VIG: I Own This ETF So I Can Sleep Like A Baby

Summary

- In today’s article, I'm going to cover an ETF that focuses on dividend-paying stocks that increase their dividends on a regular basis.

- Some are faster than others, so we will see a lower dividend yield but some consistent dividend growth on the regular.

- I’m moving money into VIG, as I consider this ETF a low-volatility complement to other non-REIT ETFs that I own, like SCHD and JEPI.

- Looking for more investing ideas like this one? Get them exclusively at iREIT on Alpha. Learn More »

SimonDannhauer

This article was published on iREIT at Alpha on Wednesday May 3, 2023.

Investors over the years have often said that the longer the time horizon, the more risk one can take. The same holds true when it comes to the power of compounding. Albert Einstein referred to the power of compounding by calling it, "the eighth wonder of the world."

Dividend investing utilizes the power of compounding, and for patient investors, dividends, especially growing dividends, can help build large amounts of wealth over time.

There is a huge misconception out there in the investing world that dividend investing is just for retirees. This could not be further from the truth. Let me explain.

When you invest in a stock, your goal is to see a return on your investment. Dividend investing is a total return strategy. Just like growth stocks can appreciate in value, so do dividend stocks. However, dividend stocks have a second component, in which they pay you a dividend, which is a share of the company profits.

If you invest in a business, you want to see some sort of return over the years and receive a piece of the profits from time to time. Not very often do you want to invest in a business and receive nothing until you sell the business.

With dividend investing, you can receive quarterly or even monthly dividend payments, giving you a share of the income the company is paying out. Not all the income, but a piece of the income. In return, you can use this money to reinvest back into the market, effectively adding more shares to your portfolio, thus the power of compounding.

If the stock or exchange-traded fund ("ETF") is one that increases its dividend regularly, then this power of compounding is put into overdrive. Not only are you utilizing the dividend to add more shares, but now you have more shares that are getting paid an even higher dividend amount per share than the year prior, and you can see how things can snowball in your favor over time. Time, though, is the hardest part.

Thus, in today's article, we are going to cover an ETF that focuses on dividend paying stocks that increase their dividends on a regular basis. Some faster than others, so we will see a lower dividend yield, but some consistent dividend growth on the regular.

VIG: The Dividend Appreciation ETF

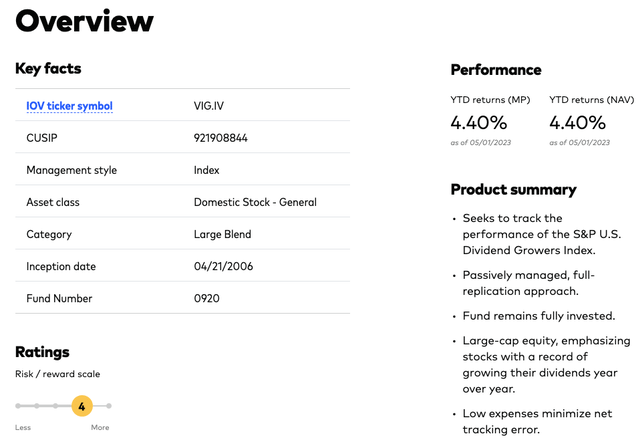

The Vanguard Dividend Appreciation Index Fund ETF Shares (NYSEARCA:VIG) is an ETF that invests in growth and value dividend stocks across a diversified group of sectors. The ETF is managed by the Vanguard group, and it was formed in April 2006. The fund seeks to track the performance of the S&P US Dividend Growers Index, by using a full replication technique.

On the year, shares of VIG are up 4.4% and being that the ETF is passively managed, they have a low expense fee of just 0.06%, meaning for a $10,000 investment, your fee would equate to just $6 annually. The fund has $67 billion in assets under management at the time of this writing.

Again, dividend appreciation is great for long-term investors looking to utilize both time and compounding to their advantage. Investors focused more on income may not find the likes of VIG to be all that attractive due to its lower yield which we will get into more below.

