WeBuy Global Pursues $8 Million U.S. Micro-IPO

Summary

- WeBuy Global Ltd. has filed proposed terms for an $8 million U.S. IPO.

- The firm operates a group purchasing e-commerce platform in Southeast Asia.

- WeBuy Global is growing revenue but faces myriad risks relevant to US investors.

- Although the low nominal price and ultra-low float may attract day traders seeking volatility, I'll watch the WeBuy Global Ltd. IPO from the sidelines.

- Looking for more investing ideas like this one? Get them exclusively at IPO Edge. Learn More »

Trevor Williams/DigitalVision via Getty Images

A Quick Take On WeBuy Global Ltd.

WeBuy Global Ltd. (WBUY) has filed to raise $8 million in an IPO of its ordinary shares, according to an F-1 registration statement.

The firm operates as an e-commerce retailer of grocery goods and travel services in the Southeast Asia region.

While WeBuy Global Ltd. is growing revenue quickly, the company has a long list of risks to U.S. investors.

Although the low nominal price of shares and the ultra-low float will likely attract day traders, I'll pass on the WeBuy Global Ltd. IPO.

WeBuy Overview

Singapore-based WeBuy Global Ltd. was founded to provide online shopping and supply chain management services for the grocery and travel verticals in Southeast Asia.

Management is headed by Founder, Chairman, and CEO, Mr. Bin Xue, who has been with the firm since its inception in August 2019 and was previously an engineer at SMIC Thermocouple Lab and a senior engineer at GlobalFoundries.

The firm seeks to market its services via a 'community-based business model' to keep customer acquisition costs low and customer retention elevated.

As of December 31, 2022, WeBuy has booked a fair market value investment of $16 million in equity and debt from investors including GBUY GLOBAL LTD, TLCW VENTURES PTE., WEBUY TALENT, Wavemaker Pacific 3, and Rocket Internet Capital Partners.

WeBuy - User Acquisition

The firm pursues customers via social media, personal interaction, and word-of-mouth marketing efforts.

WeBuy has a "group purchasing" model where the more people that come together to buy goods in bulk, the lower price they pay.

Selling & Distribution expenses as a percentage of total revenue have declined as revenues have increased, as the figures below indicate:

Selling & Distribution | Expenses vs. Revenue |

Period | Percentage |

Year Ended Dec. 31, 2022 | 9.3% |

Year Ended Dec. 31, 2021 | 19.3% |

(Source - SEC)

The Selling & Distribution efficiency multiple, defined as how many dollars of additional new revenue are generated by each dollar of Selling & Distribution expense, was 5.4x in the most recent reporting period. (Source - SEC)

WeBuy's Market & Competition

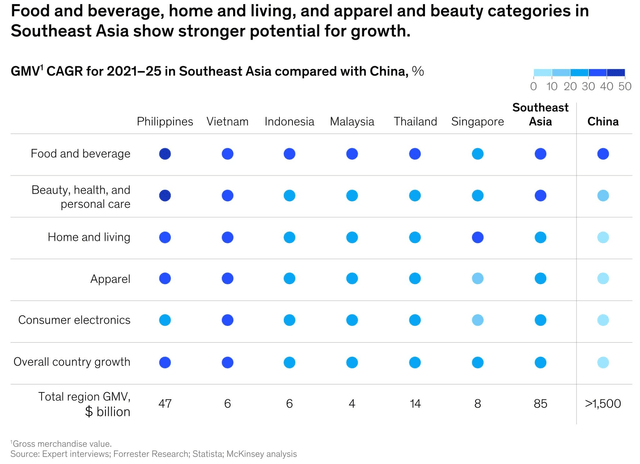

According to a 2022 market research report by McKinsey & Company, the growth of the e-commerce market in Southeast Asia accelerated during the mid-2010s and grew even faster as a result of the COVID-19 pandemic.

Southeast Asian consumers are expected to continue expanding the types of products they will purchase online, with food & beverage, home & living goods forecast to witness the highest growth in the next phase of activity.

