper than its larger competitor VBR regarding the price/book, price/sales and price/cash flow ratios, but not for price/earnings.

IJS | IJR | VBR | |

Price/Earnings TTM | 11.19 | 11.81 | 10.56 |

Price/Book | 1.26 | 1.61 | 1.64 |

Price/Sales | 0.62 | 0.85 | 0.85 |

Price/Cash Flow | 7.29 | 8.42 | 7.66 |

Source: Fidelity.

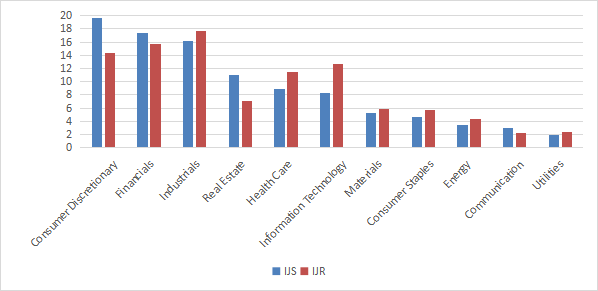

The top 3 sectors are consumer discretionary (19.6% of asset value), financials (17.4%) and industrials (16.2%). Compared to its parent index, IJS overweights consumer discretionary, real estate, and to a lesser extent, financials and communication services. It underweights mostly technology and healthcare.

Sector breakdown in % (chart: author; data: iShares)

IJS has almost 500 holdings. The top 10 names represent 7.9% of asset value. The next table reports their weights and valuation ratios. The heaviest one weighs about 1%, so the fund is well-diversified and risks related to individual stocks are very low.

Ticker | Name | Weight% | P/E ttm | P/E fwd | P/Sales | P/Book | P/FCF | Yield% |

Meritage Homes Corp. | 1.07 | 5.07 | 8.26 | 0.73 | 1.13 | 9.64 | 0.87 | |

Insight Enterprises, Inc. | 0.88 | 16.62 | 12.57 | 0.46 | 2.94 | 9.47 | 0 | |

Essential Properties Realty Trust, Inc. | 0.84 | 23.47 | 26.54 | 12.23 | 1.40 | 50.97 | 4.37 | |

John Bean Technologies Corp. | 0.77 | 25.39 | 19.27 | 1.49 | 3.72 | 100.85 | 0.39 | |

Avista Corp. | 0.74 | 23.94 | 19.11 | 1.93 | 1.40 | N/A | 4.16 | |

Group 1 Automotive, Inc. | 0.74 | 4.68 | 5.25 | 0.18 | 1.28 | 10.01 | 0.83 | |

Rogers Corp. | 0.72 | 31.70 | 38.16 | 3.12 | 2.56 | 75.22 | 0 | |

Signet Jewelers Ltd. | 0.72 | 11.18 | 6.05 | 0.47 | 2.35 | 6.29 | 1.37 | |

Select Medical Holdings Corp. | 0.71 | 23.85 | 14.70 | 0.58 | 3.29 | 123.58 | 1.72 | |

Itron, Inc. | 0.7 | N/A | 54.21 | 1.64 | 2.54 | 624.96 | 0 |

Ratios: Portfolio123.

IJS is very close to its parent index in return and risk metrics measured since 8/1/2000 (reported in the next table). It has exactly the same Sharpe ratio, a measure of risk-adjusted performance.

since 8/1/2000 | Total Return | Annual Return | Drawdown | Sharpe ratio | Volatility |

IJS | 600.70% | 8.93% | -60.11% | 0.45 | 20.51% |

IJR | 591.71% | 8.87% | -58.15% | 0.45 | 19.47% |

Data calculated with Portfolio123.

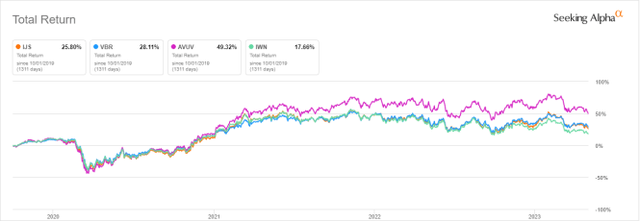

The next chart compares total returns of IJS and 3 other small cap value funds:

- Vanguard Small-Cap Value ETF (VBR), reviewed here,

- iShares Russell 2000 Value ETF (IWN), reviewed here,

- Avantis U.S. Small Cap Value ETF (AVUV), reviewed here.

The latter is actively managed and the other ones track different indexes. The starting date is 10/1/2019 to match all inception dates.

