Rose's 80-Stock Income Garden Is Green (Up 2.13% YTD) With 4.5% Yield (April Update)

Summary

- April transactions were 2 sales, 2 buys, some add-ons, and trims which are all revealed and discussed keeping the RIG portfolio at 80 stocks.

- 27 companies paid in April with 8 being raises which are all listed by date received, yearly dividend and yield, and the current price.

- 2023 dividend income was up by 14.7% from Q1 January, and up 22.74% Y/Y if ZIM is excluded.

- The dividend yield is 4.5%, and RIG has ~18% cash.

- This idea was discussed in more depth with members of my private investing community, Macro Trading Factory. Learn More »

aluxum

Rose's Income Garden "RIG"

RIG is a defensive income-quality value-built portfolio with 80 stocks from 11 sectors. RIG contains investment-grade common stock along with high yield ("HY") business development companies ("BDCs") and real estate investments. The income goal is to have 50% of it coming from defensive sectors/ stocks with a minimum 4% yield; which now is 4.5% even with 18% cash, an increase from last month's 13.7%. SPY has a yield of 1.58% and no cash. RIG continues to outperform SPY by double digits from its Nov 2021 inception being up 19.76% over SPY since then. It ended April YTD being up and green by 2.13%, but behind SPY 7.02%. The year is not over yet and I look forward to the challenge.

April RIG Dividend Income

Dividend payments came from 27 out of 80 companies in RIG or ~34% with 4 being monthly payers. The 8 raises are listed in bold print. The amounts and further information are noted in the comment section. The list is done in order of payment received date/Date Rec'd in the chart.

The following are the other abbreviations used:

$Div /share = US $ Dividend paid in April

Yearly $ Divi = US $ yearly forward dividend estimate

Div % Yield = Estimated dividend yield using current listed price and dividend

Curr $Price = US $Price on May 3rd, 2023.

| Company | 2023 | div/sh | Yearly | Divi % | Other Dividend | Current | |

| Ticker | Name | Apr | $ | $ Divi | Yield | Comments | Price |

| (PFLT) | PennantPark Float | 3 | 0.1 | 1.2 | 11.20% | Raise from .095 | 10.71 |

| (PNNT) | PennantPark Inv | 3 | 0.185 | 0.74 | 15.13% | Raise from .165 | 4.89 |

| (KO) | Coca-Cola | 3 | 0.46 | 1.84 | 2.87% | 64.03 | |

| (GPC) | Genuine Parts | 3 | 0.95 | 3.80 | 2.07% | Raise from .895 | 172.56 |

| (FSK) | FS KKR Cap | 4 | 0.7 | 2.78 | 14.98% | 18.16 | |

| (KMB) | Kimberly-Clark | 4 | 1.18 | 4.72 | 3.22% | Raise from 1.16 | 146.71 |

| (SLRC) | SLR Inv. | 4 | 0.1367 | 1.64 | 11.57% | Monthly Pay | 14.18 |

| (MRK) | Merck | 10 | 0.73 | 2.92 | 2.45% | 119.35 | |

| (DNP) | DNP Select Income | 10 | 0.065 | 0.78 | 7.27% | Monthly Pay | 10.73 |

| (PM) | Philip Morris | 11 | 1.27 | 5.08 | 5.24% | 96.88 | |

| (MPW) | Medical Prop Trust | 13 | 0.29 | 1.16 | 13.86% | 8.37 | |

| (ORCC) | Owl Rock Capital | 14 | 0.33 | 1.32 | 10.44% | 12.64 | |

| (MDLZ) | Mondelez | 14 | 0.385 | 1.55 | 1.81% | 77.3 | |

| (WPC) | W. P. Carey | 14 | 1.067 | 4.28 | 5.89% | Raise from 1.065 | 72.64 |

| (CGBD) | Carlyle Secured | 14 | 0.44 | 1.76 | 12.87% | 13.68 | |

| (BXMT) | Blackstone | 14 | 0.62 | 2.48 | 13.78% | 18 | |

| (SEAL-A) | Seapeak LNG/Prf-A | 14 | 0.5625 | 2.25 | 9.44% | preferred fixed | 23.83 |

