How To Allocate $20,000 Among My Top 20 Dividend Income Stocks For May 2023

Summary

- You can generate a significant amount of additional income in the form of dividends by investing in a mixture of high dividend yield and dividend growth companies.

- In this article, I will show you how you could allocate $20,000 among 10 high dividend yield and 10 dividend growth companies as well as one ETF.

- This dividend income oriented investment portfolio provides you with a Weighted Average Dividend Yield [TTM] of 3.74%, while offering excellent dividend growth perspectives.

arthon meekodong

Investment Thesis

Using an investment strategy that focuses on dividend income, allows you to generate an additional income without having to sell your stocks.

By focusing on dividends for additional income, you can also benefit from not having to care too much about the stock prices of the companies you’ve invested in: you will receive the dividends independently if the stocks go up or down.

As I have already mentioned in some of my previous articles, the allocation of your investment portfolio plays a big role in the success of your portfolio over the long term. Due to the enormous importance of portfolio allocation, I am providing you with another article on this topic.

I will show you how you could build a dividend income investment portfolio, which is based on my top 10 high yield dividend stocks and my top 10 high dividend growth stocks for May 2023.

Building a portfolio which combines high dividend yield companies and high dividend growth companies brings you the enormous benefit of generating a significant additional income in the form of dividends that you can use today, while at the same time being able to raise this dividend at an attractive level over the long term.

This dividend income oriented investment portfolio, which I will present in more detail in the following, achieves a Weighted Average Dividend Yield [TTM] of 3.74%. In addition to that, the selected 20 picks and one ETF have shown a Weighted Average Dividend Growth Rate of 12.21% over the past 5 years. This makes me believe that you should be able to raise your additional income to a significant amount when investing with a long investment-horizon.

I have selected the following as my top 10 high dividend yield stocks to invest in for May 2023

- Altria (NYSE:MO)

- AT&T (NYSE:T)

- Deutsche Post (OTCPK:DPSTF, OTCPK:DPSGY)

- Johnson & Johnson (NYSE:JNJ)

- Pfizer (NYSE:PFE)

- Suncor Energy (NYSE:SU)

- U.S. Bancorp (NYSE:USB)

- Vale (NYSE:VALE)

- Verizon Communications Inc. (NYSE:VZ)

- VICI Properties (NYSE:VICI)

And I have selected the following as my top 10 dividend growth stocks to invest in for May 2023

- American Express (NYSE:AXP)

- Apple (NASDAQ:AAPL)

- Itaú Unibanco Holding S.A. (NYSE:ITUB)

- JPMorgan (NYSE:JPM)

- Mastercard (NYSE:MA)

- Microsoft (NASDAQ:MSFT)

- Nike (NYSE:NKE)

- Linde (NYSE:LIN)

- The Charles Schwab Corporation (NYSE:SCHW)

- The Travelers Companies (NYSE:TRV)

Overview of the 20 Dividend Income Stocks and one 1 ETF and its Allocation

Company Name | Sector | Industry | Country | Dividend Yield [TTM] | Div Growth 5Y | Allocation | Amount in $ |

Altria | Consumer Staples | Tobacco | United States | 7.97% | 7.18% | 4.0% | 800 |

American Express | Financials | Consumer Finance | United States | 1.32% | 9.53% | 2.0% | 400 |

Apple | Information Technology | Technology Hardware, Storage and Peripherals | United States | 0.55% | 7.87% | 3.0% | 600 |

AT&T | Communication Services | Integrated Telecommunication Services | United States | 6.33% | -5.78% | 3.0% | 600 |

Charles Schwab | Financials | Investment Banking and Brokerage | United States | 1.65% | 21.22% | 1.0% | 200 |

Deutsche Post | Industrials | Air Freight and Logistics | Germany | 3.93% | 14.83% | 1.5% | 300 |

