Energy Transfer's Q1: 3 Important Takeaways

Summary

- ET recently reported Q1 results.

- We share three important takeaways from their Q1 report.

- We also share our updated outlook for ET.

- Looking for a portfolio of ideas like this one? Members of High Yield Investor get exclusive access to our subscriber-only portfolios. Learn More »

zorazhuang

Energy Transfer (NYSE:ET) has been our highest conviction midstream pick at High Yield Investor since launching our portfolio back in late 2020. Since then it has delivered exceptional total returns and distribution growth:

Moving forward, we expect distribution growth and total return outperformance to continue thanks in large part to management's recent announcement of a new distribution growth framework, stating a few days ago:

Energy Transfer LP today announced a quarterly cash distribution of $0.3075 per Energy Transfer common unit ($1.23 on an annualized basis) for the first quarter ended March 31, 2023. This cash distribution is an increase from $0.305 per Energy Transfer common unit for the fourth quarter of 2022 and will be paid on May 22, 2023, to unitholders of record as of the close of business on May 8, 2023.

Although Energy Transfer cannot guarantee future performance, the Partnership expects to make ongoing quarterly increases to its common unit distribution of $0.0025 ($0.01 on an annualized basis) and is now targeting a 3% to 5% annual distribution growth rate.

Following this event, ET reported Q1 results that further strengthened our conviction in the long-term investment thesis. In this article, we will discuss three important takeaways from ET's Q1 results and provide our updated outlook.

#1. ET's Credit Rating Is Likely Going To Get Upgraded

Since halving their distribution in late 2020 for the stated purpose of accelerating deleveraging and securing their investment grade credit rating, ET has executed on that objective extremely well.

Their leverage ratio has fallen precipitously, and management has paid down billions of dollars in debt. Q1 was no exception, with management paying down debt by an additional ~$1 billion and management guiding for the leverage ratio to remain on the lower end of their 4-4.5x target range moving forward. Management also continues to have plenty of liquidity, with over $3 billion available on the revolving credit facility.

What this is all increasingly pointing to is a credit rating upgrade for ET from BBB- to BBB. S&P appears poised to do just that for them, with the BBB- credit rating currently having a positive outlook and management's continued moves to reduce debt and the leverage ratio making it a near certainty to happen in the near future.

Management also confirmed that this is their intent on the Q1 earnings call, stating:

Our goal is to get to that BBB flat... We think that BBB is a good place to be and that's what we're going to continue to target.

While ET is working on paying down much of its debt as it matures with retained cash flows, given the significance of its growth pipeline (more on that later), it will likely also need to refinance some of its debt as it comes due. Given that interest rates have increased significantly over the past year, an improved credit rating would mean that it should be able to offset some of the headwinds from higher market interest rates when refinancing maturing debt. Moreover, this may give it additional incentive to repurchase some of its preferred units - which currently offer attractive yields - instead of its debt. Buying back preferred units is especially increasingly likely given that it is already on the low end of its target leverage ratio, so it is less essential for it to focus on paying down debt and potentially more important for it to begin paying down high yielding preferred units. Nothing has been mentioned by management to this effect yet, but it could make sense for them.

#2. ET Will Continue To Be More Aggressive Than Its Peers

While they are increasingly likely to get a credit rating upgrade in the not-too-distant future, ET nevertheless signaled on their earnings call that they will remain more aggressive than some of their ultra conservatively managed peers like Enterprise Products Partners (EPD). When asked on the earnings call by an analyst:

Some of your peers have moved lower over time... Do you see the company ever aspiring to go below 4 times eventually?

Management responded with:

If [our leverage ratio] goes below four, we're okay with that. We won't be upset with that, but I will tell you that's still the target. But here's where I'd like to expand on that a bit. Not all these leverage metrics when they come out of the same. As you know, leverage is only one metric. You have to also look at the makeup of the earnings stream, you have to look at the scale of the company and the size. And when you start looking through all those various components like what a rating agency uses, we clearly are strong in all those areas. So, our leverage metric, when we put it out, we think it's what fits for us.

While management is absolutely correct that its earnings stream is pretty stable with ~90% of its adjusted EBITDA expected to come from fee-based, commodity-price resistant contracts, this is also more or less the case with peers like EPD which have a target leverage ratio of 2.75x - 3.15x. As a result, EPD has an industry-best A- credit rating whereas ET still has a BBB- credit rating.

What this means is that - while we think ET management is still managing its balance sheet prudently - they are definitely still on the more aggressive end of the relative leverage spectrum in their industry.

This is understandable when you consider that they plan to grow the distribution meaningfully moving forward (~3-5% annualized pace) while also pursuing aggressive growth projects. As management emphasized on the earnings call by using the word "growth" a whopping 21 times, ET expects to continue investing substantial amounts of retained cash into growth projects each year in order to fuel continued deleveraging and distribution growth moving forward.

