NSL: Amortizing 'Return Of Principal' Fund

Summary

- The NSL fund aims to provide high current income from a portfolio of senior loans.

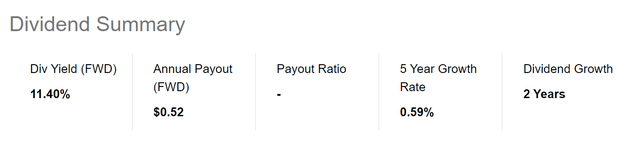

- The fund is currently yielding 11.4% based on market price.

- However, with mid-single-digit returns potential from the asset class, the NSL fund is a clear 'return of principal' fund where long-term investors lose both principal and income.

Diy13/iStock via Getty Images

Readers often ask why I am so critical of high yielding funds. My issue with these funds is the fact that they appear to be set up to lure unsuspecting retirees with high distribution yields. However, what they actually deliver is modest total returns that are far lower than their yields. Over time investors end up losing both principal and income from investing in these 'return of principal' funds.

The Nuveen Senior Income Fund (NYSE:NSL) appears to be yet another example of an amortizing 'return of principal' fund paying investors more than it earns with long-term returns of 3-5%, but paying a 9.9% of NAV distribution yield.

I would not recommend the NSL fund.

Fund Overview

The Nuveen Senior Income Fund is a closed-end fund ("CEF") that aims to provide high current income from a portfolio of floating rate senior secured loans.

The NSL fund will normally invest at least 80% of its managed asset in senior secured loans while up to 20% may be invested in loans of foreign borrowers, unsecured senior loans, and other debt and equity securities.

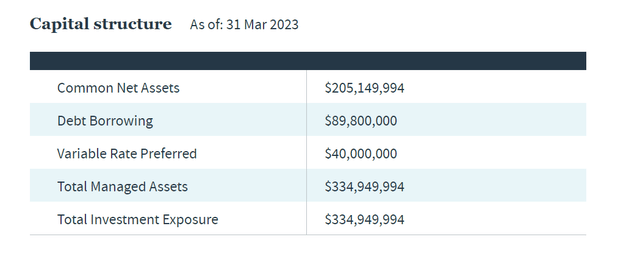

The NSL fund may use leverage to enhance returns. As of March 31, 2023, the fund had $335 million in total managed assets and $205 million in common net assets for 38.8% effective leverage (Figure 1).

Figure 1 - NSL capital structure (Nuveen)

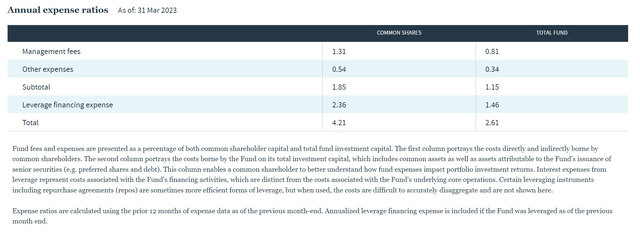

The NSL fund charges a high 4.2% total expense ratio to common unitholders with more than half of the fees due to leverage (Figure 2).

Figure 2 - NSL charges high fees (Nuveen)

Portfolio Holdings

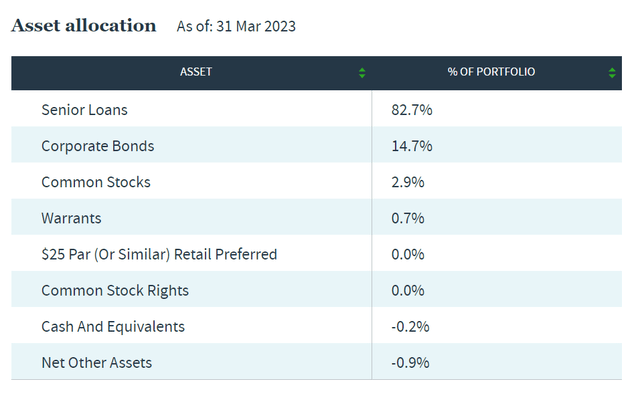

Figure 3 shows the asset allocation of the NSL fund. As designed, the fund has 82.7% of the portfolio invested in senior loans, with 14.7% in corporate bonds and 2.9% in common stocks.

Figure 3 - NSL asset allocation (Nuveen)

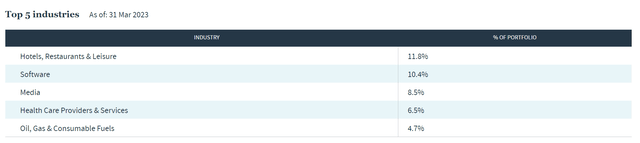

The NSL fund's top industry exposures are shown in Figure 4. Hotels, Restaurants & Leisure leads the portfolio at 11.8%, followed by Software at 10.4% and Media at 8.5% (Figure 4).

