Qualcomm Q2 Earnings: Long-Term Potential Outweighs Short-Term Challenges

Summary

- The long-term outlook for Qualcomm Incorporated still looks excellent, driven by its strong competitive position and exposure to fast-growing industries in IoT and Automotive. The recently reported Q2 earnings delivered a mixed bag which caused a 6% fall in the share price in the following trading session.

- Qualcomm is significantly impacted by the economic slowdown, with several of its end markets struggling with falling demand and high inventory levels.

- Guidance from management was even worse, with Qualcomm guiding for accelerating weakness for at least the next couple of quarters.

- While the near-term outlook is challenging, I remain bullish on Qualcomm in the long term and believe the current depressed valuation offers a great opportunity.

- I lower my target price on Qualcomm Incorporated after lowering my EPS estimates for FY24, yet I maintain my buy rating as there is still 50% upside from current price levels.

AutumnSkyPhotography

Investment thesis

I maintain my buy rating on QUALCOMM Incorporated (NASDAQ:QCOM) and update my revenue and EPS estimates following the company's fiscal Q2 2023 results, which were in line with previous guidance and that of Wall Street analysts. Qualcomm delivered an overall mixed result as the impact of the economic slowdown was more significant than anticipated by management, which also resulted in a disappointing outlook that was meaningfully below the Wall Street consensus, resulting in a 6% drop in share price in the following trading session.

I have been bullish on Qualcomm over the last several months, as the market was completely mispricing the semiconductor leader with valuation multiples far below that of its peers. The primary reason for this seemed to be the company's exposure to revenues from Apple, its dependence on the smartphone industry, and its cyclical nature.

Meanwhile, the long-term outlook for Qualcomm looks very strong, driven by its exposure to several high-growth industries like 5G, IoT, and automotive. Qualcomm holds a respectable market share in most of these industries, and this will drive future revenue for the company. In addition, management is aware of the risk associated with its dependence on Apple Inc. (AAPL) and the smartphone industry. It has been actively working on reducing this dependence, lowering the risk profile, and increasing the value proposition to investors. Yet, above all, Qualcomm has a strong portfolio and pipeline of products that should set it apart from the competition and drive market share wins.

This is why I have been bullish on the company before and rated it a buy a couple of months ago. Yet, the impact of the downturn in handsets and IoT end markets on Qualcomm turned out worse than previously anticipated, driving down the share price to ridiculous levels today. As a result, the worst-case scenario seems to be priced into the shares, offering an attractive investment opportunity in this leading semiconductor giant.

In this article, I will take you through the latest developments and financial results and update my estimates and view on the company accordingly.

Another quarter impacted by macroeconomic issues

Qualcomm reported its Q2 earnings after the market closed on May 3 and, despite it reporting revenue and EPS roughly in line with the analyst consensus, shares fell by close to 7% in after-hours trading after already losing 3% during the regular trading session. As a result, shares have lost almost 20% over the last month (and 20% since my previous article, in which I rated shares a buy) due to increasing concerns about a potential recession. With Qualcomm being primarily exposed to the highly cyclical smartphone industry, a potential recession or prolonged period of economic issues could be a drag on growth for Qualcomm, despite the strong competitive position of the company across industries.

Both the strong position of the company and the impact of an economic slowdown on its financials were clearly visible in its Q2 earnings report. Qualcomm reported revenue of $9.3 billion for the quarter, which was down 17% YoY.

As mentioned earlier, the leading cause for this YoY slowdown is the severe slowdown in demand for handsets. With handset revenue accounting for 65% of Qualcomm's revenue last quarter, a slowdown here clearly has a severe impact on total revenues for Qualcomm. Management is seeing a more severe slowdown in this product category than previously anticipated, negatively affecting last quarter's revenue. Management expects this to remain an issue for the next several quarters, with no bottom of the cycle in sight. Demand for handsets remains weak according to Qualcomm, which results in higher inventories, and bringing these down will take some time.

