Hudson Technologies: The AIM Act Tailwind Will Continue

Summary

- Hudson is well positioned to benefit from the legislative tailwind and has seen its revenue growth boosted in the past year or so.

- The company took the chance to strengthen its financials on all fronts, including margin, cost and expenses and debt.

- Further EPA rulemaking will provide clearer picture for further growth in the space that Hudson can take advantage of.

Panupat Ratanawechtrakul/iStock via Getty Images

Investment Thesis

Hudson Technologies (NASDAQ:HDSN) has seen a strong boost to its growth in 2022 following the passage of AIM Act in 2020 and its finalizing in 2021. The tailwind has really just begun for the company as a larger stepdown of HFCs is expected in '23 to '24. The company is not only well positioned to reap the benefits but also has actively used the recent growth to strengthen its balance sheet and financials. Although some slowdown is reflected in Q1's earnings, we remain optimistic about its growth extending to the next five years. The current stock is undervalued, and we recommend a buy.

Company Overview

Hudson Technologies, Inc, founded in 1991 under New York laws, is a refrigerant services company that provides "solutions from the initial sale of refrigerant gas through recovery, reclamation and reuse, peak operating performance of equipment through energy efficiency and emergency air conditioning and refrigeration system repair, to final refrigerant disposal and carbon credit trading", as indicated in its 10K. The company reports under one main segment, mainly consisting of its refrigerants and industrial gas sales used in commercial and industrial refrigerating systems and the management system of refrigerant reclamation services.

Review of Q1 Earnings

Hudson Technologies reported earnings on May 3rd, with revenue of $77.2 million, 8% lower YoY, and a gross margin of 39% compared to 54% a year ago. Its EPS was $0.33 for the quarter, lower than $0.63 same quarter last year, but still beat some consensus estimates by 6 to 11 cents. The company cited "decreased selling prices for certain refrigerants during the period as well as lower sales volume" as reasons for lower reading on a YoY basis.

Strength

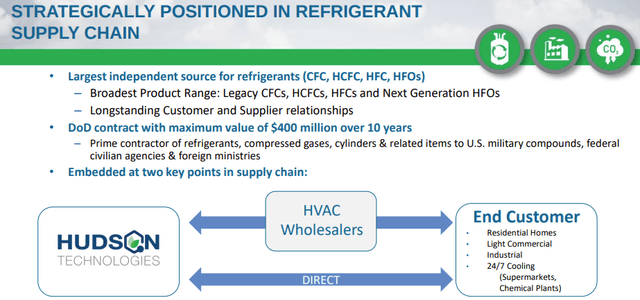

The advantage Hudson Technologies holds is its independent strategic position in the supply chain of refrigerant. Its relationship with various suppliers and customers in the industry makes it ever more critical in the process of green technological upgrades. Being the largest independent supplier, it can be flexible enough to provide to different customers, including wholesale, military, and federal or foreign governments, while still maintaining a broad selection of products in large value contracts.

Hudson Technologies Strategic Position in the Supply Chain ((Company Presentation April 2023))

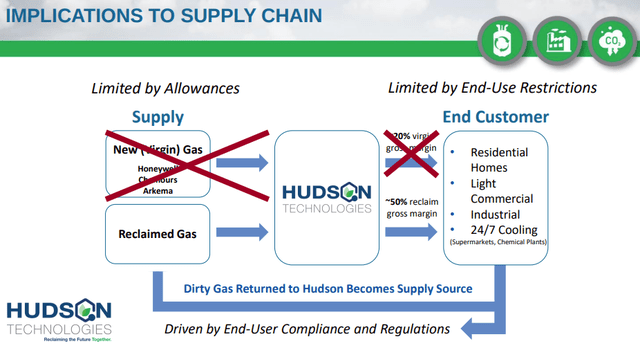

This advantage is clearly shown following the passage of the AIM Act. The widely-used hydrofluorocarbon gases to be phased down in the US's production and consumption in all manners in the next 15 years by the Act is seen as a fast acceleration of green tech in this regard. Instead, reclamation is promoted as a substitution.

HFC Phase Down Implication to Supply Chain ((Company Presentation April 2023))

EPA continued to follow up by publishing allowance allocation in Sep 2022 and more rulemaking proposals in Nov 2022. The step-down it has created in 2023 alone is about 40% shortage for HFCs, and is expected to continue, although the most significant effect is likely coming in the first five years of the 15-year framework.

