Bidding War: BP And Arko Corp. Both Want TravelCenters of America

Summary

- There is an ongoing bidding war for TravelCenters of America between a unit of BP plc and Arko Corp.

- TravelCenters of America's board of directors have unanimously approved the sale of the firm to BP for $86 per share in cash.

- On May 10, TravelCenters of America is holding a special meeting that will likely determine the fate of the bidding war.

- Between now and May 10, Arko Corp. may attempt to secure committed financing in order to make TravelCenters of America reconsider the rejection of its $92 per share bid for the firm.

syahrir maulana

There is a bidding war going on for TravelCenters of America Inc. (NASDAQ:TA) between BP Products North America, a unit of BP p.l.c (BP), and Arko Corp. (ARKO), a firm that owns 100% of GPM Investments which in turn operates ~1,400 convenience stores in the US under various regional brands (according to Arko Corp. it is the sixth largest convenience store chain in the US).

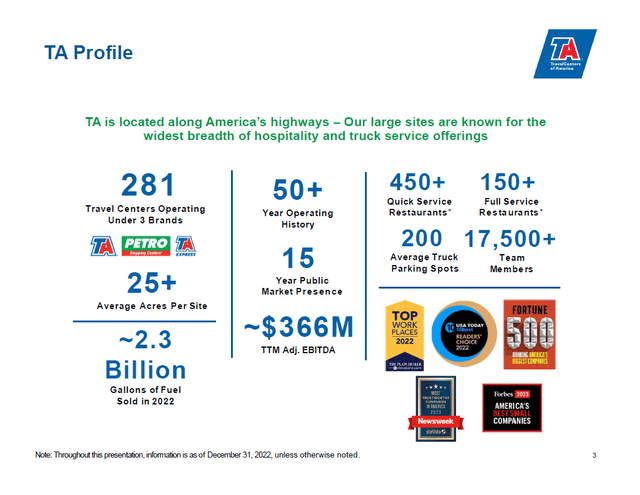

For reference, TravelCenters of America operates a full-service travel center network in the US via 280+ locations across 40+ states under the TA, Petro Shopping Centers, and TA Express brands. TravelCenters of America provides truck maintenance and repair services, offers car and truck parking, sells diesel and gasoline, operates full-service and quick-service restaurants along with travel stores, and provides other services. BP operates a fleet of gas stations across North America along with several refineries and an expansive network of infrastructure that supplies petroleum products across the continent (along the various other energy assets).

An overview of TravelCenters of America's asset base. (TravelCenters of America - April 2023 IR Presentation - BP Acquisition Of TA)

BP's Deal

For both Arko Corp. and BP, acquiring TravelCenters of America would add highly compatible operations to their existing asset bases. On February 16, 2023, TravelCenters of America agreed to be acquired by BP for $86 per share in cash which represented an 84% premium to the company's average share price during the 30 day period ended February 15. Within BP's press release announcing the all-cash ~$1.3 billion acquisition, the company was singing the deal's praises. BP noted that it was paying an EBITDA multiple of roughly 6x based on TravelCenters of America's performance from Q4 2021 to Q3 2022 for strategically located assets that would almost double BP's worldwide convenience store gross margin.

By 2024, BP sees this acquisition being accretive to its free cash flow and the firm expects to generate substantial synergies through integration efforts and future investments. Furthermore, the deal supports BP's efforts to grow its business in the realm of convenience stores, EV charging, biofuels/renewable natural gas, and hydrogen (in the future).

Please note that TravelCenters of America announced a deal with Electrify America, a firm that operates EV charging stations across the US, in January 2023 that aims to install ~1,000 individual EV charging stations at 200 locations across TravelCenters of America's operations, particularly at its locations along major US highways. One of the reasons why BP wanted to acquire TravelCenters of America was due to the firm's assets being strategically located along major US highways. Investing in highly trafficked locations should create new revenue generating opportunities for BP over the long haul.

BP can easily fund this acquisition with the $29.2 billion in cash and cash equivalents the company had on hand at the end of December 2022. The firm generated $28.9 billion in free cash flow in 2022 (defining free cash flow as net operating cash flow less 'expenditure on property, plant and equipment, intangible and other assets') as BP is a cash flow generating powerhouse in the current energy pricing environment. BP's pending acquisition of TravelCenters of America comfortably fits in with its plan to invest $16.0-$18.0 billion per year in the business through a combination of capital expenditures, acquisitions, and strategic investments.

While BP has a large net debt load, the company retains access to capital markets at attractive rates and can afford to utilize a relatively small portion of its cash position to fund its deal for TravelCenters of America with its financial standing intact. The board of directors of TravelCenters of America unanimously approved the deal with BP.

Bidding War

Pivoting to Arko Corp. the firm offered $92 per share to acquire TravelCenters of America in March 2023. This appears to be an all-cash offer, though that was not explicitly stated in any of the relevant press releases or the SEC filing covering Arko Corp.'s letter to the board of directors of TravelCenters of America (or any other SEC filings as of this writing) after the company rejected Arko Corp.'s offer. Here is what Arko Corp. had to say in that letter:

Following the submission of our March, 14, 2023 proposal to acquire TravelCenters for $92 a share and requesting access to diligence materials, and after reviewing the publicly available terms of the proposed transaction with BP Products North America Inc., a wholly owned indirect subsidiary of BP… as well as TravelCenters' preliminary proxy statement, ARKO believes the Board's decision regarding ARKO's proposal was incorrect and not in the best interests of TravelCenters' stockholders.

