Lowe's Companies: High-Quality Business, Fairly Valued

Summary

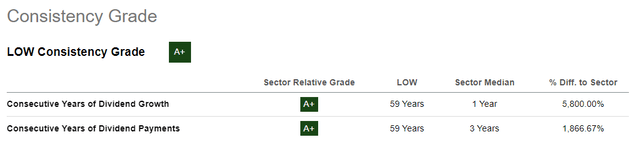

- Lowe's is a dividend consistency champion with increasing dividends in 59 straight years, which suggests that capital allocation has been stellar over multiple decades.

- I like the strategic initiatives of the management to address the changing environment and substantially improved operating margins in the last couple of years suggesting they are on the right path.

- My valuation analysis suggests the stock is fairly valued with a slight upside potential over next 12 months.

Brandon Bell/Getty Images News

Investment thesis

Lowe's Companies (NYSE:LOW) might be a very interesting investment opportunity for investors with low-risk profiles who are seeking predictable and growing dividends. The company has delivered steady revenue growth with margins expansion and its new strategic initiatives suggest that the management is willing to stay on this steady growth path. Financials are strong, except for high leverage and the valuation looks fair. I would have invested if dividend consistency was my top priority, thus I give LOW stock a neutral rating.

Company information

Lowe's is the world's second-largest home improvement retailer after Home Depot (HD) with total sales close to $100 billion in the latest reporting fiscal year of 2023. As of the last reporting date, the company operated 1,738 home improvement stores in the U.S. representing approximately 200 million square feet of selling space.

The company's fiscal year ends on the Friday closest to the end of January. Based on the fiscal calendar, FY17 had a 53rd week, which happens about every five years. The FY23 was also a 53-week fiscal year. FY24 will end on February 2, 2024.

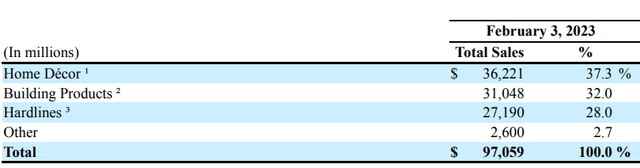

The company’s home improvement retail operations represent a single reportable segment. LOW disaggregates its revenues by merchandise divisions with revenues smoothly split between them.

Lowe's latest 10-K

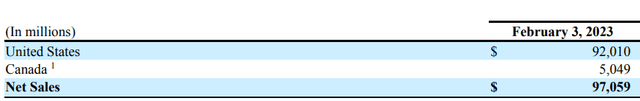

The company also disaggregated revenue by country since LOW operated a retail business in Canada as well, which was sold on February 3, 2023. The move was to focus the management's effort on the transformation of the U.S. business.

Lowe's latest 10-K

Financials

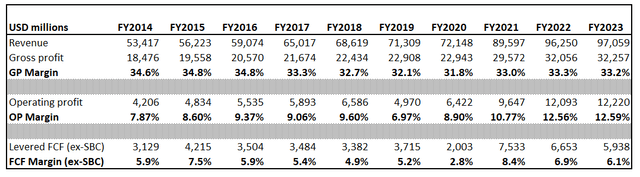

Lowe's has a very rich history of operations therefore I would like to look at the company's financials over at least the latest decade. The company compounded revenue growth at a 6.2% rate annually over the decade, with a gross profit margin of about 33%. The good sign is that the operating margin expanded significantly from below 8% in FY 2014 to 12.6% in FY 2023. Free cash flow [FCF] margin ex-stock-based compensation [SBC] has been stable and above 5% except for an FY 2020 COVID-year slip.

Author's calculations

In 2020 the company launched transformation under the Total Home strategy which aims to provide a full complement of products and services for professional customers [Pro]. According to the company's latest available 10-K the strategy has 5 pillars.

Lowe's latest 10-K

The company's strong financial performance over the last decade and its operating margin expansion substantially since 2020 convinced me that the implemented strategy with these five priorities is the right direction for the company. Improved margins suggest that the execution of the strategy is strong.