HFC Phase Down Path Under AIM Act Mandates ((Company Presentation April 2023))

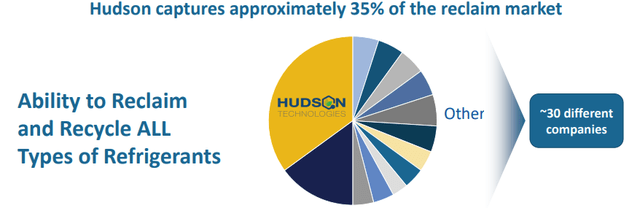

Being the largest producer in the fragmented reclamation market, Hudson Technologies has the potential to benefit not only from the increased demand but also from a consolidated market impacted by the legislative changes. More than one year later, now it's good to review what it has brought to Hudson's growth.

Hudson Technologies: Reclamation Market Share ( (Company Presentation April 2023))

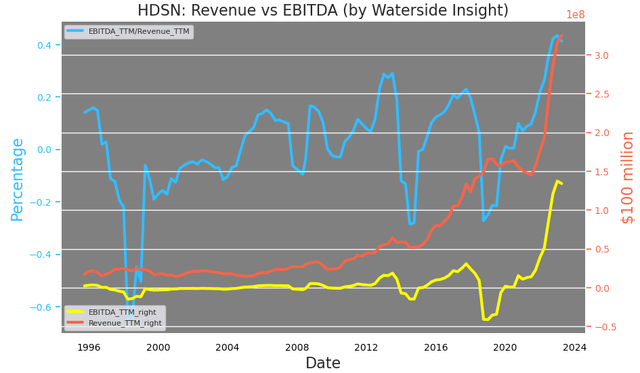

Indeed, the company has gained momentous growth from this mandatory transition. Its revenue and EBITDA have both risen to a record high on a TTM basis, as the market has seasonality in demand.

Hudson Technologies: Revenue vs Net Income ((Calculated and Charted by Waterside Insight with data from company))

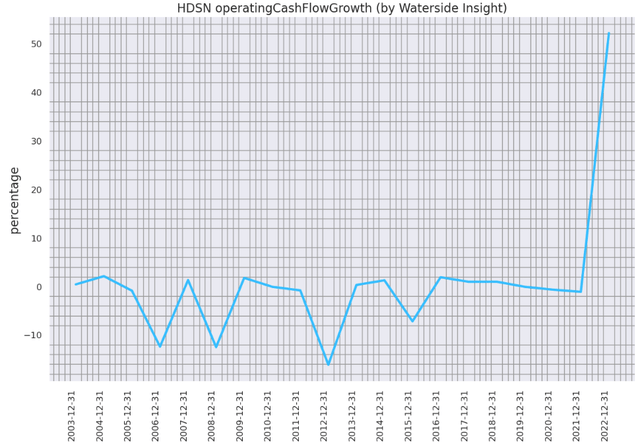

The company's operating cash flow just had the fastest growth since 2003, which signifies the solid operational results have broken out of the past range by a large margin.

Hudson Technologies: Operating Cash Flow Growth ((Calculated and Charted by Waterside Insight with data from company))

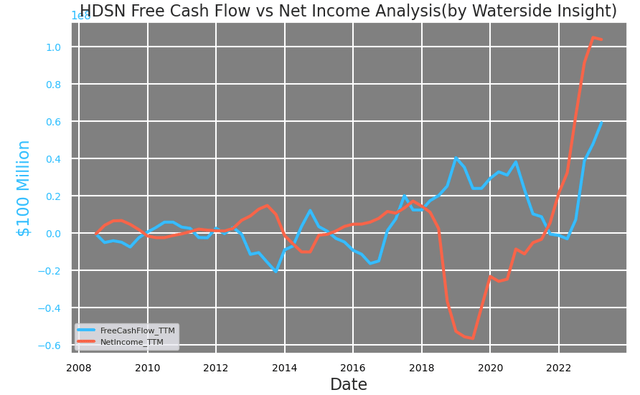

As a result, it gives its free cash flow a strong foundation. Historically, its free cash flow had remained stable on a TTM basis, even during '18-'19, when its net income got hit. Currently, it is trending towards its highest level.

