Crescent Capital: Hefty 12% Yield Plus Big Discount To NAV

Summary

- Crescent Capital BDC is executing well and pays a generous dividend yield that's well-protected by net investment income.

- It should benefit from a pullback in regional banks and from its acquisition of First Eagle BDC.

- Income investors could see potentially very strong total returns at its current material discount to NAV.

- Looking for a portfolio of ideas like this one? Members of Hoya Capital Income Builder get exclusive access to our subscriber-only portfolios. Learn More »

porcorex

The BDC sector, like other high yield asset classes such as REITs (VNQ), have seen a broad decline over the past 12 months. However, contrary to what some may believe from price action alone, many BDCs have materially grown their income over this time frame, giving value investors plenty to like.

This brings me to Crescent Capital BDC (NASDAQ:CCAP), which I last covered here in January, highlighting its material discount to NAV. The stock has underperformed the market since then, and in this article, I discuss why that makes CCAP an appealing high income play at present.

Why CCAP?

CCAP is an externally managed BDC that has $1.26 billion in total investments that are spread across 129 portfolio companies across 18 different industries. Its management takes a conservative approach toward portfolio composition, as it's primarily invested in first lien senior secured and unitranche first lien investments.

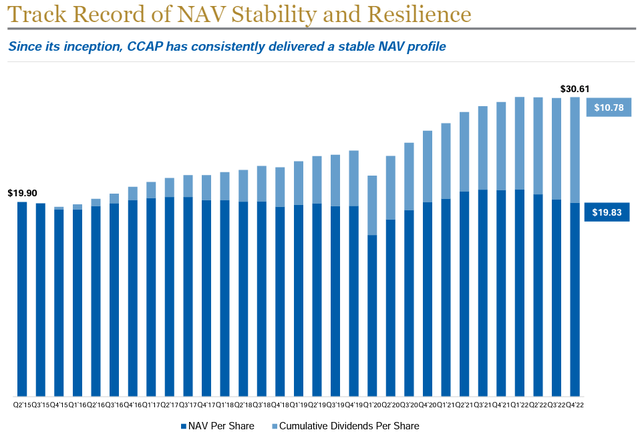

CCAP has a solid track record of shareholder returns. This includes having kept a rather steady NAV per share since inception in 2015, all while delivering plenty of cash dividends back to shareholders over this timeframe. As shown below, CCAP shareholders who bought at IPO have gotten more than half of their investment back through dividends since 2015.

Investor Presentation

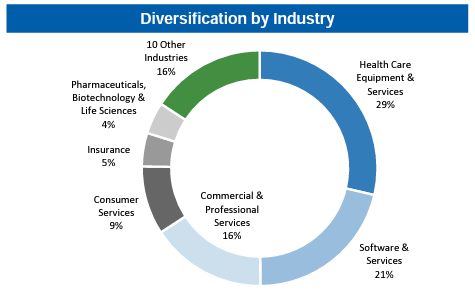

Moreover, 99% of CCAP's debt investments are floating rate, enabling CCAP to reap the benefits from the current higher interest rate environment. It's also well diversified, with the average position size representing just 0.8% of portfolio total. As shown below, CCAP primarily invests in growing and defensive segments such as healthcare, software, and business services.

Investor Presentation

Meanwhile, CCAP has demonstrated steady results, as its NAV per share declined by just 1.6% sequentially over the past 2 reported quarters. Notably, this was driven by unrealized losses due to widening credit spread amidst economy volatility rather than actual realized losses.

Investments on non-accrual remain low, at just 1.2% of portfolio fair value. Importantly, CCAP's high dividend yield is well-protected by a 1.27x NII to dividend coverage ratio (based on $0.52 NII per share in the last reported quarter).

Looking ahead, CCAP should benefit from the recent volatility in regional banks, as they have now become capital constrained. This should result in less lending capacity from regional banks, allowing BDCs like CCAP to step up. Unlike regional banks, BDCs have a permanent equity base and don't have fickle deposit bases that can be withdrawn at a moment's notice. Notably, fellow BDC Ares Capital's (ARCC) management recently released the following comment in their earnings call regarding the pullback in regional banks and how that benefits BDCs:

We believe that the banks remain constrained on new activity due to concerns regarding both capital and liquidity and which we believe makes our broad range of flexible capital solutions even more valuable.

We feel that the current environment is similar to a number of prior periods of market dislocation that have improved the opportunity set for direct lenders. The current illustration of these dynamics is highlighted by the fact that 95% of the first quarter LBO financing new issuance was completed by private capital providers, a market traditionally weighted towards the broadly syndicated channel.

Looking ahead to Q2 results, I would expect to see growth in CCAP's portfolio considering the above comments and its strong balance sheet with a debt to equity ratio of 1.08x. CCAP could also see meaningful growth from its acquisition of First Eagle BDC, which management expects to see financial synergies and benefits.

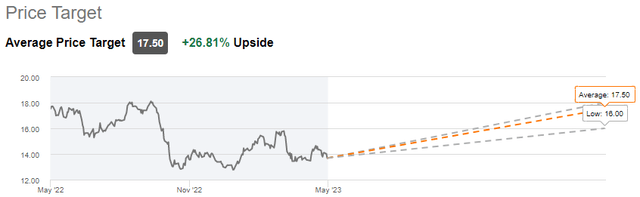

Lastly, CCAP trades at a material discount to net asset value at the current price of $13.61, with a price to book ratio of 0.78x. Analysts have a consensus Strong Buy rating with an average price target of $17.50, which combined with the 11.9% dividend yield could result in very strong double-digit total returns over the near term.

Seeking Alpha

Investor Takeaway

In summary, Crescent Capital BDC represents an appealing investment opportunity for income-seeking investors due to its high dividend yield and sizeable discount to net asset value. Moreover, the company should benefit from the pullback in regional banks and its recent acquisition of First Eagle BDC should result in material synergies and growth opportunities over the near term.

All these factors point towards potentially strong total returns ahead for CCAP. With the stock currently trading near its 52-week low, now could be an opportune time to initiate a position in this BDC for income and growth investors alike.

Gen Alpha Teams Up With Income Builder

Gen Alpha has teamed up with Hoya Capital to launch the premier income-focused investing service on Seeking Alpha. Members receive complete early access to our articles along with exclusive income-focused model portfolios and a comprehensive suite of tools and models to help build sustainable portfolio income targeting premium dividend yields of up to 10%.

Whether your focus is High Yield or Dividend Growth, we’ve got you covered with actionable investment research focusing on real income-producing asset classes that offer potential diversification, monthly income, capital appreciation, and inflation hedging. Start A Free 2-Week Trial Today!

This article was written by

I'm a U.S. based financial writer with an MBA in Finance. I have over 14 years of investment experience, and generally focus on stocks that are more defensive in nature, with a medium to long-term horizon. My goal is to share useful and insightful knowledge and analysis with readers. Contributing author for Hoya Capital Income Builder.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of CCAP either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am not an investment advisor. This article is for informational purposes and does not constitute as financial advice. Readers are encouraged and expected to perform due diligence and draw their own conclusions prior to making any investment decisions.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.