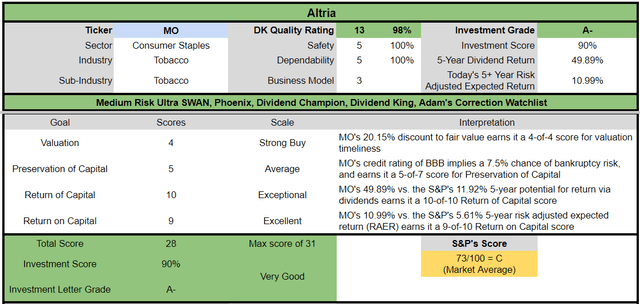

Altria Is The Ultimate 8% Yielding Dividend Aristocrat For What's Coming Next

Summary

- Altria Group, Inc.'s recent earnings showed large declines in volumes, triggered partially by California's new flavored-nicotine ban.

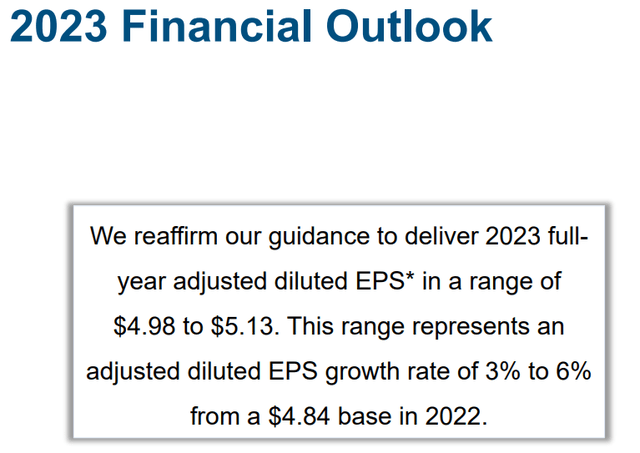

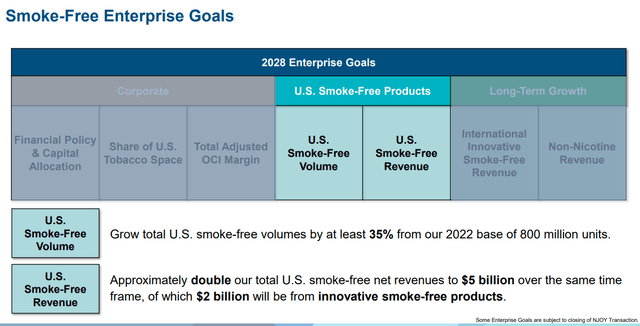

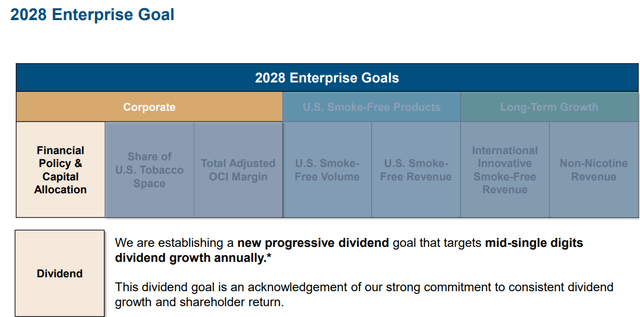

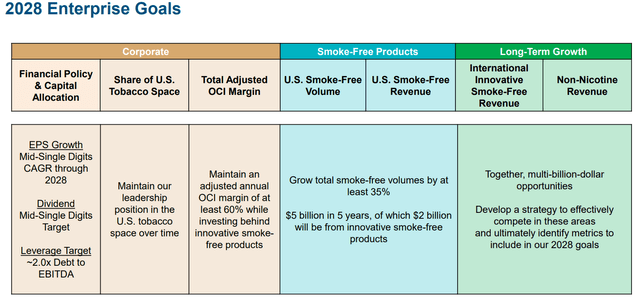

- Management is reiterating its 2023 guidance and providing new 5-year guidance based on its comprehensive smoke-free future plans.

- Altria plans to steadily cut debt, and rapidly grow its reduced-risk product portfolio, hitting 28% sales from reduced-risk products, or RRPs, by 2028.

- Management has instituted an even more shareholder-friendly dividend policy calling for 4% to 6% EPS growth in the next five years.

- Altria Group is 20% conservatively undervalued with 33% upside to fair value, and could deliver 83% total returns in 3 years, and 166% in 6 years. Long term, management is guiding for 11.9% to 13.9% annual total returns and analysts expect 13.4%. Altria Group went up 2% during the 2011 debt ceiling crisis when stocks fell 20%. It's the perfect 8% yielding aristocrat for whatever is coming next for the economy and stock market.

- Looking for a helping hand in the market? Members of The Dividend Kings get exclusive ideas and guidance to navigate any climate. Learn More »

tiero

This article was published on Dividend Kings on Tuesday, May 2nd.

---------------------------------------------------------------------------------------

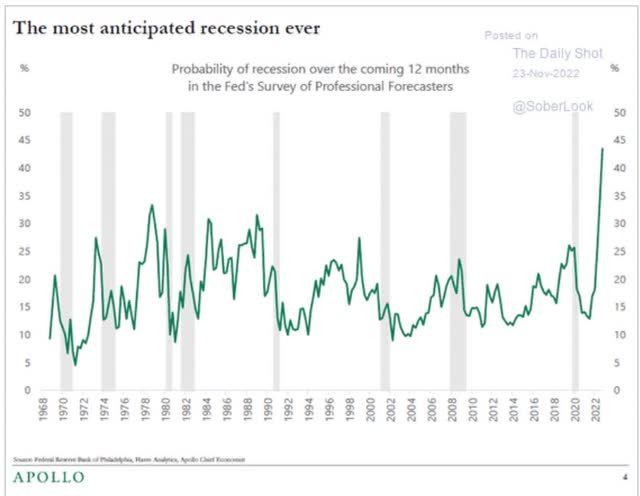

The recession of 2023 is literally the most anticipated in history.

And that's not just among economists.

- almost all CEOs expect a mild recession this year

- 80% of Americans do

- the bond market is 100% certain one is coming by October 2024

- the Federal Reserve expects a mild recession (and is still hiking).

And of course, that's just the mild recession the data is saying is likely starting around July or August.

US Treasury, Goldman Sachs

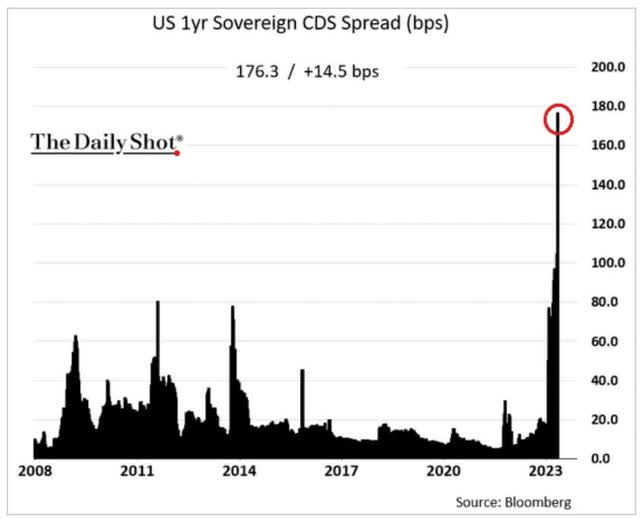

The US treasury is now warning the U.S. is a month from defaulting on its debt, though Goldman Sachs (GS), tracking daily Treasury balances, thinks we have closer to three months.

