Fed Rate Hikes Create Short-Term Pain But Long-Term Gain For REITs

Summary

- The ways in which higher interest rates hurt commercial real estate and the REITs that own it are obvious and well known.

- But the ways in which higher interest rates paradoxically benefit REITs in the long run are less well known.

- The market is focused on the short-term pain of higher interest expenses.

- Meanwhile, farsighted investors are focused on how the current environment is causing a sharp pullback in development projects.

- Less construction starts today means less future competition for REITs' existing property portfolios tomorrow.

- Looking for a helping hand in the market? Members of High Yield Landlord get exclusive ideas and guidance to navigate any climate. Learn More »

VioletaStoimenova

As I type this sentence, the Federal Reserve just announced another 25-basis point hike to their key Federal Funds rate. This key policy rate now sits in a range of 5.0% to 5.25%.

The Fed Funds rate has not been this high since the summer of 2007.

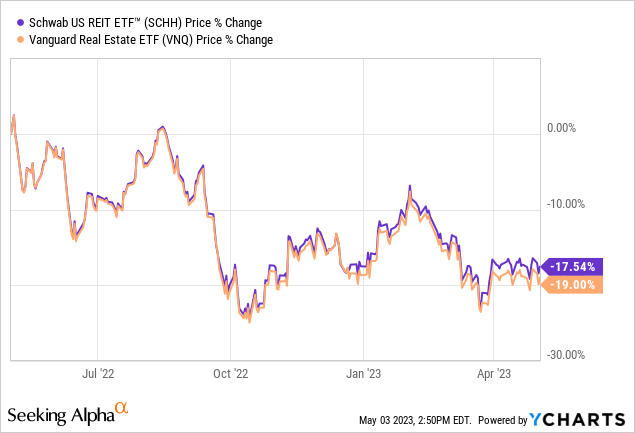

The average investor believes this is obviously bad for commercial real estate and real estate investment trusts ("REITs"), and they're not wrong. Hence the 19% selloff in the Vanguard Real Estate ETF (VNQ), which tracks both REITs and non-REIT real estate companies, and the 17.5% selloff in the Schwab U.S. REIT ETF (SCHH), tracking only equity REITs, over the last year:

The ways in which the highest Fed Funds rate in 15 years hurts REITs are myriad and well known:

- Diminishing the attractiveness of REIT dividend yields in comparison to safer bond yields

- Raising REITs' cost of equity as stock prices sell off in response to higher bond yields

- Raising REITs' cost of debt as loans are refinanced at higher interest rates

But the ways in which the highest Fed Funds rate in 15 years actually benefits REITs in the long run are much less known.

The primary way that high interest rates will ultimately benefit REITs and their existing property portfolios is through dramatically reducing the development pipeline of new commercial real estate projects.

Let's dig in.

Short-Term Interest Rate Pain Is Long-Term Supply Shortage Gain

New CRE properties take time to go from permitting to completion, typically a year to three years or more.

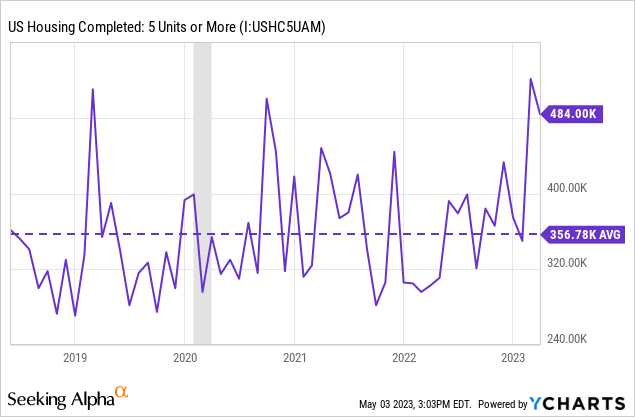

When capital/debt is cheap and easy to come by and the economy is strong, developers get euphoric in their desire to cash in on the good times and start lots of projects. That's why we are seeing elevated CRE completions, especially in the hot sectors of industrial and multifamily, this year and next year.

