- News

- City News

- chennai News

- Chennai: Now, a ‘goldmine’ scam that polishes off investors’ money

Trending Topics

Chennai: Now, a ‘goldmine’ scam that polishes off investors’ money

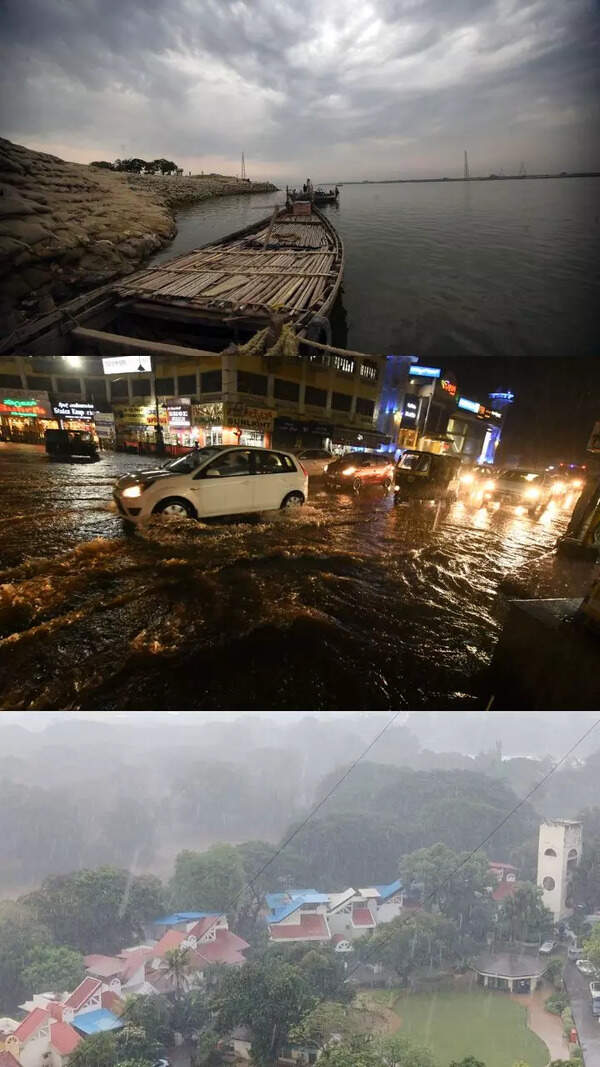

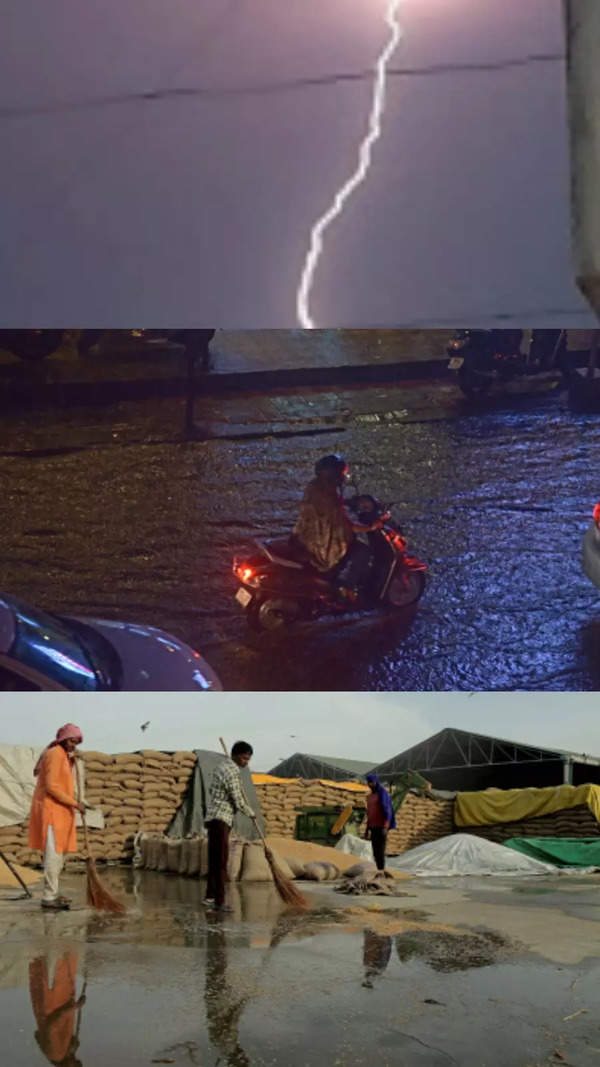

Image used for representational purpose only

CHENNAI: A company that promised fancy returns and mobilised several hundred crores of rupees saying it owned a ‘goldmine’ in the West African nation of Ghana, has joined the list of firms that cheated depositors of their ‘investments’ running to several crores.