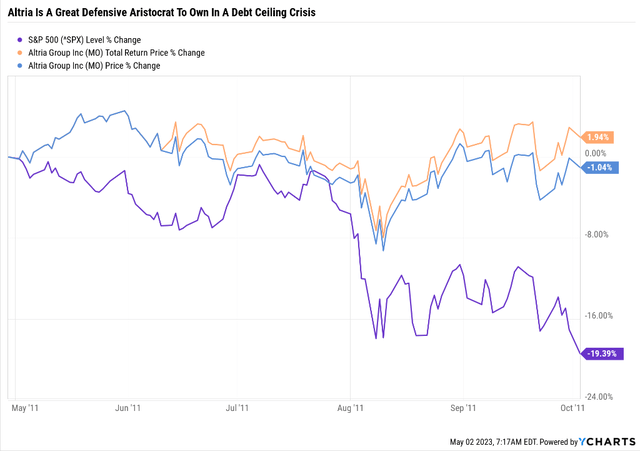

Low volatility recession-resistant consumer staples dividend kings like MO are a historically wonderful thing to own in debt ceiling crisis, such as the one in 2011.

A recession-resistant low, volatility dividend king that went up 2% in the 2011 crisis is as ideal a stock as you can buy for the coming debt ceiling showdown that's not a bond ETF.

I'm not saying MO is guaranteed to go up; no stock is. But it's likely to fall less than the market and help you sleep well at night thanks to its superb fundamentals.

S&P and Goldman think the 2023 debt ceiling crisis could be similar to the 2011 one, in which the U.S. came within two days of defaulting.

President Biden is planning on meeting with Congressional leaders on May 9th to discuss a clean increase on the Debt Ceiling, which Speaker McCarthy has pledged he won't agree to.

So we're finally going to get negotiations, with politicians on both sides talking past each other three weeks before a potential debt default.

The bond market says there is a 98.237% chance we don't default, but a 1.763% chance of default is the highest in history.

Either way, stocks aren't likely to do well as we tick steadily closer to financial doomsday, but that's where defensive Altria Group, Inc. (NYSE:MO) comes in.

MO is usually a great Ultra-SWAN aristocrat to own in a debt ceiling crisis and does very well during recessions.

In fact, 8% yielding Altria is the perfect dividend king for any economic or market condition, and here's why.

Altria's Earnings Showcase Its Strengths And Weaknesses

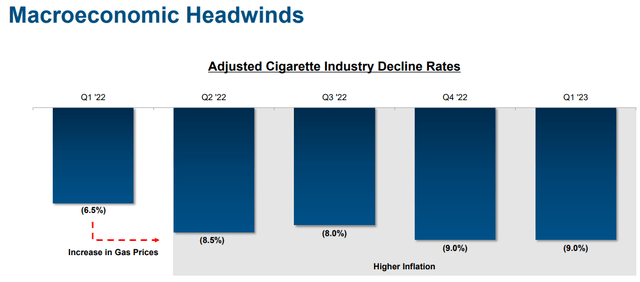

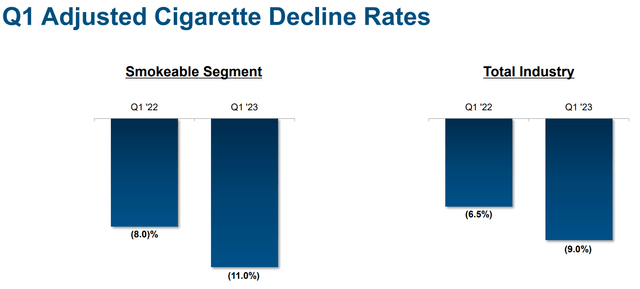

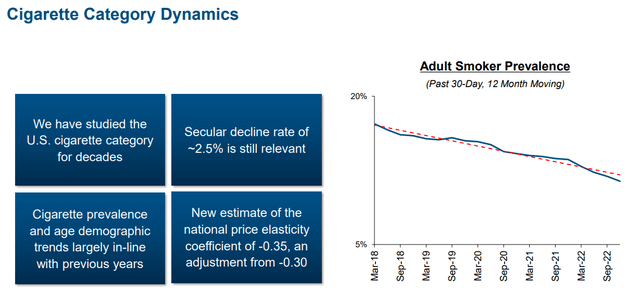

The cigarette industry's accelerated decline rates of last quarter held steady at -9%, which is significantly worse than what Morningstar expects.

Our base case is predicated on the assumption of a continued decline in cigarette volume at an annual rate of 5%, offset by continued strong pricing. The net effect is a five-year revenue compound annual growth rate of 1.5%, fading throughout our forecast period. This growth rate assumes modest contributions from vaping and heated tobacco, which we expect to be commercialized within the next two to three years." - Morningstar.

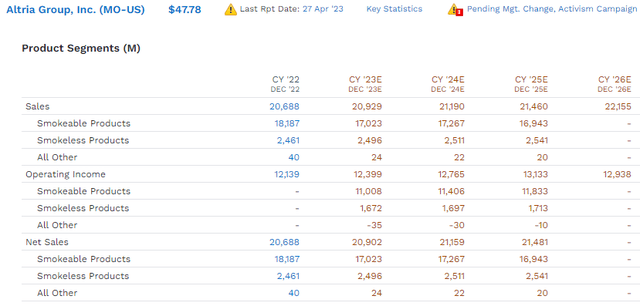

While Morningstar expects 1.5% annual sales growth, the full 19 analyst consensus expects 1.7% annual sales growth through 2026.

Cigarette sales are expected to decline by 1.8% annually.

From 2009 to 2021, cigarette sales grew by 1.9% as even faster price increases offset volume declines.

- A 3.7% sales decline headwind created by accelerated volume decline rates.

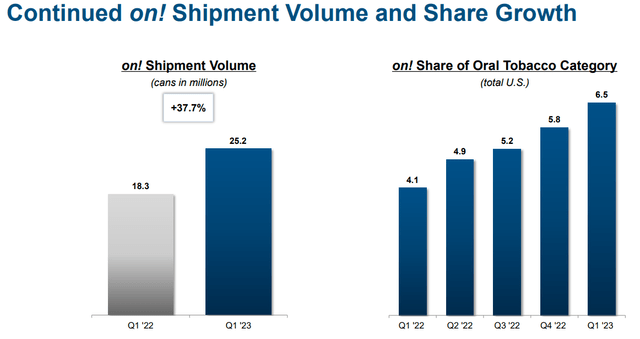

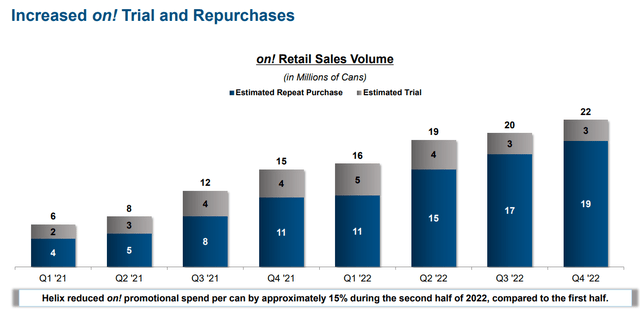

MO's only reduce-risk product, or RRP, at the moment is on! Nicotine pouches are growing at 38% and currently enjoy a 6.5% market share in the industry.

