Lowe's Is Checking All The Boxes For Improving Shareholder Value

Summary

- Over the last decade, Lowe's has experienced an 81.7% rise in revenue, a 181.58% rise in net income, expanding margins, and a 41.29% decline in share count.

- Their strong return on capital is empowering a culture of aggressive buybacks.

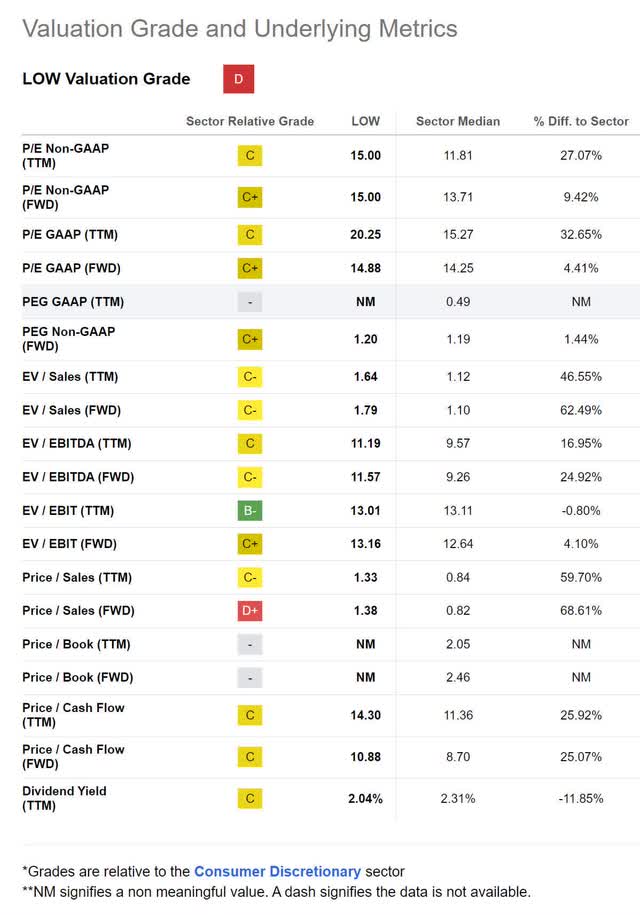

- The company has a forward P/E of 14.88x, a forward PEG of 1.20x, and a forward Price/Cash Flow of 10.88x.

- I rate Lowe's a Buy.

Scott Olson/Getty Images News

Thesis

Companies that have a culture of share buybacks and dividend growth tend to produce out-sized results for shareholders. Lowe's Companies, Inc. (NYSE:LOW) shows up repeatedly in my screens and after looking over their financials, I understand why. The company is using their strong return on capital to feed aggressive buybacks that are leading to EPS and dividend growth. I rate Lowe's a Buy.

Company Background

Lowe's is a home improvement retailer headquartered in Mooresville, North Carolina. The company's origins go back to when Lucius Smith Lowe opened North Wilkesboro Hardware in North Wilkesboro, North Carolina in 1921. After over a century of operations, the company has established itself as the second largest hardware chain on the planet. Its primary competitor, Home Depot (HD), is the largest.

Their most recent earnings call indicates management is forecasting a loss of revenue due to the low price of lumber and a decline in the home improvement market. They expect to outperform the market in 2023 with sales ranging from $88 billion to $90 billion, operating margin in the range of 13.6% to 13.8%, and approximately $13.60 to $14 in earnings per share.

Long-Term Trends

Home improvement and Do-It-Yourself retailers are expected to experience a CAGR of 4.6% through 2025.

Financials

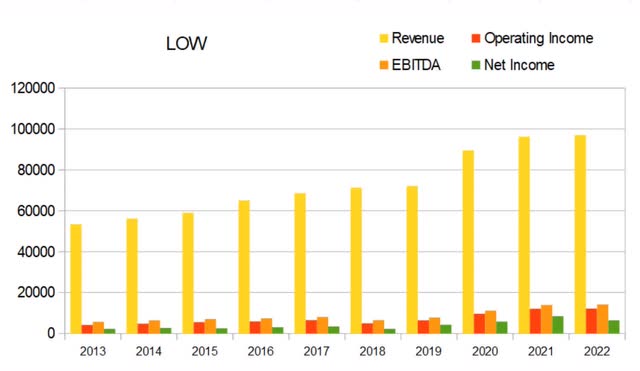

Although it varies from year to year, Lowe's has experienced significant revenue growth over the last decade. Revenue has grown from $53,417M in 2013, to $97,059M in 2022; representing a 81.7% increase. With that revenue growth, net income rose by 181.58%.