Multifamily housing completions:

But when capital/debt is expensive, the credit market is tightening, and the economy is weakening (i.e. the situation we are in today), developers pull back on new projects.

This makes sense in theory, but is it actually what's happening in the real world?

Yes. To quote Philadelphia area CRE developer Bill Glazer of Keystone Development from a recent Philadelphia Inquirer interview:

Commercial real estate today is facing a triple threat: interest rate increases, which for us are unprecedented — over 5 (percentage points) within one year; lending and capital availability, which is down; recession and revenue pressures (which discourage tenants, making projects unattractive).

... Every asset class is facing pressures. We're seeing universally that capital availability is being pulled back for every class. Not the least in retail — Bed Bath & Beyond just said they will not be reopening any of their stores in their bankruptcy. Warehouses, too.

After citing multiple real-world examples of planned projects that have recently been postponed or cancelled completely, Glazer went on to say:

... Most new, ground-up projects are being shelved or paused or sidelined. The contractors are still finishing up jobs in their pipeline. But it’s coming. The Fed, in tamping down inflation, is adding so much pressure to the (borrowing) costs of new construction, there will be far fewer new construction starts. That will translate to fewer cranes.

There are more from-the-ground-up projects that will not more forward, until either interest rate costs come way down, or construction costs come way down. Either of which are going to come with some form of recession.

Fewer construction starts. More development project cancellations. That's exactly what we are seeing across the CRE space.

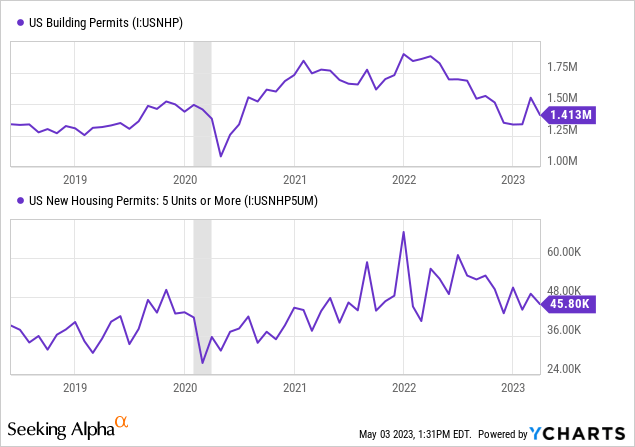

Take a look, for example, at the earliest indicator of future supply additions to the housing space - building permits:

After a sharp rise in 2021 and into the beginning of 2022, both single-family and multifamily building permits have been on a downward trend since the beginning or middle of 2022.

That means that the construction starts of 2021 and early 2022 will translate into a big bump in new supply in 2023 through mid-2025, but thereafter completions will fall off dramatically.

- Less new supply in mid-2025 and onward makes REITs' existing property portfolios more valuable by funneling demand into a smaller-than-otherwise pool of supply.

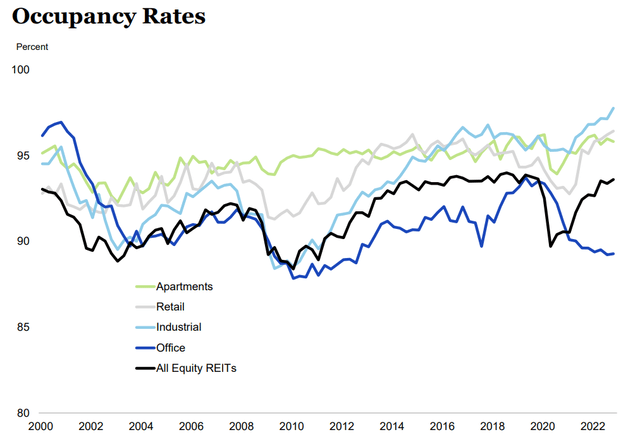

On the "demand" side of that equation, keep in mind that, as I discussed in "Is A Commercial Real Estate Crisis Coming? These Experts Say No," occupancy across nearly all sectors of CRE (with the notable exception of office) are close to their all-time highs!

NAREIT Q4 2022 T-Tracker

Clearly, demand for most types of commercial real estate remains high relative to the existing supply stock. This bodes well for continued rent growth.