Economic offences wing (EOW) officials realised the size of this ‘goldmine scam’ could be about `2,000 crore when they saw distraught depositors trooping into their offices carrying ‘receipts’ and tales of how they were promised 20% annual returns on investment by Providence Trading Corporation, which had its ‘headquarters’ at Virugambakkam.

Cashing in on the spiralling gold prices and people’s greed, the company was on a spree opening branches in at least 15 districts in the state, say EOW officials quoting victims.

The issue came to light after the company started defaulting on monthly ‘interest payments’ for the past two months. The spate of legal troubles and frauds played by many other financial institutions on their depositors, involving several thousand crores of rupees, too played on the minds of the Providence investors.

When the investors tried to reach the company’s director and chief executive officer M Siva Shakthivelu, they could not meet him. The investors turned restive after they found the office had been vacated and the staff too didn’t turn up for duty on Wednesday.

Following this, the investors rushed to the EOW-CID office at the Police Training College (PTC) in Ashok Nagar, and filed separate complaints. Preliminary inquiries revealed that the Providence Trading Corporation officials lured the investors by claiming that the company owned a huge gold mine in the West African country of Ghana.

An investor, Bala Ganesh of Chennai, said: “I was lured by a staff who displayed a few videos that played for about 10 minutes about the gold extraction process and their goldmine in Ghana.” Another investor, Priya Gurunathan, said, “the company owners showed some documents and memorandum of understanding (MoU) between the company and a ministry in Ghana.”

EOW-CID officials confirmed receipt of several complaints and said they were in the process of holding preliminary inquiry and registering a case. They rued that despite warnings given by police periodically, about fraudulent financial firms that swindle money by promising fancy returns on investments, people ignored the caution and fell victim.”

Economic offences wing (EOW) officials realised the size of this ‘goldmine scam’ could be about `2,000 crore when they saw distraught depositors trooping into their offices carrying ‘receipts’ and tales of how they were promised 20% annual returns on investment by Providence Trading Corporation, which had its ‘headquarters’ at Virugambakkam.

Cashing in on the spiralling gold prices and people’s greed, the company was on a spree opening branches in at least 15 districts in the state, say EOW officials quoting victims.

The issue came to light after the company started defaulting on monthly ‘interest payments’ for the past two months. The spate of legal troubles and frauds played by many other financial institutions on their depositors, involving several thousand crores of rupees, too played on the minds of the Providence investors.

When the investors tried to reach the company’s director and chief executive officer M Siva Shakthivelu, they could not meet him. The investors turned restive after they found the office had been vacated and the staff too didn’t turn up for duty on Wednesday.

Following this, the investors rushed to the EOW-CID office at the Police Training College (PTC) in Ashok Nagar, and filed separate complaints. Preliminary inquiries revealed that the Providence Trading Corporation officials lured the investors by claiming that the company owned a huge gold mine in the West African country of Ghana.

An investor, Bala Ganesh of Chennai, said: “I was lured by a staff who displayed a few videos that played for about 10 minutes about the gold extraction process and their goldmine in Ghana.” Another investor, Priya Gurunathan, said, “the company owners showed some documents and memorandum of understanding (MoU) between the company and a ministry in Ghana.”

EOW-CID officials confirmed receipt of several complaints and said they were in the process of holding preliminary inquiry and registering a case. They rued that despite warnings given by police periodically, about fraudulent financial firms that swindle money by promising fancy returns on investments, people ignored the caution and fell victim.”

Start a Conversation

FOLLOW US ON SOCIAL MEDIA

FacebookTwitterInstagramKOO APPYOUTUBE