Let's first look at how the ETF is assembled.

Built On A Diversified Foundation

Diversification is key, especially for buy and hold investors or those looking to be more hands off. VIG is a well-diversified ETF with holdings across many different sectors, one reason its performance stands up to that of the S&P 500 year in and year out.

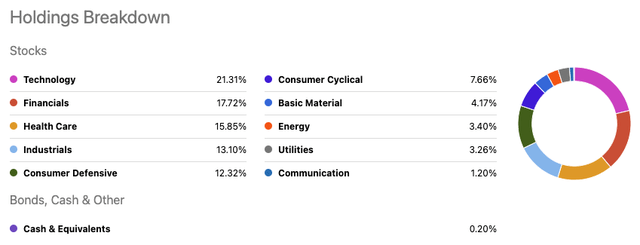

Here is a look at the sector breakdown for VIG:

Technology, Financials, and Health Care make up the top three sectors for the fund and combine for a weighting of nearly 55%. However, you can see they cast a wide net across many different sectors. Note, there is no real estate, i.e., real estate investment trusts aka REITs, in the ETF Index.

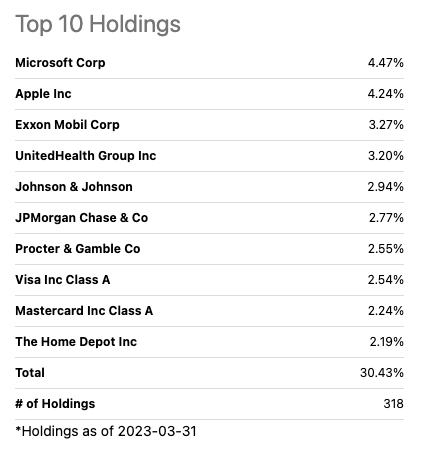

Let's next take a look at the funds top 10 holdings and their weighting within the ETF.

Seeking Alpha

Not only is the fund well-diversified amongst various sectors, but you can see there is not huge weighting amongst individual stocks as well. Microsoft Corporation (MSFT) and Apple Inc. (AAPL) are the top two positions, but only have weightings of 4.47% and 4.24%, respectively.

Just within the top five holdings you have positions covering the following sectors: Information Technology, Energy, and Health Care.

The top 10 holdings make up roughly 30% of the portfolio and as you can see above, VIG has a total of 318 total positions, making it a large fund in terms of total positions.

Here is a closer look at SCHD's top 5 positions:

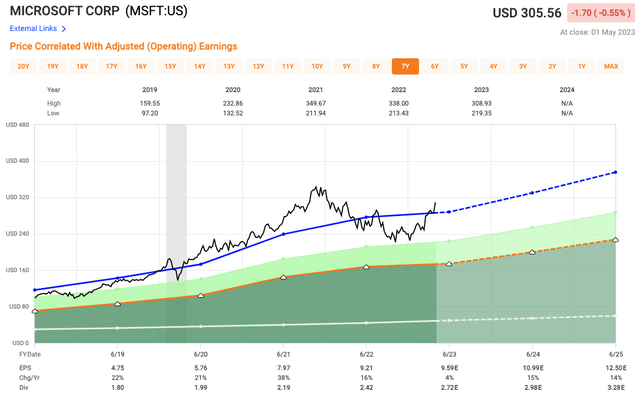

Microsoft Corporation (MSFT)

Microsoft is one of the largest companies in the world and very well diversified within the technology space, making this a great top holding for an ETF to have. MSFT currently has a market cap of $2.3 trillion.

Shares of MSFT have a dividend yield of 0.9% with a five-year dividend growth rate of 10%. Shares currently trade at a next year's earnings multiple of 27.8x compared to a 10-year average of 23.4x.

