Sell Alert: 2 REITs Getting Risky

Summary

- Many REITs are today very opportunistic.

- But not all of them are.

- We present 2 popular REITs that we would avoid.

- We're currently running a sale for our private investing group, High Yield Landlord, where members get access to portfolios, market alerts, real-time chat, and more. Learn More »

Lemon_tm

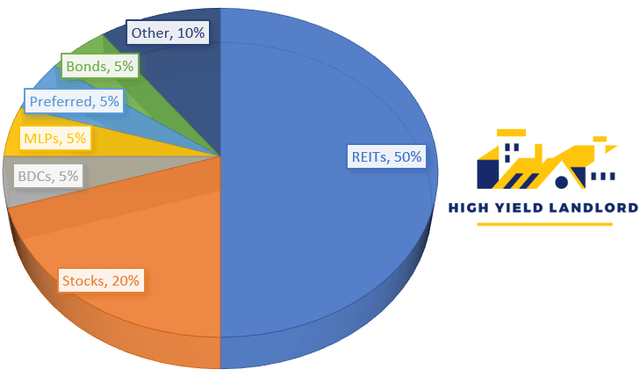

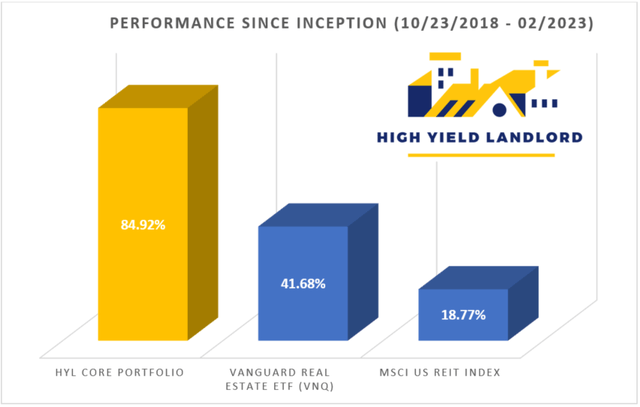

I am very bullish on REITs (VNQ) and these are not empty words as I have about half of my net worth invested in them:

High Yield Landlord

I invest so heavily in REITs because:

- Their valuations are the lowest in many years.

- Balance sheets are the strongest they have ever been.

- Rents are growing at a solid and steady pace due to inflation.

- Management teams and private equity players like Blackstone (BX), Starwood, and Brookfield (BN) are buying shares of REITs.

- Dividend yields are getting very enticing, reaching up to 9% even for high-quality REITs like EPR Properties (EPR) and Global Medical REIT (GMRE).

- You get to buy real estate at a 30-50% discount to its fair value. Good examples include BSR REIT (OTCPK:BSRTF) and Alexandria Real Estate (ARE).

But that does NOT mean that all REITs are worth buying.

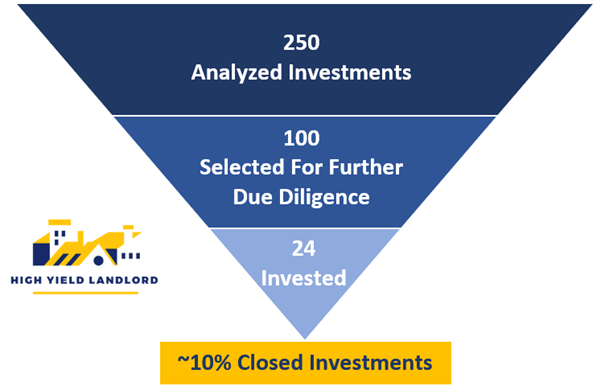

In fact, we only invest in about 1 out of 10 REITs on average at High Yield Landlord:

High Yield Landlord

We are so selective because most REITs present some issues:

- Some REITs are overleveraged in today's rising interest rate environment.

- Other REITs are poorly managed and suffer significant conflicts of interest.

- Some are overpriced even following the recent sell-off.

- Not all high dividend yields are sustainable.

- And finally, some property sectors are overbuilt and risky.

For us to invest in a REIT, it has to make sense from all these angles, but that often isn't the case.

