M.D.C. Holdings: Optimistic Guidance And New Areas Could Imply Stock Upside

Summary

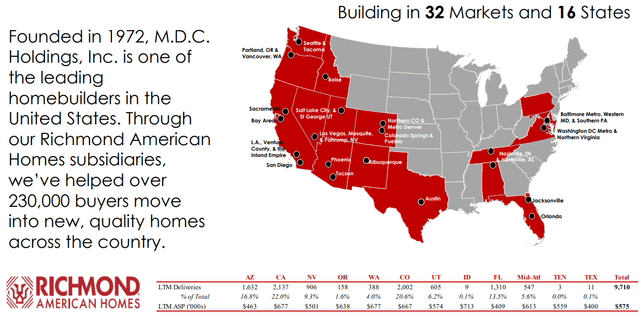

- Homebuilder M.D.C. Holdings reports expertise accumulated from 1972 and a large list of home deliveries all over the country.

- I think that further expansion into new territories could bring a lot of revenue growth and perhaps some economies of scale.

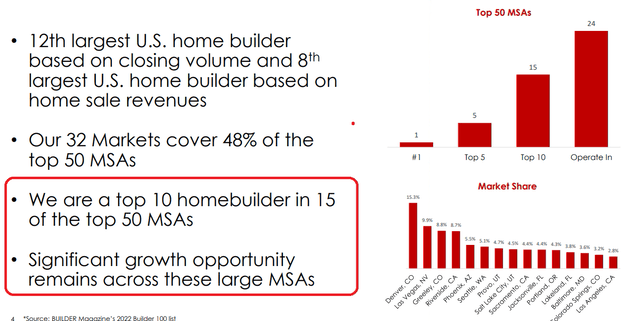

- It is worth noting that management sees significant growth opportunities across several metropolitan statistical areas.

IRINA NAZAROVA

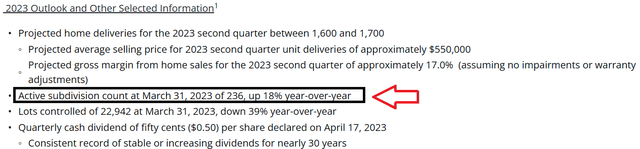

Homebuilder M.D.C. Holdings, Inc. (NYSE:MDC) recently delivered optimistic guidance that included active subdivisions’ count on March 31, 2023 up by 18% y/y and new orders. Considering the optimism from management and the current valuation, I believe that designing a financial model makes sense. In my opinion, successful pricing strategies, change in the mix of home offerings, or more initiatives in new areas could enhance future FCF generation. Under my DCF model, I believe that the fair stock price could be close to $78 per share.

M.D.C. Holdings: A Lot Of Accumulated Knowledge And Optimistic 2023 Guidance

Homebuilder M.D.C. Holdings reports expertise accumulated from 1972 and a large list of home deliveries all over the country. Considering the number of economic crises that management went through, I believe that MDC is a must read for real estate investors in the United States.

With that about what M.D.C. Holdings has done and the fact that MDC appears to be the 12th largest U.S. homebuilder in the US, it is worth noting that management sees significant growth opportunities across several metropolitan statistical areas. In this regard, the following slide was delivered in the most recent quarterly report.

I am quite impressed by the recent optimism exhibited in the most recent quarterly press release. Management noted a significant increase in the number of new orders in the first quarter as compared to that in Q4 2022. I also believe that the expectations around future dividends will likely be appreciated by market participants. In my view, if things do not go great inside M.D.C. Holdings, dividends may lower.

Thanks to a combination of improved market conditions and strategic pricing initiatives, we have seen a rebound in homebuying activity to start the year. Net new orders in the first quarter increased significantly relative to the fourth quarter of 2022, as buyers returned to the market for the start of the spring selling season. Order momentum built as the quarter progressed, and we saw order totals increase on a sequential basis each month. Source: Press Release

We believe this puts us in a great position to continue our disciplined approach to growth while simultaneously funding our industry-leading dividend payout of $2.00 per share on an annualized basis. Source: Press Release

I also saw that the guidance given for 2023 was optimistic. Active subdivisions count on March 31, 2023 was up by 18% y/y. Besides, M.D.C. Holdings expects a projected gross margin home sales of approximately 17%, so I do not believe that profitability will be an issue any time in the future.