Itaú Unibanco Holding S.A. | Financials | Diversified Banks | Brazil | 3.88% | 30.04% | 1.0% | 200 |

Johnson & Johnson | Health Care | Pharmaceuticals | United States | 2.76% | 6.11% | 3.0% | 600 |

JPMorgan Chase & Co. | Financials | Diversified Banks | United States | 2.84% | 12.91% | 3.0% | 600 |

Linde | Materials | Industrial Gases | United Kingdom | 1.30% | 8.46% | 2.0% | 400 |

Mastercard | Financials | Transaction & Payment Processing Services | United States | 0.57% | 17.66% | 3.0% | 600 |

Microsoft | Information Technology | Systems Software | United States | 0.91% | 9.92% | 3.0% | 600 |

Nike | Consumer Discretionary | Footwear | United States | 1.04% | 11.16% | 2.0% | 400 |

Pfizer | Health Care | Pharmaceuticals | United States | 4.03% | 5.51% | 3.0% | 600 |

Schwab U.S. Dividend Equity ETF | ETFs | ETFs | United States | 3.66% | 15.56% | 50.0% | 10000 |

Suncor Energy | Energy | Integrated Oil and Gas | Canada | 4.91% | 8.00% | 2.5% | 500 |

The Travelers Companies | Financials | Property and Casualty Insurance | United States | 2.08% | 5.25% | 1.50% | 300 |

U.S. Bancorp | Financials | Diversified Banks | United States | 5.79% | 10.00% | 3.0% | 600 |

Vale S.A. | Materials | Steel | Brazil | 6.95% | 31.11% | 2.0% | 400 |

Verizon Communications | Communication Services | Integrated Telecommunication Services | United States | 7.00% | 2.04% | 4.0% | 800 |

VICI Properties | Real Estate | Other Specialized REITs | United States | 4.61% | 0.00% | 2.5% | 500 |

Average | 3.74% | 12.21% | 100.0% | 20000 |

Source: The Author, data from Seeking Alpha

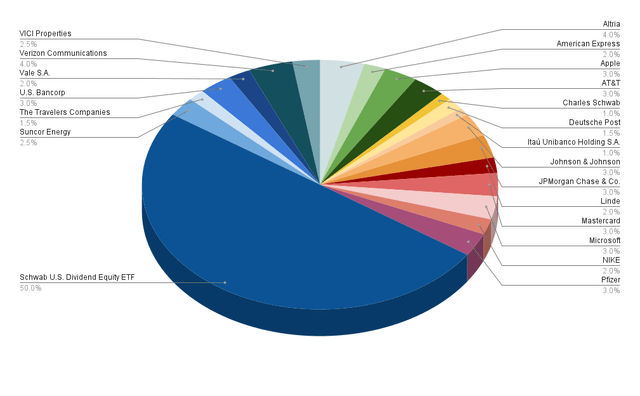

Portfolio Allocation per Company/ETF

The following ETF has the highest proportion of this investment portfolio:

- Schwab U.S. Dividend Equity ETF (NYSEARCA:SCHD) (representing 50% of the total investment portfolio)

I have included the Schwab U.S. Dividend Equity ETF in this portfolio and provided it with the highest proportion of the overall portfolio.

This ETF contributes significantly to reaching a broad portfolio diversification while at the same time offering an attractive Dividend Yield [TTM] of 3.66%.

In addition to that, it has a Dividend Growth Rate [TTM] of 16.63%, providing evidence that it can help you to significantly raise the dividend you receive year over year.

The following companies have a proportion of 4% of the overall portfolio, implying that they represent the highest percentage of the investment portfolio besides the ETF:

- Altria (representing 4% of the total investment portfolio)

- Verizon (4%)

One of the main reasons for which I have selected Altria and Verizon to have the largest proportion of the overall portfolio is the fact that both can help to raise its Weighted Average Dividend Yield: while Altria currently has a Dividend Yield [TTM] of 7.97%, Verizon’s stands at 7.00%. Companies like this can help you to generate a significant amount of extra income via dividend payments.