Qualcomm now expects handsets to be down at least by high-single digits YoY in 2023, down further from previous expectations which again is the result of a more significant impact from economic challenges. Qualcomm continues to have limited visibility on a potential recovery and remains careful in its estimates.

In addition to a generally weak smartphone market, the recovery in China was also far below expectations. Whereas Qualcomm was expecting a significant improvement in demand from China, it is seeing no such thing and, therefore, has chosen not to incorporate any improvements into its outlook for the rest of the year as this continues to weigh on global demand. And I believe this is quite surprising, as we have seen a rebound across other industries like travel or Starbucks' (SBUX) latest quarterly results. Therefore, I think we might start seeing a recovery in China demand by the second half of the year, leaving some upside for Qualcomm to see a better performance than expected. The current approach towards the outlook from QCOM management seems somewhat conservative. Still, this is probably the best approach today when taking into account all the uncertainties.

Moreover, I believe current investors should not worry about this cyclical slowdown as the smartphone industry will eventually rebound once economic issues ease off. With Qualcomm still holding a market share of around 30% in handset semiconductors and this industry expected to grow at a 7.3% CAGR until 2029, I believe the company is still in a solid position. The company's leading Snapdragon product remains the industry standard among Android smartphone manufacturers. I see no fundamental issues here and Qualcomm looks set for market share gains over the next decade due to its strong product offering and rate of innovation.

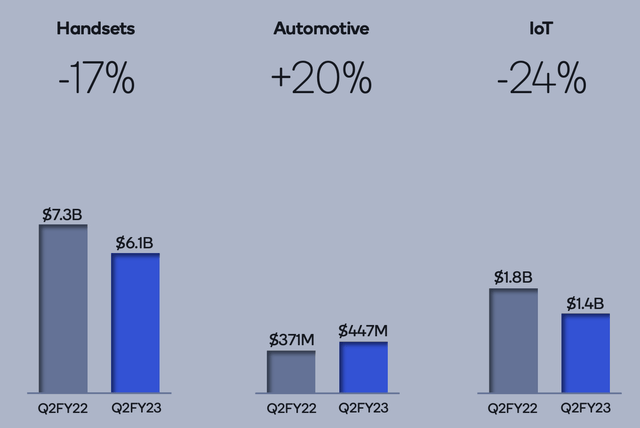

YoY change by segment (Qualcomm)

As for the other product segments, the performance in Automotive remained strong with revenues increasing by 20% YoY, coming in at $447 million and accounting for 4.8% of total revenues. Automotive continues to be one of the largest opportunities for Qualcomm. The company offers great products to support everything digital in a car, focusing on the digital cockpit and autonomous driving capabilities. And that the company is a leader in these technologies is reflected by its design wins after it reported 12 new design wins with automakers across the globe, specifically for the Snapdragon Cockpit and Snapdragon Connectivity 5G platforms.

And Qualcomm also remained optimistic about the opportunities it sees in IoT, despite Qualcomm seeing a much more significant slowdown than anticipated in this segment. Revenue came in at $1.4 billion and was down 24% YoY. But, again, Qualcomm has little visibility on when this should improve and therefore continues to expect this slowdown to remain significant over the next couple of quarters as well.

Still, this industry is a massive opportunity for the company with the IoT industry expected to grow at a CAGR of 26.1% until 2030. Qualcomm is reporting great progress in this segment as it continuously expands its offering. It is already the number one choice across several industry verticals like in XR, where it has promising partnerships with industry leaders like Meta Platforms, Inc. (META), Alphabet Inc./Google (GOOGL), and Samsung (OTCPK:SSNLF). Qualcomm is the leader in XR semiconductors, making the company a primary beneficiary of the expected explosive growth in the VR industry. How Qualcomm is expanding even further in this space is highlighted by the following comment from CEO Amon in the earnings call:

"We also continue to win designs for home robotics, smart appliances and smart camera applications with household names such as Bosch, LG Electronics, Panasonic, Samsung, and Sony."

