Qualcomm: The Gift Has Arrived

Summary

- QCOM stock fell nearly 7% in post-market trading as investors assessed the headwinds in its smartphone segment.

- Qualcomm's guidance is disappointing, as China's post-reopening tailwinds have fizzled out.

- The company's diversification is working but is not significant enough to mitigate Qualcomm's near-term headwinds in the smartphone segment.

- Apple's growth in the refurbished market could introduce new challenges for the company.

- With QCOM likely priced for peak pessimism, the opportunity to be more aggressive in adding shares has arrived.

- I do much more than just articles at Ultimate Growth Investing: Members get access to model portfolios, regular updates, a chat room, and more. Learn More »

JHVEPhoto

Qualcomm Incorporated (NASDAQ:QCOM) buyers fled after the company released its FQ2'23 earnings report yesterday (May 3). The company's results for FQ2 showed promise even though it was mixed. However, its forward guidance largely disappointed, as downstream headwinds have shown little signs of sustained improvement.

As a result, Qualcomm guided an adjusted EPS for FQ3'23 that's way below the previous Wall Street estimates.

Management promulgated adjusted revenue of $8.5B at the midpoint of its guidance range for FQ3, well below the consensus estimates of $9.1B. In addition, the company's adjusted midpoint EPS outlook of $1.8 likely caught investors off-guard, well off analysts' estimates of $2.12.

As such, QCOM holders could hardly blame the post-earnings selloff as QCOM gave up nearly 7% in post-market trading.

While the guidance was unwelcome, we assessed that management likely telegraphed a highly conservative outlook. Qualcomm reminded investors that its outlook contemplated several critical headwinds.

Accordingly, the company highlighted that it's "not incorporating improvements regarding expectations for a rebound in China demand in the second half of the calendar year." Management added that the company has seen "no evidence of meaningful recovery in China demand yet."

As such, we parsed that management is likely expecting China's recovery to be delayed further into 2024 at the very least, as China's reopening tailwinds have fizzled out lately.

China's Caixin manufacturing PMI fell to 49.5 in April after notching an improvement to 50 in March. China's economic recovery is expected to remain "uneven" as businesses remain "reluctant to hire more workers."

Moreover, China's job market "also deteriorated," worsening consumer spending sentiments further. As a result, it makes sense for Qualcomm to remain cautious about the recovery tailwinds from China in H2CY2023, highlighting the prudence in its planning assumptions.

Arch-rival MediaTek (OTCPK:MDTKF) also recently reduced its global smartphone shipment forecasts, seeing "a longer replacement cycle and the emergence of used or refurbished phones."

Analysts on the call were also concerned about how the growth of refurbished phones could threaten the recovery momentum of Qualcomm's smartphone segment moving forward.

Management attempted to assure investors that Qualcomm "is closely watching the refurbished phone market and has contemplated it in their numbers." In addition, the company added that the refurbished market is not a new phenomenon and has been "around for a long time in emerging markets."

The concerns intensified recently as India's smartphone market registered "a record decline in Q1 2023, with shipments falling by 19% annually to 31 million units." One of the factors cited for the slump is linked to "growing consumer preference for refurbished phones."

Therefore, should investors be worried?

The Wall Street Journal, or WSJ, ran an article in mid-April highlighting the trend that "Americans are keeping their smartphones longer." Notably, it stressed that it has led to "an increase in demand for used and refurbished devices, particularly iPhones."

Furthermore, Apple (AAPL) likely sees an opportunity in the growing market. The WSJ reported that the Cupertino company "has doubled down on the aftermarket for its phones, with its own secondhand-phone program." Why? This is likely attributed to Apple's stranglehold on the consumer ecosystem, differentiating itself from companies like Qualcomm, MediaTek, or even Samsung (OTCPK:SSNLF).

Apple is the gatekeeper for iOS and can continue to generate revenue from refurbished phones through services and subscriptions, even when it doesn't get a cut from the sale of a used device.

Its wide economic moat through its ecosystem has seen Apple gaining a significant share in the refurbished market. CCS Insight suggests that its iPhones account "for over 80% of the market for used phones by value."

Notwithstanding, Qualcomm is still in the process of diversifying its reliance on handsets revenue. Management stressed that it remains focused on executing its "diversification strategy."

Interestingly, management highlighted its robust generative AI strategy that could provide a tailwind, given the company's technological leadership in smartphones.

CEO Cristiano Amon articulated that "generative AI models need to run locally on devices at the edge to scale." He believes the company is "uniquely positioned to enable AI use cases on edge devices."