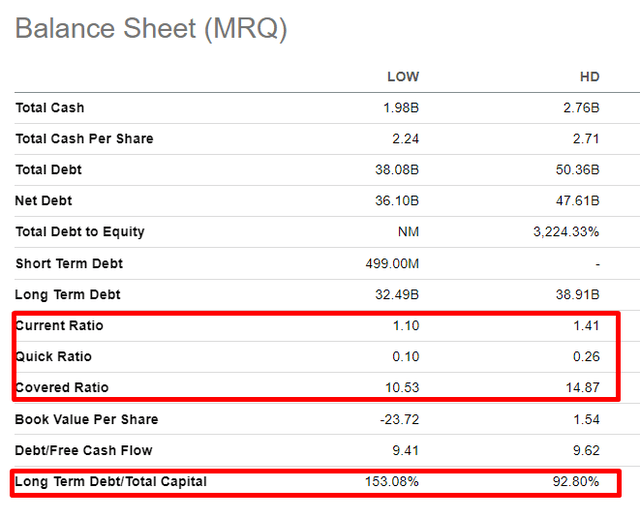

I cannot name LOW's financial position as a fortress mainly due to rather high financial leverage with long-term debt at 153% of capital. We can say that high leverage is inherent to the industry, but HD has substantially more conservative liquidity and leverage ratios than LOW.

Seeking Alpha

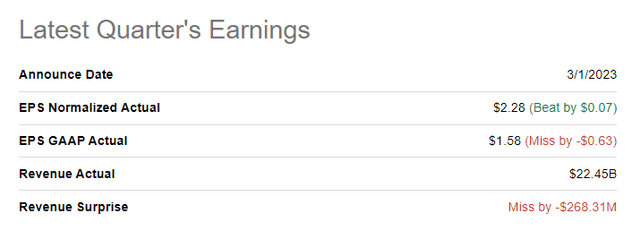

Narrowing down to the latest earnings, the company announced them on March 1. The company missed consensus estimates both in terms of revenue and GAAP EPS.

Seeking Alpha

Quarterly sales demonstrated a 5% increase YoY, but the fourth quarter of fiscal 2022 consisted of 14 weeks, compared with 13 weeks for the prior year. According to the press release, this extra week added approximately $1.4 billion to Q4 2022 sales. If we eliminate the effect of the extra week, quarterly sales decline by about 1.4%. The good sign for me is that online sales grew 5%. Marvin Ellison, the CEO, underlined additional positive catalysts for upcoming quarters:

From our perspective the core drivers of our business, disposable personal income, home price appreciation, and the age of housing stock, remain supportive. Consumer savings are still roughly $1.5 trillion higher than pre-pandemic, with 85% concentrated in the top 40% of income owners who are more likely to be homeowners. Homeowners continue to enjoy record levels of equity in their homes, nearly $330,000 on average.

Even if there is a modest decline in home prices, the level of equity built up during the pandemic would not be meaningfully eroded. And the housing stock continues to age with 50% of US homes over 41 years old, the oldest since World War II.

Overall, I believe that the company is succeeding in navigating the challenging environment, and I like the management's strategic initiatives and how they are executed.

Valuation

According to Seeking Alpha Quant ratings, LOW has the highest possible dividend consistency grade of "A+" thanks to consistent paying out and increasing dividends in 59 straight years.

Seeking Alpha

Given this hard-to-match consistency, the Dividend Discount Model [DDM] approach would best fit the valuation exercise. To execute DDM I need to incorporate a few assumptions, like the current dividend together with the required rate of return and the expected dividend growth rate. I believe that all of the abovementioned assumptions can be reliably selected based on the company's strong consistency.

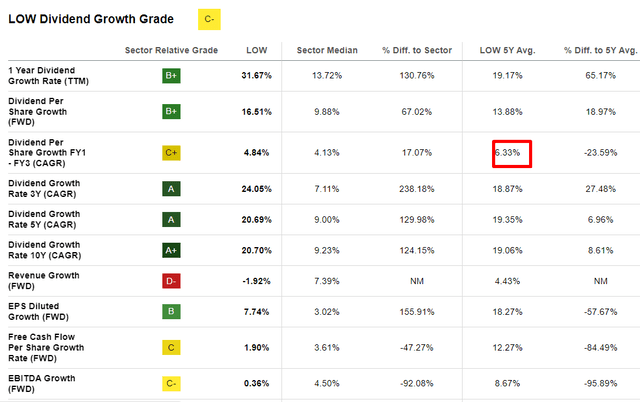

For the current dividend, I use the consensus estimate for FY 2024, which is at $4.46. The required rate of return I use is the WACC provided by valueinvesting.io, which is at 8.4%. For the dividend growth rate, I use LOW's 5-year average of the FY1-FY-3 CAGR provided by Seeking Alpha, which is at 6.33%.

