HEWJ: An Unfavorable Near-Term Setup For Japanese Equities

Summary

- The iShares Currency Hedged MSCI Japan ETF offers investors a diversified investment vehicle to express a long Japanese equities/short JPY view.

- While HEWJ has been a winning trade in recent years, it comes with a pricey normalized expense ratio and elevated valuations.

- With external conditions also worsening and equity valuations rising further post-BoJ meeting, the near-term setup isn't ideal.

SAICHI/iStock via Getty Images

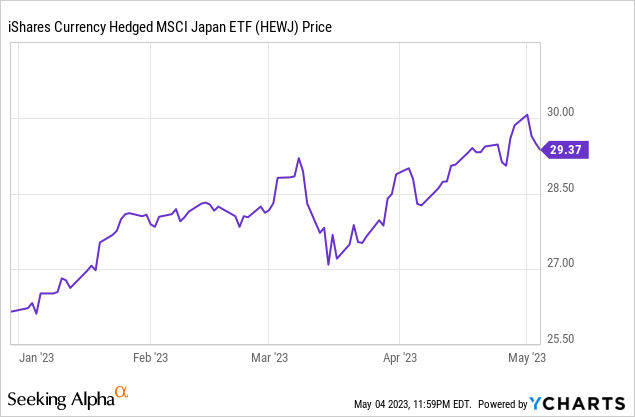

Markets reacted positively to new BOJ Governor Kazuo Ueda's first monetary policy meeting, with the unchanged policy stance and removal of forward guidance on rates signaling a supportive monetary backdrop going forward. But even with Japanese equities getting off to a positive start YTD, the outlook isn't quite as bright, given its close trade ties to regions where goods demand is starting to weaken as a result of monetary tightening. Continued weakness here will drive downward earnings revisions near-term, particularly given the iShares Currency Hedged MSCI Japan ETF's (NYSEARCA:HEWJ) outsized portfolio exposure to exporters. While corporate governance efforts are currently underway to boost corporate value (e.g., the Tokyo Stock Exchange's initiatives to improve capital efficiency), the ~13x P/E valuation doesn't screen cheaply relative to where we are in the cycle. So even with HEWJ allowing investors to hedge out the FX/macro uncertainty (albeit at a hefty ~1% normalized expense ratio), I remain sidelined on the long corporate Japan trade pending a better entry point.

Fund Overview - A Pricey FX-Hedged Japanese Investment Vehicle

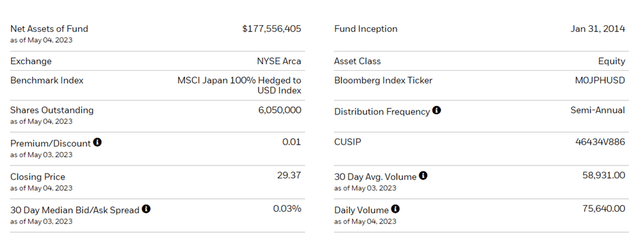

The US-listed iShares Currency Hedged MSCI Japan ETF seeks to track, before fees and expenses, the performance of the MSCI Japan Index, which comprises large and mid-cap Japanese equities (~85% of the free float-adjusted market cap), while hedging out the fluctuations of the Japanese Yen relative to the US dollar. The ETF held ~$178m of net assets at the time of writing and charged a 0.5% net expense ratio, though this includes temporary management fee waivers through 2025. The gross expense ratio, including management fees and acquired fund fees and expenses, stands at a pricey 1.0%. A summary of key facts about the ETF is listed in the graphic below:

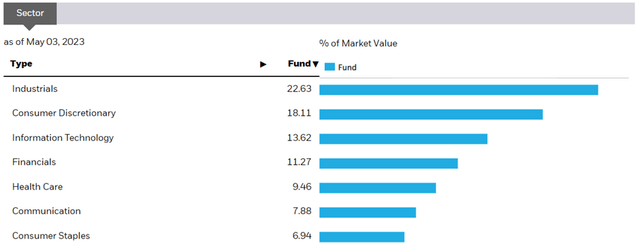

The fund has one key holding, the iShares MSCI Japan ETF (EWJ), and hedges in the form of JPY/USD forwards. The underlying EWJ holding has 237 holdings, with the largest sector allocation being Industrials at 22.6%, followed by Consumer Discretionary at 18.0%, and Information Technology at 13.5%. The only other sector with a >10% allocation is Financials at 11.2%, while sectors above the 5% threshold include Health Care (9.4%), Communication (7.8%), and Consumer Staples (6.9%). On a cumulative basis, the top five sectors accounted for ~75% of the total portfolio, so HEWJ, via EWJ, screens as a relatively top-heavy developed market ETF from a sector perspective. In line with the defensive nature of the Japanese market, the fund's equity beta is low at 0.5 relative to the S&P 500 (SPY), so it should trail any swings in the broader global markets.

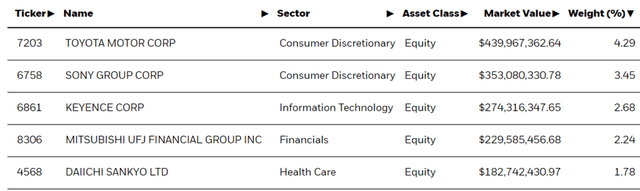

From a single-stock perspective, the ETF is well-diversified, with no position exceeding a 5% threshold. The largest holding is automotive manufacturer Toyota Motor (TM) at 4.3%, followed by tech and media conglomerate Sony Group Corporation (SONY) at 3.5%. Rounding out the top-five list are factory automation leader Keyence (OTCPK:KYCCF) at 2.7%, Mitsubishi UFJ Financial Group (MUFG) at 2.2%, and pharmaceutical company Daiichi Sankyo (OTCPK:DSKYF) at 1.8%. In total, the top five holdings account for ~14% of the overall portfolio - low by iShares ETF standards. At ~ 13.3x earnings and 1.4x book value, however, the fund is richly valued, particularly given the relative maturity and growth potential of its holdings, as well as the slowing external backdrop.

Fund Performance - Long Japan/Short JPY Strategy Underpins Outperformance

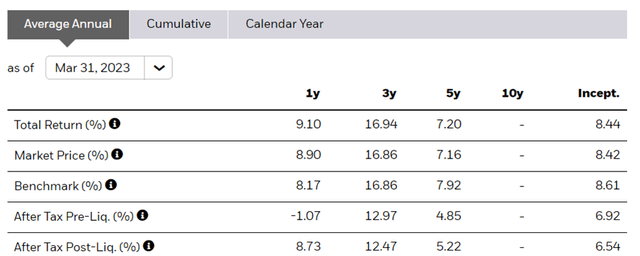

On a YTD basis, the ETF has risen by 12.0% (vs. 7.4% for the non-hedged EWJ) and has compounded at an impressive 7.2% pace in market price and NAV terms over the last five years (vs. 1.2% for EWJ). The fund has outperformed across all timelines, with the one and three-year track records at 9.1% and 16.9% in annualized NAV terms, respectively, well above the EWJ's -3.7% and 7.2% annualized returns over a similar period. In sum, the long Japan/short JPY strategy has paid off handsomely for HEWJ investors, allowing them to benefit from monetary easing in Japan without enduring the currency implications.

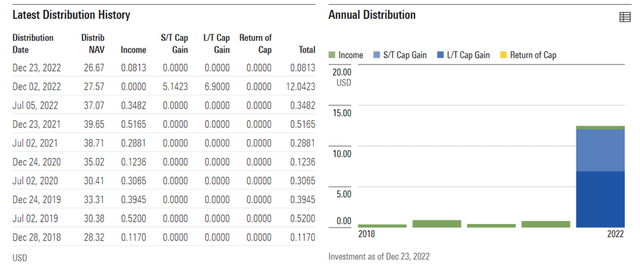

The semi-annual distribution has generally been strong as well, though last year's $12.47/share payout was boosted by the realization of capital gains. The income portion, on the other hand, was down to $0.43/share, which equates to an >1% yield. Given the prevalence of high dividend yielders in Japan, income-focused investors should perhaps look elsewhere. Investors looking for steady earnings growth (without bearing FX-related downside), on the other hand, will find HEWJ a great fit.

