Berkshire Hathaway: Betting Big In Japan

Summary

- Berkshire's increased stakes in Japan's five largest trading houses signal confidence in Japan's economy and conglomerates.

- Berkshire is marketing yen-denominated bonds in Japan, making it one of the largest foreign issuers of yen bonds.

- Investors could view Abel's track record and experience favorably, signaling a smooth leadership transition.

- Berkshire sold a significant stake in Taiwanese chipmaker TSMC, citing geopolitical risks, while increasing its ownership stake in Occidental Petroleum.

- I do much more than just articles at Yiazou Capital Research: Members get access to model portfolios, regular updates, a chat room, and more. Learn More »

Matteo Colombo

Investment Thesis

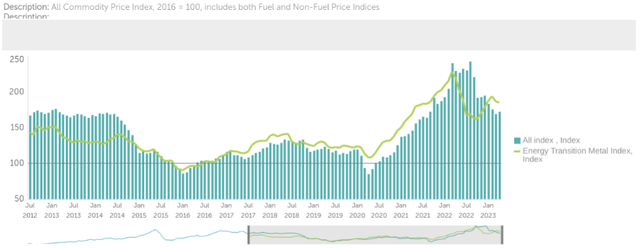

Berkshire Hathaway Inc. (NYSE:BRK.A) (BRK.B) increased its stakes in Japan's largest conglomerates, and along with its marketing of yen-denominated bonds in Japan, it is signaling a vote of confidence in Japan's economy. The move comes as the country's trading houses pivot away from fossil fuels, providing a hedge against volatile commodity markets.

The weak yen and the potential growth of many Japanese companies could also influence Berkshire's decision. With its enhanced investment in Japan last year, Buffett has a continued interest in the country's market. It shows a positive outlook for potential gains in the yen and commodity prices. Also, the recent leadership transition to Greg Abel, who has a successful track record at the company, is vital. All these factors signal progressive valuation growth, supporting Berkshire stock's buy rating.

Buffett's Japan Bet

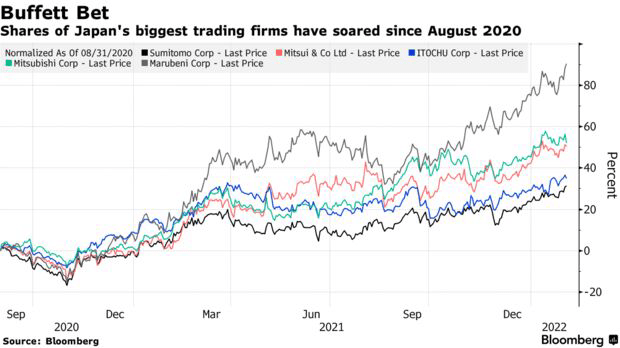

Berkshire recently increased its stakes in Japan's five largest trading houses, Mitsui & Company, Mitsubishi, Sumitomo, Itochu, and Marubeni, to 7.4% each, up from around 6.2% to 6.8%. The move comes as these trading houses, also known as "Sogo Shosha" in Japanese, are pivoting away from fossil fuels and expanding into other sectors. The renewed investment by Buffett is a significant vote of confidence in Japan's largest conglomerates and a broader endorsement of Japan's economy, often seen as less relevant than China and India.

Buffett's initial investment in August 2020 triggered a surge in the trading houses' shares. It is bringing the value of the investments above $6 billion. At the time, the pandemic dampened commodity demand. During the pandemic, LNG was at an all-time low, and coal was at its cheapest in years, leading to the companies' shares trading below book value. However, the trading houses' diversification into almost every part of the economy provided a hedge against the volatile commodity markets.

Bloomberg

Japan's trading houses have been ramping up their sustainability efforts in recent months. Mitsubishi, for example, aims to reduce its net greenhouse gas emissions to zero by 2050. The country's shift toward renewables has also seen trading houses increase their investments in wind and solar energy projects. For instance, Mitsui aims to double its renewable energy capacity by 2025.