Hudson Technologies: Free Cash Flow ( (Calculated and Charted by Waterside Insight with data from company))

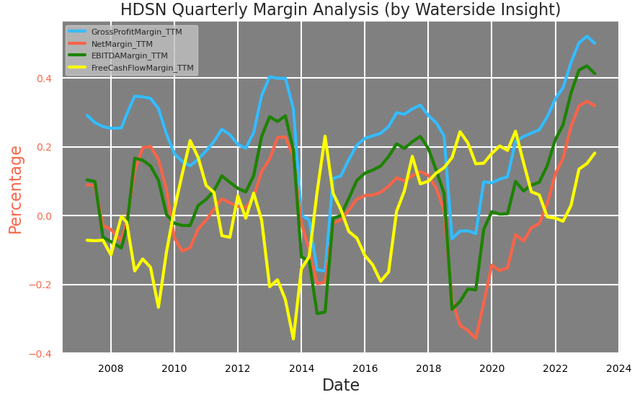

All of its margins are at their top end on a TTM basis. In the past 15 years, they have been oscillating within a range of negative 20 percent to positive 40 percent. It is likely they have entered a higher range of from above zero to 50 percent since 2022, as more growth tailwind from the Act started to show.

Hudson Technologies: Quarterly Margin ( (Calculated and Charted by Waterside Insight with data from company))

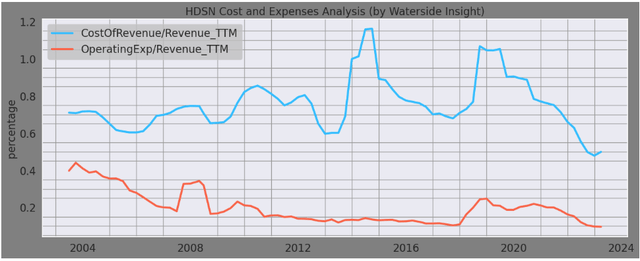

During the recent rapid expansion, Hudson has been able to consistently reduce its cost and expense, with both of which recorded the lowest percentage of revenue lately. This will ensure the company's margins remain robust in its expansion and growth, as has been confirmed in the latest earnings results.

Hudson Technologies: Cost and Expenses ((Calculated and Charted by Waterside Insight with data from company))

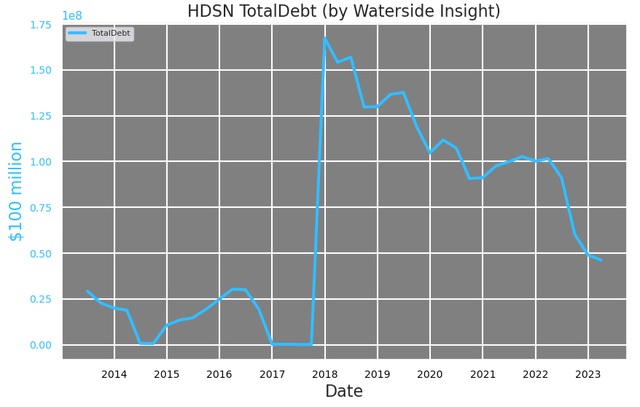

Investors can also perhaps take comfort from the fact that the company is actively implementing a debt reduction plan with its strong cash flow position. As seen from the chart, its total liabilities have been halved from its peak since 2019. Indeed, in the latest quarterly results, Hudson reduced total outstanding debt from $46.8 million at December 31, 2022 to $43.6 million at March 31, 2023. It is still much higher than the average before 2018, and we expect it will continue the process of paying them down.

Hudson Technologies: Total Debt ((Calculated and Charted by Waterside Insight with data from company))

Further growth aided by the AIM Act can be expected from more EPA rulemaking, such as adopting the California Air Resources Board (CARB)'s requirement of using at least 10% of reclamation refrigerant for OEM's factory-charged equipment. And Hudson's strategic relationship with leading OEMs, such as Lennox International and AprilAire, will stand to benefit and expand its growth momentum. Its announcement yesterday to join EPA's GreenChill Advanced Refrigeration Partnership will enhance its partnership with the retail food industry as well.

Weakness/Risks

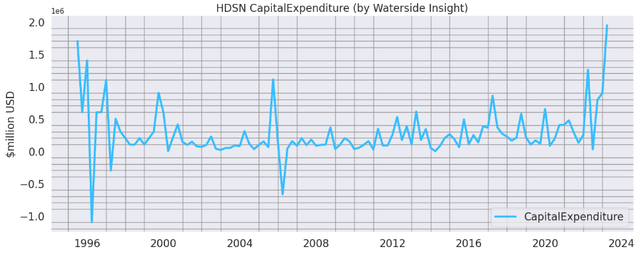

Hudson Technologies has been raising its capex spending. The company explained it is due to the increase related to the implementation of the Enterprise Resources Planning system and other expenditures on its plants. Basically, it is for upgrading and refocusing its resources throughout the company to where the demand is coming most strongly. This could be the main source of pressure on its free cash flow in the near term, but we perceive this as a long-term positive as it is strengthening its ability to keep up with the growth that likely continues in the next ten years.

