BDC Weekly Review: We Are Moving Past The Goldilocks Phase

Summary

- We take a look at the action in business development companies through the last week of April and highlight some of the key themes we are watching.

- BDCs had a good week as Treasuries and stocks both rallied while early earnings reports were good.

- We are likely moving past the Goldilocks phase that BDCs enjoyed for about a year where the sector saw sharp net income gains and stable portfolio quality.

- We also highlight earnings from CSWC and ARCC.

- Systematic Income members get exclusive access to our real-world portfolio. See all our investments here »

Darren415

This article was first released to Systematic Income subscribers and free trials on Apr. 29.

Welcome to another installment of our BDC Market Weekly Review, where we discuss market activity in the Business Development Company ("BDC") sector from both the bottom-up - highlighting individual news and events - as well as the top-down - providing an overview of the broader market.

We also try to add some historical context as well as relevant themes that look to be driving the market or that investors ought to be mindful of. This update covers the period through the last week of April.

Market Action

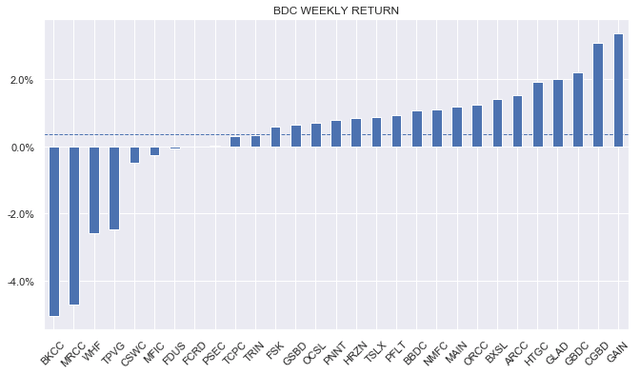

BDCs had a decent week as both Treasuries and stocks rallied on the week. Risk sentiment has been supportive due to better-than-expected corporate earnings and good reports from BDC specifically.

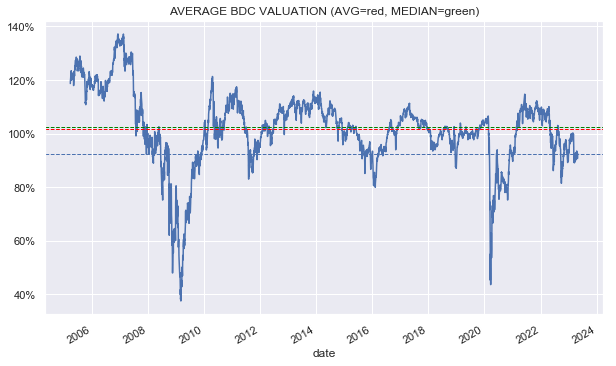

Sector valuation has crept up towards 93% which is roughly in the middle of its range this year and about 8% below the longer-term average. This looks to be around fair value in our view given the number of challenges on the horizon.

Systematic Income

Market Themes

Our view this year has been that we will be moving past the Goldilocks phase for the BDC sector after Q1. In this Goldilocks phase net income grew rapidly as a result of sharply rising short-term rates while portfolio quality remained robust as the macro picture held up well even as the economy was clearly slowing.

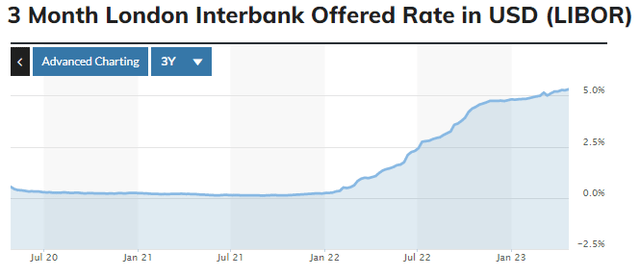

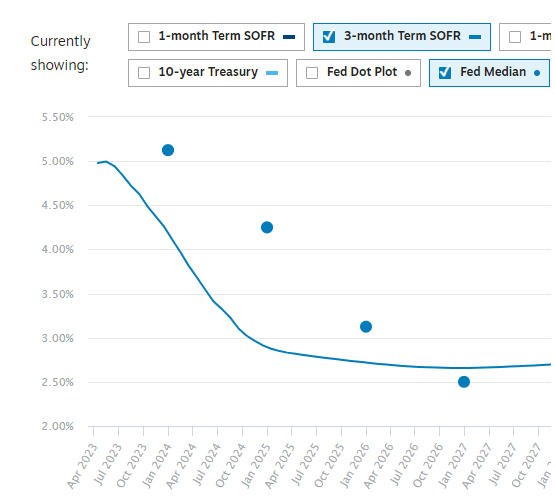

Now, this Goldilocks phase is coming to an end in our view. Net income rises are likely to slow down in Q2. We can gauge this by looking at the path of Libor in the chart below. Specifically, we see that the trajectory of short-term rates slowed down considerably last December. Because short-term rates are passed through to income with a significant lag, we can expect Q1 net income numbers to come in pretty strong. However, Q2 numbers are unlikely to rise much above their Q1 levels.

There is some disagreement over the future path of short-term rates. The market thinks short-term rates will peak imminently and start to fall at a quick pace while the Fed thinks short-term rates will remain stable this year and then start to fall next year. In any case, unless both are wrong we can expect sector net investment income to peak sometime this year or early next year.