Furthermore, Buffett's investment in these trading houses may be influenced by several factors. It includes the weakening yen, lower benchmark rate, the growth potential of Japanese companies, and the trading houses' ability to act as a guide to the Japanese market. Additionally, the International Monetary Fund has projected that the most significant growth in 2023 will come from China and India, with a focus on the Eastern Hemisphere. This region could be an opportunity for Buffett and his investments in Japan's largest conglomerates.

Notably, the move comes as Sogo Shosha is stepping up its pivot away from fossil fuels. It has been underway for years. However, it is still being determined whether Buffett is focusing on the drift away from fossil fuels, commodities, or a configuration of factors. Another factor influencing Buffett's decision is the weak yen, as well as the potential growth of many companies in Japan.

Overall, Berkshire's investment in these trading houses could benefit from gains in the yen and an increase in the value of commodities. If prices did increase, there would be an opportunity to sell commodities at a profit. In addition, the trading houses could be a guide to Japanese companies and the Japanese market. They act as a navigator due to their in-depth embedded position in the economy.

Yen Dynamics

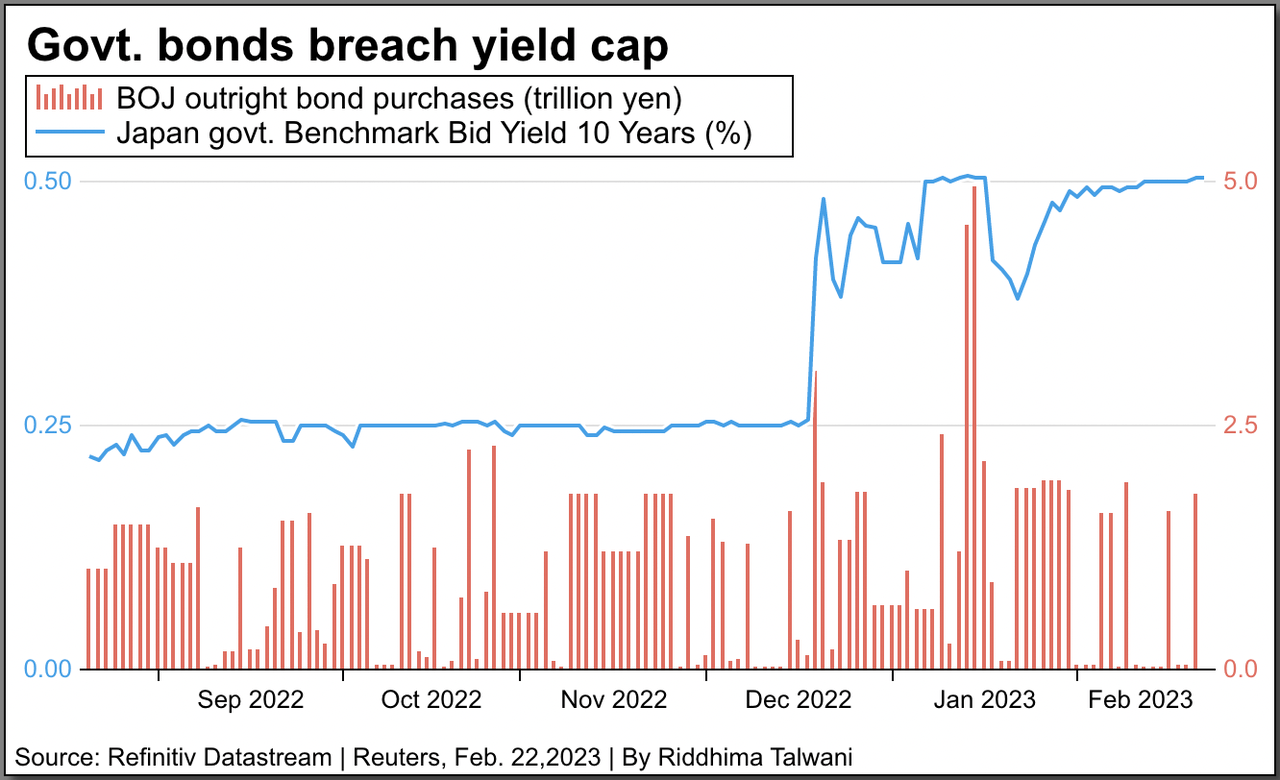

Berkshire has started marketing yen-denominated bonds in Japan. The seven-part note offering follows the company's sale of more than 1 trillion yen ($7.5 billion) of yen notes since its debut issue in 2019. According to Bloomberg data, it is one of the largest foreign issuers of yen bonds. The company will use proceeds from the Notes for corporate purposes, including refinancing some debt. The deal's pricing occurred as early as April 14. It is happening as yield premiums on yen investment-grade corporate notes have climbed eight basis points on average since the company last priced debt in December.

Further, Berkshire's decision to issue yen-denominated bonds highlights the company's increasing exposure to the Japanese market. The yen bond offering shows Berkshire's confidence in the stability of the yen. Also, it signifies a strategic focus on taking advantage of lower yields compared to other advanced economies. It also highlights the attractiveness of Japanese debt to foreign investors despite the challenging global economic environment.