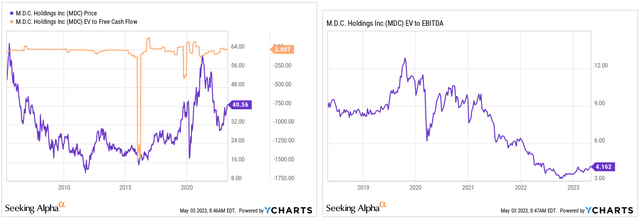

With the previous information about numbers expected in 2023 and the current EV/EBITDA, which appears quite low, I believe that designing a careful financial model about the future makes sense.

Assets: More Cash And More Total Homebuilding Assets

The balance sheet reported in the last 10-Q did not include a lot of changes as compared to that in Q4 2022. With that, it appears beneficial that management reported an increase in cash and marketable securities along with more homebuilding assets. I cannot say that the business is not growing.

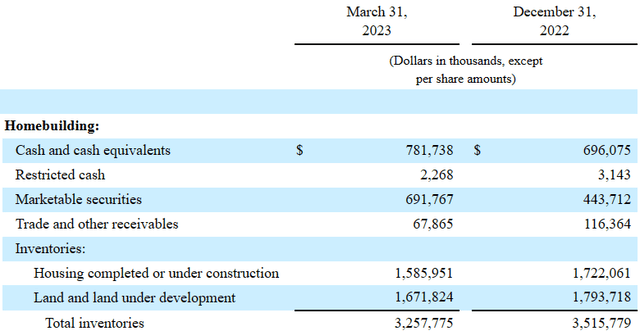

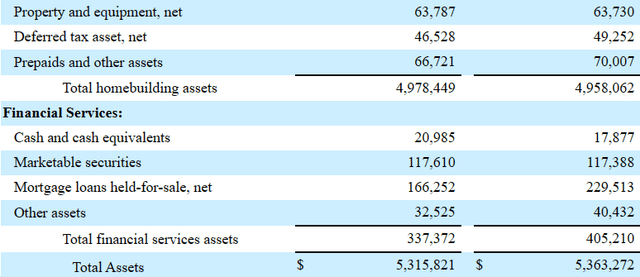

As of March 31, 2023, M.D.C. Holdings reported cash and cash equivalents of $781 million, restricted cash of $2 million, and marketable securities worth $691 million. Also, with trade and other receivables of $67 million, housing completed or under construction stands at $1.585 billion, with land and land under development of $1.671 billion, total inventories is equal to $3.257 billion.

Property and equipment stood at $63 million, with deferred tax assets of $46 million and total homebuilding assets of $4.978 billion. With regard to financial services, the company reported cash worth $20 million, marketable securities around $117 million, and total assets close to $5.315 billion. M.D.C. Holdings reports an asset/liability ratio close to 2x, so I think that the balance sheet stands in a good position.

I Am Not Afraid Of The Total Amount Of Debt

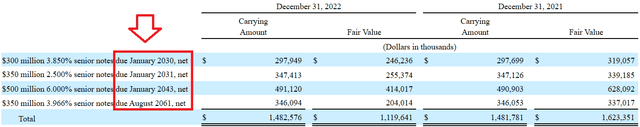

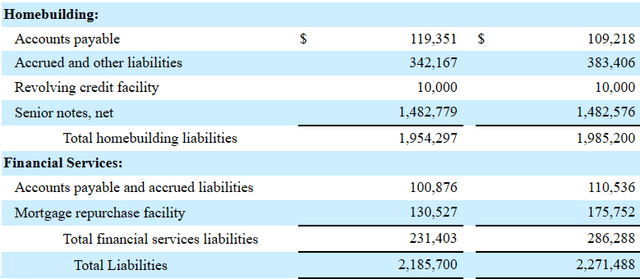

The list of liabilities includes accounts payable worth $119 million, accrued and other liabilities of $342 million, a revolving credit facility of $10 million, and senior notes of close to $1.482 billion. I am not concerned about the senior notes because most of them mature around 2030-2061.

