UVXY: Don't Get Carried Away By The Low VIX

Summary

- The VIX index is known to be mean-reverting. Its level is expected to trend toward its long-term average over time.

- The VIX is currently rather low, so one could bet on a rise in the VIX with UVXY.

- Violent short-term surges in volatility happen from time to time, but are difficult to time.

- The VIX futures market is most of the time in contango: you lose money while you’re waiting (for that violent surge).

PeopleImages

The ProShares Ultra VIX Short-Term Futures ETF (BATS:UVXY) allows you to take a long position in volatility. UVXY ETF holds a constant one-month rolling long position in the first and second month VIX futures contracts. UVXY performs very well during stock market crashes.

Crashes are very difficult to time and in “normal” times VIX futures markets tend to be in contango. The negative roll yield makes you lose money while you wait for that stock market crash to happen.

Stay away from UVXY (unless you know to time stock market crashes very well).

The VIX is low

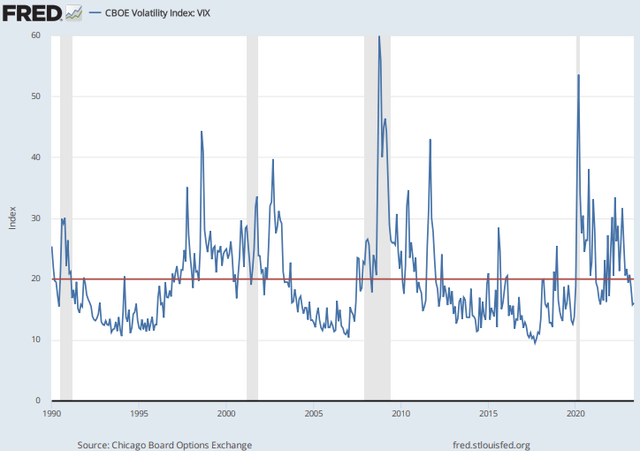

The Cboe Volatility Index (a.k.a. the VIX Index) is a well-known measure of market expectations of near-term volatility conveyed by S&P 500 Index option prices. Generally, the VIX Index tends to have an inverse relationship with the equity markets. This negative correlation has led to the nickname “fear index” because the VIX Index has a tendency to move up quickly when the broad market falls sharply. The long –term graph of the VIX (Figure 1) shows the violent spikes at the big crisis moments like the Russian default in 1997, the LTCM-crisis in 1998, the Great Financial Crisis in 2008 and the Covid pandemic in 2020.

Figure 1: Cboe Volatility Index (FRED)

Expected volatility typically increases when markets are turbulent or the economy is faltering. In contrast, if stock prices are rising the VIX Index tends to fall or remain steady at a low level.

The VIX Index is known to be mean-reverting. Its level is expected to trend toward its long-term average (around 20) over time. Unlike e.g. stock indices, volatility cannot move lower or higher indefinitely. After a violent surge, the VIX can be expected to revert to its long-term average.

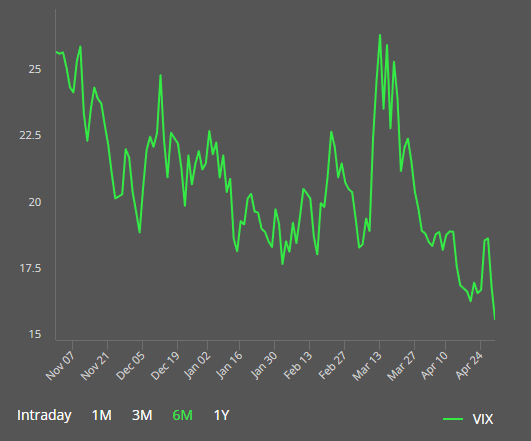

Figure 2: VIX Index (CBOE)

This happened e.g. recently after the spike due the banking crisis.

The other way around, the VIX is currently rather low, so its mean-reverting property could inspire some investors to bet on a rise in the VIX. VIX futures provide a pure play on the level of expected volatility. One can establish a long or short position by buying or selling VIX futures.