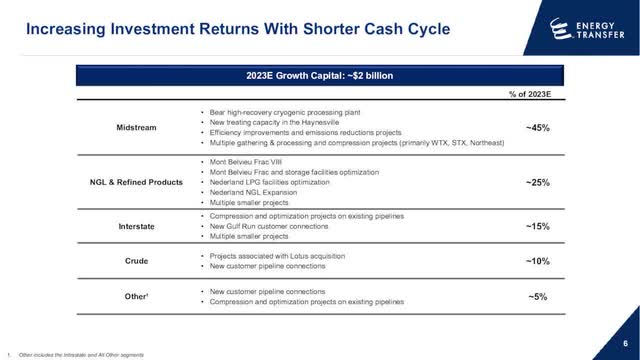

In 2023 alone, it expects to spend ~$2 billion on growth projects, primarily focused on its midstream, NGL, refined products, and interstate pipeline assets. With only 10% being invested in crude oil, we expect this portion of their business to decline on a relative basis moving forward.

ET 2023 Growth Budget (Investor Presentation)

As long as they can execute better on these growth projects and keep costs controlled, they should generate very attractive growth for ET that will simultaneously prove to be deleveraging as well. However, if they fail to do so - as is increasingly the case with the Lake Charles project that has hit a bureaucratic/political snare at the Department of Energy - it could lead to a lot of cash being inefficiently deployed and ultimately significant unitholder value destroyed. Over time, this could lead to underperformance relative to their projected distribution growth.

While we would prefer to see them deploy excess cash flow towards buying back common and preferred units (which offer similar cash flow yields on a leverage-neutral basis to many of their growth projects but with far lower execution risk), part of the deal with investing in ET is that they like to invest aggressively in growth projects. It simply seems to be firmly engrained in their culture. Time will tell how these growth projects work out. If all goes well, it will be a great use of capital. If not, it will be disappointing, but ET could still generate attractive total returns.

#3. ET Remains Meaningfully Undervalued

On that note, ET units remain meaningfully undervalued. In a bull case scenario where their reinvested cash flow generates reasonable returns, they should be able to continue growing DCF per unit at a rate roughly in-line with their distribution growth guidance of 3-5% per year. When combined with the 9.72% current distribution yield, the path to double-digit annualized returns is very clear without even considering multiple expansion potential.

That said, in a bear case scenario where some of their growth projects hit regulatory snags and/or cost overruns, ET may only be able to generate 1-3% annualized DCF per unit growth. If energy demand falters, ET may also face some re-contracting challenges, leading to a flattish performance in DCF per unit. However, even in this scenario, the distribution should still provide ~10% annualized total returns, which is still likely to outperform the S&P 500 (SPY) moving forward given that the index is overvalued relative to its historical metrics and economic growth is widely expected to slow moving forward.

Ultimately, we consider the most likely scenario to be one in which ET generates ~3% annualized DCF per unit growth, combining with its near 10% distribution yield and some likely multiple expansion moving forward to drive ~15% annualized total returns over the next half decade. We expect ET to see multiple expansion because it trades at a clear discount to MPLX (MPLX), a peer MLP that (AMLP) that has a BBB credit rating:

| EV/EBITDA | P/DCF | |

| ET | 7.51x | 5.17x |

| MPLX | 9.30x | 7.00x |

Investor Takeaway

ET has come a long way over the past two-and-a-half years, dramatically paying down debt, meaningfully reducing its leverage ratio, and ultimately bringing itself to the cusp of a credit rating upgrade.

On top of that, it has continued to diversify and strengthen its already well-diversified portfolio of midstream assets and appears poised to continue doing that, with particularly exciting growth potential in its midstream and NGL businesses.

Last, but not least, it remains deeply undervalued, with multiple paths to delivering double-digit annualized total returns, driven primarily by its hefty and well-covered distribution. As a result, we continue to hold it in our Core Portfolio and rate it an attractive Buy.

As a final note, it is important to remember that, as an MLP, ET issues a K1 tax form, which can result in complications for certain non-U.S. investors as well as investments held in retirement accounts. As a result, each investor would be prudent to consider the tax implications before making a purchase of ET units.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

If you would please click "like", comment below, and "follow" me that would mean a lot as it helps me to continue producing quality content.

SAVE 50% BY SIGNING UP TODAY!

You can join Seeking Alpha’s #1 community of high-yield investors at just $199 for your first year!

Try it Free for 2-Weeks. If you don’t like it, we won’t charge you a penny! We have over 150 five-star reviews and we spend 1000s of hours and over $100,000 per year researching the market and share the results with you at a tiny fraction of the cost.

(Limited to only 50 spots!)

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ET, EPD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.