The following have a proportion of 3% and still represent an important part of the overall investment portfolio:

- Apple

- AT&T

- Johnson & Johnson

- JPMorgan

- Mastercard

- Microsoft

- Pfizer

- U.S. Bancorp

I consider these companies that have a high proportion of the overall portfolio (3% each) to be excellent choices in regards to risk and reward. I would like to remind you of what I mentioned in a previous article:

The companies that have the highest proportion on the portfolio have a significant impact on the Total Return that the portfolio provides. By overweighting companies that give us relatively low risk factors and at the same time offer an attractive expected compound annual rate of return, we significantly increase the probability of making successful long-term investments.

In addition to the above, I believe that it makes sense to overweight Johnson & Johnson in this investment portfolio, since it can help you to decrease portfolio volatility (the company has a 60M Beta Factor of 0.53), thus making it an important defense play for your portfolio.

JPMorgan provides your portfolio with an important mix between dividend income (the company has a Dividend Yield [TTM] of 2.84%) and dividend growth (with a Dividend Growth Rate [CAGR] of 12.91% over the past 5 years).

By overweighting Mastercard (Dividend Growth Rate 3Y [CAGR] of 13.24%) and Microsoft (Dividend Growth Rate 3Y [CAGR] of 10.25%), you can raise the Weighted Average Dividend Growth Rate of your portfolio.

AT&T (Dividend Yield [TTM] of 6.33%), Pfizer (4.03%) and U.S. Bancorp (5.79%) contribute to raising the Weighted Average Dividend Yield of the portfolio.

Furthermore, I believe that it makes sense to allocate a larger portion of this portfolio to Apple. This is due to the company’s strong competitive advantages, its enormous financial health and its proven resistance to crisis, making the company a perfect fit in terms of risk and reward.

The remaining companies represent between 1% and 2.5% of the overall portfolio, meaning that their performance has a lower impact on the Total Return of this portfolio.

Illustration of the Portfolio Allocation per Company

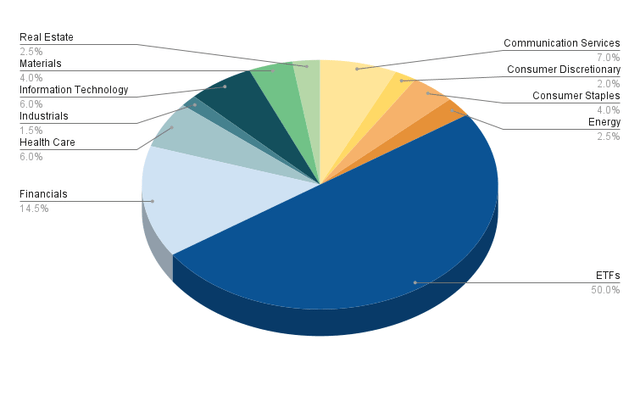

Portfolio Allocation per Sector

The Schwab U.S. Dividend Equity ETF represents the largest percentage (50%) of the overall portfolio, followed by the Financials Sector (14.5%).

The Financials Sector is represented in this investment portfolio by companies such as JPMorgan (3% of the overall portfolio), Mastercard (3%), U.S. Bancorp (3%), American Express (2%), The Travelers Companies (1.5%), Charles Schwab (1%), and Itaú Unibanco Holding S.A. (1%).

The Communication Services Sector (with Verizon making up 4% and AT&T 3%) represents 7% of the portfolio.

The Health Care Sector (with Johnson & Johnson and Pfizer having 3% each) represents 6% of the total portfolio. The same percentage of the overall portfolio goes to the Information Technology Sector (with Apple and Microsoft having 6% each).

The Materials Sector (Linde and Vale represent 2% each) and the Consumer Staples Sector (Altria has 4%) have a proportion of 4% each.