Consumers are also expected to broaden the platforms that they use to inform themselves and to purchase goods and services.

Also, the chart below shows the expected growth rates for various product categories by country:

Southeast Asia Ecommerce Growth (McKinsey & Company)

Major competitive or other industry participants include the following:

Shopee

Lazada

Tokopedia

Bukalapak

Snatch

Fresh4ALL

Others

WeBuy's Financial Performance

WeBuy Global Ltd.'s recent financial results can be summarized as follows:

Sharply growing topline revenue

Increasing gross profit but decreasing gross margin

Reduced operating loss

Growing cash used in operations

Below are relevant financial results derived from the firm's registration statement:

Total Revenue | ||

Period | Total Revenue | % Variance vs. Prior |

Year Ended Dec. 31, 2022 | $44,560,418 | 99.9% |

Year Ended Dec. 31, 2021 | $22,295,682 | |

Gross Profit (Loss) | ||

Period | Gross Profit (Loss) | % Variance vs. Prior |

Year Ended Dec. 31, 2022 | $3,751,569 | 49.9% |

Year Ended Dec. 31, 2021 | $2,503,258 | |

Gross Margin | ||

Period | Gross Margin | % Variance vs. Prior |

Year Ended Dec. 31, 2022 | 8.42% | -25.0% |

Year Ended Dec. 31, 2021 | 11.23% | |

Operating Profit (Loss) | ||

Period | Operating Profit (Loss) | Operating Margin |

Year Ended Dec. 31, 2022 | $(7,370,064) | -16.5% |

Year Ended Dec. 31, 2021 | $(8,207,388) | -36.8% |

Comprehensive Income (Loss) | ||

Period | Comprehensive Income (Loss) | Comprehensive Margin |

Year Ended Dec. 31, 2022 | $(6,772,699) | -15.2% |

Year Ended Dec. 31, 2021 | $(8,105,838) | -18.2% |

Cash Flow From Operations | ||

Period | Cash Flow From Operations | |

Year Ended Dec. 31, 2022 | $(4,117,551) | |

Year Ended Dec. 31, 2021 | $(3,994,972) | |

(Source - SEC)

As of December 31, 2022, WeBuy had $1.6 million in cash and $10.8 million in total liabilities.

Free cash flow during the twelve months ending December 31, 2022, was negative ($4.1 million).

WeBuy Global's IPO Details

WeBuy Global Ltd. intends to raise $8 million in gross proceeds from an IPO of its ordinary shares, offering two million shares at a proposed price of $4.00 per share.

No existing shareholders have indicated an interest in purchasing shares at the IPO price.

Assuming a successful IPO, the company's enterprise value at IPO would approximate $193 million, excluding the effects of underwriter over-allotment options.

The float to outstanding shares ratio (excluding underwriter over-allotments) will be approximately 4.0%. A figure under 10% is generally considered a "low float" stock which can be subject to significant price volatility.

As a foreign private issuer, the company can choose to take advantage of reduced, delayed or exempted financial and senior officer disclosure requirements versus those that domestic U.S. firms are required to follow.

The firm is an "emerging growth company" as defined by the 2012 JOBS Act and has elected to take advantage of reduced public company reporting requirements; prospective shareholders will receive less information for the IPO and in the future as a publicly-held company within the requirements of the Act.

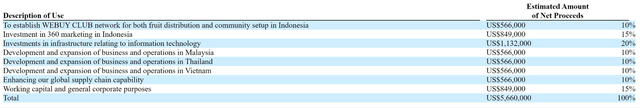

Management says it will use the net proceeds from the IPO as follows:

Proposed IPO Use Of Proceeds (SEC)

Management's presentation of the company roadshow is not available.

Regarding outstanding legal proceedings, management said the firm has 'no pending or threatened claims and litigation' as of the prospectus date.

The sole listed bookrunner of the IPO is Univest Securities.

