KRE: There Will Be A Time To Buy Banks, But Not Yet

Summary

- The Federal Reserve’s interest rate policy is still pressuring valuation in banks’ held-to-maturity portfolios.

- High Treasury yields still mean there’s a more meaningful alternative to stocks than there’s been in years.

- Credit quality remains at risk, with delinquency and default rates rising.

- Wait for conviction before buying the SPDR® S&P Regional Banking ETF or individual bank stocks.

- Looking for a helping hand in the market? Members of Top Stocks For Tomorrow get exclusive ideas and guidance to navigate any climate. Learn More »

wildpixel

Three of the largest five banking failures have happened in 2023 and more failures may be lurking. The FDIC’s response has so far been reassuring, but the structural problems that caused First Republic Bank (FRC), Signature Bank (OTC:SBNY), and Silicon Valley Bank (OTC:SIVBQ) to fail remain:

- The Federal Reserve’s interest rate policy is still pressuring valuation in banks’ held-to-maturity portfolios.

There’s been some relief in held-to-maturity portfolios thanks to a decline in Treasury yields since last fall, but we’re still talking about an effective Fed Funds rate that’s above 5% after the Fed’s latest increase on May 3. Bonds acquired by banks in the go-go, easy-money years remain underwater, posing a risk if deposit outflows force their sale, causing them to shift into bank’s mark-to-market portfolios where their losses can no longer be ignored.

- High Treasury yields still mean there’s a more meaningful alternative to stocks than there’s been in years.

The appeal of Treasury bills and notes to savers, including risk-averse retirees likely stung by stocks last year, shouldn’t be ignored as a risk to banks, either.

It’s relatively simple to open a TreasuryDirect account, link it to your savings account, and begin buying 1-month and 3-month Treasuries yielding 4.4% and 5.24%, respectively. It's even easier to move money from savings into money market accounts or bond exchange-traded funds.

So far, about $472 billion has flowed into money market funds this year, according to Lipper Refinitiv, and according to Morningstar, $69 billion has flowed into bond ETFs in 2023. A lot of that money comes from low-yielding savings accounts – the lifeblood of bank financing for loans that helped banks’ net-interest margin swell last year.

- Credit quality remains at risk, with delinquency and default rates rising.

It also doesn't help bank bulls that delinquency and default trends remain unfavorable.

For example, Capital One's credit card delinquency rate was 3.66%, up from 2.32% in March 2022 and 1.92% in April 2021. Its default rate was 4.16%, up from 2.13% in the same month last year. In its auto loan book of business, 5% were behind on payments in March. Given the upticks, it's little wonder banks across the industry are setting aside greater provisions for losses, reducing earnings.

In short, while there will be a time to buy bank stocks or bank exchange funds, like the SPDR® S&P Regional Banking ETF (NYSEARCA:KRE) or SPDR® S&P Bank ETF (KBE), that time isn’t now.

When will it be time?

While it may be tempting to step into weakness hoping to time it correctly, that's a risky bet. A better option is to wait until banks move up our weekly industry ranking. Currently, they score below average, where they’ve ranked for months.

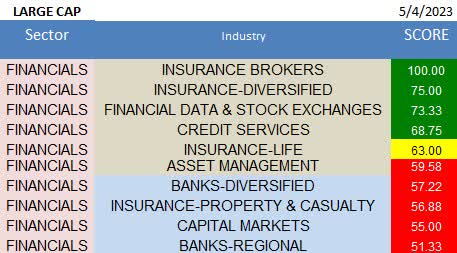

The following industry ranking comes from our Best & Worst Large Cap Stocks, Sectors, and Industries report. Weekly, we score over 1600 stocks for 7 specific catalysts associated with winning stocks and aggregate those scores by sector and industry to help members focus on the best risk to reward ideas.

I explain the methodology more here, but in short, stocks are ranked based upon their history of beating expectations, anticipated earnings growth, insider buying activity, short- and long-term money flow, contra short interest analysis, valuation relative to historical P/E, and seasonality.

Top Stocks for Tomorrow

As you can see in the previous table, savings and loans is the lowest ranked industry in large-cap financials. Diversified banks, such as big money center banks, also rank below average, trailing insurers, which benefit from higher yielding bonds held in investment portfolios and inflationary price increases.

The situation isn’t any better in mid cap or small cap. Regional banks score below average in those universes too.

Currently, finding winners in the industry is daunting. For perspective, just five banks have scores of 80 or higher (the lowest level of buy-rated conviction) in our universe, and two of them are in Indian banks. That's very narrow breadth.

| Banks | 5/4/2023 | 4 Week MA | ||

| Company Name | Symbol | INDUSTRY | SCORE | SCORE |

| Best Scoring | ||||

| JPMorgan Chase & Co. | (JPM) | BANKS-DIVERSIFIED | 85 | 80.0 |

| UBS Group AG | (UBS) | BANKS-DIVERSIFIED | 80 | 81.3 |

| HDFC Bank Limited | (HDB) | BANKS-REGIONAL | 95 | 98.8 |

| ICICI Bank Limited | (IBN) | BANKS-REGIONAL | 95 | 75.0 |

| The Bancorp, Inc. | (TBBK) | BANKS-REGIONAL | 90 | 68.8 |

Eventually, that will change. Banks will climb our industry ranking, financials will climb our sector ranking, and more individual stocks will climb our stock ranking. However, headwinds facing the banks should give you pause for now.

Especially since it’s unlikely that the April Senior Loan Officer Opinion Survey or SLOOS, to be released May 8, will offer reassurance.

The January's SLOOS report already signaled banks are tightening lending standards and reducing credit limits because of the rising risk of defaults and delinquencies. The April survey will likely show credit availability is worsening after last month’s banking crisis.

In the short term, banks may experience oversold rallies as bargain hunters pick up shares and short-sellers lock in gains. However, those rallies should be viewed with skepticism. Once banks climb our ranking again, you'll have more favorable risk to reward, more stocks to choose from, and more conviction that you're not catching a falling knife. That's when you can buy banks and the SPDR® S&P Regional Banking ETF again.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Don't miss when banks are buys. Weekly large cap, mid cap, small cap and ADR rankings by sector and industry. Join Top Stocks for Tomorrow today.

This article was written by

Limelight Alpha provides weekly sector, industry, and stock idea generation to day traders, swing traders, and buy and hold minded investors. Our research spans over 1,600 stocks and our quantitative scoring model has been used by professional investors for nearly 20 years.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.