A smaller percentage of the overall portfolio is home to the Energy Sector (with Suncor Energy representing 2.5%), the Real Estate Sector (with VICI Properties representing 2.5%), the Consumer Discretionary Sector (Nike has 2%), and the Industrials Sector (with Deutsche Post representing 1.5%).

Besides the ETF, no sector represents more than 14.5% of the overall portfolio, indicating that my diversification requirements have been fullfiled: this investment portfolio offers you a broad diversification over sectors.

Illustration of the Portfolio Allocation per Sector

Below you can see which companies belong to each sector of this investment portfolio:

ETFs (50%)

- Schwab U.S. Dividend Equity ETF (50%)

Financials (14.5%)

- JPMorgan (3%)

- Mastercard (3%)

- U.S. Bancorp (3%)

- American Express (2%)

- The Travelers Companies (1.5%)

- Charles Schwab (1%)

- Itaú Unibanco Holding S.A. (1%)

Communication Services (7%)

- Verizon (4%)

- AT&T (3%)

Health Care (6%)

- Johnson & Johnson (3%)

- Verizon (3%)

Information Technology (6%)

- Apple (3%)

- Microsoft (3%)

Consumer Staples (4%)

- Altria (4%)

Materials (4%)

- Linde (2%)

- Vale (2%)

Energy (2.5%)

- Suncor Energy (2.5%)

Real Estate (2.5%)

- VICI Properties (2.5%)

Consumer Discretionary (2%)

- Nike (2%)

Industrials (1.5%)

- Deutsche Post (1.5%)

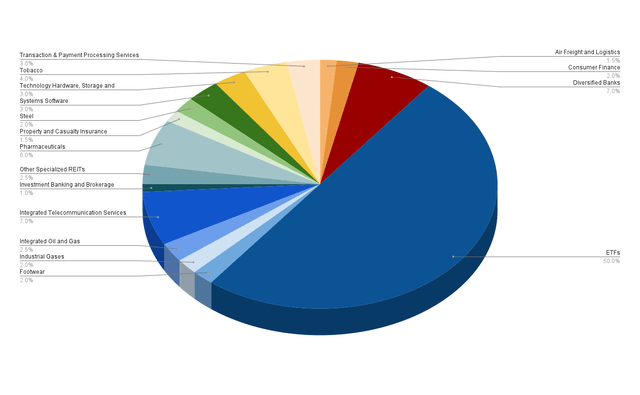

Portfolio Allocation per Industry

Excluding the ETF, the largest industries represented in this portfolio are Diversified Banks accounting for 7% (JPMorgan and U.S. Bancorp represent 3% each and Itaú Unibanco Holding makes up 1%) and the Integrated Telecommunication Services Industry, also accounting for 7% (Verizon represents 4% while AT&T is at 3%).

The Pharmaceuticals Industry accounts for 6% of the overall portfolio, with Johnson & Johnson and Pfizer each representing 3%. The Tobacco Industry represents 4% (Altria accounts for the entire allocation).

The Technology Hardware, Storage and Peripherals Industry (with Apple representing 3%), the Transaction & Payment Processing Services Industry (with Mastercard representing 3%), and the Systems Software Industry (with Microsoft representing 3%) each account for 3% of the overall portfolio.

All other industries represent 2.5% or less of the overall portfolio, indicating that this investment portfolio is broadly diversified over industries.

