City Office REIT: Cheap For A Reason

Summary

- An office REIT located in the promising sunbelt region.

- Unfortunately, with high lease expirations and low liquidity.

- I present my analysis which leads me to a hold rating.

asbe/E+ via Getty Images

Overview

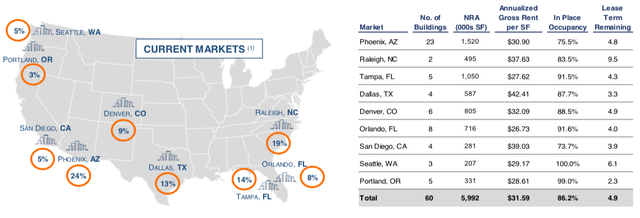

City Office REIT (NYSE:CIO) has an office portfolio of 6 million square feet located in the sunbelt region which has been a very popular location and many people move there. While the demand has risen significantly, so has the supply and there are countless new projects in the real estate sector. That puts companies, especially small ones like City Office, under a lot of pressure to stand out from the competition and find tenants for their buildings. Frankly, I am not sure if CIO's position in the market is good enough to get through the crisis that is currently happening in the office sector since many people are starting to work for home, leaving many office spaces unoccupied. But let's look at how the firm has been and will be performing.

City Office REIT Investor Presentation

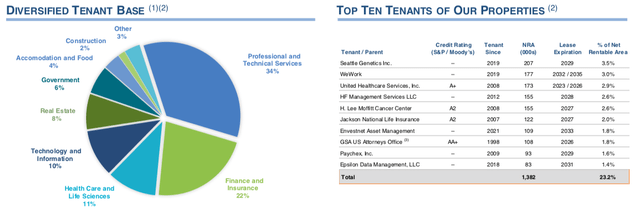

They have a good variety of tenants and while professional and technical services account for a third of the tenant base, it is a wide sector that is not dependent on each other, containing anything from scientific research to legal services. Furthermore, their top 10 tenants take up less than a fourth of the rented space which is also good because one tenant leaving is not going to make a big difference for the company's leasing.

City Office REIT Investor Presentation

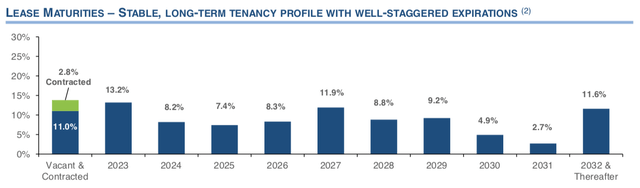

They currently have an occupancy of 84.9% which is similar to a lot of office REITs during this time, still it is not very high. They have a 4.9 year weighted average remaining lease term (WAULT) with lease maturities for mostly less than 10% after 2023. However, lease maturities for 2023 are 13.2% which is pretty high and it will put the company under considerable amount of pressure to renew and/or find more tenants for the following years.

City Office REIT Investor Presentation

Financials

The core FFO of the firm stands at around $64 million and the FFO per share is $1.53 for the last year, including Q1 of 2023. Last year rental and other revenues increased by 11.2% and the NOI by 3%. The amount of properties did not change and was 24 throughout both years, meaning that the increase was driven by rent increases. However, the occupancy went down by 1.3%, which is not a very good sign. The company provided guidance for the year 2023 with the NOI possibly dropping from current $112 million down to $109 million and the core FFO per share dropping between $1.38 and $1.43. Though obviously not ideal, in light of recent economic events, this isn't too bad a drop.

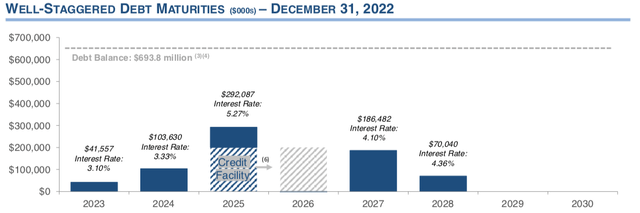

The company has debt of $705 million with 4.5% weighted average interest rate and 92.2% of the debt is fixed which is up from 71% in the last quarter of 2022. This is a really good shift. They have $28 million in cash and a line of credit of $300 million a third of which is undrawn. The other two thirds mature in 2025 but can be transferred to 2026. This way the firm should not have a problem paying off their debt in the coming years. They do have very little cash, however, with the line of credit they should be able to pay off the debt in the in the near future without any major issues.

City Office REIT Investor Presentation

The dividend per share per year was $0.8 with a 14% dividend yield, however, yesterday the Board of Directors decided to cut the dividend in half leaving a $0.10 dividend per share per quarter, which brings down the dividend yield to 7%. Considering the current state of the office market this was an inevitable move at this time. The company's CEO James Farrar stated that the new adjustment will help them get additional $16 million in liquidity which is a quarter of their current FFO and therefore could be vital for CIO going forward.

Valuation

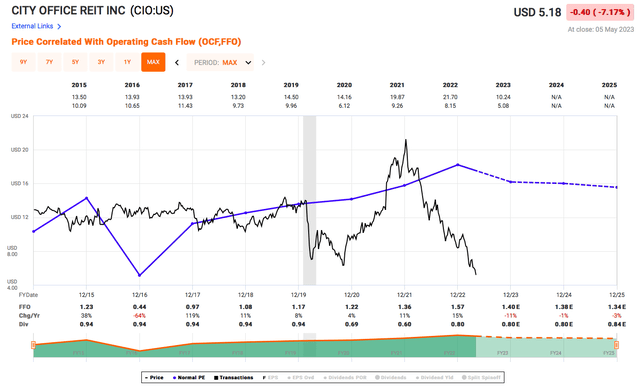

CIO currently trades at 3.43x FFO with a historical average of 11.61x. For comparison their peers trade at the following multiples - Highwoods Properties (HIW) 5.55x, Boston Properties (BXP) 6.85x. HIW is a much bigger company than CIO, also located mainly in the sunbelt region, yet their multiple is not that far off from City Office. Same thing goes for BXP which is an even bigger company. This leads me to believe that CIO could be even cheaper. This is confirmed by guidance provided by analysts on Fastgraphs, who expect FFO to fall in each of the following three years.

Final words

To sum up, the REIT is cheap for a reason. Shorting at this depressed level is out of the question, but I'm not ready to buy either. This leads me to a hold rating for CIO here at $5.20 per share.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.