Chatham

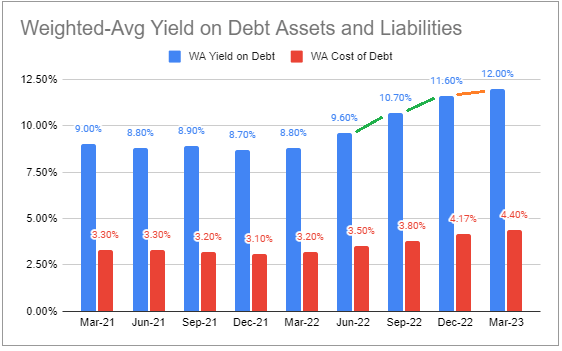

Very few BDCs have reported so far. However, if we look at Ares Capital Corp (ARCC) which has, we see that while portfolio yield increased by 1% on average for Q3 and Q4 it increased by only 0.4% over Q1 and this increase will be even lower in Q1 in our view.

Systematic Income BDC Tool

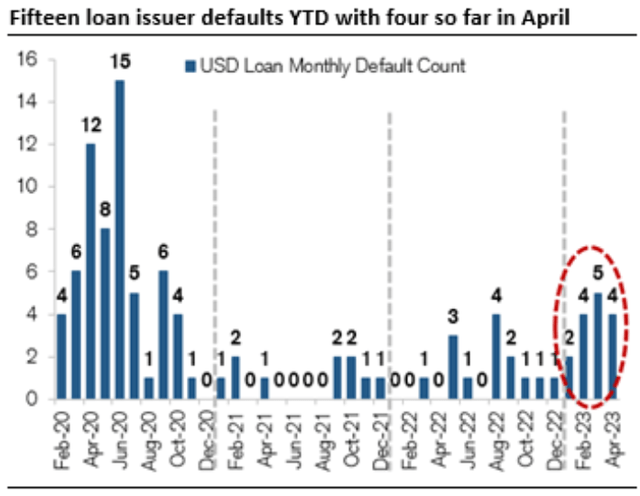

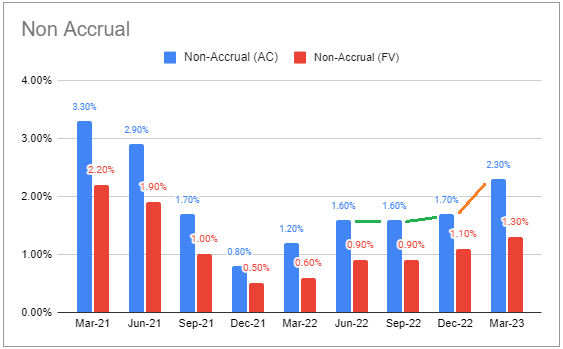

The second element of the end-of-Goldilocks view has to do with portfolio quality. Specifically, portfolio quality is likely to worsen at a quicker pace from here on if the economy continues to slow down as we expect. Q1 GDP surprised to the downside the other day, leading indicators continue to fall and bank loan defaults have increased.

Taking another look at ARCC, non-accruals at cost have risen after being flat for a couple of quarters while its net realized losses have increased to a 3-year high as well.

Systematic Income BDC Tool

None of this means that BDC investors should run for the hills, particularly as valuations have come off their pre-March levels. At the same time, however, investors shouldn't assume they can enjoy the same kinds of net income gains or stable portfolio quality they have seen over the past year. This stabilization in net income may also remove a key price support for the sector, making sector stocks more vulnerable.

Market Commentary

Capital Southwest (CSWC) increased the regular dividend by a penny to $0.54 and redeclared the $0.05 special. The company provided guidance earlier of its net investment income of $0.63-0.64 so not a big surprise and net income is still comfortably above the dividend. The stock jumped 5% on the day which tells us that people aren’t really paying attention to anything except actual dividend declarations even if they are highly probably ahead of time.

Ares Capital Corp net investment income fell to $0.57 from $0.63 despite a continued increase in base rates. The key drivers of the drop in income was the big drop-off in fees likely due to a lower level of prepayments (from a subdued level of deal activity in Q1 vs. Q4 which benefited from year-end seasonality) and a sharp drop in leverage. Leverage fell to 1.1x from 1.3x primarily driven by a low level of new investments (apparently as a couple of large deals fell away) and recent equity issuance. The dividend remained unchanged at a pretty conservative $0.48.

Stance and Takeaways

In line with our end-of-Goldilocks view, we will continue to sell rallies in the BDC sector as we did when the sector moved out to a clearly expensive valuation at the start of March. However, now that we have built up some dry powder we would not hesitate to add to our sector positions once again if valuations move back towards attractive levels. Unlike some investors, we don't view BDCs as uninvestable just because the probability of recession has risen. Everything depends on valuation and if sector valuation moves back towards the levels we saw in October of last year we would not hesitate to add new capital to the sector.

Check out Systematic Income and explore our Income Portfolios, engineered with both yield and risk management considerations.

Use our powerful Interactive Investor Tools to navigate the BDC, CEF, OEF, preferred and baby bond markets.

Read our Investor Guides: to CEFs, Preferreds and PIMCO CEFs.

Check us out on a no-risk basis - sign up for a 2-week free trial!

This article was written by

At Systematic Income our aim is to build robust Income Portfolios with mid-to-high single digit yields and provide investors with unique Interactive Tools to cut through the wealth of different investment options across BDCs, CEFs, ETFs, mutual funds, preferred stocks and more. Join us on our Marketplace service Systematic Income.

Our background is in research and trading at several bulge-bracket global investment banks along with technical savvy which helps to round out our service.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ARCC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.