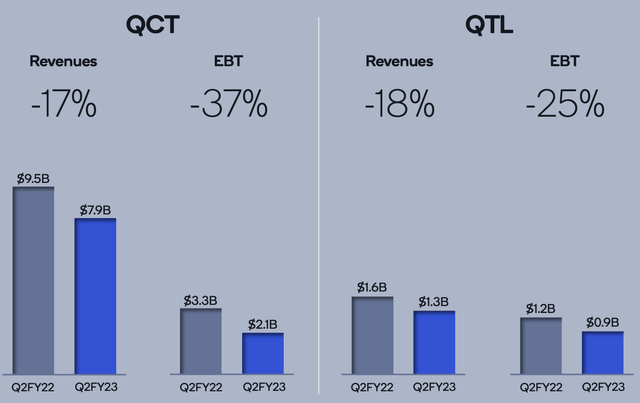

As a result of the performance of these individual product segments which fall under its QCT segment, Qualcomm reported QCT revenue of $7.9 billion, which was at the high end of management guidance but still down 17% YoY. In addition, Licensing (QTL) came in at the lower end of guidance with $1.3 billion and was down 18% YoY, primarily due to weaker demand for handsets. Qualcomm estimates this decline to be around 14%.

Revenue by segment Q2 (Qualcomm)

Moving to the bottom line, Qualcomm reported a drop in net income of 34% to $2.4 billion. EPS came in at $2.15 and was down 33% YoY. Net income was impacted by the lower revenue base and continued investments of the company as reflected by the net income margin drop from 33% last year to 26% this year's second quarter, despite operating expenses coming in slightly lower than anticipated as Qualcomm is starting to focus on cost efficiencies. Going forward, Qualcomm remains committed to decreasing operating expenses by 5% in this fiscal year which should be achieved by lowering short-term investments and looking for additional cost-cutting opportunities.

Despite the overall slowdown, Qualcomm apparently remains committed to returning cash to shareholders. Last quarter Qualcomm returned $1.7 billion to shareholders through share repurchases ($903 million) and dividends ($834). Also, Qualcomm grew the dividend by 7%, which is a decent increase considering all circumstances. Shares now yield around 3.1% based on a share price of $104. Qualcomm has been growing the dividend for 19 consecutive years now and still, the payout ratio stands at a very conservative 25% which indicates that the dividend is still well supported so investors should not be scared of a potential dividend cut in my opinion. Yet, if financials don't improve over the next few quarters, I expect Qualcomm to slow down its share repurchases, if not already. Still, I believe investors are rewarded handsomely with a dividend that is 76% above the sector median and growing consistently.

As for the balance sheet, Qualcomm increased its cash position since the start of its fiscal year from $2.8 billion to $3.5 billion today, combined with $3.2 billion in marketable securities. Yet, at the same time, Qualcomm also increased its long-term debt by approximately $2 billion to $15.5 billion. While this is far from ideal at today's high-interest rates, the current situation is still manageable due to this debt being long-term and the company only holding around $500 million in short-term debt.

Overall, Qualcomm remains focused on the factors it can control like diversifying its business and introducing new groundbreaking semiconductor solutions which should cement its strong market position. Fundamentally, this company is still in great shape and has a solid long-term outlook. Qualcomm holds significant market shares in its leading segments, which should drive solid revenues as the business is exposed to several high-growth industries. Therefore, I believe investors should not worry overly much about these financial results as the company is simply a cyclical one due to its exposure to cyclical industries. Yet, the company has proven in the past that it is very well able to grow through these economic cycles, and looking at the current product portfolio and pipeline, I have no doubt about its future prospects.

Outlook & QCOM stock valuation

For the current or third fiscal quarter, Qualcomm guides revenue to be between $8.1 billion to $8.9 billion, showing a further deceleration from last quarter as this equals a YoY drop of 22% compared to 17% last quarter. In addition, this is also quite significantly below the consensus estimate of $9.12 billion.