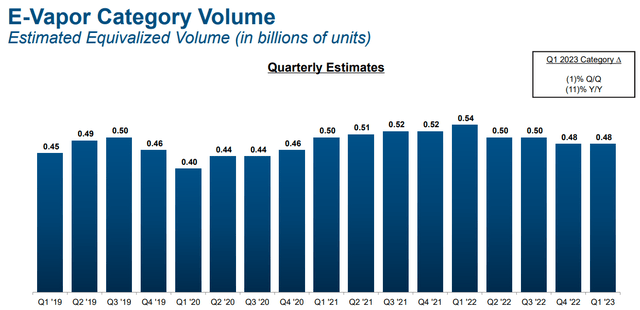

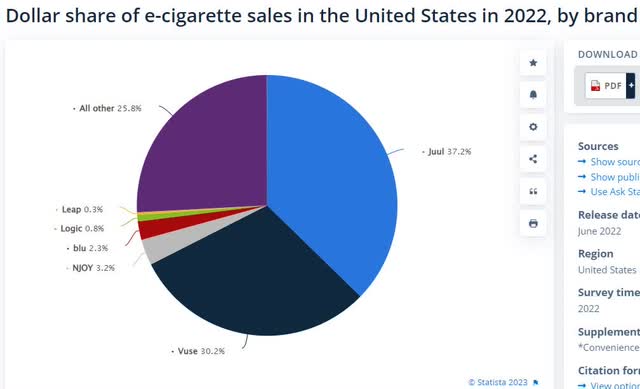

U.S. vaping has remained stalled since the FDA's crackdown on Juul, which began four years ago.

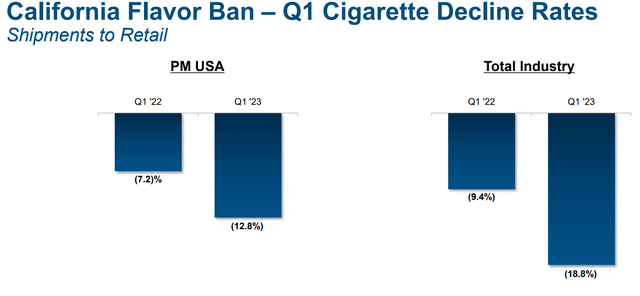

California's ban on flavored nicotine products went into effect in late 2022, and MO believes this could further hamper the industry's growth rate.

MO has pointed out for years that both states and the FDA have been inconsistent with regulations.

The FDA is supposed to approve all vaping products, and yet there are thousands of non-approved products on the market, with the FDA seemingly focused on blocking products from large companies and allowing small operators to do whatever they want.

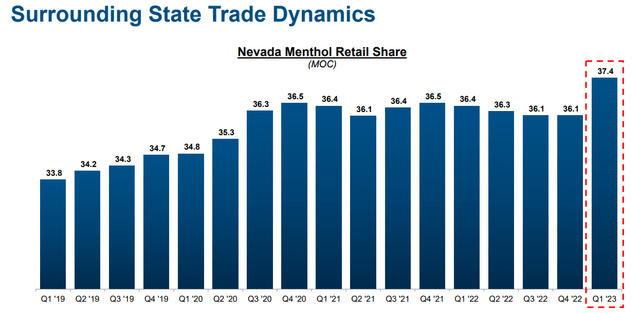

Meanwhile, CA residents are going to surrounding states to buy menthol products, as they should.

- Banning flavored nicotine for adults is severe regulatory overreach not supported by science

We have seen evidence that some California smokers are self-mentholating their cigarettes using alternative products such as flavor cards and menthol drops. We have also observed flavored e-vapor products in the market that appear to have been renamed to mislead state regulators." - CEO Q1 conference call.

The effects of the flavor ban appear to be dramatic in California. Much of that demand is going to surrounding states.

While this is true, MO's job is to adapt and overcome these challenges; they are merely an explanation, not an excuse for potentially weak future results.

- U.S. regulators have been enemies of the industry for over 50 years

- this isn't a new threat

Our operating companies immediately ceased the shipment of products to California wholesalers that we determined were not compliant with the law." - CEO Q1 conference call.

The CA ban appears partially responsible for the accelerated declines in MO's volumes. If so, we should expect similarly poor volume results for the rest of the year.

- At an 11% decline rate, MO's cigarette volumes would be cut in half in 6.5 years

- analysts currently expect price hikes of 9.2% for the foreseeable future

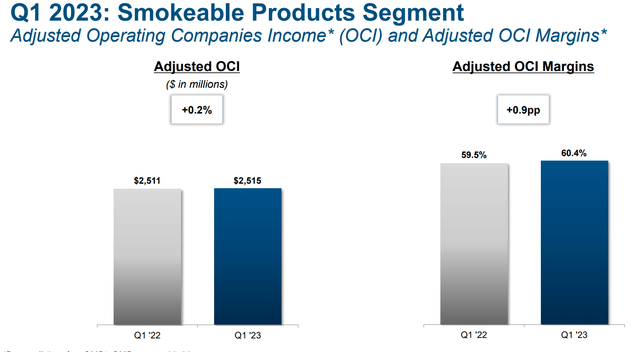

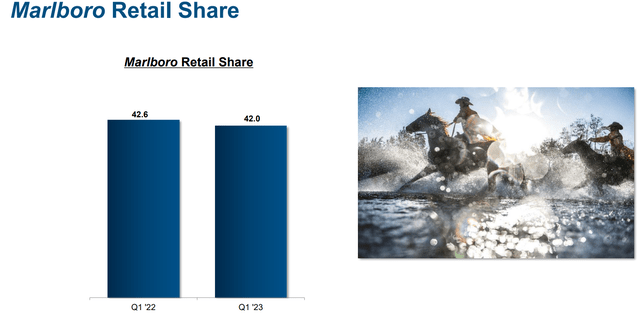

At retail, Marlboro’s net pack price increased 6.8% in the first quarter compared to last year. The total smokeable segment reported shipment volumes declined by 11.1% in the first quarter, as an 11.4% decline in cigarette volumes was partially offset by modest growth in cigars. " - CFO.

MO's pricing power was good in Q1, but after double-digit price increases last year, the company chose to raise prices by 6.8%, resulting in a 4.2% reduction in cigarette revenue.

Operating profits on cigarettes are holding steady, as are margins. That's the good news. Here's the bad news.