Valuation Metrics For WeBuy

Below is a table of relevant capitalization and valuation figures for the company:

Measure (TTM) | Amount |

Market Capitalization at IPO | $200,046,400 |

Enterprise Value | $193,016,763 |

Price/Sales | 4.49 |

EV/Revenue | 4.33 |

EV/EBITDA | -26.19 |

Earnings Per Share | -$0.13 |

Operating Margin | -16.54% |

Net Margin | -15.20% |

Float To Outstanding Shares Ratio | 4.00% |

Proposed IPO Midpoint Price per Share | $4.00 |

Net Free Cash Flow | -$4,117,551 |

Free Cash Flow Yield Per Share | -2.06% |

Debt/EBITDA Multiple | -0.28 |

Revenue Growth Rate | 99.86% |

(Source - SEC)

Commentary About WeBuy's IPO

WBUY is seeking U.S. public capital market investment to fund its expansion efforts in Southeast Asia.

The company's financials have shown quickly growing topline revenue, higher gross profit but lower gross margin, decreased operating loss but increasing cash used in operations.

Free cash flow for the twelve months ending December 31, 2022, was negative ($4.1 million).

Selling & Distribution expenses as a percentage of total revenue have dropped as revenue has grown; its Selling & Distribution efficiency multiple was 5.4x in the most recent year.

The firm currently plans to pay no dividends in the foreseeable future and to reinvest any earnings back into the firm's growth and working capital requirements.

WeBuy didn't make any capital expenditures in its most recent calendar year period.

The market opportunity for e-commerce products and services in Southeast Asia is large and expected to continue growing, especially as a result of the global pandemic, which served as a forcing function for consumers to become more comfortable and reliant on ordering through a variety of platforms.

Like other firms with Asian country operations seeking to tap U.S. markets, the proposed listing entity operates as a Cayman Islands corporation that owns interests in its other country operations.

U.S. investors would only have an interest in an offshore firm with interests in or only agreements with operating subsidiaries (i.e., potentially no equity interests), some of which may be located in or have substantial operations in China or other Asian countries with restrictions or unpredictable regulatory environments regarding those interests.

Additionally, restrictions on the transfer of funds between subsidiaries within China or other Asian countries may exist.

Prospective investors would be well advised to consider the potential implications of specific laws regarding earnings repatriation and changing or unpredictable regulatory rulings that may affect such companies and their U.S. stock listings.

Additionally, post-IPO communications from the management of smaller Asian companies that have become public in the U.S. has been spotty and perfunctory, indicating a lack of interest in shareholder communication, only providing the bare minimum required by the SEC and a generally inadequate approach to keeping shareholders up-to-date about management's priorities.

Univest Securities is the sole underwriter, and IPOs led by the firm over the last 12-month period have generated an average return of 11.2% since their IPO. This is a top-tier performance for all major underwriters during the period but is subject to wide swings of volatility due to Univest's client base.

Further risks to the company's outlook as a public company include its exposure to non-US dollar-denominated currencies, its international expansion efforts which may be more expensive or entail localization risks, and infrastructure limitations, among others.

As for valuation expectations, management is asking investors to pay an Enterprise Value/Revenue multiple of approximately 4.3x.

While WeBuy Global Ltd. is growing revenue quickly, the company has a long list of risks to US investors.

Although the IPO will likely attract day traders interested in its low nominal price and ultra-low float, I'll pass on the WeBuy Global Ltd. IPO.

Expected IPO Pricing Date: To be announced.

Gain Insight and actionable information on U.S. IPOs with IPO Edge research.

Members of IPO Edge get the latest IPO research, news, and industry analysis.

Get started with a free trial!

This article was written by

I'm the founder of IPO Edge on Seeking Alpha, a research service for investors interested in IPOs on US markets. Subscribers receive access to my proprietary research, valuation, data, commentary, opinions, and chat on U.S. IPOs. Join now to get an insider's 'edge' on new issues coming to market, both before and after the IPO. Start with a 14-day Free Trial.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.