My Dividend Growth Portfolio April Update - Dividend ETFs Are Looking Appealing

Summary

- There are a lot of "ok" bargains available, but not a lot of great deals. This may be a time to consider ETFs to capture the broad value.

- Projected income growth stands at 8.2%, below my goal of 10%.

- Ameriprise provided another fantastic increase, while Apple continued to place share buybacks ahead of the dividend.

southtownboy/iStock via Getty Images

It's hard to believe that we are already a third of the way through the year. Markets are proving to be very resilient, if a bit boring. I recall two other recent periods where the market felt this dull and uninspired. During these times, I quit buying and let dividends accumulate, much as I'm doing now.

The most recent was in the summer of 2021, when everything was moving higher together. Almost always, there are fragments of value, but not that summer. Everything was expensive, and seemingly nothing was out of favor. Finally, in September, Lockheed-Martin (LMT) showed up as a significant bargain, and I was able to put some cash to work. Of course, conditions were much different then than today.

In the last couple of months, I have written often about the return on cash. Before last year, holding cash was a major drag on income, as it offered no return. It made sense to reach a little bit for a solid dividend growth stock. Now, with cash yielding well over 4.5%, an investor can afford to wait. However, there are other differences in the market today.

In the summer of 2021, not only were there no great bargains, there just weren't any good bargains. Today, I show many, many solid deals that I am tracking. However, there are few great bargains. Right now, with a "well advertised coming recession," coupled with a decent return on cash, I want slightly better deals than the market offers. However, it's important to acknowledge that there are a lot of decent deals available and to strike a balance between waiting for that great deal and taking advantage of what's available. After all, only a couple of years ago, I would have been excited to see so many good bargains available.

I have always been slightly averse to using ETFs. This is primarily because I don't want to overpay for some of the positions and believe that selectively buying bargains is a better strategy. However, with so many solid deals and nothing standing out, ETFs are making more sense today than ever. In my other portfolios, I have been making small daily purchases of Schwab US Equity Dividend ETF (SCHD) and, to a lesser extent iShares Core Dividend Growth ETF (DGRO) for all of this year. SCHD's 3.6% return is appealing right now, and I like DGRO's exposure to some companies that I wouldn't typically buy. This portfolio has never held any ETFs, but I am seriously considering starting a position in SCHD.

Portfolio Goals

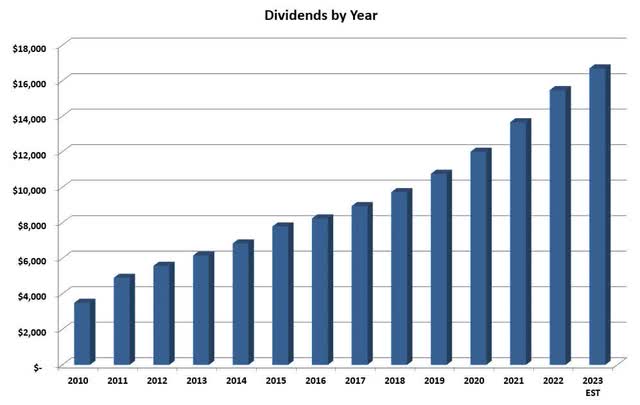

The portfolio goals are simple: Grow the income by 10% annually with dividends reinvested and 7% annually without reinvesting. This goal allows my income to double approximately every seven years while reinvesting and every ten years after I begin withdrawing the dividends. It's important to know that this portfolio has been closed to new capital since 2016. The graph below shows the steady progress of income growth.

Wyo Investments

Portfolio Guidelines

I use guidelines to achieve my goals rather than rules. Rules imply something hard and fast, whereas guidelines are flexible but give a general direction to follow. I keep these simple, as I have found that complexity adds time without any real benefit. These have evolved over the years, the most recent being the addition of selling covered calls in certain circumstances.

- Invest in companies from the Champions and Contenders list with at least 15 years of dividend growth.