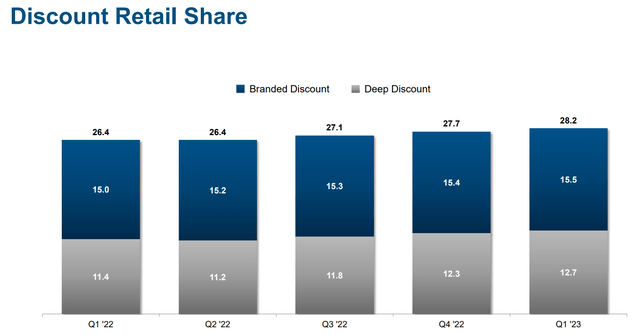

Compared to the average 5% decline rate of the last decade, the cigarette industry is running into consumers pushing back on price hikes.

MO's premium brands suffered more than the industry, with negative volume growth hitting 11% in Q1.

Pamela Kaufman (Morgan Stanley)

So given the elevated rate of cigarette volume declines, do you believe it’s becoming increasingly difficult to drive PM USA revenue growth through pricing in excess of volumes? Higher pricing seems to create a virtuous cycle, which drives trade down and market share pressure. And with the exception of 2020, which was clearly an unprecedented time, PM USA's top line hasn’t grown since 2017. So, can you talk about how you’re thinking about driving top-line growth in PM USA and if you think it’s possible?" - Q1 conference call.

Mrs. Kaufman of Morgan Stanley asked the question that we all want to know, what happens when rising prices create a negative feedback loop of steadily falling volumes, resulting in accelerating negative cigarette revenue?

I think I would really point you to price elasticity. And when you think about price elasticity, that’s the nature of a negative 0.35 is that for the percent that you increase the price, you expect that 0.35 impact on volume. So it’s much lower than other industry categories in the CPG space." - Q1 conference call (emphasis added).

For every 1% increase in price, volumes are currently declining at 0.35%, a relatively strong level for consumer staples.

Of course, that might accelerate in the future.

Smokers are the most brand-loyal customers of all, but even they have their limits, and discount brands have been slowly but steadily winning market share for the past year.

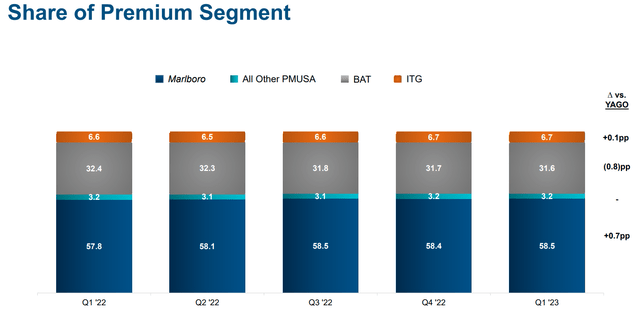

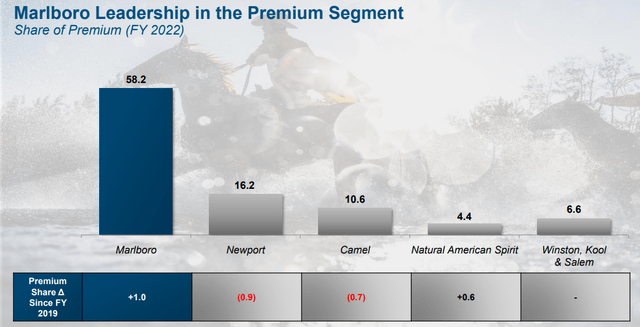

Marlboro's market share has dipped to 42.6%, down just 1.5%, while the premium cigarette market share is down 6.8%.

- Marlboro customer loyalty is better than that of other premium brand smokers.

MO actually gained market share in the last year in the premium cigarette market, mostly at the expense of British American Tobacco (BTI).

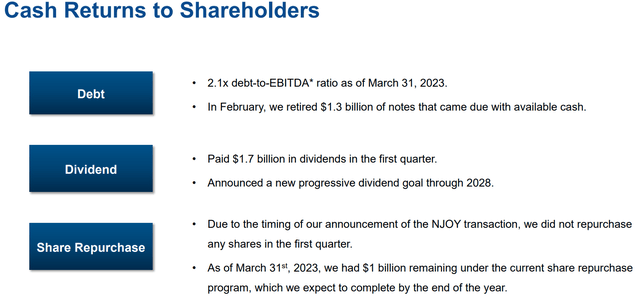

MO's leverage is well below the 3X debt/EBITDA ratio rating agencies want to see for this industry, and the company's progressive dividend policy (what makes it an aristocrat) remains in effect.

Buybacks are on hold as MO acquires NJOY though the company expects to buy back $1 billion in stock by the end of the year.

Despite the many headwinds, management is reiterating guidance for about 4.5% EPS growth this year, and analysts expect 5%.

In Q1, earnings grew 5.4%, so management is expecting slower growth for the rest of the year.

Bottom line, MO's earnings showcase how it faces a lot of headwinds, just as it always has, and management has thus far continued to stay ahead of them, delivering expected growth rates.

But while MO's short-term prospects are fine, the key question for all long-term investors is how the company plans to execute its smoke-free future plans in the face of the FDA's eventual plans to ban menthol nationwide and regulate nicotine to non-addictive levels.

- BTI estimates the menthol ban might be coming in 2027

- and nicotine regulation in 2028 or a few years after.

Altria's Plans For A Smoke-Free Future

Several years ago, MO management admitted that cigarettes are a dying industry and have no future. Reduced-risk nicotine products have been the long-term strategy for a long time and that's where MO has fallen down compared to its peers.

BTI and Philip Morris International Inc. (PM) have successfully launched their own internally developed vaping and heat stick brands.

MO chose to pursue M&A with disastrous results thus far.

It invested in Juul, buying 35% of the company for $13 billion, and had to write that down to zero after the FDA launched a full-scale crackdown that has extended to an attempted ban from US shelves.

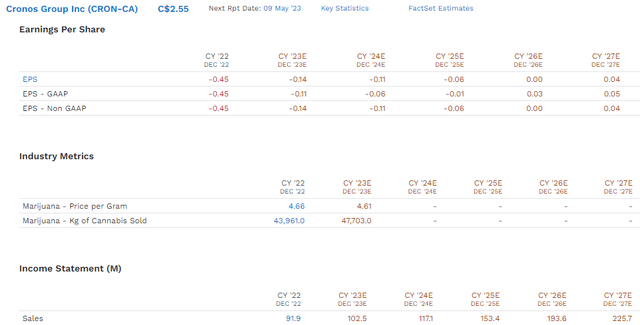

Its 45% stake in Cronos Group Inc. (CRON, a cannabis company) has also not gone well since that was bought at the peak of the cannabis bubble.

Cronos is a rapidly growing company that isn't expected to break even until 2026 and become profitable in 2027.

In 2022 MO and PM struck a $2.7 billion deal in which PM would buy out MO's share of the iQos sales in the U.S.