LOW Annual Margins (By Author)

Over the last decade, the company has experienced operating and net margin expansions. In 2013 operating margins were at 7.87%; by 2022 that had risen to 12.59%. Over that same time period net margins rose from 4.28% to 6.63%.

LOW Annual Margins (By Author)

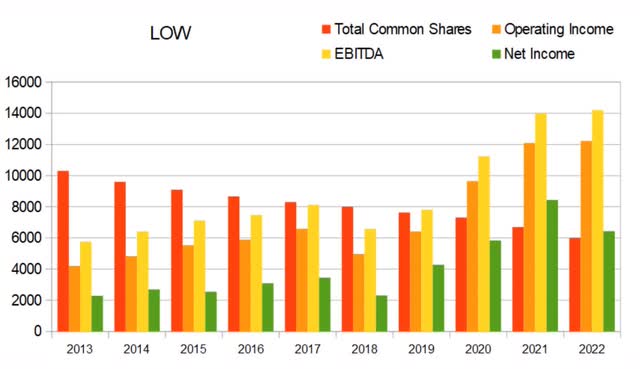

While growing revenue and income, Lowe's has been buying back shares at a truly impressive rate. In 2013 total common shares outstanding was at 1,030M; by 2022 that was down to 601M. This 41.29% drop in share count is extremely attractive for long-term holders.

LOW Annual Share Count vs. Incomes (By Author)

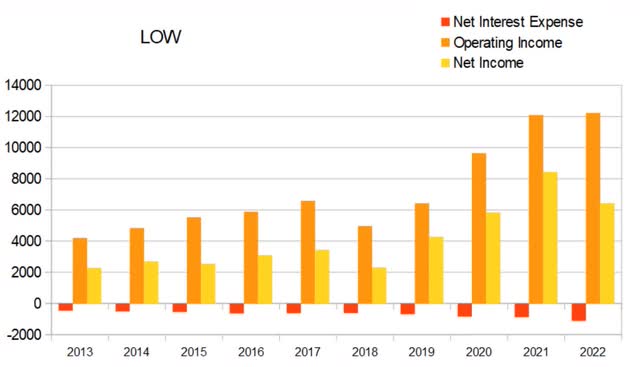

While their net interest expense is still quite manageable, their annual debt obligation has been rising. In addition to this, total debt is now elevated in comparison to their operating income. I didn't make a chart showing it, but in 2013 the ratio of their total debt divided by operating income was 2.5x, it reached a peak of 3.69x in 2019, and was at 3.11x by 2022. When companies sign themselves up for a steady stream of buybacks and dividend raises, they often take on debt. Aggressively buying back shares helps all their per-share metrics, making it easier to pay the loans back later while also allowing for continued dividend raises. However, if they ever experience a significant enough decline in operating income, they risk falling behind their intended pace for dividend growth.

LOW Annual Net Interest Expense (By Author)

Annual total equity has actually been declining and has turned negative. Normally this is to be seen as a red flag, but it is due to their buyback program coupled with dividend raises. As long at their short-term debt obligations stay easily manageable by their operating income, this is not as scary as it first seems. If anything, it can be taken as a sign management has confidence that the company is going to stay healthy financially.

LOW Annual Total Equity (By Author)

Lowe's has been improving its annual return on capital over the last decade. In 2023 it was at 10.21%, rose to 15.07% in 2017, then reached a new low of 11.64% in 2018. Since 2018, annual return on capital rose all the way to 34.32% in 2021 and has contracted to 26.99% in 2022.

LOW Annual Return On Capital (By Author)

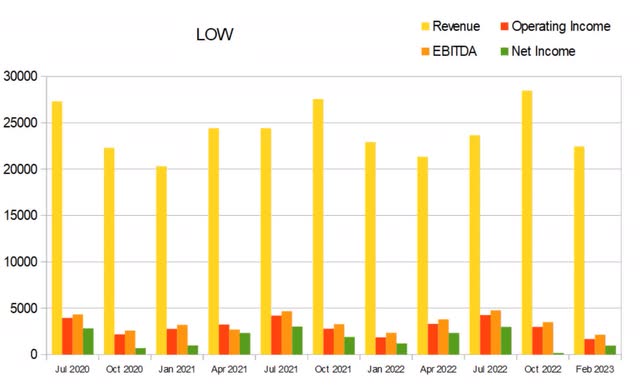

Looking over their quarterly statements makes it clear that Lowe's experiences seasonality. This is to be expected since a portion of their revenue is dependent on their customers having free time and good weather.