VIX futures are in contango

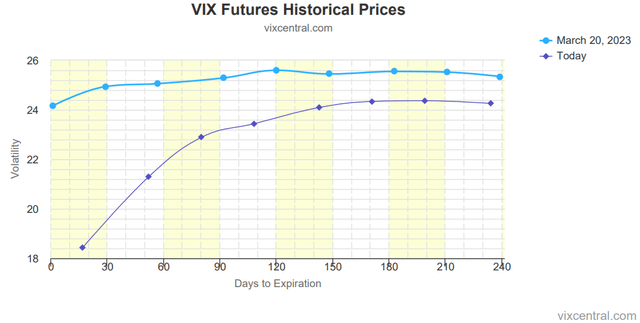

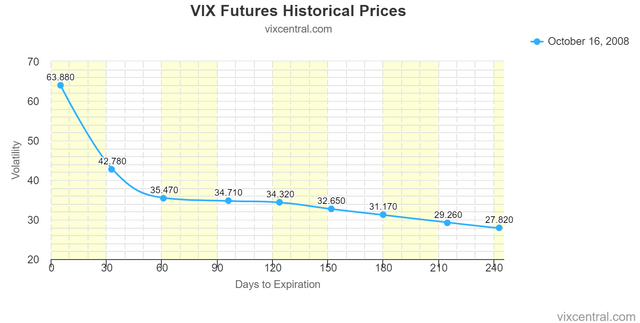

VIX futures contracts price the market's view of the value of the VIX on the expiration dates of the futures contracts. Currently the VIX is below its long term average, so one could expect the VIX Index to move higher in the near future. This expectation is also visible in the term structure of the VIX futures.

Figure 3: VIX Futures (vixcentral.com)

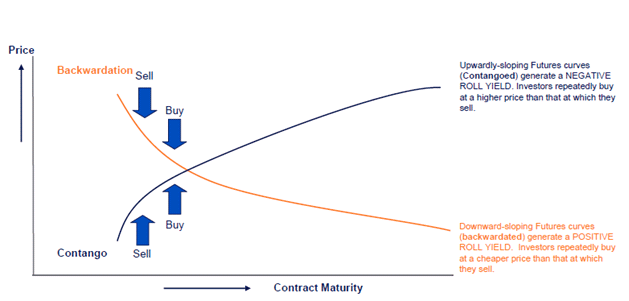

If the price of the front-month futures contract is higher than the price of the next contract, you make money if you “roll” into the new contract. Selling high and buying low. Your “roll yield” is positive. Such a futures market is said to be in backwardation. This term was coined by Keynes. Commodity producers e.g. fear that the price at harvest will be lower than today and are willing to pay a premium to hedge this risk. As a consequence, future prices will be lower than the spot price and Keynes named this condition (normal) backwardation. This implies that a futures price is appreciating as it is getting closer to maturity.

Figure 4: Backwardation and contango (PTMC)

The opposite of backwardation is contango. The price of the front-month contract is lower than the price of the next contract, and you lose money if you “roll” into the new contract. Selling low and buying high. Your “roll yield” is negative. This means that a futures price is depreciating as it is getting closer to maturity.

The VIX futures are most of the time in contango. But they are not always in contango. After large jumps in the VIX, they can be in backwardation. This was e.g. the case during the GFC in 2008.

Figure 5: VIX Futures (vixcentral.com)

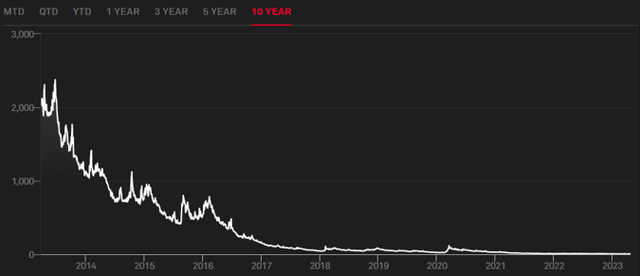

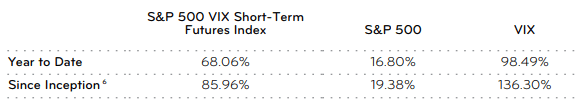

But most of the time VIX futures are in contango and the roll yield is negative. Going long VIX-futures seems hence a certain way to lose money. Let’s take the example of the S&P 500 VIX Short-Term Futures Index. This index utilizes prices of the next two VIX futures contracts to replicate a position that rolls the nearest month VIX futures to the next month on a daily basis in equal fractional amounts. This results in a constant one-month rolling long position in the first and second month VIX futures contracts. The long-term performance of the index is indeed terrible.

