Vaalco Energy: Not So Fast

Summary

- The Vaalco Energy, Inc. annual report was delayed for a few days. This points to underestimating the resources needed by accounting.

- The negative net debt position should minimize any market concerns about late reporting.

- If Vaalco Energy, Inc. management wants to make more acquisitions, then the accounting side needs some attention so this does not happen in the future.

- The Vaalco Energy, Inc. addition of TransGlobe Energy adds some predictability and cash flow to the very erratic offshore business.

- If Vaalco Energy, Inc. management can make the combined company work as it should, the stock price valuation should be considerably higher.

- This idea was discussed in more depth with members of my private investing community, Oil & Gas Value Research. Learn More »

Jeremy Poland

Vaalco Energy, Inc. (NYSE:EGY) recently completed a merger with TransGlobe Energy (TGA). But one minor detail was "assumed" that is now coming undone. Recently, management filed a notification that the annual report would be late. That was corrected, as the website noted a filing on April 6, 2023.

What many managements do not realize is that corporate accounting rarely has the training to tackle a relatively large acquisition when compared to the company size. That is particularly true when the company and hence the accounting department are relatively small. As a result, the deadline for the annual report approached and extra time was needed.

Many times, a delay in reporting an annual or quarterly report can do a number on the stock price. But in this case, the combined company has a decent cash position (which leads to a negative net debt position). So, whether or not Mr. Market punishes the stock, the financial situation is in excellent shape.

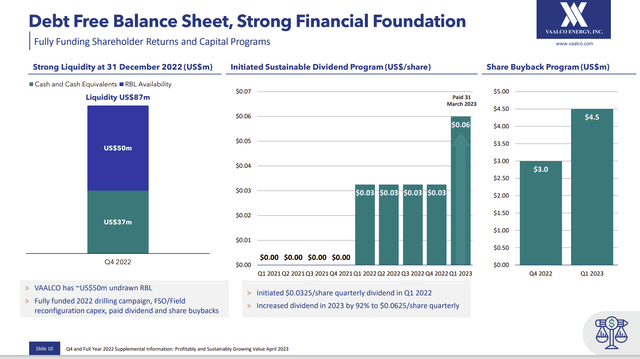

Vaalco Negative Net Debt Structure And Dividend And Stock Repurchase Progress (Vaalco Fiscal Year 2022, Earnings Conference Call Slides)

This kind of strong financial structure will allow for a buying opportunity should the market decide that the extended deadline is unacceptable as the original deadline approaches.

I have often mentioned that companies with strong balance sheets often get all the chances that they need to succeed. This is one example of a situation that is as likely as not to go unpunished because the Vaalco Energy, Inc. balance sheet is so strong. Therefore, this management is likely to be able to work out the acquisition details before filing the annual report without a lot of blow-back from the market.

The Combination Justification

Vaalco Energy by itself was growing on an irregular basis. The offshore business is expensive, and the projects are relatively large. Therefore, management could do a project every so many years. The same was true of the wells drilled. These were large wells, and a poor result could really wreak havoc with the stock for months or years until the next significant announcement was made.

On the other hand, TransGlobe Energy was getting no respect as a standalone company. Yet the business in Egypt and Canada would provide some badly needed diversification as well as some steady growth. The business also generates badly needed cash flow to accelerate the sizable offshore business.

Bringing major project announcements closer together is nearly always desirable for the market. The combined company is likely to have a smoother trajectory. In theory, that should lead to a better combined valuation than was the case for each company separately.

The Projects

The single largest significant upside for VAALCO Energy, Inc. lies with the offshore business. Individual wells tend to be large and, therefore, have an outsized effect on the immediate company projections. This business can also be relatively unpredictable when one considers this company generally proceeds one well at a time even if an overall project looks good. The market tends to react strongly to an announcement about a large well given the size of the company.

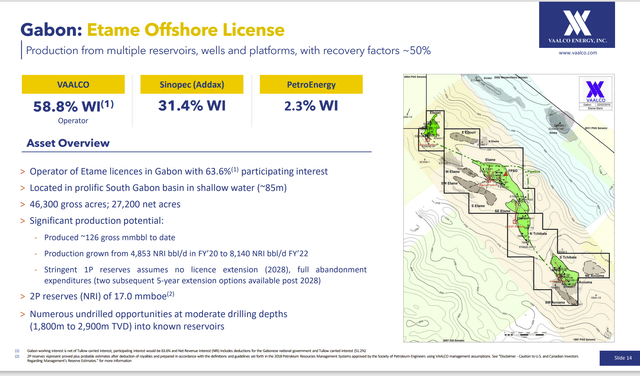

Vaalco Energy Summary Of Gabon Prospects (Vaalco Energy Corporate Presentation March 2023)

This was the standalone company's main core area of operation. The need for more core areas was reason enough to merge with TransGlobe Energy. The risks have been reduced by operating in older, known fields that no longer interest larger companies. This reduces the risk of dry wells somewhat.

However, offshore wells can disappoint, just as they can surprise to the upside. That probably caused a lot of stock volatility for the company. Management does have a discovery in Equatorial Guinea. Once this discovery becomes producing, it will add another offshore core area that would stabilize the offshore operations somewhat so that the company is not so dependent upon the results of one area (and one big well at a time).