Could an upcoming recession cause a decrease in demand for CRE? Certainly. They almost always do. But it's better to go into a recession from a position of strength than a position of weakness.

REITs operating in the sectors of apartments, industrial, and retail currently enjoy nearly their highest occupancy rates on record. That strikes me as a position of strength.

Anecdotal Evidence From REITs

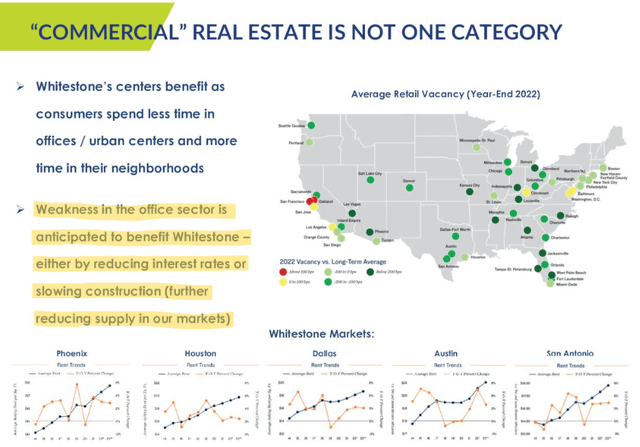

Let's look at some anecdotal data provided by several individual REITs, starting with the following slide in Whitestone REIT's (WSR) Q1 2023 investor presentation. (As discussed in this article, WSR is a retail REIT focused on shopping centers in affluent neighborhoods of five Sunbelt markets: Phoenix, Dallas/Fort Worth, Houston, Austin, and San Antonio.)

Whitestone REIT Q1 2023 Presentation

In Phoenix, retail vacancy is over 200 basis points below its long-term average level. In DFW, Austin, and San Antonio, it's between 100 and 200 basis points below its long-term average. In Houston, vacancy is somewhere between 0 and 100 basis points below its average.

And, as WSR points out, the current chaos erupting in the office sector should have a beneficial effect on WSR by either causing a recession that ultimately brings down interest rates, or slowing construction of retail centers, or both.

And, of course, we still must keep in mind that construction costs remain high.

Although we've seen the US producer price index drop from over 10% to under 3% in recent months, construction costs remain high, and availability of both particular parts/materials and skilled workers is scarce. This is particularly true of highly specialized and technology-specific buildings, such as life science facilities wherein scientists conduct research and development for medical purposes.

Peter Moglia, CEO and co-CIO of Alexandria Real Estate Equities (ARE), explained the difficulties of further life science developments in the ARE Q1 2023 conference call (bold text by me):

Cost of materials and supply chain volatility were the initial drivers of construction inflation, but now the primary driver is labor with a triple whammy of wage increases, shortage of workers and the inefficiency of the remaining labor force due to the retirement of older, more skilled labor.

... Specific to life science buildings, the availability of switchgear and equipment such as HVAC units and generators are - has slightly improved but their lead times are still extraordinarily long with custom air handlers taking 27 weeks longer to get than before COVID and switch gear and generators and astounding 64 weeks longer. Even worse is the availability of large transformers provided by the utility companies, which can take as long as three years now to get.

... Anyone contemplating a speculative development these days will have to contend with these delays and associated high costs, which will put the feasibility of building and financing the project at considerable risk.

(That's) one reason we will likely not see the supply many are expecting beyond what is under construction today.

And though construction costs are not rising as much as they were a year ago, that doesn't necessarily mean they are falling.

Here's industrial giant Prologis' (PLD) CFO Tim Arndt from the Q1 2023 PLD conference call:

Market rents have continued to grow, demand has been consistent and we're seeing sharp declines in new construction limiting future supply.

... It's noteworthy that following the belief that construction costs may decline in the coming quarters. We now see them as likely to increase mostly in line with inflation.

And when asked by an analyst on the call if there has been a pullback in the availability of construction loans for new development projects, CEO Hamid Moghadam answered:

Yes, the answer to that one is absolutely, yes. I think there's been a significant pullback in the availability of construction loans.