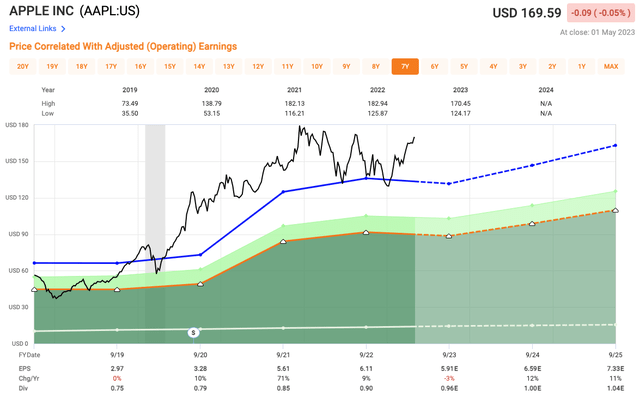

Apple Inc. (AAPL)

Apple is the most valuable company in the U.S. with a market cap of $2.7 trillion. They have popular products and a growing service segment that will be key for the company moving forward.

The stock yields a dividend of 0.6% and they have a five year dividend growth rate of 8%. AAPL shares currently trade at a 2023 earnings multiple of 28.7x compared to a five-year average of 22.2x.

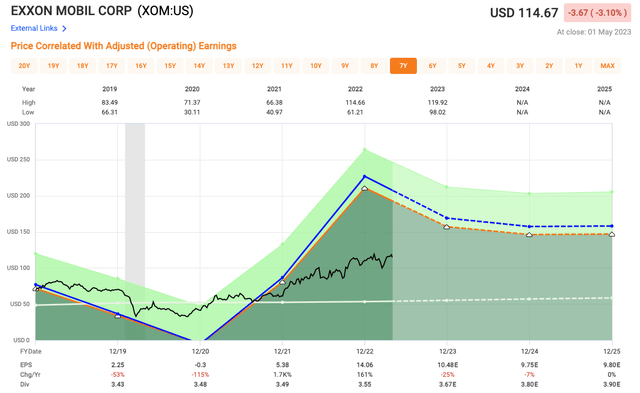

Exxon Mobil Corporation (XOM)

Exxon Mobil is an energy conglomerate in what has been a wild ride for the company that saw the stock fall to $30 during the pandemic and now over $100 per share and climbing. Exxon has a market cap of $464 billion.

The stock yields a dividend of 3.2% and they have a five year dividend growth rate of 3%. XOM shares currently trade at a 2023 earnings multiple of 10.9x compared to a five-year average of 16.1x.

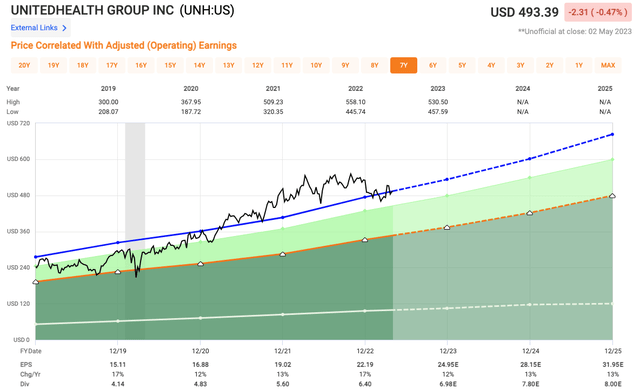

UnitedHealth Group Incorporated (UNH)

UnitedHealth Group is a leading health care insurance company and it has the top spot in terms of weighting within the Dow Jones Industrial Average with a high share price near $500.

The company has a market cap of $462 billion. The stock yields a dividend of 1.3% and they have a five year dividend growth rate of 17%. UNH shares currently trade at a 2023 earnings multiple of 19.8x compared to a five-year average of 21.4x.