| (SEAL-b) | Seapeak LNG/Prf-B | 14 | 0.5313 | 2.125 | 9.01% | preferred fixed | 23.59 |

| (DBRG) | DigitalBridge | 17 | 0.01 | 0.04 | 0.36% | 11.04 | |

| DBRG-H | DigitalBridge- pref H | 17 | 0.4453 | 1.78 | 9.22% | preferred fixed | 19.3 |

| (BCE) | BCE/ Cdn | 17 | 0.71 | 2.8 | 5.70% | Canada exch rate | 48.04 |

| (KEN) | Kenon Holdings | 19 | 2.97 | 2.97 | 10.85% | Varies | 27.38 |

| (FMC) | FMC Corp | 20 | 0.58 | 2.32 | 1.99% | 116.83 | |

| (XEL) | Xcel Energy | 20 | 0.52 | 2.08 | 3.00% | Raise from .4875 | 69.22 |

| (CSCO) | Cisco | 26 | 0.39 | 1.54 | 3.29% | Raise from 38c | 46.26 |

| (MO) | Altria | 28 | 0.94 | 3.76 | 7.97% | 47.2 | |

| (RC) | Ready Capital | 28 | 0.4 | 1.6 | 15.33% | 10.44 | |

| (ARDC) | Ares Capital Fund | 28 | 0.1125 | 1.35 | 11.06% | Raise from 0.1075 | 12.03 |

Raises-8

2 of the raises were monthly payers and are discussed first:

PFLT - PennantPark Floating Rate was a nice surprise from this BDC, since there had not been a raise since 2015. It is consistent with paying and holding its dividend, which makes it nice to own. The raise from 9.5c to 10c = 5.2% raise. The current price and new dividend give it over 11% yield

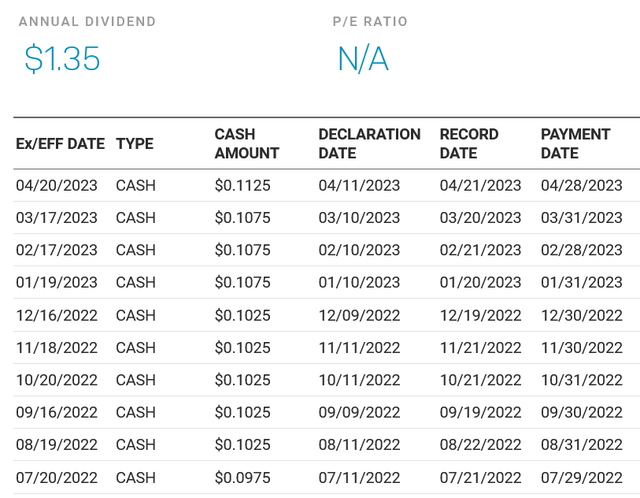

ARDC - Ares Dynamic Allocation Fund

The raise for April was unexpected as it had raised August 2022 and in Jan 2023. Below are listed the most recent raises as found at Nasdaq. Quite wonderful and giving it an almost 11% yield now.

Dividend Payments ARDC 2 years (NasDaq )

PNNT - PennantPark Investment Corp.

The 2c raise = 12% and was quite the surprise from this BDC. It now has a 15% yield, quite amazing. It has been raising the dividend since I purchased it a few years ago in 2021. It was a recommendation from The Fortune Teller at The Wheel of Fortune back then. It did cut the dividend in 2020 after it got new management and the main reason for better performance now.

GPC - Genuine Parts

Raise = 6.5% was nice on top of the 2.1% yield just about keeps it ahead of inflation.

BBB S&P credit rating and 68 years of rising payments from this auto parts company makes it solid reliable income.

KMB - Kimberly-Clark

Raise = 1.7%. Kind of truly sad, but I was hoping for better. It does have a 3.24% yield, 50 years of raises and an "A" S&P credit rating, so it is solid income from a consumer staple company.