ARKO's proposal is superior to BP's offer of $86 a share, and engaging with ARKO is obviously beneficial for TravelCenters' stockholders. ARKO's proposal represents a meaningful premium of $6.00 per share to the value of BP's offer, adding nearly $100 million in additional value to TravelCenters' stockholders. The proposal maintains the discipline that ARKO's stockholders are accustomed to, and that is characteristic of ARKO's systematic growth strategy designed to increase cash flow and profitability.

TravelCenters' Board should seriously consider ARKO's strong financial position. ARKO is prepared to immediately commence confirmatory due diligence and quickly enter into an Agreement and Plan of Merger along with the other ancillary arrangements on the same material terms as in the Merger Agreement with BP. As one of the most acquisitive operators of convenience stores in the United States, with 23 transactions completed since 2013 and one pending and expected to close in the second quarter of 2023, ARKO has never required any financing conditions and has closed every acquisition it has put under contract. ARKO's proposal to TravelCenters offers no financing-related conditions.

At the end of December 2022, Arko Corp. had $0.3 billion in cash, cash equivalents, and short-term investments on hand (exclusive of restricted cash). In 2022, Arko Corp. generated $0.1 billion in free cash flow. The company would have to tap capital markets to fund a potential deal for TravelCenters of America, as compared to BP which already has ample cash on hand to fund its pending acquisition. TravelCenters of America rejected Arko Corp.'s offer in favor of BP's. Please note that Service Properties Trust (SVC), a real estate investment trust ['REIT'], owns some of the real estate where TravelCenters of America's operations are located and also owns a sizable equity stake in the firm. In a March 28 press release, TravelCenters of America provided this reasoning for rejecting the offer made by Arko Corp.:

The BP transaction is the result of an extensive process during which TA and its advisors engaged with multiple potential buyers who the TA Board believed could close with cash on hand or otherwise had committed financing. In addition, in order to meet SVC's [Service Properties Trust's] minimum credit criteria for the new tenant and guarantor of the leases between TA and SVC, only parties that had a minimum investment grade credit rating of BBB/Baa2 were invited into the process. BP is financing the transaction with cash on hand and has an investment grade credit rating of A3/A-. As ARKO concedes, ARKO requires third party capital to close any potential acquisition and its sub-investment credit rating of B+/B2 is several notches below BBB/Baa2.

It appears that TravelCenters of America didn't think that Arko Corp. would be able to raise the capital required to fund the deal and that should the company pick Arko Corp. over BP, it would be giving up a sure thing in favor of a gamble. Additionally, it appears that TravelCenters of America thought it was unlikely that Arko Corp. would be able to get Service Properties Trust onboard with its acquisition attempt. The REIT has already given its blessing to the deal with BP and intends to vote in favor of the deal.

RMR Group Inc (RMR) provides management services to Service Properties Trust and also owns a sizable equity stake in TravelCenters of America. Please note that RMR Group also intends to vote in favor of the BP deal. Here is another excerpt from TravelCenters of America's March 28 press release:

A condition to consummation of the BP transaction is approval by shareholders who own a majority of TA's shares outstanding. SVC [Service Properties Trust], which owns 7.8% of TA's shares outstanding, and The RMR Group, which owns 4.1% of TA's shares outstanding, both have agreed to vote their shares in favor of the transaction. TA has set a record date of March 23, 2023 and has filed its preliminary proxy statement for shareholder approval of the BP transaction. Subject to shareholder and regulatory approval, the parties are targeting closing the acquisition by mid-year 2023.

Beyond the aforementioned press release, TravelCenters of America responded to the letter from Arko Corp. with a brief letter of its own, noting that one of its biggest concerns with Arko Corp.'s deal is that the firm has yet to secure committed financing. While Arko Corp. has proceeds incoming from a sizable sale-leaseback transaction along with some access to credit via existing credit facilities, that isn't enough to assuage the concerns of TravelCenters of America's management team or board of directors.

There is a special shareholder meeting for TravelCenters of America coming up on May 10 that will decide whether shareholders want to approve the deal with BP. Should the deal get rejected, that would indicate TravelCenters of America's shareholders want to gamble and attempt to get a better deal by going with Arko Corp. However, several of TravelCenters of America's largest shareholders have already indicated that they intend to go with BP. The deal as envisioned is expected to close in the middle of this year.

Concluding Thoughts

I'm following the saga between TravelCenters of America, BP, and Arko Corp. closely and it will be interesting to see what happens between now and May 10. There is a chance that BP may raise its bid for TravelCenters of America should Arko Corp. make meaningful progress on securing secured financing for its acquisition attempt, or if it appears that TravelCenters of America is getting cold feet, though that appears to be unlikely as of early May 2023.

It appears that BP's pending deal will proceed as planned as of this writing, though shares of TravelCenters of America have been trading at or above the $86 per share acquisition price of late which means there are at least some investors out there that believe the ultimate acquisition price could be higher than BP's current offer (whether that involves BP raising its bid or Arko Corp. getting its chance). What happens over the next week will be key to determining how this bidding war ultimately plays out. Stay tuned.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.