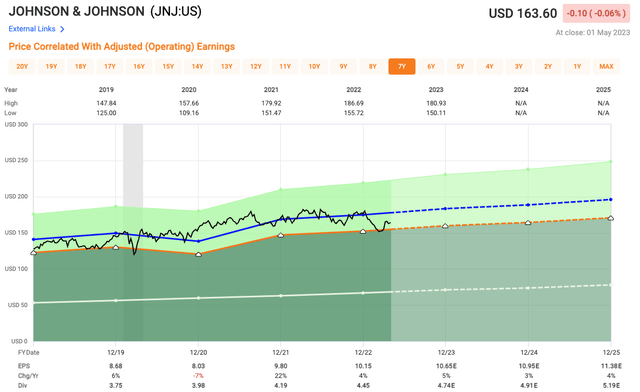

Johnson & Johnson (JNJ)

Rounding out the top five is Johnson & Johnson, one of the proud American companies and one that is going through a break up, as JNJ will be spinning off its consumer health segment later this year. JNJ owns popular brands such as: Tylenol, Motrin, Listerine, Aveeno, and many more.

The total company has a market cap of $425 billion. The stock yields a dividend of 2.9% and they have a five year dividend growth rate of 6%. JNJ shares currently trade at a 2023 earnings multiple of 15.4x compared to a five-year average of 17.2x.

In Closing

The top five spots are all leaders within their respective sectors and companies that have been around for years, withstanding all types of economic backdrops. These top positions provide for stable footing for the fund, but as you can see, the top five is not loaded with much in terms of dividend growth.

The strong stability allows the fund to look for more in terms of dividend growth outside these top 5 positions. Looking at the bottom half of the top 10, you can see the dividend growth starting to take effect. Here are positions 6-10 and their 5-year dividend growth rates:

- JPMorgan Chase (JPM): 13%

- Procter & Gamble (PG): 6%

- Visa (V): 18%

- Mastercard (MA): 18%

- The Home Depot (HD): 16%

In terms of the dividend paid by the fund, the latest quarterly dividend paid was $0.75 per share, which annualized is $3.00. Using the annualized dividend, VIG currently yields a forward dividend of 1.9%. Over the past five years, VIG has seen annual dividend growth of 10% and the dividend has been higher for 9 consecutive years.

Performance

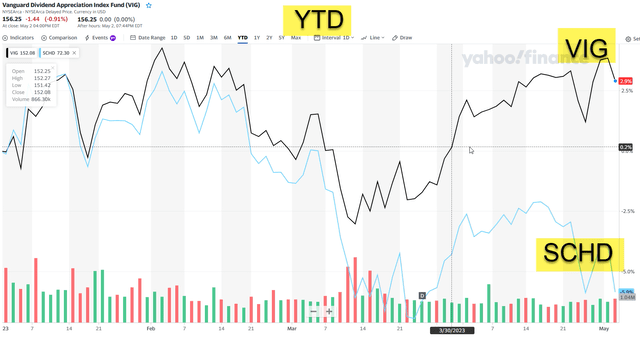

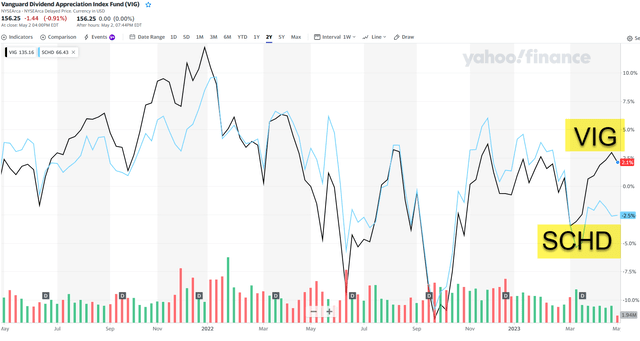

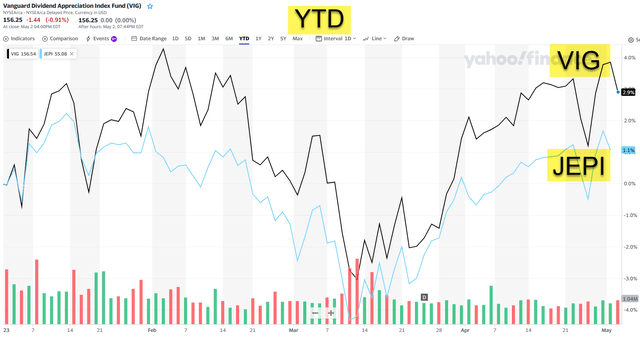

I just wrote on the Schwab U.S. Dividend Equity ETF™ (NYSEARCA:SCHD), another popular dividend ETF that yields 3.7%. Let's compare the performance with VIG, first starting with year-to-date:

Let's compare the 2-year performance of both ETFs:

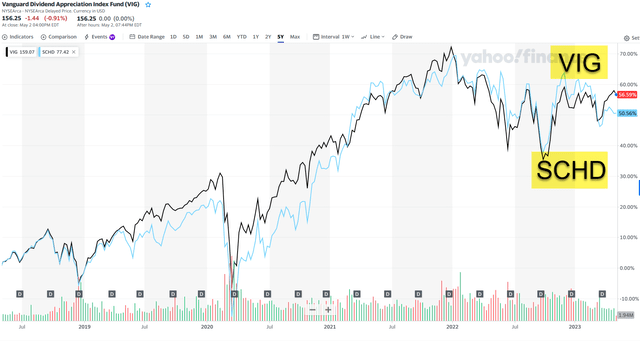

Now the 5-year performance:

VIG comes out on top for all periods referenced above, but remember that these charts are for price only. VIG yields 1.9% vs SCHD that yields 3.7%.

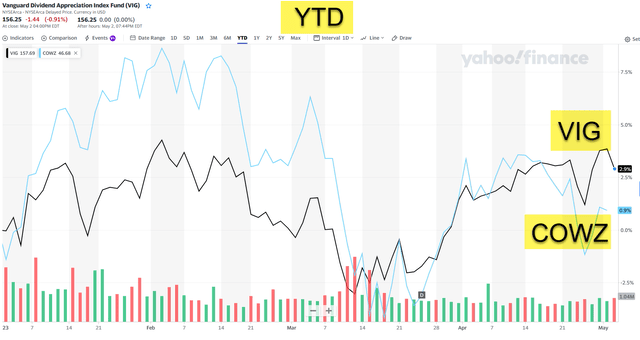

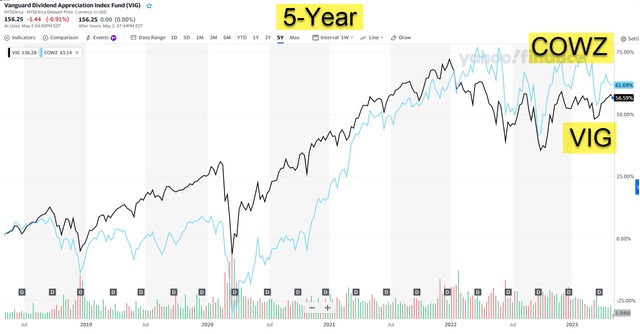

Let's take a look at Pacer US Cash Cows 100 ETF (BATS:COWZ), another popular ETF that seeks to invest in the stocks of companies operating across diversified sectors, excluding the financial sector, and screens the Russell 1000 for the top 100 companies based on free cash flow yield. I recently wrote on COWZ, too.

Keep in mind COWZ is yielding 2.12% vs VIG's 1.9%.

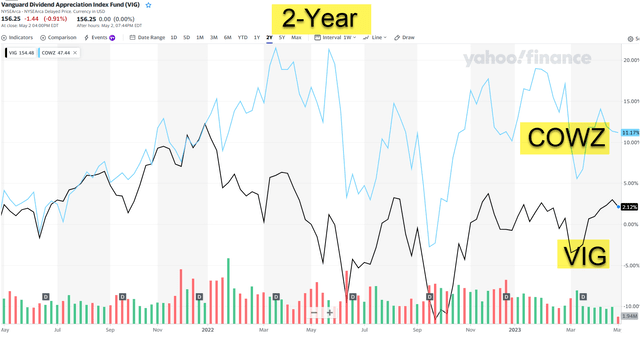

Now take a look at the 2-year performance chart below:

Finally, let's compare the 5-year performance for these two ETFs:

Now, one last comparison.