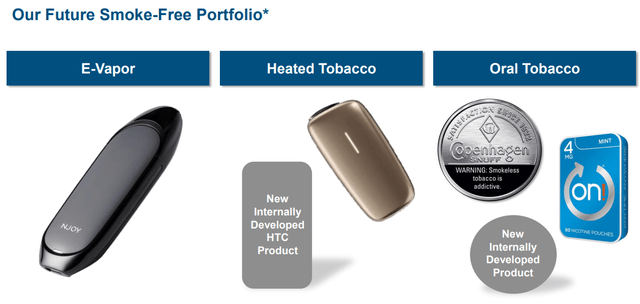

That means MO was left with no significant RRP products other than oral nicotine pouches.

- PM's acquisition of Swedish Match gives it Zyn, the #1 brand of nicotine pouches in America

- 70% market share.

So MO struck a joint-venture deal with Japan Tobacco to market its heat sticks in the U.S., with MO getting 75% of the revenue in exchange for launching through MO's extensive distribution network.

MO is also working on its own heat stick product, which it will update investors on after it actually has a working model.

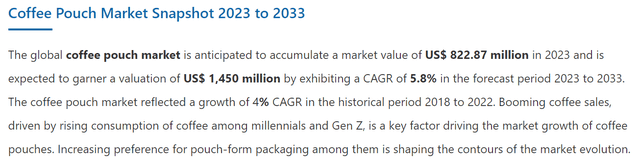

It also plans to return to overseas sales with things like nicotine pouches and caffeine pouches.

The coffee pouch market is $833 million in size globally and is expected to grow at 6% annually to $1.5 billion by 2033. It's not going to move the needle for MO.

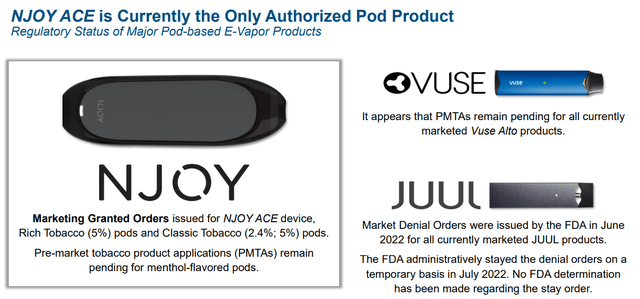

MO is buying NJOY for $2.7 billion, not because it's the leading vaping brand in the U.S., but because MO thinks it might be able to make it so.

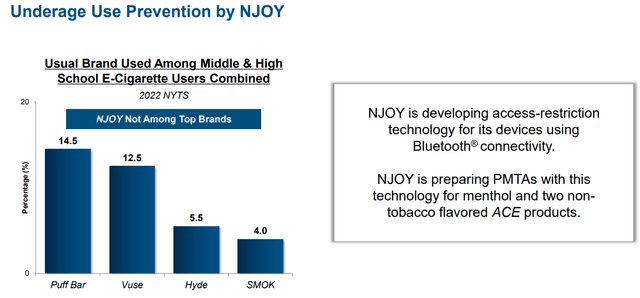

NJOY is the only approved product by the FDA so far, and with the FDA trying to pull Juul and Vuse from store shelves (courts are blocking that for now), MO thinks its regulatory enemy might be handing NJOY market dominance.

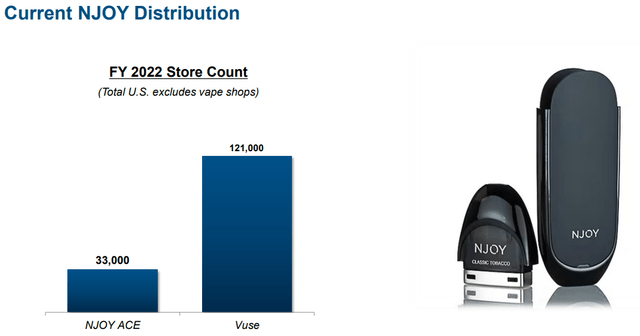

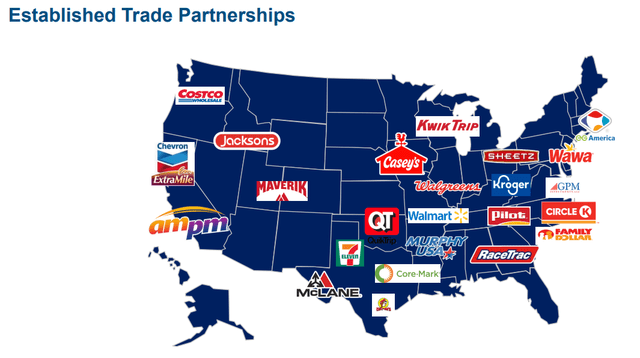

NJOY is currently 3rd in the U.S., but that is without significant distribution. MO's products are sold everywhere in the U.S. where you can buy cigarettes, and it believes it will be able to grow sales rapidly.

Vuse, owned by BTI, is in 121,000 stores around America, outside of vaping shops where small operators are dominant.

Altria uses 900 wholesale distributors to market its products in over 200,000 stores around the country.

- Potential to grow on! market share to around 20% quickly.

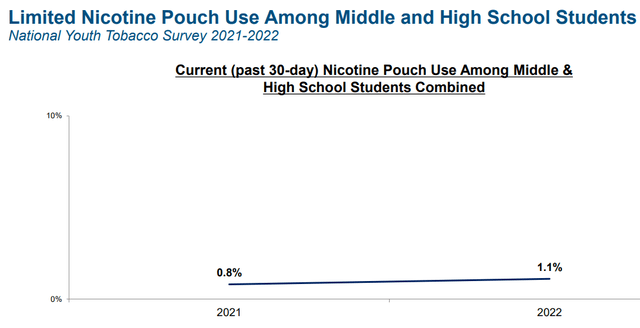

MO is wary of running afoul of the FDA again, and that's why it's going with a highly regulatory-compliant brand that the FDA can't claim is targeting kids.

- the downside is that NJOY isn't exactly super popular with anyone at the moment

- the FDA does not target it because it's not particularly successful.

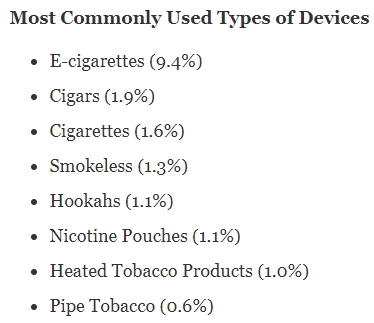

CDC

According to the CDC, vaping is 9X as popular as heat sticks among younger nicotine users.

This is why the industry is aggressively pursuing vaping, even though brand loyalty and margins are less attractive than heat sticks.

Under the licensing deal with PM, MO will retain the ability to market heat sticks in the U.S. under the Marlboro name.

Its JV with Japan Tobacco, called "Horizon," will use things like the PloomX to try to sell Marlboro heat sticks in the U.S.

- heat sticks have similar margins to cigarettes

- and higher brand loyalty.

We'll have to see if MO is able to keep the Marlboro brand of heat sticks when it tries to launch its own heat stick products later.

- Marlboro heat sticks would be the biggest asset MO has in the future.

On! is growing rapidly, nearly 40% per year, and is proving popular with growing repeat usage.

