Air Transport Services Group: Unjustified Stock Selloff

Summary

- Air Transport Services Group, Inc. lowered its 2023 guidance.

- The market has overreacted, pushing Air Transport Services Group stock towards levels last seen during the pandemic.

- Even on a lower EBITDA basis, significant upside exists for Air Transport Services Group, Inc.

- Looking for a helping hand in the market? Members of The Aerospace Forum get exclusive ideas and guidance to navigate any climate. Learn More »

Monty Rakusen/DigitalVision via Getty Images

In Friday’s trading session, Air Transport Services Group, Inc. (NASDAQ:ATSG) stock is taking it on the chin as it lowered its guidance for the full year. At the time of writing, the stock is down 23%. Seeking Alpha contributors have been bullish on ATSG stock, so it is interesting to analyze whether the market is overreacting or whether this selloff is justified.

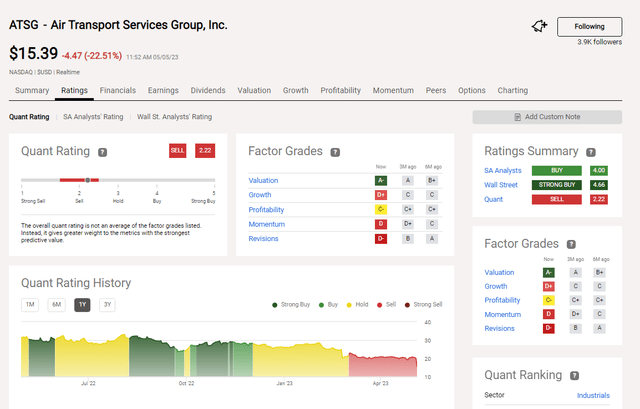

SA Analysts, Wall Street Or Quant?

While I certainly would not want to make the case that the Quant is better than Seeking Alpha analysts, the Quant got it right this time. In early March, the Seeking Alpha Quant already had changed its signal to sell, and since then ATSG stock has lost 50%. So, credit where credit is due, and they go to the Quant system this time.

What Does Air Transport Services Group Do?

Air Transport Services Group derives its revenues from various streams. It provides leasing of cargo aircraft and training services, ACMI (Aircraft, Crew, Maintenance and Insurance) and CMI services for cargo and passengers, maintenance and passenger-to-freighter conversions as well as logistics and material support. So, a nicely diversified business but that seemingly hasn’t shielded them adequately from risks in the market.

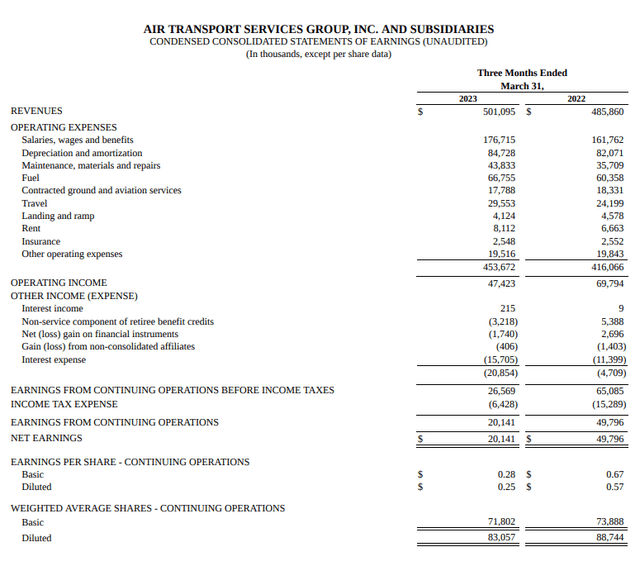

Revenues increased by $15.3 million year-over-year, but that almost fully offset by higher salaries on which higher fuel, rent and maintenance cost compounded resulting in $22.4 million lower operating profits and on top of that came $16 million non-operating expenses bringing the overall net earnings to $20.1 million from $50 million a year ago. Analysts were looking for over $510 million in revenues and $0.47 per share profit while the company was only able to post adjusted profits of $0.36.

The cargo aircraft leasing business did quite well with revenues up 8% as its fleet kept growing. The pre-tax earnings decreased 2% driven by higher interest expenses but I would consider that to be a natural flow of the business as the segment owns more aircraft including aircraft acquired as feedstock for freighter conversion. These airplanes are financed with debt. What pushed results down were the results at Omni Air. ACMI services generated a loss of $2 million versus a profit of $22 million in the comparable period last year. Costs were higher for flight crew travel, training and line maintenance while cargo block hours flown increased by 4% and passenger block hours were down 25%. So, on a higher asset base the company generates less value primarily due to weak passenger block hours execution.

ATSG Lowers Expectations

Air Transport Services Group, Inc. now expects adjusted EBITDA of $610 million to $620 million down from $650 million to $660 million in February guidance, while adjusted EPS has come down to 30 cents in the $1.55 per share to the $1.70 per share range. This reflects the weak ACMI performance in Q1 and improvements in the remainder of the year.

Listen To The Quant Or Not?

When considering the 6% reduction in EBITDA and the 17% reduction in earnings per share for the guidance, a 23% hit might seem a bit steep. However, this is mostly driven by the analyst consensus of $1.96, which now indicates that at the mid-point the company will fall 21% short of expectations for 2023. I put in the company’s market cap, the impact on 2023 earnings, and its net debt in my model, and the drop still seems to be extremely overdone. The forward EV/EBITDA is 4.2x while the company’s median is 6.1x, which would put the price target at $22, providing 45% upside from current trading levels.

Conclusion: Upside Remains Despite Soft First Quarter

Air Transport Services Group, Inc. did revise its guidance downward, and that caused the stock to crash. However, the negative sentiment ignores the fact that demand for cargo airplanes remains strong and the downward pressure primarily came from the poor performance in passenger ACMI services. I think the market has largely handled this as an indication that freighter airplane and operations demand is dropping and affecting the business, but that appears not to be the case.

The Air Transport Services Group, Inc. stock price is now pushed towards the lows witnessed during the pandemic. With airplane shortages heading into the summer season, I don’t think that is justified at all. So, while SA Quant correctly anticipated the drop, I have to side with SA analysts here and mark Air Transport Services Group, Inc. stock a buy.

This article was written by

His reports have been cited by CNBC, the Puget Sound Business Journal, the Wichita Business Journal and National Public Radio. His expertise is also leveraged in Luchtvaartnieuws Magazine, the biggest aviation magazine in the Benelux.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.