LOW Quarterly Revenue (By Author)

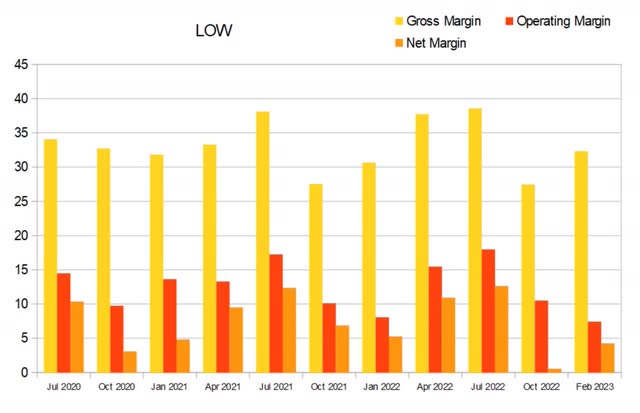

We can see this same seasonality in their quarterly margins. The warmer months tend to produce quarters with better margins.

LOW Quarterly Margins (By Author)

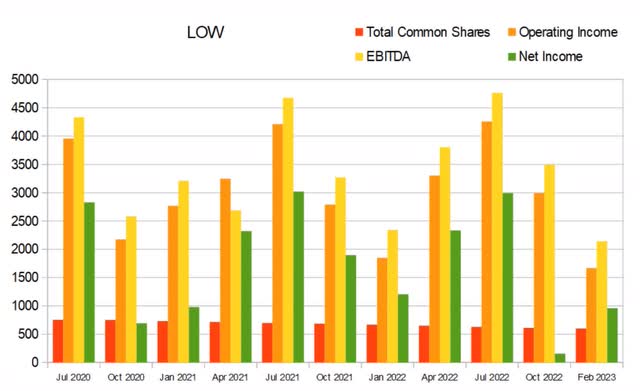

Total common shares outstanding went from 756M in Jul 2020 to 601M in Feb 2023. This represents a 20.5% drop in share count.

LOW Quarterly Share Count vs. Income (By Author)

The same negative equity that shows up in their annual equity chart, shows up in more detail here on their quarterly chart.

LOW Quarterly Total Equity (By Author)

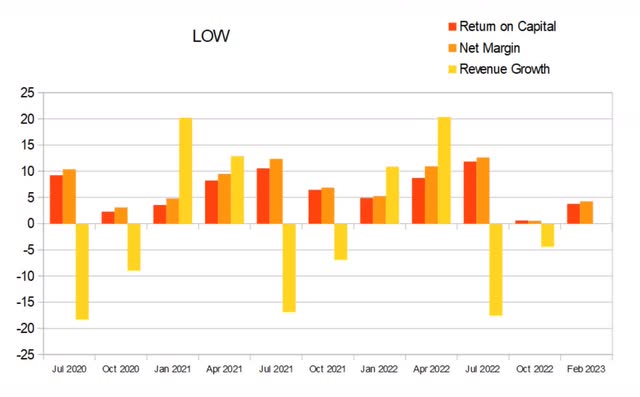

Seasonality also affects their quarterly return on capital. The last four quarters of return on capital were 8.71%, 11.86%, 0.61%, and 3.76%. These come out to an average quarterly return on capital of 6.235%.

LOW Quarterly Return On Capital (By Author)

Valuation

As of May 3, 2023, Lowe's had a market capitalization of $122.83B and traded for $205.31 per share. The company has a forward P/E of 14.88x, a forward PEG of 1.20x, and a forward Price/Cash Flow of 10.88x. I typically look for a P/E below 15, a PEG below 1, and a Price/Cash Flow below 10. Considering their strong return on capital, I see these metrics as showing that Lowe's is slightly undervalued.

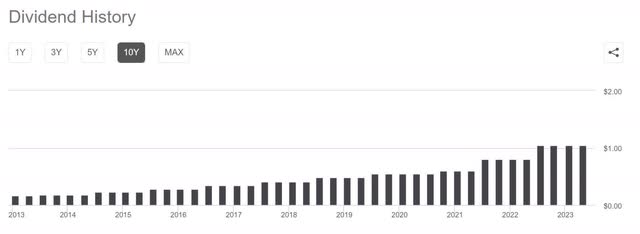

They have been steadily rising their dividend for most of the last decade. This is why Lowe's keeps showing up when I screen for dividend stocks. This company is a standout because unlike many other companies currently maintaining ambitious dividend growth, Lowe's is buying back shares even more aggressively. This leads me to believe their dividend growth is more likely to be sustainable over the long term.