Figure 4 - NSL top industry exposures (Nuveen)

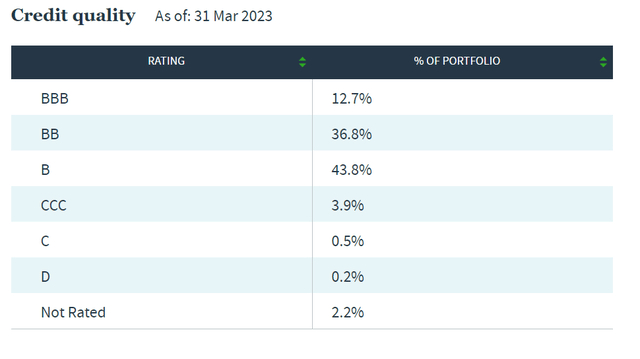

In terms of credit quality, the fund's portfolio is predominantly non-investment grade (<BBB rating), with 36.8% rated BB, 43.8% rated B, and 6.8% rated CCC or lower (Figure 5).

Figure 5 - NSL credit quality allocation (Nuveen)

Returns

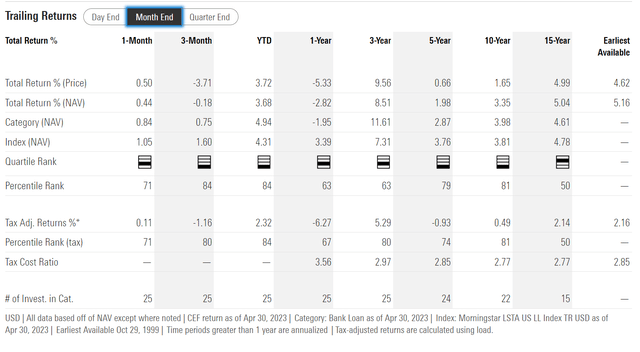

Figure 6 shows the NSL fund's historical returns to April 30, 2023. The fund has generated 3/5/10/15Yr average annual returns of 8.5%/2.0%/3.4%/5.0% respectively.

Figure 6 - NSL historical returns (morningstar.com)

Investors should note that the 3Yr average return figure may not be representative of the strategy's long-term returns, as the 3-Yr period (April 2020) began near the COVID lows, which may have flattered the annual returns figure.

I believe the longer-term 10 and 15Yr average annual returns are more representative of what NSL's strategy can earn over a cycle from floating rate senior loans.