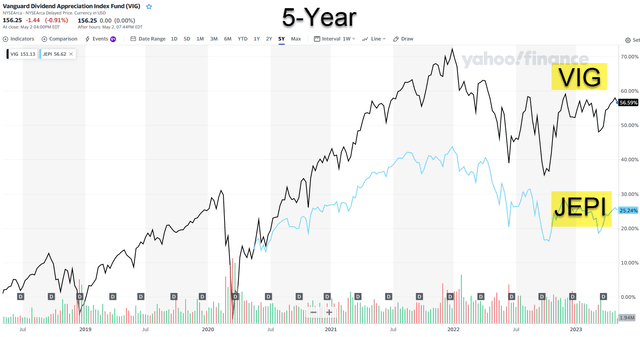

Let's examine an extremely popular ETF, JPMorgan Equity Premium Income ETF (JEPI), that yields a whopping 11.3%. I also wrote on this one recently and remember that this strategy focuses on high income based on their approach of owning not only dividend stocks, but also utilizing derivatives such as ELN's and covered calls to juice a high distribution yield.

Now consider the 5-year chart:

My fellow Dividend King founder Dividend Sensei also likes VIG, as he explained:

"While SCHD is the best high-yield ETF, VIG is slightly superior on safety, quality, and annual income dependability. VIG owns almost 300 of the highest-quality dividend aristocrats and future aristocrats. If VIG owns it, it's worth owning."

In closing, I'm moving money into VIG, as I consider this ETF a low volatility compliment to other non-REIT ETFs that I own, like SCHD and JEPI.

I hope you're enjoying my ETF series, which is extremely beneficial to me as I recently launched my first ETF Index: iREIT-MarketVector™ Quality REIT Index.

I'm in New York City this week, as I'm hoping to move closer to solidifying the REIT ETF that's designed for Average Joe and Jane to sleep well at night.

As always, thanks for reading and happy SWAN Investing!

Get My New Book For Free!

Join iREIT on Alpha today to get the most in-depth research that includes REITs, mREIT, Preferreds, BDCs, MLPs, ETFs, and we recently added Prop Tech SPACs to the lineup. Nothing to lose with our FREE 2-week trial.

And this offer includes a 2-Week FREE TRIAL plus my FREE book.

This article was written by

Brad Thomas is the CEO of Wide Moat Research ("WMR"), a subscription-based publisher of financial information, serving over 100,000 investors around the world. WMR has a team of experienced multi-disciplined analysts covering all dividend categories, including REITs, MLPs, BDCs, and traditional C-Corps.

The WMR brands include: (1) iREIT on Alpha (Seeking Alpha), and (2) The Dividend Kings (Seeking Alpha), and (3) Wide Moat Research. He is also the editor of The Forbes Real Estate Investor.

Thomas has also been featured in Barron's, Forbes Magazine, Kiplinger’s, US News & World Report, Money, NPR, Institutional Investor, GlobeStreet, CNN, Newsmax, and Fox.

He is the #1 contributing analyst on Seeking Alpha in 2014, 2015, 2016, 2017, 2018, 2019, 2020, 2021, and 2022 (based on page views) and has over 108,000 followers (on Seeking Alpha). Thomas is also the author of The Intelligent REIT Investor Guide (Wiley) and is writing a new book, REITs For Dummies.

Thomas received a Bachelor of Science degree in Business/Economics from Presbyterian College and he is married with 5 wonderful kids. He has over 30 years of real estate investing experience and is one of the most prolific writers on Seeking Alpha. To learn more about Brad visit HERE.Analyst’s Disclosure: I/we have a beneficial long position in the shares of VIG, SCHD, JEPI either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Author's note: Brad Thomas is a Wall Street writer, which means he's not always right with his predictions or recommendations. Since that also applies to his grammar, please excuse any typos you may find. Also, this article is free: Written and distributed only to assist in research while providing a forum for second-level thinking.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.