In today's article, we want to highlight two REITs that we recently analyzed and decided to pass on to pursue other opportunities instead:

Extra Space Storage (EXR)

Extra Space Storage is one of the leading self-storage REITs. It recently made headlines after it acquired one of its close peers, Life Storage (LSI).

ExtraSpace Storage

Life Storage

I am not a big fan of the deal.

Sure, there are some synergies.

I don't doubt that.

But are those synergies really worth the price?

Not long ago, LSI was trading below $100. Its lowest point in the last 6 months is $94 per share.

Then, Public Storage (PSA) came out and offered to buy out LSI for $129, which was already a pretty healthy premium for the company.

Public Storage has one of the lowest costs of capital in the sector and so it can afford to pay more than most of its peers.

But then came ExtraSpace, which offered $145.82 per share for the company and it won the bid.

That's a ~50% premium relative to what the company was selling for just recently in the public market.

Public Storage did not seem willing to offer so much, despite having a lower cost of capital.

That makes me nervous and I am not alone to feel this way since the share prices of both companies have dropped slightly since the deal was announced.

ExtraSpace Storage

Now, ExtraSpace is going to become the largest self-storage operator in the US, even larger than Public Storage.

Size has advantages as it results in cost savings, but it also has one major disadvantage: it makes it more difficult to grow externally.

When you have a portfolio that's worth $1 billion, you typically have a much easier time than if you have a $50 billion portfolio because you can be more selective and each new acquisition moves the needle.

ExtraSpace will now have a near $50 billion value, which means that it will have to find a huge amount of deals each year just to keep the ball rolling.

But are there so many opportunities left in the storage market?

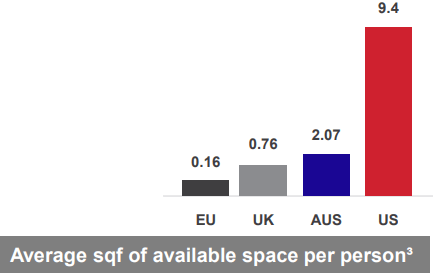

Today, there's already >10x more storage space per capita in the US than in the UK:

Big Yellow Group

It seems that a storage facility has been built in every busy intersection already and so I wonder how many new development opportunities are there still today?

There might be enough for a small regional player, but are there enough for a $50 billion mastodon?

I am not sure.

Besides, I fear that some of the gains of the pandemic will prove to be only temporary.

The demand grew significantly for self-storage space during the pandemic because people were moving around, wanted to make extra space for a home office, and older generations left stuff behind.

But now things are returning back to normal and I fear that the elevated demand of the recent years will decline from here right as new supply hits the market.

So for these reasons, it is hard for me to get excited about EXR at 18x FFO.

I think that there are better opportunities out there.

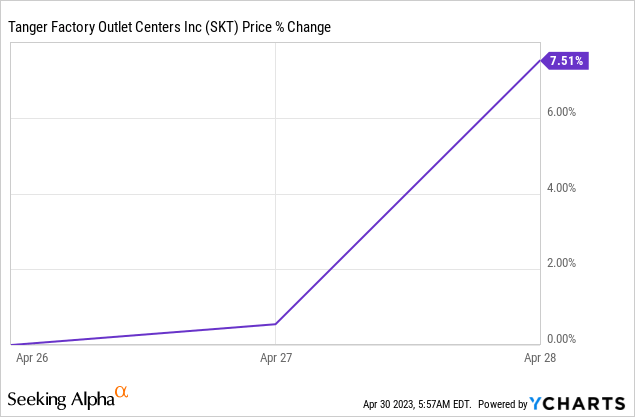

Tanger Factory Outlet Centers (SKT)

Tanger Factory Outlet recently released its first quarter results and it caused its share price to surge:

Congrats to them. They had a great first quarter:

- The traffic at their outlet centers increased.

- New leases are being signed with double-digit spreads.

- And the guidance was raised.

I recently also got to meet the management at the Citi Global Property Conference and I was quite impressed.