IJS vs competitors since 10/1/2019 (Seeking Alpha)

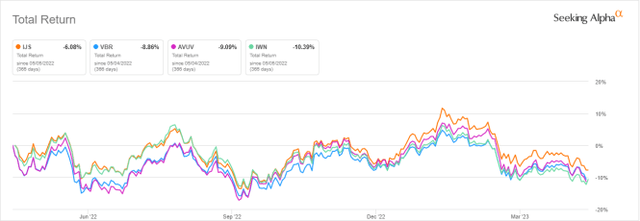

IJS beats the Russell 2000 Value ETF, it is close behind the Vanguard fund, but it lags the Avantis ETF by 23.5% in total return. However, IJS has been the best performer in the last 12 months:

IJS vs competitors, last 12 months (Seeking Alpha)

Comparison with my Dashboard List model

The Dashboard List is a list of 60 to 80 stocks in the S&P 1500 index, updated every month based on a simple quantitative methodology. All stocks in the Dashboard List are cheaper than their respective industry median in Price/Earnings, Price/Sales and Price/Free Cash Flow. An exception in utilities: the Price/Free Cash Flow is not taken into account to avoid some inconsistencies. Then, the 10 eligible companies with the highest Return on Equity in every sector are kept in the list. Some sectors are grouped together: energy with materials, communication with technology. Real estate is excluded because these valuation metrics don't work well in this sector. I have been updating the Dashboard List every month on Seeking Alpha since December 2015, first in free-access articles, then in Quantitative Risk & Value.

The next table compares IJS since August 2000 with the Dashboard List model, with a tweak: here, the list is reconstituted once a year to make it comparable with a passive index.

since 8/1/2000 | Total Return | Annua Return | Drawdown | Sharpe ratio | Volatility |

IJS | 600.70% | 8.93% | -60.11% | 0.45 | 20.51% |

Dashboard List (annual) | 1061.86% | 11.38% | -58.16% | 0.62 | 17.26% |

Past performance is not a guarantee of future returns. Calculation: Portfolio123.

The Dashboard List outperforms IJS by 2.5 percentage points in annualized return and has slightly better risk metrics (drawdown and volatility). A note of caution: ETF price history is real, whereas the model is simulated.

Two weaknesses of value indexes

I like the idea of mixing various ratios to rank value stocks. However, I think most value indexes doing so have two weaknesses, and IJS no exception. The first one is to classify all stocks using the same criteria. It means the valuation ratios are considered comparable across sectors. Obviously, they are not: my monthly dashboard here shows how valuation and quality metrics may vary across sectors.

The second weakness comes from the price/book ratio (P/B), which adds some risk in the strategy. Historical data show that a large group of companies with low P/B has a higher probability to hold value traps than a same-size group with low price/earnings, price/sales or price/free cash flow. Statistically, such a group shows a higher volatility and deeper drawdowns. The next table shows the return and risk metrics of the cheapest quarter of the S&P 500 (i.e., 125 stocks) measured in price/book, price/earnings, price/sales and price/free cash flow. The sets are reconstituted annually between 1/1/2000 and 1/1/2023 with elements in equal weight.

Annual Return | Drawdown | Sharpe ratio | Volatility | |

Cheapest quarter in P/B | 8.54% | -81.55% | 0.35 | 37.06% |

Cheapest quarter in P/E | 10.71% | -73.62% | 0.48 | 25.01% |

Cheapest quarter in P/S | 12.82% | -76.16% | 0.47 | 34.83% |

Cheapest quarter in P/FCF | 15.32% | -74.77% | 0.61 | 27.03% |

Data calculated with Portfolio123.

This explains why I use P/FCF and not P/B in the Dashboard List model.

Takeaway

iShares S&P Small-Cap 600 Value ETF holds almost 500 small caps selected and weighted based on six value and growth metrics. It is well-diversified across sectors and holdings. VIOV and SLYV have the same underlying index and they are equivalents for long-term investors. However, iShares S&P Small-Cap 600 Value ETF is a better instrument for tactical asset allocation and trading, because it has a higher trading volume. Performance and risk metrics since inception are very close to the parent index S&P Small-Cap 600.

iShares S&P Small-Cap 600 Value ETF may be part of a tactical allocation strategy switching between investing styles (value/growth or small/large). Like most value indexes, it has two weaknesses: ranking stocks regardless of their industries, and relying too much on the price/book ratio.

Quantitative Risk & Value (QRV) features data-driven strategies in stocks and closed-end funds outperforming their benchmarks since inception. Get started with a two-week free trial now.

This article was written by

Step up your investing experience: try Quantitative Risk & Value for free now (limited offer).

I am an individual investor and an IT professional, not a finance professional. My writings are data analysis and opinions, not investment advice. They may contain inaccurate information, despite all the effort I put in them. Readers are responsible for all consequences of using information included in my work, and are encouraged to do their own research from various sources.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.