11%-Yielding Owl Rock Capital: Buy In May And Sleep Away

Summary

- Owl Rock Capital has sold off to start the month, giving income investors a high yielding opportunity.

- Its portfolio is well-positioned and it could benefit from a pullback in regional banks.

- The stock trades at a material discount to NAV and pays a well-covered dividend.

- Looking for a portfolio of ideas like this one? Members of Hoya Capital Income Builder get exclusive access to our subscriber-only portfolios. Learn More »

Deagreez

There is an old stock market adage that goes something like "Sell in May and go away". More often than not, this seems to hold true for this month for one reason or another.

While there are some legitimate reasons for why the market has sold off so far this month, with regional bank troubles being one thing, perhaps investor jitters are also making matters worse.

This brings me to Owl Rock Capital (NYSE:ORCC) which I last covered here back in last December. While the stock hasn't budged much at all, it's given investors a 6.1% total return since my last bullish take thanks to dividends, and this has far surpassed the 2.7% return of the S&P 500 (SPY) over the same timeframe.

The stock has sold off from the $13 level since the start of the month and in this article, I highlight why now may be an opportune time to pick up this high yielding stock, so let's get started.

Why ORCC?

Owl Rock Capital is one of the biggest BDCs on the market today by asset size, and is externally managed by Owl Rock Capital Advisors. It focuses on direct lending for U.S. upper middle market companies and has a $13 billion portfolio size covering 184 portfolio companies.

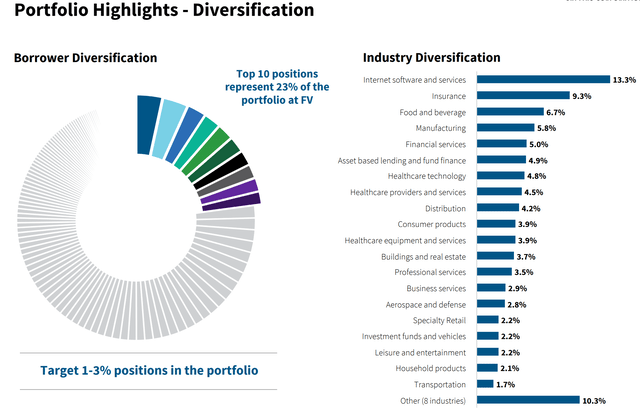

ORCC is well-diversified with positions that generally represent between 1% to 3% of the portfolio size. This also holds true for ORCC's largest positions, as its top 10 investments represent just 23% of the portfolio at fair value. ORCC also invests primarily in defensive and growing industries. As shown below, internet software and services, insurance, food and beverage, manufacturing, and financial services make up its top 5 industries comprising just over 40% of the portfolio fair value.

Encouragingly, ORCC's net asset value per share has held up well amidst a rising rate environment. This is reflected by NAV per share rising by $0.14 on a sequential quarter on quarter basis to $14.99 at the end of last year. This was due to ORCC generating net investment income that was in excess of both the regular and special dividend (1.24x NII to regular dividend coverage ratio) combined with a $0.09 gain in value of investments (both realized and unrealized appreciation).

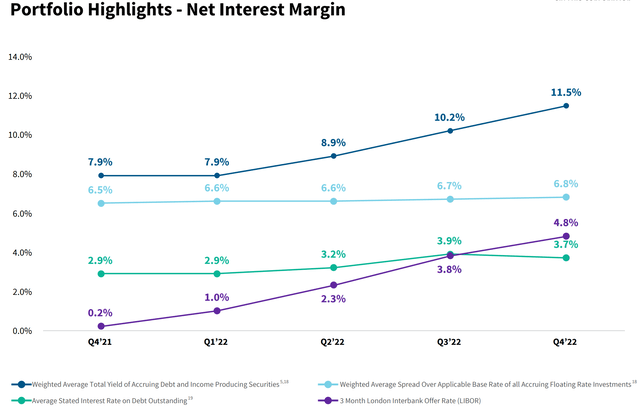

Looking forward to Q1 results, I would expect to see continued improvement in the yield of ORCC's interest bearing investments. This is considering that 98% floating rate nature of ORCC's debt investments and rate hikes by the Federal Reserve since the start of the year, including the most recent quarter point rate hikes. As shown below, ORCC's weighted average yield on debt grew by 11.5% at the end of last year.

Potential headwinds include the added burden that higher interest may have on borrowers. This could be mitigated by the fact that ORCC has had a decent track record of capital stewardship, with an annual loss rate of just 13 basis points since inception.

Moreover, the majority of ORCC's debt (86%) is in the form of senior secured debt, with 71% being first lien investments. Non-accruals also remained low as of the end of last year, with it being just 1.3% of investments at fair value. ORCC also carries a reasonably strong balance sheet to handle potential headwinds, with a debt to equity ratio of 1.19x, sitting well below the 2.0x statutory limit for BDCs and had $1.8 billion in total liquidity at the start of the year.

Notably, the recent pullback in regional banks actually presents an opportunity for BDCs to step up to the plate. This is considering the fact that BDCs have a permanent equity base, that unlike customer deposits, can't be withdrawn by investors.

Lastly, I find ORCC to be highly appealing for income investors at the current price of $12.25 with a 10.8% regular dividend yield, which could be boosted by special dividends along the way, such as the $0.04 special that was paid in March. As noted earlier, the dividend comes with a 1.24x coverage ratio.

ORCC also trades at a hefty 18% discount to net asset value with a 0.82x price to book ratio. As shown below, this sits on the low end of ORCC's 3-year trading range. Analysts have a consensus Buy rating with an average price target of $14.73, which translates to a potential 31% total return over the next 12 months.

Investor Takeaway

Overall, ORCC appears to be a compelling opportunity for income investors with its generous 10.8% yield and solid dividend coverage along with its attractive NAV discount. ORCC's debt investments have proven to be resilient and the company has a strong balance sheet to weather potential headwinds. With potential catalysts from the pullback in regional banks and higher interest rates, ORCC could be set to reward investors with potentially strong returns. As such, investors may want to give ORCC a hard look while tuning out the noise.

Gen Alpha Teams Up With Income Builder

Gen Alpha has teamed up with Hoya Capital to launch the premier income-focused investing service on Seeking Alpha. Members receive complete early access to our articles along with exclusive income-focused model portfolios and a comprehensive suite of tools and models to help build sustainable portfolio income targeting premium dividend yields of up to 10%.

Whether your focus is High Yield or Dividend Growth, we've got you covered with actionable investment research focusing on real income-producing asset classes that offer potential diversification, monthly income, capital appreciation, and inflation hedging. Start A Free 2-Week Trial Today!

This article was written by

I'm a U.S. based financial writer with an MBA in Finance. I have over 14 years of investment experience, and generally focus on stocks that are more defensive in nature, with a medium to long-term horizon. My goal is to share useful and insightful knowledge and analysis with readers. Contributing author for Hoya Capital Income Builder.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ORCC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am not an investment advisor. This article is for informational purposes and does not constitute as financial advice. Readers are encouraged and expected to perform due diligence and draw their own conclusions prior to making any investment decisions.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.