Buy Aldeyra Therapeutics For Consecutive Runups

Summary

- They headlined 3 top-line results coming in Q2 2023.

- An all-important PDUFA Date is on tap in June.

- Further out, a second potential approval awaits in November.

Bill Oxford

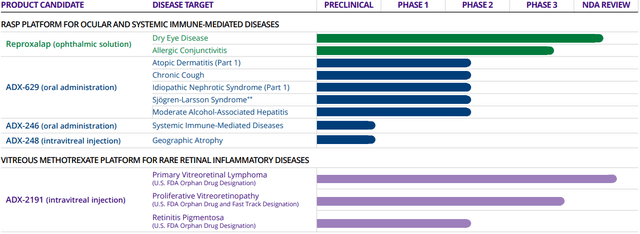

Aldeyra Therapeutics (NASDAQ:ALDX) is a small (~$600 million market cap) biotechnology company devoted to focusing on immune-mediated diseases. It highlighted data readouts and regulatory action for its 3 most-advanced drug candidates (Figure 1) in the Q1 earnings report:

- Top-Line Results from the Phase 2 Clinical Trial of ADX-2191 in Retinitis Pigmentosa Expected in the Second Quarter of 2023

- Top-Line Results from the Phase 2 Clinical Trial of ADX-629 in Chronic Cough Expected in the Second Quarter of 2023

- Top-Line Results from the Phase 3 INVIGORATE-2 Trial of Reproxalap in Allergic Conjunctivitis Expected in the Second Quarter of 2023

- NDA Priority Review PDUFA Date for ADX-2191 for the Treatment of Primary Vitreoretinal ("PVR") Lymphoma is June 21, 2023

- NDA PDUFA Date for Reproxalap for the Treatment of Dry Eye Disease is November 23, 2023

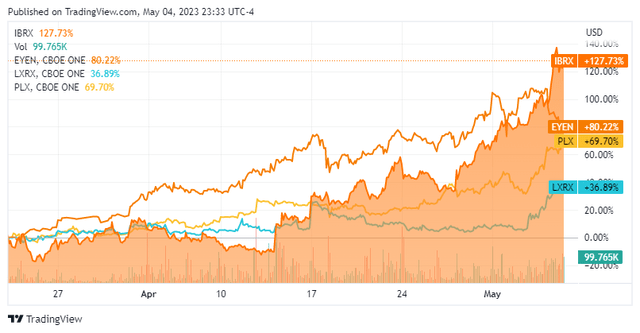

Eyenovia (EYEN) ($218 million cap, May 8 PDUFA date, +83% since March 22), ImmunityBio (IBRX) ($1.46 billion cap, May 23, 136% since April 6), and Lexicon Pharmaceuticals (LXRX) ($517 million cap, May 27, +31% since April 10) all had substantial gains (Figure 2), as nothing brings out investor excitement quite like the prospect of securing a first drug approval. Protalix BioTherapeutics (PLX) ($206 million cap, May 9, +73% since March 23), also had a substantial rally while gunning for its second. While none of these are guaranteed to win the FDA's nod, traders will likely be missing out by not jumping in before such price moves happen in advance of the decision.

Figure 1. Aldeyra Therapeutics Pipeline

Figure 2. Companies with PDUFA dates in May

As far as the chances of ADX-2191 approval, the Phase 3 GUARD Trial's primary end point was claimed to be achieved. ADX-2191's prevention of retinal detachment due to PVR the was statistically superior to historical control (HC; p = 0.024), but only numerically better than routine surgical care. The use of HCs for pivotal studies in rare disease where there are no approved therapies or standard of care is not uncommon. Approved drugs employing only HCs or external control groups include Sanofi's (SNY) MYOZYME, and Sarepta Therapeutics' (SRPT) EXONDYS.

Aldeyra is already classified a Strong Buy according to Seeking Alpha's Quant System. This is mostly driven by an A grade in Momentum. Their strong $165 million cash position is likely to last until late 2024, given Q1's $16.8 million operational burn, so it's unlikely to need immediate financing after PDUFA. However, failures on any of the catalysts might force management's hand.

To conclude, approval isn't required to make money from this stock, and traders unconvinced by the preceding information need not be deterred in buying ALDX, they only have to sell by June 20. Note that the days prior to PDUFA will be volatile and trading could be halted. It's even possible that "selling the news" could wipe out most if not all profit. Options are also viable; the ones beyond Q2, such September 15, are probably better suited to encompass the various clinical readouts. The in-the-money $5 call is well-priced, although contracts may be in short supply for most of the strikes. If able to sell in time, whatever the trading strategy or outcome of the event, rinse and repeat for the next catalyst.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ALDX, SRPT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.