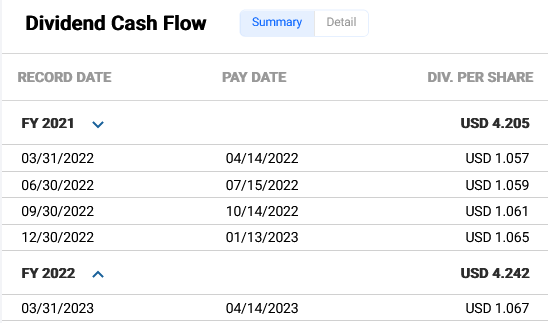

WPC - W. P. Carey

This international triple net real estate company raises its dividend in miniscule strange amounts, but the yield of 5.76% makes it tolerable. Below is a list of its last 12 months of dividend raises and you will note the strangeness. It barely comes to 0.9% for the year. I keep it for reliable, safe rising income which it has provided for 25 years.

W. P. Carey 12 months of dividends (FASTGraphs )

XEL - Xcel Energy

The raise = 6.7% was excellent and as usual from this utility. It has an "A-" S&P credit rating and 19 years of rising payments. The yield sits around 3%, but the raises allow it to beat inflation easily.

CSCO - Cisco

The low 1c raise was kind of expected but disappointing at 2.6%. It does have 12 years of raises and a nice 3.21% yield for a tech stock, which in general do not carry great yields. It has an "AA-" S&P credit rating and is from what I see undervalued and quality safe income, so I keep it.

Transactions -4

BUY- 2

UGI - UGI Corp

This regulated gas utility has been headquartered in King of Prussia, PA since incorporating there in 1991 and operates internationally as well in many distributive venues.

It offers 35 years of rising dividends and 7.76% 5 year DGR. The next raise should be announced this week with the ER.

SEAL-A - Seapeak LLC Preferred A

Seapeak LLC, formerly known as Teekay LNG Partners L.P., is headquartered in Vancouver BC, Canada. It provides marine transportation services focusing on liquefied natural gas (LNG) and liquefied petroleum gas (LPG) worldwide.

These preferred shares offer $2.25 yearly with the yield 9.35% at the current price. No foreign tax issues as the payment comes from Bermuda and is an ordinary dividend.

Sell -2

GOLD - Barrick Gold

Gold itself has been moving sideways and the opportunity to sell this BBB+ S&P credit rated mining company at just over cost after owning it a year or more seemed smart. The dividend was lowered to 10c/Q which gives it ~2% yield, from the previous 3% it had been.

TRTN - Triton International

This industrial sector company is the largest owner and renter of shipping containers with a BBB- S&P credit rating. It is in the process of being acquired by Brookfield Infrastructure (BIP) which will pay in essence $85/ share for it in a deal that has been approved for $68.50 per share in cash, with the remaining $16.50 paid in partial shares of Brookfield stock. I decided to sell out at the time of the announcement, take the full amount as $83.50 in cash and go without the final last dividends of 70c that will be paid until the Q4 closing. I was very pleased to make a nice large profit in the Roth IRA for having bought it quite cheaper a while back when The Fortune Teller suggested owning it.

Add-Ons

Position sizes were increased for:

ARDC - Ares Dynamic Allocation Fund-

Information about this monthly payer is under the Raise section of this article.

DLNG-A - Dynagas LNG Partners, LP- preferred A

This pays 56.25c quarterly in February, May, August and November for a total of $2.25 yearly. At the current price represents ~ 9.5% yield

VZ - Verizon

This communications sector telecom company headquartered in NY, NY. offers 18 years of a rising dividend and right now a 6.9% yield. The normal 5 year DGR is usually 2%, which is like owning a high yield bond that pays more every year.

Trims

Position sizes were lowered or trimmed for the following:

ABBV - AbbVie: Healthcare sector, big pharma company, was trimmed from a very large position size. It was somewhat over valued and lower earnings are expected as well.

BCE - BCE Inc is a Canadian telecom company. The yield is a decent ~5.9%, but the dividend suffers from currency exchange rates. The future earnings are flat looking and It seems it does not grow, so I trimmed it.

KEN - Kenon Holdings Ltd. is a subsidiary of Ansonia Holdings Singapore B.V. which keeps the dividends from foreign tax. It had owned a large holding of ZIM Integrated shipping, which it recently sold, which generated a nice portion of its dividend. The dividend now is coming from its own container liner shipping services and the larger energy OPC power plant components that operate in the US and Israel. The dividend is paid unreliably and usually twice yearly. The most recent payment of $2.79 was just paid as noted in the April dividend chart. I trimmed prior the dividend to take advantage of the higher price, which normally drops post ex-date.