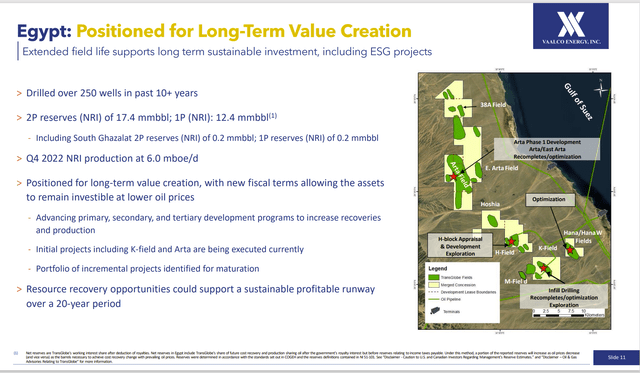

Vaalco Energy Summary Of Egyptian Eastern Desert Opportunities (Vaalco Energy Corporate Presentation March 2023)

Unlike the offshore business, the secondary recovery business in Egypt is very predictable, with far lower-cost wells. These fields are old fields that the original producers were no longer interested in. But a relatively small operation that is focused can make a good living off this business.

Prior management had over time doubled production from these fields. The new agreement with the Egyptian government now allows management to take the recovery a step further to again raise production significantly.

This part of the company is likely to be a net cash generator once some of the long-term projects begin operating.

VAALCO Energy, Inc. also has some acreage where the large reserves were produced, but there is an excellent possibility to discover smaller remaining reserves. The advantage of the strategy in Egypt is that the large companies are no longer interested in this acreage either. So, competition for the acreage is lower. Therefore, profit opportunities are greater.

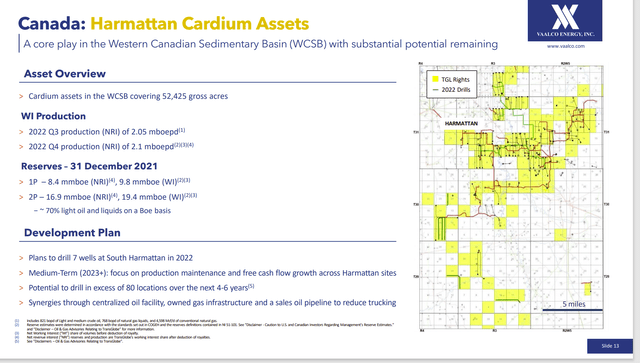

Vaalco Energy Summary Of Canadian Opportunities (Vaalco Energy Corporate Presentation March 2023)

The Canadian business is in an area that is experiencing a revival due to "modern completion techniques." The previous management "discovered" a significant amount of liquids, whereas the seller of the acreage had been primarily a natural gas producer. That discovery alone upgraded the acreage considerably from the previous use.

For previous management, this area had been a secondary consideration to the Egyptian business. There had been issues in the past with takeaway capacity (that are now resolved) and prices briefly "went through the floor." Now, however, this business could easily be built upon by current management to provide a steady cash flow as well as a growing business. Acreage in Canada is generally dirt cheap. So, growth is far easier to achieve.

The Future

Vaalco Energy, Inc. management sought less dependence upon the results of the one offshore core area as a reason for the acquisition. Now management has what it wanted.

Admittedly, that dependence meant that the market was forever fixated on the latest results or the latest large project that went years into the future to complete. This is one of the issues with small companies in that irregular and variable results cause a lot of stock price volatility.

Now management has added an Egyptian business and a Canadian business that are very predictable (comparatively speaking) and can easily be grown without major cash infusions for one well or even several wells when compared to the offshore business. Vaalco Energy, Inc. management furthermore has plans for another core offshore area in the future to diversify.

This is all well and good. However, there are now several different businesses that need to be run well. Technically, this was an offshore business that is expanding into new businesses in new areas. It is up to management to demonstrate the benefits. Success in doing that could result to better valuation.

The periodic offshore announcements will still be very significant in the future. But now there is a growing, steady business to help stabilize the Vaalco Energy, Inc. stock price and support a better stock price valuation.

The strong balance sheet will support more tries at growth should any one area "fall flat" or fail to meet expectations. That is an extra measure of safety not many companies of any size have.

Still, the market wants a track record of Vaalco Energy, Inc. as it is now before any better valuations of the stock price are available. I personally like Vaalco Energy, Inc. management's chances and think that the overall downside risk is minimal while the upside potential is considerable even given the usual small company risks. For me, Vaalco Energy, Inc. is a strong buy, knowing that small companies need considerable patience and usually a fair amount of time for ideas to work out.

I analyze oil and gas companies like Vaalco Energy and related companies in my service, Oil & Gas Value Research, where I look for undervalued names in the oil and gas space. I break down everything you need to know about these companies -- the balance sheet, competitive position and development prospects. This article is an example of what I do. But for Oil & Gas Value Research members, they get it first, and they get analysis on some companies that is not published on the free site. Interested? Sign up here for a free two-week trial.

This article was written by

Occassionally write articles for Rida Morwa''s High Dividend Opportunities https://seekingalpha.com/author/rida-morwa/research

Occassionally write articles on Tag Oil for the Panick High Yield Report

https://seekingalpha.com/account/research/subscribe?slug=richard-lejeune

Analyst’s Disclosure: I/we have a beneficial long position in the shares of EGY either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: I am not an investment advisor, and this article is not meant to be a recommendation of the purchase or sale of stock. Investors are advised to review all company documents and press releases to see if the company fits their own investment qualifications.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.