KeyCorp: Not The Right Time To Buy The Stock Yet

Summary

- For KeyCorp, high interest rates mean higher deposit costs, higher charge-offs, and higher deposit outflows.

- KEY’s provision for credit losses in 1Q 2023 was lower than in 4Q 2022.

- However, it was still 67% higher than in 1Q 2022, and with the current interest rates and economic condition, it may remain high in the next few quarters.

- On 3 May 2023, Federal Reserve increased interest rates again by 0.25%. However, the Fed may stop increasing the rates as inflation rates are decreasing. Rate cuts may start in 2024.

- KEY stock is a hold.

hapabapa

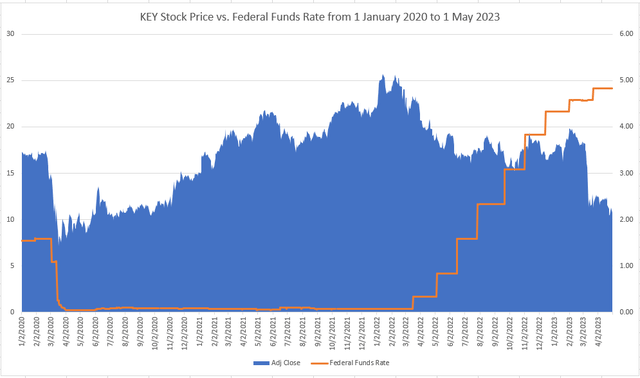

In the past few years, KeyCorp's (NYSE:KEY) stock price has had a strong negative correlation with Federal Reserve funds rate. As the U.S. monetary authority started increasing interest rates to combat inflation in 2022, KEY's stock price dropped. On 3 May 2023, the Fed raised rates by 0.25% for the tenth consecutive time to the range of 5.0% to 5.25%. At first glance, it is not a sign for KeyCorp, as higher rates mean higher deposit costs, higher charge-offs, and higher deposit outflows for the company. Jerome Powell, the Fed's chair said that the central bank may stop increasing the rates further. Inflation rates decreased significantly in the past few months, and higher interest rates can cause serious financial instability in the United States. Thus, higher interest rates are not likely. However, we cannot expect the rates to decrease soon. I think interest rate cuts might start in the first half of 2024. However, if inflation rates decrease faster than expected in the following months, the Fed might consider slight interest rate decreases in the last quarter of 2023. As the stock's price plunged in the past few months, it may recover part of the losses in the short term. However, it is nothing that we can count on. For now, the stock is a hold.

Financials and performance

KeyCorp's net income from its continuing operations in the first quarter of 2023 was lower than in the fourth quarter of 2022 (down 23% QoQ), as Fed funds rate increased further in 2023. The company's net interest margin decreased from 2.73% in 4Q 2022 to 2.47% in 1Q 2023. Also, its ROTCE decreased from 18.07% in 4Q 2022 to 13.16% in 1Q 2023. KEY's net interest income and net interest margin were impaired in the first quarter of 2023, due to higher interest-bearing deposit costs and a change in the funding mix, partially offset by higher earning asset balances and a benefit from higher interest rates.

The company's net interest income decreased from $1227 million in 4Q 2022 to $1106 million in 1Q 2023. Furthermore, KEY's non-interest income decreased from $671 million in 4Q 2022 to $608 million in 1Q 2023, driven by lower investment banking and debt placement fees, and lower corporate services income. It is important to know that KEY reported 1Q 2023 service charges in deposit accounts of $67 million, compared with $91 million in 1Q 2022 and $71 million in 4Q 2022. Higher inflation rates caused higher spending. Also, higher interest rates to combat inflation made KEY's customers move their deposits to bigger banks and money market funds. KEY's average deposits totaled $143.4 billion in 1Q 2023, compared with $145.7 billion in 4Q 2022, and $150.2 billion in 1Q 2022.

In the first quarter of 2023, KEY's total loans increased slightly, driven by higher commercial and industrial loans. Due to the economic conditions resulting from high inflation rates and high interest rates to combat inflation, KEY's net loan charge-offs increased from $33 million in 1Q 2022 to $41 million in 4Q 2022, then increased further to $45 million in 1Q 2023. Its net loan charge-offs to average total loans increased from 0.13% in 1Q 2022 to 0.14% and 0.15% in 4Q 2022 and 1Q 2023, respectively. It is important to know that while KEY's allowance for credit losses increased from $1562 million in 4Q 2022 to $1656 million in 1Q 2023, its provision for credit losses decreased from $265 million in 4Q 2022 to $139 million in 1Q 2023. It simply means that compared with the fourth quarter of 2022, KEY's known credit losses (which is an income statement expense) decreased in the first quarter of 2023. It can be a good sign for the company's shareholders. However, KEY's provision for credit losses of $139 million in 1Q 2023, was significantly higher than $83 million in 1Q 2022.