- Look for companies with a 3% starting yield and the potential to maintain a 7% dividend growth for decades. The growth is critical as it's impossible to continue growing income at 7% without reinvesting unless companies raise distributions by at least that amount.

- Replace (or sell covered calls against) significantly overvalued positions if the opportunity exists to reduce risk and increase income. In practice, this usually means higher quality at a higher yield.

- I want to see flat to mild payout ratio creep. A payout ratio growing from 30% to 35% over ten years is acceptable. One that has gone from 30% to 60% is not. I want companies to grow the dividend with earnings, not by increasing the payout ratio.

- Unless it is well-diversified across industries, no single sector should account for more than 20% of the income. This burned me in 2016 when several energy companies cut dividends.

Again, these are just guidelines and are flexible to accommodate what makes sense to achieve my overall goals. I follow a few other items but don't see them as integral to my investing. Instead, these tend to be more personal preferences. They include avoiding foreign companies because I don't enjoy accounting for the taxes and FX rates causing fluctuating dividends.

Current Holdings

Below is a table of the holdings in this portfolio, along with the position size and percent of income each produces.

| Company | % of Portfolio | % of Income |

| Ameriprise (AMP) | 6.4% | 3.5% |

| Microsoft (MSFT) | 6.1% | 1.7% |

| Blackstone (BX) | 5.2% | 7.2% |

| Phillip Morris (PM) | 4.7% | 7.5% |

| AbbVie (ABBV) | 4.6% | 5.5% |

| Altria (MO) | 4.6% | 11.2% |

| Visa (V) | 4.4% | 1.1% |

| Lockheed Martin (LMT) | 4.3% | 3.5% |

| Apple (AAPL) | 4.0% | 0.7% |

| Texas Instruments (TXN) | 3.9% | 3.6% |

| Cincinnati Financial (CINF) | 3.3% | 2.8% |

| Enterprise Products Partners (EPD) | 3.1% | 6.9% |

| Medtronic (MDT) | 3.0% | 2.8% |

| Broadcom (AVGO) | 2.9% | 2.7% |

| Pepsi (PEP) | 2.5% | 1.8% |

| Aflac (AFL) | 2.3% | 1.7% |

| Blackrock (BLK) | 2.3% | 2.2% |

| Duke Energy (DUK) | 2.1% | 2.7% |

| Johnson & Johnson (JNJ) | 2.0% | 1.7% |

| Starbucks (SBUX) | 2.0% | 1.2% |

| MSA Safety (MSA) | 1.8% | 0.7% |

| Phillips 66 (PSX) | 1.6% | 2.1% |

| Abbott Laboratories (ABT) | 1.6% | 0.9% |

| J.M. Smucker (SJM) | 1.4% | 1.1% |

| A.O. Smith Corp (AOS) | 1.4% | 0.7% |

| Home Depot (HD) | 1.2% | 1.0% |

| Automatic Data Processing (ADP) | 1.2% | 0.8% |

| CME Group (CME) | 1.2% | 1.5% |

| Unilever (UL) | 1.1% | 1.1% |

| Omega Healthcare Investors (OHI) | 1.1% | 3.0% |

| CVS Healthcare (CVS) | 1.0% | 0.9% |

| Simon Property Group (SPG) | 1.0% | 2.0% |

| Intercontinental Exchange (ICE) | 1.0% | 0.5% |

| Prudential Financial (PRU) | 0.9% | 1.6% |

| Fortune Brands Innovations (FBIN) | 0.9% | 0.4% |

| Best Buy (BBY) | 0.9% | 1.3% |

| Walgreens Boots Alliance (WBA) | 0.7% | 1.3% |

| Ladder Capital (LADR) | 0.7% | 2.1% |

| Realty Income (O) | 0.6% | 0.9% |

| Cardinal Health (CAH) | 0.5% | 0.4% |

| National Retail Properties (NNN) | 0.5% | 0.7% |

| Honeywell (HON) | 0.5% | 0.3% |

| Snap-On (SNA) | 0.4% | 0.3% |

| Diamond Hill Investment Group (DHIL) | 0.3% | 0.7% |

| Cash | 2.8% |

How Am I Doing So Far In 2023?