Seeking Alpha

Incorporating all of the above assumptions together gives me a fair stock price at $215.46 which is about 5% higher than the last close price, indicating slight undervaluation.

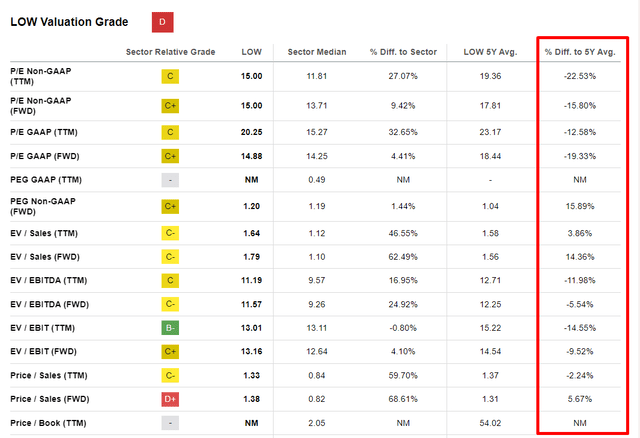

To cross-check myself, I also look at the valuation multiples by comparing current values to the company's 5-year average valuation ratios. The dynamic is mixed across the board with different P/E metrics currently significantly below comps.

Seeking Alpha

Overall, I believe that the stock is fairly valued with a slight upside potential in the short term.

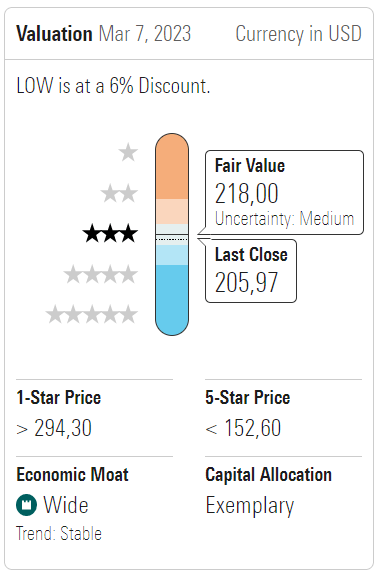

Morningstar Premium also suggests the stock has a mid-single-digit upside potential with a wide economic moat and stable trend.

Morningstar Premium

Risks to consider

As I mentioned in the "Financials" section, Lowe's has high leverage, which is substantially higher than the closest rival has. High leverage increases LOW's financial risk and can limit options to manage the company's capital structure. High leverage also makes the company more vulnerable to interest rate fluctuations, which is especially important given the current strict Fed funds rate policy. Last but not least, high leverage also means a lower ability to pursue opportunistic growth opportunities. The company may need to prioritize debt reduction over growth initiatives, which could limit the ability to compete in the longer term.

Given the nature of LOW's business, the second major risk that I see is potential supply chain disruptions. The company's operations rely on a complex network of manufacturers, suppliers and logistic partners. Disruptions to the supply chain are out of the company's immediate control which can potentially lead to product shortages and delays which will lead to increased costs and might undermine reputation.

The cyclical nature of the company's business is the third significant risk for LOW, in my opinion. Home improvement sales heavily depend on the turnover of homes, which is closely related to the overall health of the economy. During times of economic contraction, which is likely to come in the foreseeable future, people are highly likely to postpone their plans to move to bigger homes or make improvements to their current homes. This in turn might hit LOW's sales and put pressure on margins.

Bottom line

Overall, I believe that Lowe's is a high-quality business and the management is being proactive with its strategic initiatives to address the challenging market and changing customer behavior. I expect the business to grow in a mid-single-digit range, and dividends continue to increase accordingly. The stock is a good option for low-risk dividend investors, but I prefer to look for more aggressive opportunities; therefore, I give LOW stock a neutral rating.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.