Overall, the move comes as speculation rises that the Bank of Japan will tighten monetary policy under new Governor Kazuo Ueda. As a result, it is leading investors to seek higher credit premiums on yen bonds. Berkshire's latest debt deal may be priced higher than in December due to rising yield premiums. The enhanced debt issue in Japan surprised the market and likely led to the continued interest in the Japanese market.

New Buffett At Berkshire

Warren Buffett has revealed that Greg Abel is his successor at Berkshire Hathaway. He has taken over most of his responsibilities at the conglomerate. Abel's over two-decade track record at the company has included high-profile dealmaking and overseeing non-insurance businesses such as the BNSF railroad and Dairy Queen. Buffett himself admitted that Abel is a "big improvement" on him, stating, "He does all the work, and I take the bows."

Recently, Abel bought $25 million in Berkshire shares on the open market. It is increasing his stake in the company by around 30%. This move may have been motivated by new shareholding rules for directors that Buffett introduced. It requires all directors to have a "significant investment in Berkshire shares relative to their resources for at least three years."

Notably, Berkshire's investments in a group of trading houses in Japan have gained an estimated $4.5 billion since 2020. It highlights the success of the company's investment strategy and its potential for continued growth under Abel's leadership.

Finally, predicting the impact of Greg Abel's appointment as Buffett's successor on the company's long-term market valuations takes time and effort. However, in the short term, it could positively affect investor sentiment. It signals a smooth transition of leadership and continuity in Berkshire's investment philosophy. Additionally, Abel's track record and experience within the company could be viewed favorably by investors.

Over the long term, Berkshire's performance will depend on many factors. It includes the overall performance of the economy, the success of the conglomerate's investments, and the effectiveness of Abel's leadership. If Abel successfully continues Berkshire's strong track record of generating significant returns for investors, this could support and expand the stock's valuation.