Interest rates

Figure 1 shows KEY stock price versus Fed's fund rate from January 2020 to May 2023. From April 2020 to February 2020, Fed's fund rates were close to zero and stable, and KEY's stock price increased. However, as Federal Reserve started increasing interest rates to combat inflation, KEY's stock price started decreasing. For a bank like KeyCorp, a higher interest rate in an inflationary economy means higher deposit costs and deposit outflow. As a result of hiked interest rates, the amount of total assets in money market funds jumped from $4.7 trillion on 28 December 2022, to $5.3 trillion on 26 April 2023. It is worth noting that in the mentioned economic situation, higher interest rates cannot increase KEY's interest income from its loans. On the other hand, high interest rates, cause higher provision for credit losses, and higher bad debts.

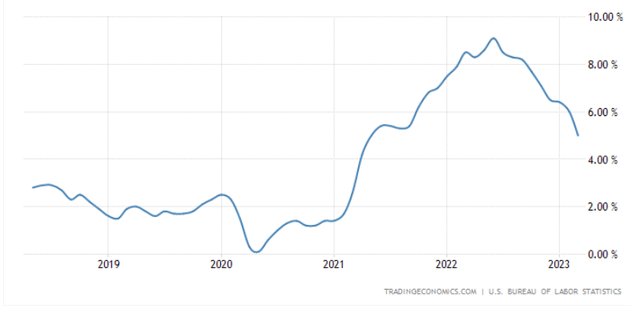

On 3 May 2023, Federal Reserve raised interest for the 10th consecutive time, by 0.25%, to the range of 5.00% to 5.25%. Federal Reserve announced that it might stop increasing interest rates at this range. Moreover, it is important to know that several lawmakers are pressing the Fed's chair to stop raising interest rates, mentioning that the inflationary pressures have been tamed. More rate hikes might cause serious financial and banking instabilities, putting the U.S. economy at serious risk. According to Figure 2, the annual inflation rate in the United States decreased to 5% in March. This inflation rate is the lowest since May 2021. However, U.S. consumer inflation expectations increased to 4.7% in March, from 4.2% in February. This might be the reason that Federal Reserve decided to increase interest rates further; to control inflation expectations. I don't expect interest rates to decrease soon. However, with lower inflationary pressures, and the importance of economic recovery, Federal Reserve may start decreasing the rates in 1Q 2024. KEY's total deposit costs increased from 0.04% in 1Q 2022 to 0.51% in 4Q 2022 and increased further to 0.99% in 1Q 2023. With lower interest rates, the company's cost of deposit can get back to normal.

The company's financial results in the last few quarters show that in hard times, the company can manage the risks. As of 31 March 2023, KEY's risk-based capital ratios were better than the regulatory benchmarks. The company's Common Equity Tier 1 (CET1) was 9.1% on 31 March 2023, flat quarter-over-quarter. It is worth noting that KEY's CET1 was 9.4% on 31 March 2022. However, a CET1 ratio of 9.1% in the current economic condition, should be considered as a sign of financial health.

Figure 1 - KEY stock price vs. Fed's interest rates

Author (based on Yahoo Finance and ICI data)

Figure 2 - Unites States annual inflation rate

End note

Federal Reserve increased interest rates by 0.25% on 3 May. Higher interest rates hurt KEY's financial results. However, the U.S. central bank may stop increasing the interest rates as inflation rates are decreasing. Thus, I don't expect KEY's financial results to get worse. However, to be considered a buy stock, interest rates should decrease to very lower levels, and I don't expect that to happen until 2024. Some might argue that even with the current interest rates and economic conditions, KeyCorp's financial results are attractive. Actually, higher earning asset balances and higher interest rates paved the way for an over 8% increase in KEY's net interest income in 1Q 2023 as compared to 1Q 2022. However, the company's net interest income in 1Q 2023 was $121 million lower than in 4Q 2022. The stock is a hold.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.