Assertio Holdings: A Little More Risk, A Lot Higher Reward

Summary

- A shocking M&A move tanked the stock, but it is recovering.

- Some are skeptical about the newly-acquired product, but it is better than a blockbuster rival.

- Through it all, the company is still a deep value play.

Fahroni

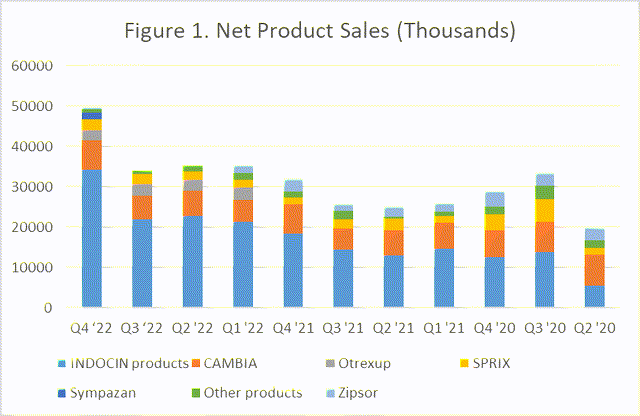

Assertio (NASDAQ:ASRT) is a small ($307 million market cap) specialty pharmaceutical company. Several observations since my last coverage has come to pass. Share prices have risen 36.7% as valuation is still A-rated according to Seeking Alpha’s Quant system, and broad insurance coverage of lead product INDOCIN and new asset Sympazan helped the company crush Q4 earnings on the strength of $50.3 million revenue (Table 1), on the way to $1.34 EPS and the seventh straight quarter of positive cash flows. The company decided to address its continued reliance on INDOCIN (Figure 1) by acquiring Spectrum Pharmaceuticals (SPPI) for $248 million and future considerations for Spectrum stockholders, initially provoking a negative market reaction. I believe investors can be assured that ROLVEDON, a novel long-acting granulocyte-colony stimulating factors (G-CSF) product, is an excellent asset and will join INDOCIN in bolstering future revenues.

Table 1. Quarterly Revenues (in thousands in US$)

Q4 ‘22 | Q3 ‘22 | Q2 '22 | Q1 '22 | Q4 '21 | Q3 '21 | Q2 '21 | Q1 '21 | Q4 '20 | Q3 '20 | Q2 '20 | |

INDOCIN products | 34271 | 21869 | 22841 | 21357 | 18344 | 14541 | 13075 | 14597 | 12477 | 13773 | 5434 |

CAMBIA | 7256 | 5808 | 6183 | 5473 | 7344 | 5038 | 6128 | 6462 | 6847 | 7449 | 7780 |

Otrexup | 2450 | 3004 | 2616 | 3078 | |||||||

SPRIX | 2673 | 2455 | 2216 | 1766 | 1765 | 2272 | 2942 | 1697 | 3833 | 5642 | 1602 |

Sympazan | 1768 | ||||||||||

Other products | 787 | 884 | 1358 | 1644 | 1316 | 2147 | 518 | 1049 | 1827 | 3405 | 1814 |

Zipsor | 661 | 259 | 216 | 2228 | 3383 | 1999 | 2581 | 2222 | 4025 | 3395 | 3535 |

Total product sales, net | 52310 | 34279 | 35214 | 33318 | 28769 | 23998 | 22663 | 23805 | 24984 | 30269 | 16630 |

Royalties and milestone revenue | 487 | 473 | 451 | 992 | 1187 | 416 | 542 | 434 | 361 | 299 | 452 |

Other revenue | 0 | -540 | -750 | -9 | -941 | -413 | 378 | 806 | 602 | ||

Total revenues | 50353 | 34212 | 35131 | 36538 | 33330 | 25472 | 25373 | 26839 | 30176 | 34565 | 20617 |

Assertio Holdings

ROLVEDON helps to prevent infections in adult nonmyeloid cancer patients whose chemotherapy regimens suppress the production of blood cells called neutrophils in the bone marrow, and could get febrile neutropenia ("FN") as a result. The drug directly competes with G-CSFs recommended in the National Comprehensive Cancer Network (NCCN) guidelines: NEUPOGEN and Neulasta from Amgen (AMGN), as well as their biosimilars. ROLVEDON is administered subcutaneously once per chemo cycle, which is one major advantage over daily NEUPOGEN, while Neulasta shouldn’t be used for regimens that have weekly cycles. However, for patients who can’t return to the clinic for next-day administration after chemo, the Neulasta Onpro device can be applied the same day as chemo and delivers the full dose the following day. In a rat study, ROLVEDON decreased the duration of FN when given at the same time as chemo or up to 5 hours after, which supports the ongoing Phase 1 same-day dosing trial in breast cancer.

ROLVEDON was approved based on data from two Phase 3 studies, ADVANCE and RECOVER. Each demonstrated noninferiority of ROLVEDON in the duration of severe neutropenia (“DSN”) compared to Neulasta, with a similar safety profile. In these trials, SN was defined as absolute neutrophil count <0.5 × 109/L, a Grade 4 Adverse Event (Life-threatening consequences; urgent intervention indicated) per the National Cancer Institute. However, a pooled analysis established that ROLVEDON was in fact superior; it significantly reduced DSN by 0.120 days (95% confidence interval: -0.227, -0.016; superiority p = 0.029), and the relative risk reduction in the incidence of SN in cycle 1 versus Neulasta was 27.1% (17.5% vs. 24.0%, p = 0.043). With its flaws, Neulasta averaged $500 million in U.S. quarterly sales in 2020. NEUPOGEN (and its biosimilars) have no advantage over ROLVEDON, so its $87 million share in 2022 is largely up for grabs.

Spectrum had quickly rolled up ROLVEDON milestones, gaining approval in September, inclusion in the NCCN guidelines by December, and a permanent Centers for Medicare & Medicaid Services J-Code J1449 that went into effect on April 1. The unique J-Code simplifies claim submissions, documentation, and reimbursement. During the launch quarter in which ROLVEDON net sales were $10.1 million, Spectrum President and Chief Executive Officer Thomas Riga touted having the top 3 community oncology networks, which does around 22% of the total clinic business, among the 70 clients that bought ROLVEDON. Senior Vice President of Sales and Marketing Erin Miller stated that the number of purchasing accounts “more than doubled in the first quarter.” Assertio rightly is keeping a very productive sales force.

To conclude, investors may rely on the confidence of Spectrum management and accumulate more ASRT. If they are correct and ROLVEDON net sales hits $175 million in 2024 and $225 million in 2025, SPPI holders are rewarded with contingent value rights (“CVR”) of $0.10 per share for each year the targets are achieved. If not, Assertio doesn’t have to pay the CVR, a sort of win-win situation either way. Assertio CEO Dan Peisert believes ROLVEDON will join INDOCIN as its second $100 million earner this year; I believe he will likely be right, as a simple and extremely conservative $6 million quarterly increase (i.e., 16-22-28-34) will do the trick. Longs who were happy with the old $300M-ish cap biotech expected to rake in $157.22 million this year should also be very receptive to a combined $520M company doing $260 million with an explosive best-in-class launch product to boot. Further out, ROLVEDON, with a patent not expiring until 2031, could plausibly achieve half of Neulasta's U.S. take, as Jefferies estimated peak sales at $550 million before the pooled analysis was out.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ASRT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.