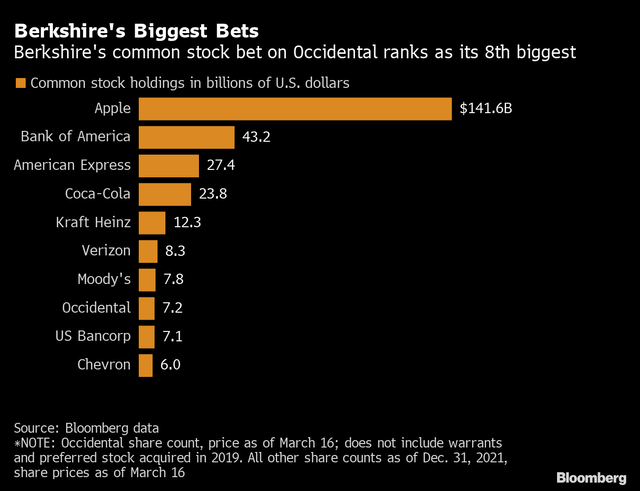

Massive Moves In Occidental Petroleum & TSMC

Berkshire's investment moves have been the topic of much discussion in recent months. While the company sold off 86% of its stake in Taiwan Semiconductor Manufacturing Company Limited (TSM) due to geopolitical tensions, its investment in Occidental Petroleum Corporation (OXY) has continued to grow, purchasing nearly $1 billion of shares over the past year. This has resulted in Berkshire's stake in Occidental increasing to 23.6%, making it the largest shareholder in the company. The value of Berkshire's investment in Occidental now stands at $12.6 billion, a significant increase from its initial investment.

Interestingly, the decision to sell off TSM shares may have been unexpected, given Buffett's preference for long-term investments. However, it highlights the importance of considering geopolitical risks when making investment decisions. Meanwhile, the increase in Berkshire's stake in Occidental demonstrates the company's confidence in the future of the energy sector, despite the ongoing shift towards renewable energy sources.

Notably, the fundamental here to observe is that it is quite the opposite of the moves in Japan (focusing on renewable energy). A high-level review suggests that the company is diversifying, considering the state of the economy and the sector's progress.

Finally, these points suggest that Berkshire Hathaway has strategically managed its portfolio. It divested most of its TSM stake, citing geopolitical risks. Simultaneously, it has increased its ownership stake in Occidental Petroleum. Thus, Buffett is confident in the oil industry's long-term potential. However, Berkshire's purchase of Occidental shares came at a time when oil prices were declining. It indicates the company's perspective that the market had undervalued the company.

The recent moves suggest that Berkshire is willing to be opportunistic and agile in its investment decisions while keeping a long-term perspective. However, Berkshire's investment in TSMC may have a short-term negative impact on the company's stock price, as investors may be concerned about the decision-making process behind the sale.

Takeaway

In conclusion, Berkshire Hathaway's bullish stance on Japan's economy is evident through its increased investments in Japanese conglomerates and the marketing of yen-denominated bonds. In addition, Japanese trading houses' concentration towards renewables and drift away from fossil fuels provide a hedge against volatile commodity markets, which may have influenced Berkshire's decision.

The move is strategic, with a weak yen and the potential growth of Japanese companies. In addition, the smooth leadership transition to Greg Abel, who has a successful track record, adds to investor confidence. Finally, despite geopolitical risks causing the company to sell a significant stake in TSMC, Berkshire's ownership of Occidental Petroleum highlights positive growth prospects.

Author of Yiazou Capital Research

Unlock your investment potential through deep business analysis.

I am the founder of Yiazou Capital Research, a stock-market research platform designed to elevate your due diligence process through in-depth analysis of businesses.

I have previously worked for Deloitte and KPMG in external auditing, internal auditing, and consulting.

I am a Chartered Certified Accountant and an ACCA Global member, and I hold BSc and MSc degrees from leading UK business schools.

In addition to my research platform, I am also the founder of a private business.

This article was written by

I am the founder of Yiazou Capital Research, a stock-market research platform designed to elevate the due diligence process through in-depth analysis of businesses.

I previously worked for Deloitte and KPMG in external & internal auditing and consulting.

I am a Chartered Certified Accountant and a Fellow Member of ACCA Global, and I hold BSc and MSc degrees from leading UK business schools.

In addition to my research platform, I am also the founder of a private business.

My primary strategy focuses on high-quality, free cash flow generative stocks with an above-average growth rate and a strong business moat.

I manage my own highly concentrated portfolio, and I occasionally engage in short-term trades to profit from asset mispricings when Mr. Market does not feel very well.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.