AN2 Therapeutics: Boron Chemistry For Infectious Diseases

Summary

- AN2 is a developer of rare, infectious disease therapeutics.

- AN2 leverages its boron chemistry expertise and has a history of a successful sale to Pfizer.

- The company needs cash.

- Looking for more investing ideas like this one? Get them exclusively at The Total Pharma Tracker. Learn More »

Pgiam/iStock via Getty Images

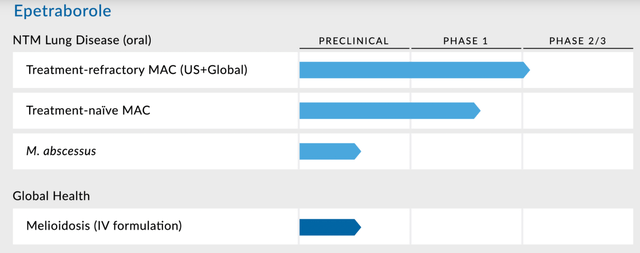

AN2 Therapeutics (NASDAQ:ANTX) is a small company targeting rare diseases and is in a pivotal trial for lead candidate epetraborole to treat Mycobacterium avium complex, or MAC, the most common type of nontuberculous mycobacterial (NTM) lung disease. Here's the pipeline:

Lead asset epetraborole is an oral, boron-containing small molecule. It inhibits bacterial leucyl-tRNA synthetase, or LeuRS. The LeuRS enzyme is responsible for attaching leucine to transfer RNA or tRNA molecules. Inhibition of this pathway blocks synthesis of harmful proteins. Epetraborole is, thus, a synthetic antibiotic. The rationale for its development is as follows:

Mycobacterium abscessus lung disease is notoriously difficult to treat due to the bacterium's high intrinsic drug resistance (1, 2). In addition to resistance to all first-line tuberculosis (TB) drugs, M. abscessus displays resistance to macrolides (3, 4), threatening the current macrolide-based treatment regimens (2, 5).

Epetraborole (EBO) is in a pivotal Phase 2/3 trial for nontuberculous mycobacterial (NTM) lung disease. This is a large market with high unmet need. The only other approved drug is Arikayce, and last year it had net sales of more than $245mn. In preclinical NTM models, EBO showed a superior profile than SoC.

There are an estimated 200,000 US patients. Of these, 55,000 are actually diagnosed with NTM, of which 44,000 are diagnosed with MAC. Treatment naive patients are treated with Ethambutol, macrolides, and rifamycin, which have a 65% efficacy rate but suffer from various side effects. Nearly 30% of patients are treatment-refractory, or about 15,000 patients. These are treated with Arikayce, which has a mere 29% efficacy rate, and a host of severe toxicity issues, including respiratory toxicity, voice changes, and ototoxicity. This is the unmet need EBO is trying to serve.

In in vitro models, EBO was shown to have a better capability of reducing 51 MAC isolates compared to Arikayce, and at par with clarithromycin; however, its "novel MoA allows it to maintain activity against MAC isolates resistant to clarithromycin." In chronic mice models, EBO 300 and 500 mg/kg QD was shown to be superior in controlling bacterial activity in MAC lung disease with M. avium 2285 (R) versus clarithromycin 250 mg/kg QD. At these doses, the differences were statistically significant, but at every dosage tested, the data showed numerical superiority.

In a 28-Day Phase 1b dose ranging study of oral epetraborole, the molecule was shown to have useful pk/pd, with 5x the concentration in lung macrophages (site of NTM infection) compared to plasma. The trials supported 500 mg once-daily dose, but it also showed that clinically beneficial exposures were attained at much lower doses than the maximum tolerated dose.

EBO's composition of matter patent expires in 2028, however, with orphan and QIDP designations, it can expect 12 years of US exclusivity post-marketing.

The company plans to complete enrollment in the pivotal trial this year, and announce phase 2 topline data from this trial in mid-2024.

Financials

ANTX has a market cap of $124mn and a cash balance of $99mn. They say this is sufficient to fund them through mid-2024, or when they announce phase 2 data. Recall that this will be the first human efficacy data that they will announce, so it is important for them to have cash till that time, at the least. Last month, they filed for a $300mn mixed shelf offering, meaning there's potential for a major dilution in the coming months. R&D expenses for the fourth quarter of 2022 were $8.7 million, while G&A expenses were $3.7mn. At that rate, even with their relatively poor cash balance, they have a long runway.

The fund is heavily smart money owned, with ownership evenly spread between institutions, insiders, and PE/VCs. Keyholders are RA Capital, Adjuvant, BVF, even Pfizer. Pfizer's presence has a history. Epetraborole was once being developed by GSK in partnership with discovered Anacor Pharma, but GSK abandoned the drug after they found microbiological resistance. This was more than a decade ago. Pfizer eventually purchased Anacor for $5.2bn, from whom AN2, which was founded by former Anacor executives, licensed the molecule for only $2mn upfront, and potential milestone promises of $125mn.

There are a number of large insider purchases prior to Oct 2022, but between Oct and Nov, the CEO sold $1.5mn of shares in the open market in around 8-10 separate sells.

Risks

These insider sells are not inherently risky. The low cash position is a concern, however, because clearly, they will need more cash before they can generate revenue of any sort - actually, way earlier than that. The massive shelf offering hangs like a sword on the head of would-be investors, who will think it's better to invest after the dilution, not before. Last year, the company received some $17.8mn from the NIH, to advance the development of epetraborole for acute systemic melioidosis, so they do manage to get non-dilutive funding.

The other obvious risk is lack of human efficacy data. We will only see this data 12 months from now. Until then, there's no real derisking.

Bottom Line

The story of a molecule, developed by one company, resurrected by another a decade later, but formed by key people from that same old company - I like that story. It has drama in it. Whether it has any solid efficacy data remains to be seen. I will sit on the sidelines and watch this unfold for the time being.

About the TPT service

Thanks for reading. At the Total Pharma Tracker, we offer the following:-

Our Android app and website features a set of tools for DIY investors, including a work-in-progress software where you can enter any ticker and get extensive curated research material.

For investors requiring hands-on support, our in-house experts go through our tools and find the best investible stocks, complete with buy/sell strategies and alerts.

Sign up now for our free trial, request access to our tools, and find out, at no cost to you, what we can do for you.

This article was written by

Dr Dutta is a retired veterinary surgeon. He has over 40 years experience in the industry. Dr Maiya is a well-known oncologist who has 30 years in the medical field, including as Medical Director of various healthcare institutions. Both doctors are also avid private investors. They are assisted by a number of finance professionals in developing this service.

If you want to check out our service, go here - https://seekingalpha.com/author/avisol-capital-partners/research

Disclaimer - we are not investment advisors.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.