The current income projection is $16,738, up 8.2% over last year. However, I don't project any dividend reinvestments, so this generally climbs as the year progresses. Additionally, I am usually pretty conservative on my dividend increase projections, only tightening them up the month of the expected increase.

This year's income has been hurt by the dividend cut from Intel (INTC) and the Blackstone dividend reduction. Because Blackstone has a variable dividend policy, I look at the long-term trend of the dividend rather than any particular year. I have reduced my projection on BX's distribution to $3.85, representing a 22% reduction from last year. It's likely that I will reduce this projection again based on the current consensus estimates. However, BX is difficult to project, and the long-term dividend growth trend is intact.

While the portfolio has no goals around the total return, many readers are interested. The portfolio is up 5.2% year-to-date, significantly trailing the S&P 500. However, on a 1-year basis, the portfolio beats the S&P 500 by nearly 5%. These results aren't surprising given the portfolio's makeup and are irrelevant to income growth goals.

April's Dividend Increases

Last month there were three expected increases. Apple pushed their announcement into May, although I have included it here.

Ameriprise

So far this year, asset managers have struggled to give much in the way of raises. This shouldn't be surprising, given the market performance of 2022. However, Ameriprise bucked the trend with an 8% increase. This raise is right in line with its five-year growth rate of 8.5%.

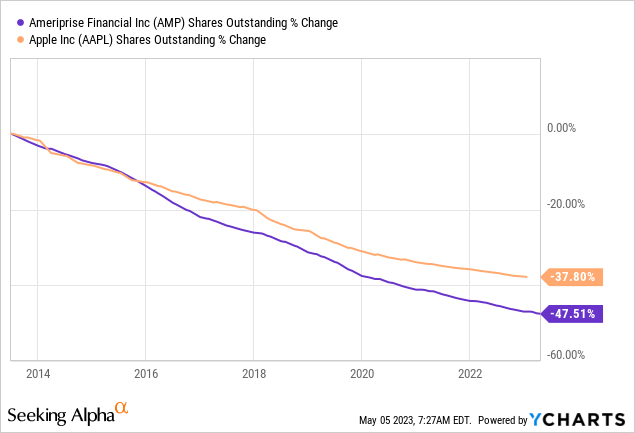

Ameriprise was able to buck the trend because of its massive share buybacks. Very few companies have reduced the share count as much as AMP over the last decade. This reduction is a direct boost to the EPS and supports dividend increases. The table below shows the decline in shares of AMP and compares it to another company often touted for its strong buybacks, Apple.

Johnson & Johnson

On April 18, Johnson & Johnson announced a 5.3% increase. This represents a smaller increase than investors are used to as the company has given relatively consistent 6% raises for a long time, with 3, 5, and 10-yr growth rates all at 6%.

Apple

Once again, Apple showed its commitment to share buybacks over dividends. They will reach twelve years of increases with the penny raise announced on May 4. This translates to a 4.3% dividend increase.

May's Expected Increases

May is another fairly light month for increases. Only one of the companies, Medtronic (MDT), is a top-income producer in my portfolio.

Medtronic

This dividend champion seeks to build on its 45 years of dividend growth. With a 10-yr growth rate of 10% and a 5-yr growth rate of 8%, the company continues to grow the dividend at a respectable rate after all those years. However, the company has struggled since 2020, and the payout ratio has grown along with the distribution. I think it's likely that this year, investors will see a smaller increase in the 4-5% range.

Cardinal Health

As a micro position in the portfolio, CAH doesn't get a lot of attention other than consideration for cutting it loose. However, I have held it in anticipation of the opioid lawsuits wrapping up and brighter earnings in the future. While the price has popped, it might be too early to see a big jump in the dividend.

