Gold Hits New All Time Highs, Don't Expect Them To Last

Summary

- Gold prices hit new all-time highs in overnight trading, briefly touching as high as $2,082, but the fundamental outlook continues to deteriorate as inflation pressures decline.

- The three main drivers of gold prices - interest rate expectations, inflation expectations, and commodity prices - put the fair value of gold below $1,500.

- We would need to see a full percentage point decline in real 10-year bond yields and/or a 50% rise in commodity prices to fully remove gold's overvaluation.

monsitj

Gold prices squeezed to new all-time highs in overnight trading, briefly touching as high as $2,082 at one point before settling back below the previous highs seen in August 2020. The speculative nature of the metal suggests that a close above these highs at $2,075 has the potential to ignite another leg higher in the metal. However, from a fundamental perspective, current monetary policy conditions are extremely tight, and we would need to see a dramatic reversal in policy in order for gold to continue its rise.

Macroeconomic Backdrop Increasingly Negative For Gold

I last wrote about gold on March 20, warning that deflationary macroeconomic conditions left the metal at risk of a downside reversal (see 'Deflation Risks Suggest Gold Is No Safe Haven'). Since then, while gold has moved higher, real bond yields have moved higher, thanks to falling inflation expectations, increasingly the downside risks for the metal.

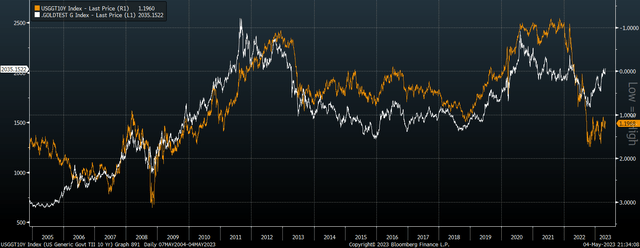

As a monetary metal gold competes with cash in investors’ portfolios and therefore tends to rise when real interest rate expectations fall and vice versa. The relationship is best seen when comparing gold prices with 10-year US inflation-linked bond yields, which is a measure of long-term real interest rate expectations. The chart below shows this correlation going back to 2006, with gold adjusted for inflation over time. The fair value of gold on this basis sits around $1,500, making the current gold price more overvalued than even the 2011 peak.

Real Gold Price Vs 10-Year TIPS Yield (Bloomberg)

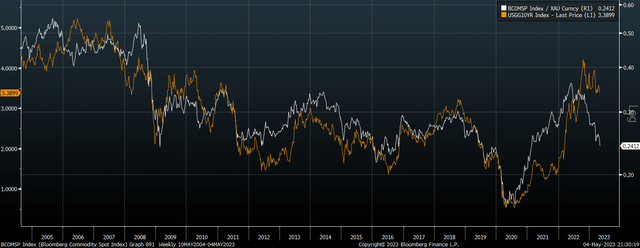

Another way to look at gold's valuation is to compared 10-year nominal bond yields with the ratio of commodity prices over gold prices. The fair value of gold rises when either commodity prices rise or bond yields fall. On this metric, the fair value of gold is even lower, at just $1,360.

US 10-Year Yield Vs Ratio Of Commodity Price Index over Gold Price (Bloomberg)

What Would It Take For Another Leg Higher?

In order to expect gold to continue rising, then, we likely would need to see its fair value rise via either falling bond yields or rising inflation expectations and commodity prices. Or, we would need to see the strong correlations that have been in place for decades completely break down.

Regarding the first point, I fully expect to see bond yields fall considerably, but in the current environment of collapsing money supply and weakening growth, commodity prices and inflation expectations also face downside risks. As we saw in 2008, major policy tightening failed to prevent gold prices from falling sharply as a surge in the demand for dollars amid a financial crisis saw inflation expectations and commodity prices fall even faster. Based on the correlations above, we would need to see a full percentage point decline in real 10-year bond yields and/or a 50% rise in commodity prices to fully remove gold's overvaluation. If this were to occur, investors are likely to be much better placed in commodities and bonds themselves.

Regarding the potential for gold to continue rallying in the face of continued tight monetary policy, I see this as extremely unlikely. I understand the long-term bullish arguments that emerging market economies are increasingly ditching the dollar for international trade and are building up their gold reserves, but these arguments are already widely understood. The impact of recent tightening and the 4.1% y/y decline in money supply suggest the dollar faces little risk of a collapse any time soon.

How I'm Playing My Bearish View

I currently hold short positions on gold via at-the-money call options sales, which should benefit unless we see a spike higher in the metal. I should also note that my short gold positions form part of a broader portfolio which is heavily weighted towards US bonds as well as exposure to silver and industrial metals. If my gold positions lose out, it is highly likely that the rest of my portfolio will perform very well.

This article was written by

Analyst’s Disclosure: I/we have a beneficial short position in the shares of XAUUSD:CUR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.