Supportive Monetary Policy Backdrop to Continue in the Ueda Regime

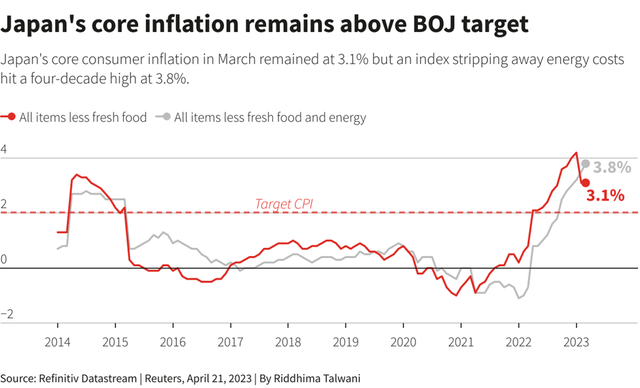

The inaugural Governor Ueda-led BoJ policy meeting came and went with no big surprises. For the most part, the BoJ will be continuing with the extremely easy monetary policy stance adopted by the previous governor in an effort to reignite Japan's economic growth. To recap, the Policy-Balance rate remains intact at -0.10%, while 'yield curve control' will keep the 10-year Japanese Government Bond yield within the target 0% +/-50bps range. Also intact is the BoJ's policy on fixed-rate bond-buying operations, as well as ETF and REIT purchases. Thus, any concerns around the BoJ changing course under this new regime seem unfounded at this point, particularly given the policy decision came despite upward revisions for its underlying inflation measures. Following a multi-decade high 3.8% print, core inflation (ex-fresh food and energy) is now projected to come in at +2.5% in FY23 (up from +1.8% prior) and +1.7% in FY24 (up from +1.6% prior).

The market reacted positively to the meeting, with pressure on JGB yields easing and equity markets rallying on the back of Governor Ueda's dovish tone. With the BoJ ready and willing to be 'behind the curve' on monetary tightening relative to other developed market central banks, economic activity and, by extension, domestically-oriented equities should benefit. The exporter-heavy HEWJ portfolio, on the other hand, remains exposed to slowing manufacturing conditions overseas (leading indicators such as the US ISM Manufacturing and Services PMIs remain in a contractionary territory). As global conditions begin to recover, though, the long equities/short JPY trade via HEWJ should pay off, particularly considering exporters tend to be prime beneficiaries of a weaker Yen. The catch is the valuation - at ~13x earnings and an ~30% premium to book, equities have likely priced in the benefits, and investors may be better off waiting for a better entry point.

An Unfavorable Near-Term Setup for Japanese Equities

Governor Ueda's first policy meeting last week may have allayed market concerns of a reversal (most notably its 'yield curve control' policy), but Japanese equities could still underperform in the near term. For one, Japanese large-caps are typically exporters with an outsized exposure to EU/US end markets currently undergoing extended monetary tightening cycles. With a 'shallow recession' scenario back on the table following 'sticky' inflation prints and emerging economic weakness in these regions, corporate Japan could still face downward earnings revisions ahead. Plus, the HEWJ portfolio isn't cheap at ~13x earnings and 1.4x P/Book, so there remains ample room for multiple compression. While I like that HEWJ offers an option to hedge out FX risk (likely to the downside given the early dovishness of the new BoJ regime), it comes at a price; the near-term setup for Japanese stocks isn't compelling either, and thus, I would wait for a better entry point.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.