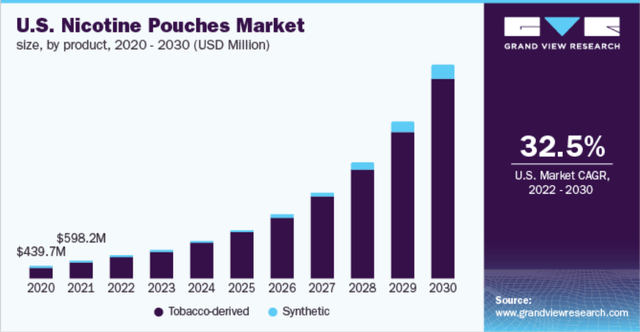

In the US, oral nicotine pouches are a $800 million business growing at 33% annually.

Globally, it's a $1.5 billion business growing at 36% annually.

- $7.6 billion estimated US market in 2030

- $23.4 billion international market in 2030

- The total global market in 2030: $31.0 billion.

For context, the global nicotine market is about $500 billion outside of China (which doesn't allow foreign companies to compete).

At the current market share of 6.5% (which has been growing at 40% annually despite the dominance of Zyn), MO would be generating $500 million in on! sales in 2030.

If MO can split the market with Zyn and achieve 33% market share by 2030, that's approximately $2.5 billion in sales or about 10% of total company sales from then on!

Altria's Global Nicotine Pouch Potential In 2030

| Global Market Share | Nicotine Pouch Revenue | Total Sales | Total Company Sales |

| 5% | $1,550 | $23,684 | 6.5% |

| 10% | $3,100 | $23,684 | 13.1% |

| 15% | $4,650 | $23,684 | 19.6% |

| 20% | $6,200 | $23,684 | 26.2% |

| 25% | $7,750 | $23,684 | 32.7% |

| 30% | $9,300 | $23,684 | 39.3% |

| 35% | $10,850 | $23,684 | 45.8% |

| 40% | $12,400 | $23,684 | 52.4% |

| 45% | $13,950 | $23,684 | 58.9% |

| 50% | $15,500 | $23,684 | 65.4% |

(Source: FactSet, Grandview Research)

Analysts expect MO's sales to be around $24 billion in 2030; oral pouches could potentially make up 25% to 50% of that.

Oral pouches are not that popular with young people and have not incurred the wrath of the FDA.

By 2028 MO plans to have 28% of its sales from smoke-free products.

- BTI is 15% today

- PM is 40% today.

According to BTI, the earliest the FDA is expected to start regulating nicotine is 2028 (likely by 2030).

What Does This Mean For MO's Growth Prospects?

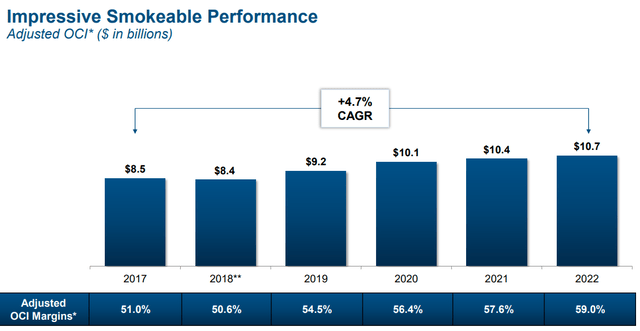

MO has done a great job cost-cutting its way to steadily higher margins on cigarettes.

MO estimates its customer base in cigarettes is shrinking by 2.5% per year, and price sensitivity has increased from -0.3 price elasticity to -0.35 due to higher inflation.

- A 10% increase in price leads to a 3.5% decrease in volume

- a 100% increase in price leads to a 35% decrease in volumes.

Note that the price elasticity has recently been greater than -1, thus the reason for a 5% decline in cigarette revenues.

Marlboro has gained market share over the last four years in premium cigarettes, meaning MO has some time to ramp up its smoke-free RRP portfolio.

MO plans to maintain 60+% margins on cigarettes and ramp up RRP sales to generate 4% to 6% EPS growth through 2028.

MO's progressive dividend policy means it plans to raise the dividend by 4% to 6% annually through 2028.

- a 58-year dividend growth streak in 2028.

Progressive dividend policy = the dividend only gets increased or held steady, never cut (unless the company's survival is threatened).

This is actually a stronger shareholder commitment to dividends than what MO currently has.

- Management's way of pledging no cuts unless the wheels completely fall off the bus.

According to rating agencies, management plans to keep leverage at 2.0X vs. 3.0 or less safe.

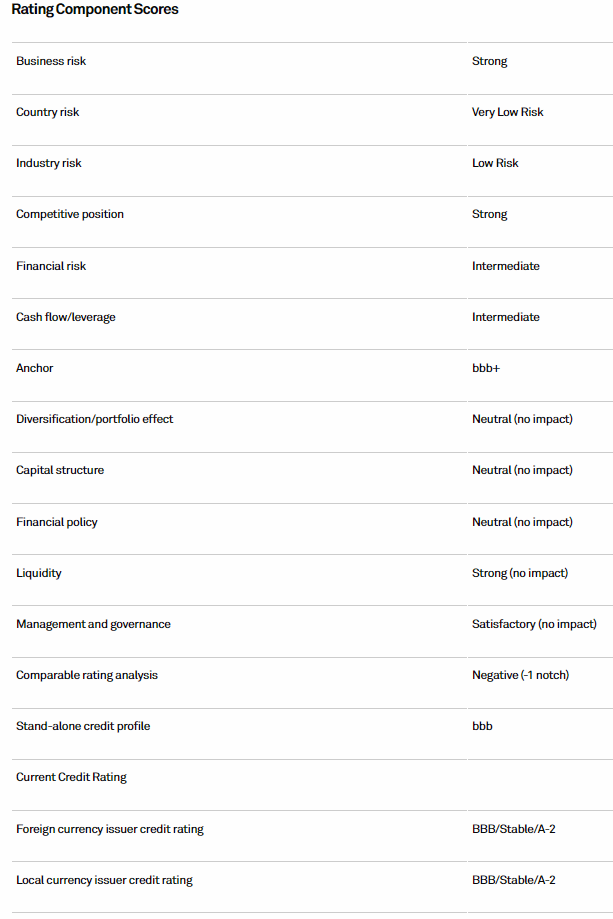

S&P Reviewed MO's Rating February 2023

S&P

If MO maintains 2X leverage, S&P will upgrade them back to BBB+, the rating they lost after investing in Juul.

We could raise the ratings if Altria demonstrates a commitment to deleveraging and if debt to EBITDA improves and is sustained in the mid-2x area. This would be predicated on our view that the company is unlikely to pursue further large debt-financed acquisitions that would lead to meaningful deterioration in credit metrics." - S&P.

Here are the consensus debt/EBITDA forecasts for MO.

- 2023: 1.75

- 2024: 1.66

- 2025: 1.49

- 2026: 1.39

If MO executes well on its smoke-free plans, including acquiring NJOY and rapidly growing its sales, then it should achieve a BBB+ credit rating by 2026.

- If it continues to deleverage as expected and achieves its RRP sales goals by 2028, it could become an A- rated company like PM.

Altria's Risk Management: Average

DK uses S&P Global's (SPGI) global long-term risk-management ratings for our risk rating.