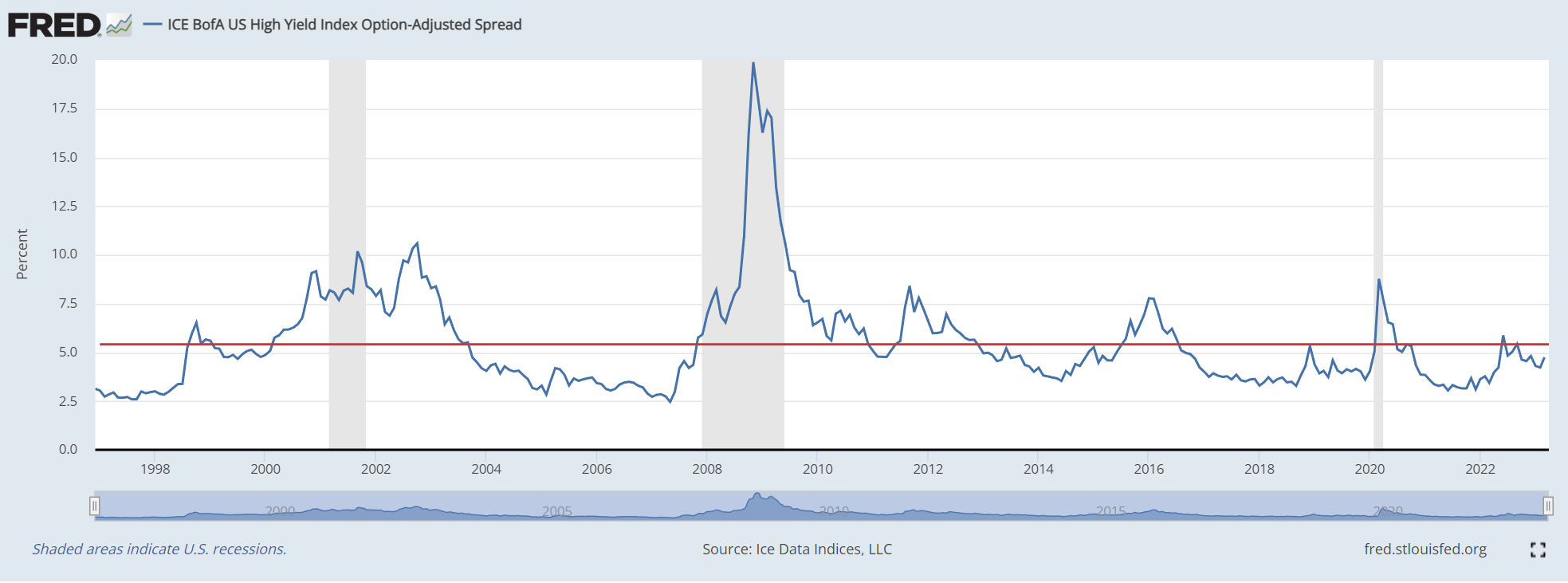

This is because the senior loan asset class basically offers investors high yield credit spreads, since these investments have little duration exposure. Over the long-run, high yield credit spreads averages around 5% (Figure 7).

Figure 7 - High yield credit spreads average 5% over a cycle (St. Louis Fed)

Leverage can enhance fund returns, however, credit defaults and management fees will decrease returns. Overall, investors should not expect to earn significantly more than mid-single-digit ("MSD") annual returns over a cycle from senior loan funds.

Distribution & Yield

While the NSL fund earns only MSD annual returns over a cycle, it pays a very generous distribution, currently set at $0.0435 / month or 11.4% annualized. On NAV, the NSL fund is paying a 9.9% distribution yield (Figure 8).

Figure 8 - NSL distribution yield (Seeking Alpha)

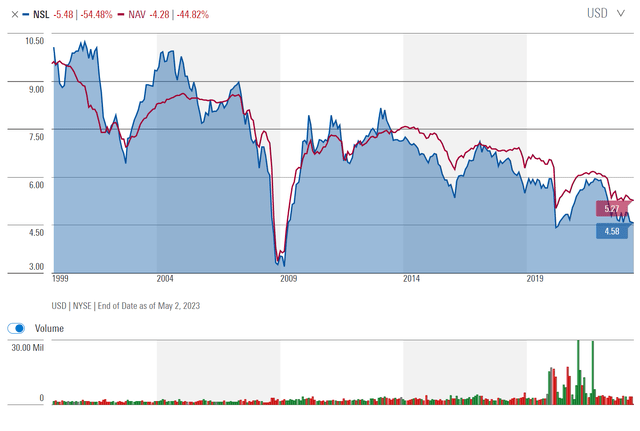

In fact, I would argue NSL's distribution is not sustainable, as it is significantly higher than the fund's earnings potential. The NSL fund appears to be yet another example of an amortizing 'return of principal' fund that does not earn sufficient earnings to pay its distribution yield. This assessment is confirmed by analyzing NSL's long-term NAV profile, which shows the NSL fund has a long-term amortizing NAV (Figure 9).

Figure 9 - NSL has an amortizing NAV profile (morningstar.com)

Note, my 'return of principal' assessment of NSL is subtly different from the common tax terminology 'return of capital', which refers to funds using capital to fund distributions.

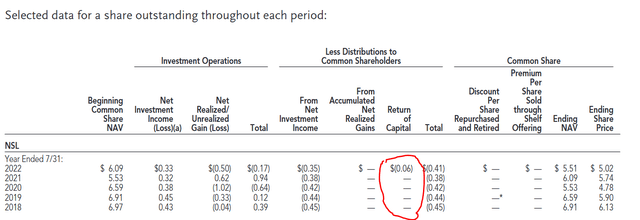

According to the fund's annual report, the NSL fund does not often use ROC (Figure 10).

Figure 10 - NSL does not often use ROC (NSL annual report)

Instead, 'return of principal' is an economic concept used to characterize funds that pay distribution yields higher than their total returns. In the case of NSL, although it earns sufficient NII to fund its distributions, shareholders may lose out in other ways, for example through persistent investment losses.

In the past 5 fiscal years, NSL had cumulative net investment losses of $1.27 per share. This suggest the fund may have been stretching for yield and invested in securities that led to substantial credit losses, so while NII was maintained, NAV declined.

Conclusion

In summary, the Nuveen Senior Income Fund appears to be yet another case of an amortizing 'return of principal' fund paying investors more than it earns. There is nothing fundamentally wrong with the senior loan asset class. Over a cycle, it should generate MSD total returns. If funds are structured such that they pay MSD distribution yields, then I would be perfectly fine to recommend them to investors comfortable with the yield.

The problem is that when investors buy into an amortizing 'return of principal' fund, they end up losing on their principal investment, as the NAV shrinks and market price tracks NAV. So instead of a 11.4% return like NSL's distribution yield implies, investors really only earn 5 or 6%. Furthermore, as NAV shrinks, there is less income earning assets to support future returns. So eventually, the distribution rate may be cut. Long-term investors in 'return of principal' funds end up losing both principal and income.

I would not recommend the NSL fund.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.