Liabilities related to financial services include accounts payable and accrued liabilities worth $100 million, a mortgage repurchase facility worth $130 million, and total liabilities of $2.185 billion.

Pricing Strategies, Change In The Mix Of Home Offerings, Or New Areas Could Imply A Valuation Of $78 Per Share

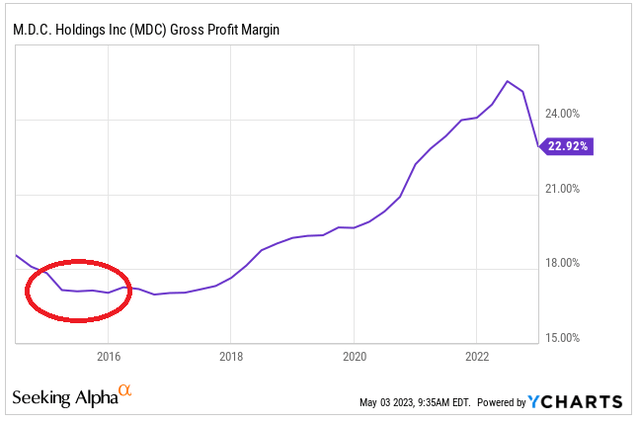

Under my financial model for the next ten years, I assumed that management will successfully be able to apply pricing strategies as market conditions change. Besides, changes in the mix of home offerings to reduce the costs of the houses could have a beneficial effect on the gross margins. In the last ten years, management knew well how to improve the gross profit margin, so I believe that it knows how to do it in the future.

I also believe that MDC will successfully manage to navigate potential supply chain obstacles. In addition, the accumulated expertise dealing with previous supply chain issues will likely help.

Our teams did an excellent job overcoming supply chain obstacles and municipal delays to close homes in backlog in a timely manner. Source: Press Release

Besides, I think that further expansion into new territories could bring a lot of revenue growth and perhaps some economies of scale. In this regard, I would draw attention to the number of new openings in new areas.

Richmond American Homes of California, a subsidiary of M.D.C. Holdings, Inc. is excited to announce the grand opening of Torrin at Valencia. Scheduled to open on Saturday, April 29, this dynamic new community boasts four inspired two- and three-story floor plans with the open layouts and designer details today's homebuyers are seeking. Source: Richmond American Announces Grand Opening of New Valencia Community Richmond American Homes of Colorado, Inc., a subsidiary of M.D.C. Holdings, Inc., is pleased to announce the grand opening of the ranch-style Cypress model home at North Vista Highlands in Pueblo. Richmond American Announces Grand Opening Event in Pueblo

Richmond American Homes of Tennessee, Inc., a subsidiary of M.D.C. Holdings, Inc., is excited to announce the Grand Opening of Friendship Ridge in Hazel Green. Source: Richmond American Announces Community Grand Opening in Hazel Green

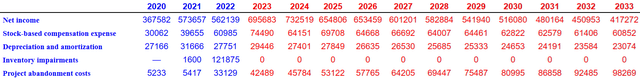

My DCF model includes 2033 net income close to $417.55 million, with stock-based compensation expenses around $60.55 million, 2033 depreciation and amortization of $23.55 million, and 2033 project abandonment costs of $98.55 million.

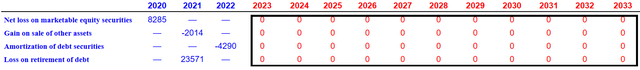

In the past, the company included net losses on marketable securities, gains on sale of assets, and amortization of debt securities for the calculation of the CFO. I don't believe that these changes are necessary as they do not represent daily activities of the business model reported by MDC.