- S&P has spent over 20 years perfecting their risk model

- which is based on over 30 major risk categories, over 130 subcategories, and 1,000 individual metrics

- 50% of metrics are industry specific

- this risk rating has been included in every credit rating for decades.

The DK risk rating is based on the global percentile of a company's risk management compared to 8,000 S&P-rated companies covering 90% of the world's market cap.

MO scores 45th Percentile On Global Long-Term Risk Management

S&P's risk management scores factor in things like:

- supply chain management

- crisis management

- cyber-security

- privacy protection

- efficiency

- R&D efficiency

- innovation management

- labor relations

- talent retention

- worker training/skills improvement

- occupational health & safety

- customer relationship management

- business ethics

- climate strategy adaptation

- sustainable agricultural practices

- corporate governance

- brand management.

MO's Long-Term Risk Management Is The 344th Best In The Master List 31st Percentile In The Master List)

| Classification | S&P LT Risk-Management Global Percentile | Risk-Management Interpretation | Risk-Management Rating |

| BTI, ILMN, SIEGY, SPGI, WM, CI, CSCO, WMB, SAP, CL | 100 | Exceptional (Top 80 companies in the world) | Very Low Risk |

| Strong ESG Stocks | 86 | Very Good | Very Low Risk |

| Foreign Dividend Stocks | 77 | Good, Bordering On Very Good | Low Risk |

| Ultra SWANs | 74 | Good | Low Risk |

| Dividend Aristocrats | 67 | Above-Average (Bordering On Good) | Low Risk |

| Low Volatility Stocks | 65 | Above-Average | Low Risk |

| Master List average | 61 | Above-Average | Low Risk |

| Dividend Kings | 60 | Above-Average | Low Risk |

| Hyper-Growth stocks | 59 | Average, Bordering On Above-Average | Medium Risk |

| Dividend Champions | 55 | Average | Medium Risk |

| Altria | 45 | Average | Medium Risk |

| Monthly Dividend Stocks | 41 | Average | Medium Risk |

(Source: DK Research Terminal.)

MO's risk-management consensus is in the bottom 31% of the world's best blue chips and is similar to:

- Exxon Mobil (XOM): blue-chip aristocrat

- General Dynamics (GD): Super SWAN dividend aristocrat

- Honeywell (HON): Ultra SWAN

- Costco (COST): Ultra SWAN

- Leggett & Platt (LEG): blue-chip dividend king.

The bottom line is that all companies have risks, and MO is average at managing theirs, according to S&P.

How We Monitor MO's Risk Profile

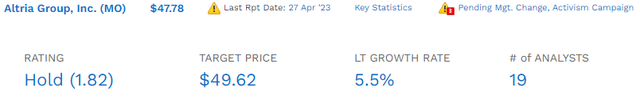

- 19 analysts

- three credit rating agencies

- 22 experts who collectively know this business better than anyone other than management

- the bond market for real-time fundamental risk assessment.

When the facts change, I change my mind. What do you do, sir?" - John Maynard Keynes

There are no sacred cows at iREIT or Dividend Kings. Wherever the fundamentals lead, we always follow. That's the essence of disciplined financial science, the math behind retiring rich and staying rich in retirement.

New Long-Term Guidance

MO's guidance for the next five years is positive for long-term investors.

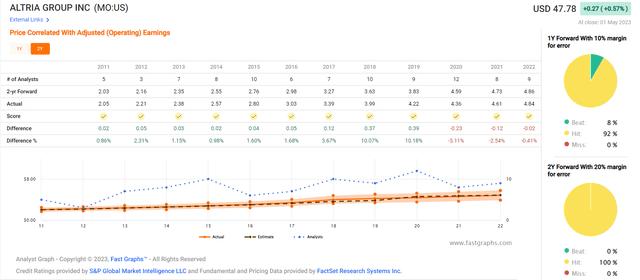

How often does management achieve its guidance? Almost always.

MO's consensus estimates are based on guidance and management, and analysts basically know this business well enough to predict growth rates with near-perfect accuracy.

Altria's Medium-Term Growth Outlook After Investor Day And Earnings

| Metric | 2022 consensus growth | 2023 consensus growth (recession year) | 2024 consensus growth | 2025 consensus growth |

| Sales | 0% | 2% | 1% | 1% |

| Dividend | 5% | 5% (Official) | 5% | 5% |

| EPS | 5% | 5% | 4% | 4% |

| Operating Cash Flow | 0% | 9% | 3% | 5% |

| Free Cash Flow | 0% | 9% | 0% | -1% |

| EBITDA | 38% | -21% | 4% | 2% |

| EBIT (operating income) | 39% | -21% | 3% | 1% |

(Source: FAST Graphs, FactSet.)

Despite its challenges, MO's growth prospects are modest but positive in the coming years.

Long-Term Growth Prospects

Analysts expect MO's long-term growth rate to be 5.5%, the upper end of management guidance.

And as we've just seen, MO almost never misses estimates, with margins of error of plus or minus 5% in any given year for the last decade.

- 5.2% to 5.8% likely growth rate going forward.

| Investment Strategy | Yield | LT Consensus Growth | LT Consensus Total Return Potential | Long-Term Risk-Adjusted Expected Return |

| ZEUS Income Growth (My family hedge fund) | 4.2% | 10.0% | 14.2% | 9.9% |

| Altria | 7.9% | 5.5% | 13.4% | 9.4% |

| Vanguard Dividend Appreciation ETF | 2.0% | 11.3% | 13.2% | 9.3% |

| Nasdaq | 0.8% | 11.2% | 12.0% | 8.4% |

| Schwab US Dividend Equity ETF | 3.6% | 7.6% | 11.2% | 7.8% |

| REITs | 3.9% | 7.0% | 10.9% | 7.6% |

| Dividend Champions | 2.6% | 8.1% | 10.7% | 7.5% |

| Dividend Aristocrats | 1.9% | 8.5% | 10.4% | 7.3% |

| S&P 500 | 1.7% | 8.5% | 10.2% | 7.1% |

| 60/40 Retirement Portfolio | 2.1% | 5.1% | 7.2% | 5.0% |

(Sources: DK Research Terminal, FactSet, Morningstar.)

MO offers 13% to 14% long-term return potential.

- Management guidance: 11.9% to 13.9%.

That's better than almost every popular ETF, including the Nasdaq.