Figure 6: S&P 500 VIX Short-Term Futures Index (S&P Global)

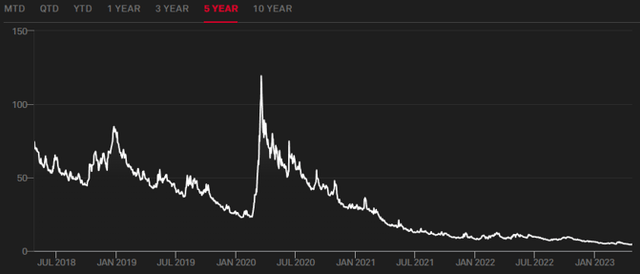

It’s only during violent spikes in volatility that the index is performing nicely. This was the case during e.g. the Covid crisis.

Figure 7: S&P 500 VIX Short-Term Futures Index (S&P Global)

UVXY

ProShares Ultra VIX Short-Term Futures ETF provides leveraged exposure to the S&P 500 VIX Short-Term Futures Index. UVXY seeks daily investment results that correspond to one and one-half times (1.5x) the daily performance of the S&P 500 VIX Short-Term Futures Index.

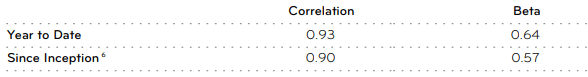

While the S&P 500 VIX Short-Term Futures Index has historically been highly correlated to the VIX, it has tended to have relatively low beta to the VIX, indicating less sensitivity to price movement.

Figure 8: Index correlation and beta to the VIX (ProShares)

The S&P 500 VIX Short-Term Futures Index has historically also been less volatile than the VIX (but significantly more volatile than the S&P 500).

Figure 9: Index Volatility (ProShares)

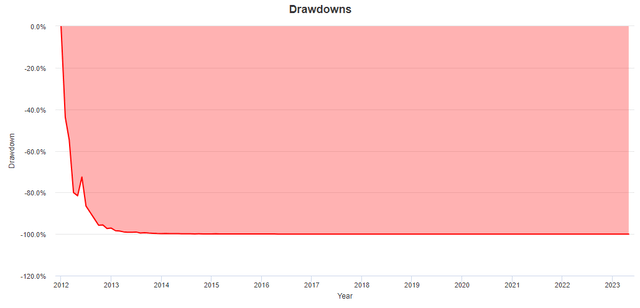

It will not surprise you that UVXY’s long-term performance is terrible also. Figure 10 shows the drawdowns since inception of the ETF in 2011.

Figure 10: Drawdowns (Portfolio Visualizer)

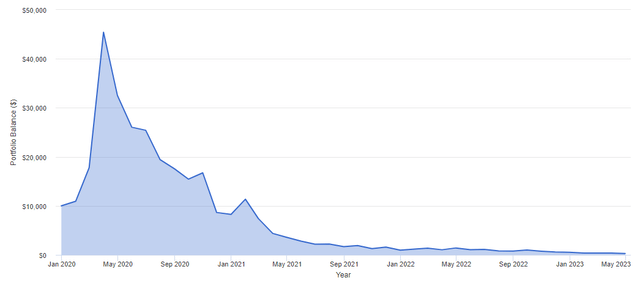

The only way to profit from an investment in UVXY is to time perfectly during a sharp fall in stock markets, like in 2020 during the Covid crisis.

Figure 11: UVXY Performance (Portfolio Visualizer)

Please note that UVXY had a negative performance over the whole of 2020.

Conclusion

The VIX index is currently rather low, so one could bet on a rise in the VIX with the ProShares Ultra VIX Short-Term Futures ETF. But to make money with a long position in volatility (futures) you need a sharp spike in volatility. Those spikes tend to coincide with sharp drops in stock markets. Such drops are difficult to time and because the VIX futures market is in contango, the negative roll yield makes you lose money while you wait for that stock market crash to happen.

Stay away from UVXY (unless you know to time stock market crashes very well).

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.