Hudson Technologies: Capital Expenditure ( (Calculated and Charted by Waterside Insight with date from company))

Big Picture

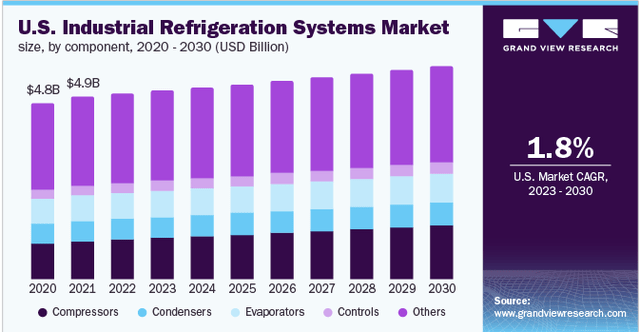

The US industrial refrigeration system market is expected to grow at 1.8% CAGR through 2030, as it is the largest market in the world,

US Industrial Refrigeration Systems Market ((Grandview Research))

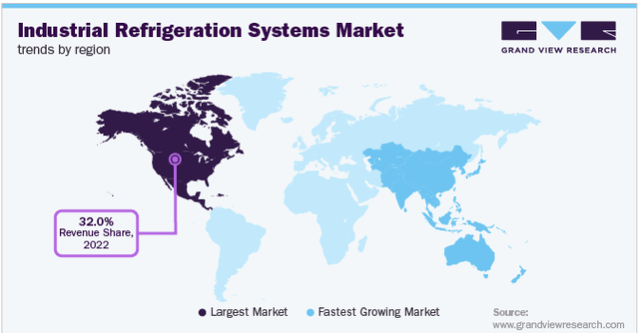

But the emerging fast-growth market in China and India is going to be a longer-term story as the world experiences more acute food shortages due to extreme weather such as heat and flood, and ample food and beverage storage becomes imperative to hold all stocks. More emerging market countries could be joining this movement as food security tops politicians' agenda, as has been seen in the past few years. As mentioned as Hudson's advantage is its strategic relationships earlier that it has customers in foreign governments. Its engineers were recognized as the Lead International Energy Experts for steam, chillers and refrigeration systems for the United Nations Industrial Development Organization ("UNIDO"). The company is well positioned to benefit from emerging international growth in the long term as well.

Industrial Refrigeration Systems Market Trends by Region ( (Grandview Research))

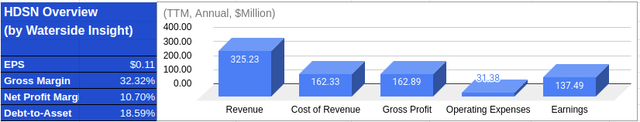

Financial Overview

Hudson Technologies: Financial Overview ( (Calculated and Charted by Waterside Insight with data from company))

Valuation

We incorporate the analysis above and use our proprietary models to assess the company's growth with a ten-year forward projection. We use a cost of equity of 7.57% and a WACC of $7.74. In our bullish case, the company has steady growth in the single to double digits in the next five years, with more volatility afterward; it was valued at $14.05. In our bearish case, higher volatility is priced in for the last five years in the ten-year horizon as the policy benefits wind down and the company adjusts to different growth dynamics; it was valued at $8.17. In our base case, we dial down the volatility in comparison with the bearish case and maintain steady, strong growth for the first five years; it was valued at $10.98. In all cases, we are optimistic about its growth trajectory in the next five years. The differentiation came from the expectation further out on the horizon. The current market price is under our lowest estimate.

Hudson Technologies: Fair Valuation ( (Calculated and Charted by Waterside Insight with data from company))

Conclusion

Hudson Technologies has gone through a volatile growth period during 2016-2019, but the passage of AIM Act in 2020 has provided a growth tailwind to the company that has only begun. The company took advantage of the rapid growth brought by the policy to strengthen its balance sheet, including improving margin, cutting costs and expenses, and paying down debt. And with its strategic position in the supply chain, we believe more growth in the medium term could be expected. The company's stock has been impacted by recent market weakness and could still be impacted going forward by bearish sentiment. But it is currently undervalued, and we will initiate coverage of the stock with a buy.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.