A Wonderful Company At A Wonderful Price

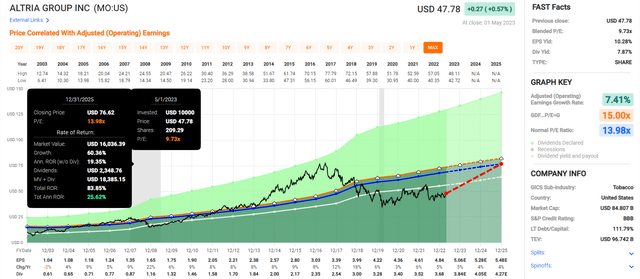

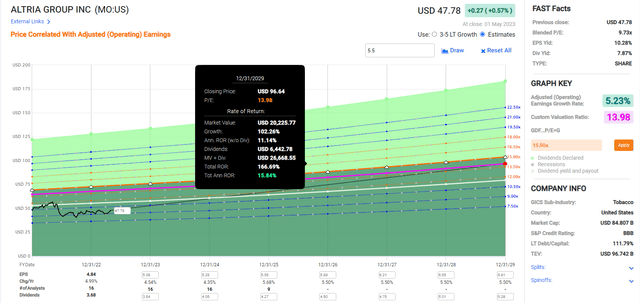

FAST Graphs, FactSet FAST Graphs, FactSet FAST Graphs, FactSet

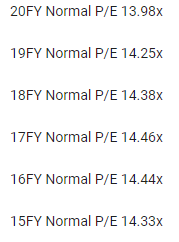

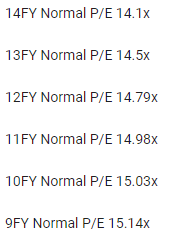

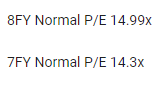

For the last 20 years, MO has consistently traded between 14 to 15X earnings outside of bear markets and bubbles.

| Metric | Historical Fair Value Multiples (all years) | 2022 | 2023 | 2024 | 2025 | 2026 | 12-Month Forward Fair Value |

| 5-year average yield | 7.32% | $48.09 | $51.37 | $51.37 | $58.33 | $58.47 | |

| Earnings | 13.98 | $64.45 | $70.60 | $73.67 | $77.31 | $78.29 | |

| Average | $55.08 | $59.47 | $60.53 | $66.49 | $66.94 | $59.83 | |

| Current Price | $47.78 | ||||||

Discount To Fair Value | 13.25% | 19.65% | 21.06% | 28.14% | 28.63% | 20.15% | |

Upside To Fair Value (Including Dividends) | 15.27% | 24.46% | 26.69% | 39.17% | 40.11% | 33.10% | |

| 2023 EPS | 2024 EPS | 2023 Weighted EPS | 2024 Weighted EPS | 12-Month Forward EPS | 12-Month Average Fair Value Forward P/E | Current Forward P/E | Current Forward Cash-Adjusted P/E |

| $5.05 | $5.27 | $3.30 | $1.82 | $5.13 | 13.1 | 9.3 | 8.4 |

Conservatively I estimate MO is worth 13.1X earnings and today trades at 9.3X and 8.4X adjusted for cash.

| Rating | Margin Of Safety For Medium-Risk 13/13 Ultra SWAN | 2023 Fair Value Price | 2024 Fair Value Price | 12-Month Forward Fair Value |

| Potentially Reasonable Buy | 0% | $59.47 | $60.53 | $59.83 |

| Potentially Good Buy | 5% | $56.49 | $57.50 | $56.84 |

| Potentially Strong Buy | 15% | $50.55 | $51.45 | $50.86 |

| Potentially Very Strong Buy | 25% | $42.37 | $45.40 | $44.88 |

| Potentially Ultra-Value Buy | 35% | $38.65 | $39.34 | $38.89 |

| Currently | $47.78 | 19.65% | 21.06% | 20.15% |

| Upside To Fair Value (Including Dividends) | 32.33% | 34.55% | 33.10% |

For anyone comfortable with its risk profile, MO is a potentially strong buy.

Altria Consensus 2025 Total Return Potential

Altria Consensus 2029 Total Return Potential

MO's great discount means a very strong return potential of 83% over the next three years and 166% over the next six.

- about 3X the S&P's consensus return potential over the next six years.

Bottom Line: Altria: An 8% Yielding Dividend Aristocrat You Can Trust

Dividend Kings Automated Investment Decision Tool

Let me be clear: I'm NOT calling the bottom in MO (I'm not a market-timer).

Even Ultra SWAN kings can fall hard and fast in a bear market.

Fundamentals are all that determine safety and quality, and my recommendations.

- over 30+ years, 97% of stock returns are a function of pure fundamentals, not luck

- in the short term; luck is 25X as powerful as fundamentals

- in the long term, fundamentals are 33X as powerful as luck.

While I can't predict the market in the short term, here's what I can tell you about MO.

- 39th highest quality company on the Master List (top 8% of the world's best blue-chips)

- dividend king with a 53-year dividend growth streak

- very safe 7.9% yield (1.0% risk of a dividend cut) growing 4% to 6% over time

- 13% to 14% long-term return potential vs. 10.2% S&P

- conservatively 20% undervalued

- 9.4X earnings vs. 14 to 15X historical

- 166% consensus return potential over the next six years, 16% annually, 3X more than the S&P 500

- 100% better risk-adjusted expected returns than the S&P 500 over the next five years

- 4.5X the income of the S&P over the next five years.

If you're worried about the debt ceiling, consider buying some Altria today.

If you're worried about the 2023 recession, MO is a great choice.

If you're looking for one of the safest 8% yields on earth, MO could be just what you're looking for.

And if you like the idea of 13% to 14% long-term returns, better than the Nasdaq is likely to deliver, Altria is a great way to possibly achieve that while swimming in very safe and steadily rising dividends.

Dividends that have been growing for 53 consecutive years, since 1970, through:

- nine recessions

- two economic crises

- inflation as high as 15%

- interest rates as high as 20%

- 13 bear markets

- three 50+% market crashes.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

----------------------------------------------------------------------------------------

Dividend Kings helps you determine the best safe dividend stocks to buy via our Automated Investment Decision Tool, Zen Research Terminal, Correction Planning Tool, and Daily Blue-Chip Deal Videos.

Membership also includes

Access to our 13 model portfolios (all of which are beating the market in this correction)

my correction watchlist

- my $2.5 million family hedge fund

50% discount to iREIT (our REIT-focused sister service)

real-time chatroom support

real-time email notifications of all my retirement portfolio buys

numerous valuable investing tools

Click here for a two-week free trial, so we can help you achieve better long-term total returns and your financial dreams.

This article was written by

Adam Galas is a co-founder of Wide Moat Research ("WMR"), a subscription-based publisher of financial information, serving over 5,000 investors around the world. WMR has a team of experienced multi-disciplined analysts covering all dividend categories, including REITs, MLPs, BDCs, and traditional C-Corps.

The WMR brands include: (1) The Intelligent REIT Investor (newsletter), (2) The Intelligent Dividend Investor (newsletter), (3) iREIT on Alpha (Seeking Alpha), and (4) The Dividend Kings (Seeking Alpha).

I'm a proud Army veteran and have seven years of experience as an analyst/investment writer for Dividend Kings, iREIT, The Intelligent Dividend Investor, The Motley Fool, Simply Safe Dividends, Seeking Alpha, and the Adam Mesh Trading Group. I'm proud to be one of the founders of The Dividend Kings, joining forces with Brad Thomas, Chuck Carnevale, and other leading income writers to offer the best premium service on Seeking Alpha's Market Place.

My goal is to help all people learn how to harness the awesome power of dividend growth investing to achieve their financial dreams and enrich their lives.

With 24 years of investing experience, I've learned what works and more importantly, what doesn't, when it comes to building long-term wealth and safe and dependable income streams in all economic and market conditions.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I own $4,000 worth of MO via ETFs.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.