CAH has a 10-year dividend growth rate of nearly 7%, which is quite a feat considering the 5-year growth rate is an abysmal 1.4%. While this year will likely be better than the last couple of years' 1% increases, I think we will probably see something in the 3% range. On the plus side, earnings are expected to pick up substantially over the next couple of years, and investors can look forward to better increases in the future.

MSA Safety

This lesser-known Dividend King has increased the dividend for 51 years. The company has 5 and 10-yr growth rates of around 5%, although the last few have been slightly below this rate. While I was expecting a return to close to the 5-yr average, on May 2, the company announced a disappointing 2.2% increase.

MSA is one of the portfolio's oldest positions and, with its small yield and relatively slow dividend growth, isn't a great fit anymore. I trimmed about a third of the position in 2021 on massive overvaluation but decided to keep the rest because of the safety and consistency the company represents. Today the company is in a slightly below-average position at 1.7% of the portfolio and accounts for 0.7% of the income.

Sales In March

I rarely sell companies in this portfolio. Every company is bought with the intention of holding forever. However, I regularly evaluate the positions for significant overvaluation and a change in my thesis. Last month there were no sales in the portfolio.

Purchases In March

There are two types of purchases I make. The first is the reinvestment of dividends. For these purchases, I try to stick with good bargains, generally adding to companies I already hold. However, I will start a new position if enough funds are available to open a meaningful one and the right opportunity presents itself. The second type of purchase is the reinvestment from a sale. I focus on replacing the income with a higher overall quality dividend for these.

Last month there were no replacement purchases.

Regular Purchases

In April, cash accumulation continued to outpace investments. Many companies continued to drop down close to my buy points only to jump back up again. I reached a little again for a share of Home Depot, as I would like to get it at $278, but I am trying to build out the position.

Below is a summary of purchases for the month; the price shown is the average price paid per share.

- CVS Corp (CVS), 1 share @ $73.59

- Home Depot, 1 share @ $288.05

- Texas Instruments (TXN), 2 shares @ $164.50

What Else Am I watching?

Since this is a closed portfolio, I can only buy some of the companies that look interesting. This section covers what I purchase and consider in my other portfolios. My other portfolios have different goals and rules but are also dividend growth portfolios.

Presently, I am seeing a lot of "ok" bargains but not many great deals. This makes me confident that it's a good time to make ETF purchases, of which I continue my small daily purchases of SCHD.

The best deals based on historical dividend yields continue to be in banking. There is plenty of room for short-term volatility here, but banks are setting up for strong long-term returns. I have added to my US Bank (USB) and The Toronto Dominion Bank (TD) positions again in a small way. US Bank knocked off Best Buy as my highest-rated bargain, where BBY had been sitting for several months. Right now, I'm not considering any smaller regionals, but there are probably some tremendous opportunities for those willing to take the risk.

In the first couple of days of May, Texas Instruments reached a 3% yield again, reaching my third buy point, and I have added a little.

If I were forced to start a new position in this portfolio today, I would consider United Parcel Service (UPS), Williams-Sonoma (WSM), or a small one in Nexstar Media (NXST). These are all at excellent historical yields.

Final Thoughts

The markets are feeling spooky right now. They seem rather range bound, like everyone is waiting for something to happen. There isn't much good news about the economy, the banking issues are a bit concerning, and the debt ceiling is looming.

We are fortunate to get a return on cash right now for those who are more comfortable taking a wait-and-see approach. For the long-term investor, there isn't a lot of downside to being patient for the right bargains to come along.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AAPL, ABBV, ABT, ADP, AFL, AMP, AOS, AVGO, BBY, BLK, BX, CAH, CINF, CME, CVS, DHIL, DUK, EPD, FBIN, HD, HON, ICE, INTC, JNJ, LADR, LMT, MDT, MO, MSA, MSFT, NNN, O, OHI, PEP, PM, PRU, PSX, SBUX, SJM, SNA, SPG, TD, TXN, UL, USB, V, WBA, SCHD, DGRO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.