I also included 2033 deferred income tax expense of -$270.55 million, trade and other receivables of -57.5 million, mortgage loans held-for-sale close to $169.5 million, and changes in housing completed or under construction of -$460.5 million. Besides, with land and land under development of $326.5 million, prepaids and other assets close to $239.5 million, and changes in accounts payable and accrued liabilities of -$129 million, 2033 CFO would stand at $419.5 million. Finally, with capital expenditures of -$31.5 million, I obtained a 2033 FCF of $389.5 million.

With a WACC of 9%, if we also assume a conservative EV/FCF ratio of 4x-5x, the net present value of future free cash flow would stand at $5.67785 billion. I also added cash and cash equivalents of $781 million, restricted cash of $2 million, marketable securities close to $691 million, cash and cash equivalents from financial services of $20 million, and marketable securities from financial services of $117 million. Besides, if we subtract a revolving credit facility of -$10 million, senior notes worth -$1.483 billion, and a mortgage repurchase facility of -$131 million, the equity valuation would stand at $5.668 billion. Finally, the implied fair price would be close to $78 per share.

Risk Factors

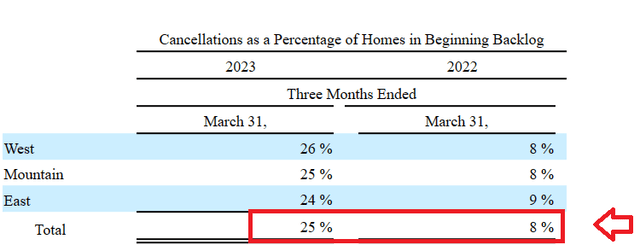

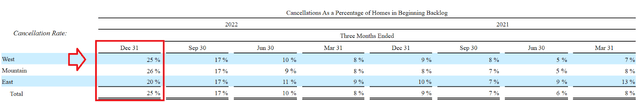

I am a bit concerned about the increase in the number of cancellations reported in the quarter ended March 31, 2023. If cancellations continue in Q2 and Q3, I believe that the expectations for revenue growth would most likely decline, which may push the stock price even lower.

M.D.C. Holdings reports a large amount of housing completed or under construction. If prices in the real estate industry decline, I believe that many of the houses built may be sold at a loss. MDC may have to reduce the valuation of these assets in the balance sheet, which would bring the book value per share down. As a result, many investors would most likely sell their shares, which may lead to lower demand for the stock and stock price declines.

If MDC fails to sell new houses, future free cash flow would most likely decline, which may lead to increases in the net leverage ratio. As a result, market participants may be afraid of the total amount of debt, and may also decide to sell their stakes in the MDC.

Finally, labor conditions, cost of building materials, or lack of these two necessary elements could significantly damage the cash flow statement reported by MDC. Besides, management may not be able to make predictions about future costs, which may lead to lower projects and less homes available.

We generally contract for our materials and labor at a fixed price for the anticipated construction period of our homes. This allows us to mitigate the risks associated with increases in the cost of building materials and labor between the time construction begins on a home and the time it is closed. Increases in the cost of building materials and subcontracted labor may reduce gross margins from home sales to the extent that market conditions prevent the recovery of increased costs through higher home sales prices. From time to time and to varying degrees, we may experience shortages in the availability of building materials and/or labor in each of our markets. Source: 10-k

Conclusion

M.D.C. Holdings reports a significant amount of expertise in building homes, and the most recent guidance given for the following quarter was beneficial. Considering the current economic environment, I am quite impressed by the optimism reported by management. In my view, MDC stock will likely deliver successful long term performance, so a long term financial model makes sense here. Successful pricing strategies, change in the mix of home offerings, or the recent initiatives in new areas will likely help in offering operating margin growth enhancements and FCF generation. Even taking into account potential risks from volatility in the price of real estate assets or challenging labor conditions, I believe that the stock price could be worth close to $78 per share.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MDC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.