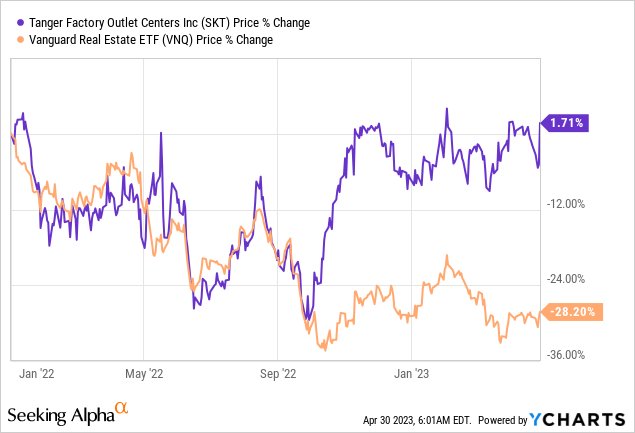

Despite that, it is hard for me to see the opportunity here. The share price is now near its 3-year high, even as the rest of the REIT market (VNQ) has collapsed over the past year:

I think that part of this outperformance is justified, but part of it isn't.

It seems to me that the market has gotten overly excited about the near-term strength in its fundamentals as we still recover from a tough retail environment, but it has forgotten about the long-term risks facing outlet centers.

As I have explained in a previous article, I fear that outlet centers will be the retail format that will suffer the most from the growth of Amazon (AMZN) and TJ Maxx (TJX).

Outlet centers are typically located a bit outside of cities where land is abundant and so you need to drive to them. They have managed to attract people in the past because they were promising better prices. But now, you can get better or comparable prices online on Amazon and/or at more convenient locations at places like TJ Maxx.

Tanger Factory Outlet Centers

I think that Class A malls are better positioned to face these risks because they typically enjoy better locations with stronger demographics and higher barriers to entry. Moreover, their layouts are more flexible and allow malls to include many non-retail uses to drive more consistent traffic to the mall.

With that in mind, I would much rather buy Simon Property Group (SPG), the leader in Class A malls, at 9x FFO than Tanger Factory Outlet (SKT), the leader in outlet centers at 11x FFO.

I think that it should be the opposite. SKT should be priced at a discount relative to SPG because outlets face greater long-term risks.

Bottom Line

A lot of REITs are today undervalued, but not all of them are. EXR and SKT are two examples that I would avoid because there are much better options out there.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

If you want full access to our Portfolio and all our current Top Picks, feel free to join us for a 2-week free trial at High Yield Landlord.

We are the fastest-growing and best-rated stock-picking service on Seeking Alpha with 2,500+ members on board and a perfect 5/5 rating from 500+ reviews:

Start Your 2-Week Free Trial Today!

Finally, if you would please click "like" and "follow" that would mean a lot to me as it helps me to continue producing content like this.

Finally, if you would please click "like" and "follow" that would mean a lot to me as it helps me to continue producing content like this.

This article was written by

Jussi Askola is a former private equity real estate investor with experience working for a +$250 million investment firm in Dallas, Texas; and performing property acquisition in Germany. Today, he is the author of "High Yield Landlord” - the #1 ranked real estate service on Seeking Alpha. Join us for a 2-week free trial and get access to all my highest conviction investment ideas. Click here to learn more!

Jussi is also the President of Leonberg Capital - a value-oriented investment boutique specializing in mispriced real estate securities often trading at high discounts to NAV and excessive yields. In addition to having passed all CFA exams, Jussi holds a BSc in Real Estate Finance from University Nürtingen-Geislingen (Germany) and a BSc in Property Management from University of South Wales (UK). He has authored award-winning academic papers on REIT investing, been featured on numerous financial media outlets, has over 50,000 followers on SeekingAlpha, and built relationships with many top REIT executives.

DISCLAIMER: Jussi Askola is not a Registered Investment Advisor or Financial Planner. The information in his articles and his comments on SeekingAlpha.com or elsewhere is provided for information purposes only. Do your own research or seek the advice of a qualified professional. You are responsible for your own investment decisions. High Yield Landlord is managed by Leonberg Capital.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of EPR; GMRE; ARE; HOM.U either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.