According to management, guidance reflects the impact of macroeconomic headwinds, weaker global handset units and channel inventory drawdown. They expect Android handset sales and automotive to be roughly flat sequentially and IoT to show mid-single-digit growth. Operating expenses are expected to remain flat sequentially which in combination with a sequential decline in revenue will not bode well for EPS.

EPS is expected to come in between $1.70 to $1.90, down close to 40% YoY due to a lower revenue base and continued investments. And indeed, this is far from good. Also, QCOM management is not expecting to see a meaningful improvement in the fourth quarter of its fiscal year.

Yet, on a slightly positive note, Qualcomm does look well positioned to benefit from the eventual recovery in its end markets and despite the economic turndown, Qualcomm continues to gain market share in the IoT and Automotive industries. Also, with Qualcomm pushing for diversification and the company looking to expand its offering to PCs and AI for example, the future does still look bright for this company.

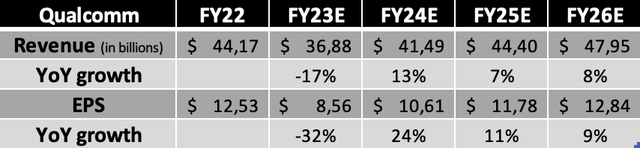

Following this guidance from management and the latest financial results delivered by the company for its fiscal Q2, I update my outlook for the company and now project the following results for the years until fiscal FY26 (ending September 2026).

Shortly explaining these estimates, I now expect it to report a revenue decline of 17%, compared to 12% before, as the outlook is quite a bit below the previous estimate. Still, I expect revenue to come in at the high end of guidance from management as the recovery in China will be more meaningful in this quarter. In addition, I also significantly lowered my EPS estimate for the same reasons and now expect this to decline by 32% compared to a previous 26% drop. For FY24, I expect Qualcomm to recover as demand will return and Qualcomm will have an easy comparison to the prior year. Also, EPS will outpace revenue. For the following years, I expect Qualcomm to report solid growth driven by its strong market positions in handsets and IoT and strong growth in the Automotive industry. I also see plenty of margin improvement potential for Qualcomm which will drive faster EPS growth.

Moving to the valuation, I remain of the opinion that Qualcomm is criminally undervalued, partly due to analysts underestimating the future potential of this company and its technological expertise. Based on a current share price of $105 and my EPS estimate, shares are valued at a depressed forward P/E of just 12x which is 38% below its sector average and 30% below its 5-year average. Therefore, I believe it is currently trading at a depressed valuation and is simply too cheap to ignore.

In fact, I believe Qualcomm deserves to be trading at a P/E of at least 15x (from 16x before), also taking into consideration the current downturn and cyclical nature of the company which creates a somewhat higher risk profile.

Therefore, based on a 16x P/E and my FY24 EPS estimate, I calculate a target price of $159 per share, leaving investors with an upside of 51%. For comparison, 31 Wall Street analysts currently maintain a target price of $141 combined with a buy rating.

Conclusion

Qualcomm Incorporated delivered a mixed quarterly report, but with an especially weak outlook as the business is clearly impacted by the current macroeconomic headwinds and a cyclical slowdown in semiconductors and its end markets. Moreover, Qualcomm management expects this to remain a problem for the next several quarters as well, with no signs of a recovery in China and a continued weak outlook for the handsets market.

Yet, despite the incredibly weak outlook and financials, I remain bullish on Qualcomm, as the company is trading at a depressed valuation, making it simply too cheap to ignore. In addition, the long-term outlook for Qualcomm still looks excellent, driven by its strong competitive position and exposure to fast-growing industries in IoT and Automotive.

Still, following the mixed financial results and downbeat outlook for the next several quarters, I lowered my Qualcomm estimates for FY23 and FY24, resulting in a reduced price target from a previous $190 to $159 per share. Still, with this leaving a 50% upside for investors from a current share price of around $105 per share, I maintain my buy rating on Qualcomm Incorporated, as the shares remain undervalued and offer great long-term value with an attractive risk-reward profile.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of QCOM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.