Management stressed that running generative AI locally will help "optimize costs" while providing "better latency, security, privacy" and meeting regulatory requirements.

Hence, Qualcomm sees tailwinds from on-device generative AI that could provide further growth impetus moving ahead. Therefore, we urge investors to continue monitoring the developments in this area, even as Qualcomm continues to diversify.

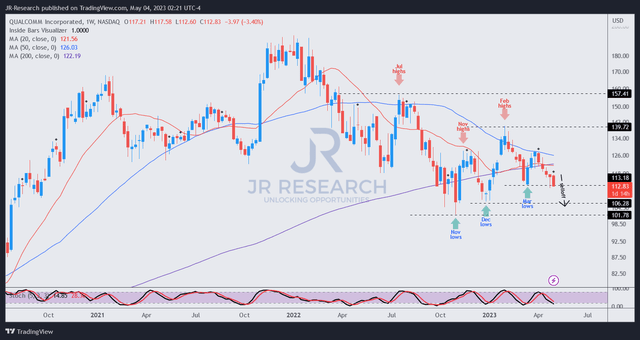

QCOM price chart (weekly) (TradingView)

As a result of the post-earnings selloff, QCOM should re-test its December lows in the regular session, taking out dip buyers from March.

We still expect dip buyers to return and defend QCOM's December lows, with headwinds for H2CY2023 likely priced in.

Samsung's optimism at its recent earnings conference could lend credence to a more robust H2 recovery, despite Qualcomm's prudent guidance. The Korean semiconductor leader "predicts that the overall handset market demand in H2 2023 will be higher than in H1."

As such, we assessed that the market is likely pricing in peak pessimism in QCOM for H1. Hence, it should subsequently support a recovery in operating performance, bolstered by Qualcomm's conservative outlook, lowering the bar for it to cross.

With QCOM falling well below our blended fair value estimate of about $150, we assessed that it has moved into significantly undervalued zones, improving risk/reward for investors looking to add more exposure.

Rating: Strong Buy (Revised from Buy).

Important note: Investors are reminded to do their own due diligence and not rely on the information provided as financial advice. The rating is also not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have additional commentary to improve our thesis? Spotted a critical gap in our thesis? Saw something important that we didn’t? Agree or disagree? Comment below and let us know why, and help everyone in the community to learn better!

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA's bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!

This article was written by

Seeking Alpha features JR Research as one of its Top Analysts to Follow for Technology, Software, and the Internet. See: https://seekingalpha.com/who-to-follow

JR Research was featured as one of Seeking Alpha's leading contributors in 2022. See: https://seekingalpha.com/article/4578688-seeking-alpha-contributor-community-2022-by-the-numbers

Unlock the key insights to growth investing with JR Research - led by founder and lead writer JR. Our dedicated team is focused on providing you with the clarity you need to make confident investment decisions.

Transform your investment strategy with our popular Investing Groups service.

Ultimate Growth Investing specializes in a price action-based approach to uncovering the opportunities in growth and technology stocks, backed by actionable fundamental analysis.

We believe price action is a leading indicator.

Price action analysis is a powerful and versatile toolkit for the informed investor because it can be used to analyze any publicly traded security. As such, it offers investors with invaluable insights into understanding market behavior and sentiments.

Plus, stay ahead of the game with our general stock analysis across a wide range of sectors and industries.

Improve your returns and stay ahead of the curve with our short- to medium-term stock analysis.

We not only identify long-term potential but also seize opportunities to profit from short-term market swings, using a combination of long and short set-ups.

Join us and start seeing experiencing the quality of our service today.

Lead writer JR's profile:

I was previously an Executive Director with a global financial services corporation. I led company-wide award-winning wealth management teams that were consistently ranked among the best in the company.

I graduated with an Economics Degree from National University of Singapore [NUS]. NUS is Asia's #1 university according to Quacquarelli Symonds [QS] annual higher education ranking. It also held the #11 position in QS World University Rankings 2022.

I'm also a Commissioned Officer (Reservist) with the Singapore Armed Forces. I was the Battalion Second-in-command of an Armored Regiment. I currently hold the rank of Major. I graduated as the Distinguished Honor Graduate from the Armor Officers' Advanced Course as I finished first in my cohort of Armor officers. I was also conferred the Best in Knowledge award.

My LinkedIn: www.linkedin.com/in/seekjo

Analyst’s Disclosure: I/we have a beneficial long position in the shares of QCOM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.