Later in the call, Moghadam also commented:

I mean, I've never seen such a fast slowdown, such a sudden slowdown in construction volume in our business. It's just been - and I'm not sure it's only - it was related to Silicon Valley Bank. It was already happening before that, and SVB just made it worse.

This same sentiment was backed up with data by Marshall Loeb, CEO of Sunbelt industrial landlord/developer EastGroup Properties (EGP) in the EGP Q1 2023 conference call, when he cited data on industrial construction starts from CBRE:

What's promising is to see the decrease in industrial starts. To quantify, starts as measured by square footage, fell 25% from third to fourth quarter in 2022. Then comparing third quarter 2022 to first quarter 2023 starts dropped approximately 45%, and I suspect this quarter will be a further decline.

Likewise, on the Q1 2023 conference call for Mid-America Apartment Communities (MAA), in response to an analyst question about financing sources for private multifamily developers, MAA's Brad Hill responded:

[G]iven the last few weeks and just the restriction there in capital with banks, it's more acute than it has been. First quarter, it was difficult. Equity was difficult. Debt was difficult. And I'd say the debt piece has gotten even more difficult for them. But generally, they're going to regional banks for their banking needs. And they generally have strong relationships with these banks, so they can get a deal or two done with the banks but it's a lot more difficult. It takes a lot longer than what it has in the past. And so that's really restricting. One of the other areas that it's restricting new deals getting done and I don't see that changing for the foreseeable future.

The same sentiment was expressed by Matt Birenbaum, CIO of AvalonBay Communities (AVB), on AVB's Q1 2023 conference call:

[A]s we look to future development starts, we are certainly starting to see shifts in the development market in response to the Fed tightening of the past several quarters. Among our competitors, many planned projects are being postponed or abandoned as third-party financing becomes scarce and cut.

Bottom Line

Clearly, the "triple threat" mentioned above by Bill Glazer of higher interest rates, suppressed capital availability, and recessionary revenue pressures are taking their toll on at least the pipeline of CRE development projects.

Although I would dispute the idea that most CRE is suffering from recessionary revenue pressures at this time. Rather, what we see is, to borrow the wording of John Chang, Senior VP of Research at CRE services firm Marcus & Millichap, a shift from "an exceptional growth period to a more normal operating climate."

According to Chang, all major sectors of CRE are stronger today than in the five-year period prior to COVID-19.

- In Q1, multifamily vacancy sat at 5.2% with 6.4% average rent growth, compared to 5% vacancy and low single-digit rent growth pre-COVID.

- Multi-tenant retail enjoys 5.6% vacancy and 5.5% average rent growth today versus 5.9% vacancy and 2.7% rent growth pre-COVID.

- Industrial enjoys 4.0% vacancy and 16.6% rent growth today versus 4.9% vacancy and 5.8% rent growth pre-COVID.

- Office, the sole weak sector, saw Q1 2023 vacancy of 16.8% and rent growth of 0.7% compared to pre-COVID vacancy of 13.1% and rent growth of 3.1%.

High construction and capital costs are causing a sharp pullback in CRE development starts, which means less competition in the future for REITs' existing property portfolios, even while the demand outlook for most CRE remains strong.

Many non-office REITs look like an excellent bargain today.

If you want access to our entire Portfolio and all our current Top Picks, feel free to join us for a 2-week free trial at High Yield Landlord.

We are the largest real estate investment community on Seeking Alpha with over 2,000 members on board and a perfect 5/5 rating from 400+ reviews:

For a Limited Time - You can join us at a deeply reduced rate!

This article was written by

I write about high-quality dividend growth stocks with the goal of generating the safest, largest, and fastest growing passive income stream possible. My style might be called "Quality at a Reasonable Price" (QARP) in service to the larger strategy of low-risk, low-maintenance, low-turnover dividend growth investing. Since my ideal holding period is "lifelong," my focus is on portfolio income growth rather than total returns.

My background and previous work experience is in commercial real estate, which is why I tend to heavily focus on real estate investment trusts ("REITs"). Currently, I write for the investing group, High Yield Landlord.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ARE, EGP, MAA, WSR, VNQ either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.