LOW Dividend History (Seeking Alpha)

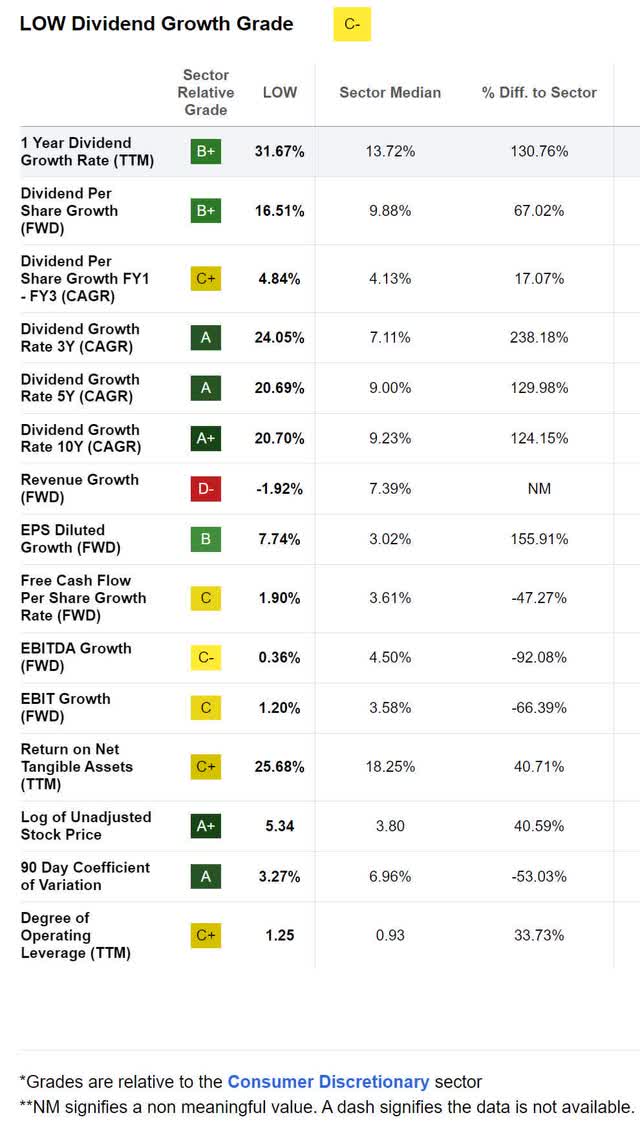

Their dividend growth has a projected 10 year CAGR of 20.7%. Using today's annual dividend of $4.20 per share, a dividend growth rate of 20%, a discount rate of 9%, and assuming they can maintain this dividend growth for 20 years, a discounted cash flow calculator produces a fair value estimate of $586.83 per share.

If dividend growth is instead maintained at a more reasonable 15% annual raise for 20 years then the fair value estimate comes out to $290.86 per share.

Running the calculator backwards now: for today's share price of $205.31 to be fair, and using the same discount rate of 9%, the annual growth rate of the dividend would have to be maintained at 12.45% for today's share price to be at fair value. As long as they are able to maintain their aggressive buyback rate, I believe they will be able to maintain a dividend growth rate at or above 12.45%. This implies that purely from a dividend yield point of view, Lowe's appears to be undervalued.

LOW Dividend Growth (Seeking Alpha)

Risks

Although their financials are presently quite healthy, the company seems to be taking on additional debt to help it achieve additional returns. When employed responsibly, debt can be good for a company. It is possible, but unlikely, that Lowe's experiences a significant decline in its financials and today's easily serviceable debt obligations become extremely burdensome. If this happens, they might have to temporarily lower or halt their dividend to pay the debt down to healthy levels.

Unlike many brick & mortar retailers, home improvement chains are unlikely to suffer from a rise in mail order shipping. This is mostly due to the extreme impracticality of shipping heavy construction and remodeling materials, but it's also backed up by the convenience of heading to a local hardware store when problems arise mid-project. Also, when it comes to buying things like appliances, many people refuse to order online without first looking over a display model. Because of several factors, Lowe's faces a relatively low level of threat from further rises in the popularity of online shopping.

Catalysts

As the average age of houses in the United States rises, so should demand for home improvement retailers. The company can also expect tailwinds during times when housing is perceived to be expensive because people are more incentivized to improve the home they are in than they are to move.

While not exactly major catalysts on an individual basis, each buyback and dividend rise contributes to a compounding effect that should lead to a dramatic shareholder value improvement over many years.

Conclusion

Even without its buybacks and dividend growth, I believe Lowe's would be a reasonable long-term investment because of its strong return on capital and well-established moats. I do not currently have a position in Lowe's and do not have any plans to establish one in the immediate future, because all of my free capital is currently being put to use in other places. I will keep Lowe's on my watch list and am very likely to buy it the next time I close out of one of my long-term investments.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.