LYB - LyondellBasell NV is a petrochemical producer. My April article here reveals the reasoning for the trim. I am still waiting to learn what the next dividend will be. It has 12 years of raising it, but I am unsure of how much this next one will be which should be announced this month. It did pay a very special extra dividend of $5.20 on top of the normal payment last year, which was very pleasing. I am positive it will not happen this year.

MRK - Merck is a quality big pharma, healthcare sector company. RIG just owned too much and trimming it while the price was up was smart, but actually kind of hard to do. I see its earnings dipping and the price might do so as well. My portfolio management rules say to trim large positions, so it was done. It has 12 years of raising the dividend and 5 year DGR of 9.25%.

Summary/Conclusion

This is a marathon and not a race and I have confidence RIG will continue to perform well. The dividend income yield is 4.5% with nice cash on hand of ~18%. Steady rising income is the main focus and primary goal of RIG. Retaining value is very important as well, which is done by having quality low debt and high credit rated companies while purchasing them at great or fair value. 80 stocks may seem like a lot, but I continue to enjoy watching and owning them all for the diversity they offer to keep portfolio movement / beta low. I have hopes to own perhaps even more quality dividend paying stocks at great value, so I always have a watch list. That "WTB" /want to buy list of Non-RIG stocks is available for subscribers to follow. Buy under prices and a deep value buy price is provided for those and all 80 current RIG stocks.

Happy Investing to All!

Macro Trading Factory is a macro-driven service, run by a team of experienced investment managers.

The service offers two portfolios: "Funds Macro Portfolio" & "Rose's Income Garden"; both aim to outperform the SPY on a risk-adjusted basis, in a relaxed manner.

Suitable for those who either have little time/knowledge/desire to manage a portfolio on their own, and/or wish to get exposed to the market in a simple, though more risk-oriented (less volatile), way.

Each of our portfolios, spanning across all sectors, offers you a hassle-free, easy to understand and execute, solution.

Macro Trading Factory for an Upward Trajectory!

This article was written by

I am a Promoting and Contributing author for Macro Trading Factory run by The Macro Teller / The Fortune Teller. The following list shows the # of stocks in each sector along with the largest holding. All stocks listings and statistics are presented at The Macro Trading Factory service alphabetically with sector, credit ratings, current and forward dividend information, yield, x-dates, pay dates, charts and more. I also check chat daily for questions and present in real time my smaller trades in the chat. All bigger portfolio changes, major sells and buys get a larger Trading Alert and article. Smaller buys or changes to an existing position will get an alert only.

Goals:

- Quality, low debt companies with great credit ratings and selling at a fair or better price and with a safe and rising dividend.

- To keep defensive stocks/sectors at 50% Portfolio Income.

- Also needed is continued patience watching and waiting for it to happen. Doing nothing when others panic makes for success!

Update: April 23, 2023.

How to join Macro Trading Factory: explained here: https://seekingalpha.com/author/the-macro-teller/research.

Sectors and holdings are as suggested by Bloomberg. Some positions are large and some small ; The service has listings for all 80.

Consumer Staples (11 stocks): (PM) / Philip Morris

Healthcare (9) : (MRK ) / Merck

Communications- tele (4): (VZ) / Verizon

Utility (9): (XEL) / Xcel Energy

Consumer Discretionary (2): (HD) / Home Depot

Energy (6): (ENB) / Enbridge

Tech/ "fin-tech" : (4): (AVGO) / Broadcom

Industrial- Defensive (2): (LMT) / Lockheed Martin

Industrial (6): (SBLK) / Star Bulk Carriers

Material (2) : (FMC) FMC Corp.

Financial: (15): (10) BDCs/ (ARCC) / Ares Capital, (1) bank, (1) ETF CEF , (1) BDC preferred and (2) mREIT

-Fixed Bond (1): STWD

REAL ESTATE (Healthcare REITs): (3) : (OHI) / Omega Healthcare

REAL ESTATE Misc (6): (SPG) / Simon Property Group

Cash is ~17.3%

Happy Investing to ALL !!! Rose :))

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SEAL.PA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Rose and Rose's RIG has 80 stocks

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.