Illustration of the Portfolio Allocation per Industry

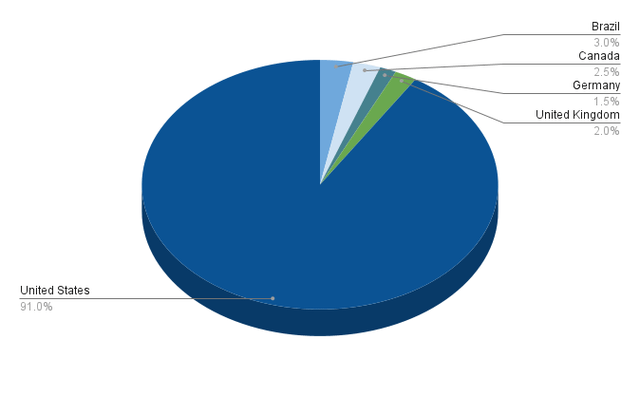

Portfolio Allocation per Country

The majority of companies that are part of this investment portfolio, which was built with the objective of providing you with an attractive Weighted Average Dividend Yield, while at the same time offering Dividend Growth, are from the United States.

91% of the selected companies/ETF are U.S. based while 9% come from other countries.

The non-U.S. part of this portfolio is divided as follows: 3% are from Brazil (Vale represents 2% and Itaú Unibanco Holding represents 1% of the overall portfolio), 2.5% from Canada (Suncor Energy accounting for 2.5%), 2.0% from the United Kingdom (Linde accounting for 2%), and 1.5% from Germany (with Deutsche Post comprising 1.5%).

The investment portfolio meets my geographical diversification requirements: the largest percentage of this portfolio is represented by U.S. companies, but at least 5% of the portfolio consists of companies that are based outside the U.S.

Illustration of the Portfolio Allocation per Country

How to achieve an even Broader Diversification

If you would like to achieve an even broader diversification than this investment portfolio offers, you might consider investing in an additional ETF: you could take a closer look at the iShares Core Dividend Growth ETF (NYSEARCA:DGRO), since it provides you with a relatively attractive Dividend Yield [TTM] of 3.37% and a Dividend Growth Rate [CAGR] of 10.32% over the past 5 years.

In case you ask yourself if it makes sense to only invest in SCHD, I would like to highlight some advantages of picking stocks individually over only investing in ETFs:

- It provides your portfolio with more individuality and flexibility

- You can protect your investment portfolio against the next stock market crash by adding companies with a low Beta Factor (an example of a company with a low Beta Factor would be Johnson & Johnson, which is part of this portfolio)

- You can overweight industries with which you are more familiar and you can avoid others you don’t want to invest in

- You can select stocks which you think are able to beat the market or you can select ones to raise the Weighted Average Dividend Yield or Weighted Dividend Growth Rate of your investment portfolio

- You can also achieve an even broader geographical diversification of your portfolio

In my article 10 Dividend Stocks To Show The Advantages Of Investing In Individual Stocks Over ETFs I discuss the advantages of the selection of stocks over ETFs in greater detail.

Conclusion

In this article, I have shown how you could build a dividend income oriented investment portfolio that achieves an attractive Weighted Average Dividend Yield [TTM] of 3.74%.

This investment portfolio consists of 10 high dividend yield companies and 10 dividend growth companies, which I currently consider to be appealing due to their attractive Valuation, strong competitive advantages and their financial health (among other factors).

Building such an investment portfolio offers the enormous benefit that you do not need to worry much about stock prices going up and down, since you receive the dividend payments regardless of whether the stocks increase or decrease (even though it is true that the dividend can be cut).

Moreover, the selected 20 companies and one ETF have shown a Weighted Average Dividend Growth Rate [CAGR] of 12.21% over the past 5 years, which clearly indicates that you should be able to grow this additional income over the long term.

Another benefit of this investment portfolio is its broad diversification over sectors and industries as well as its strong focus on U.S. companies (91% of the companies are based in the United States) while still including some companies from outside the country.

This dividend income oriented investment strategy can help you to successfully invest over the long term while avoiding speculation and the risk of losses over the short term.

Author’s Note: Thank you very much for reading and I would love to hear your opinion on this investment portfolio and its allocation! Do you own or plan to acquire one of the selected picks?

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MO, AXP, AAPL, T, ITUB, JNJ, JPM, MA, MSFT, NKE, PFE, SU, VZ, USB either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.