Shopify: Getting Rid Of Its Logistics Business

Summary

- Shopify dropped a stunning announcement as it sells its logistics business to Flexport, reversing a buildout since 2019.

- The company also slashed 23% of its workforce (including its logistics business) as Shopify refocuses on its core business.

- Management updated its free cash flow outlook, expecting free cash flow profitability for the rest of 2023.

- As such, the disposal of its logistics business has given impetus to the market, as SHOP surged more than 25% at writing.

- With SHOP's valuation reaching highly unattractive zones, don't be tempted to jump in.

- I do much more than just articles at Ultimate Growth Investing: Members get access to model portfolios, regular updates, a chat room, and more. Learn More »

Sean Gallup

Shopify (NYSE:SHOP) dropped two stunning announcements as the leading e-commerce platform provider released its FQ1'23 earnings.

The company decided to sell its logistics business (Deliverr, most of Shopify Fulfillment Network, or SFN) to Flexport, a "leading tech-driven global logistics platform." As such, it reverses a buildout that started in 2019 when it started to develop SFN.

The company focused on developing an "asset-light" and less capital-intensive logistics infrastructure, culminating with the Deliverr acquisition in 2022. However, that acquisition was poorly received last year, as it caused a massive downgrade in Wall Street's estimates of its free cash flow or FCF profitability.

Notably, the acquisition of Deliverr was initially expected to "affect its FCF margins markedly through FY24."

Management also alluded to the dilutive impact at its earnings conference as CFO Jeff Hoffmeister stressed that "Deliverr historically has been a headwind to margins."

Therefore, we assessed that the strategic U-turn by Shopify management in further building out its logistics infrastructure was a nod to recovering its profitability metrics.

Notably, management updated its FCF outlook for FY23, accentuating that the company "plans to achieve free cash flow profitability for each quarter of 2023."

That's a significant revision from the previous consensus estimates, which projected negative FCF through FY24. Therefore, with Shopify Logistics expected to be disposed of, management demonstrated that the focus is on higher-margin software platform-driven profitability.

Despite that, investors must account for revenue growth headwinds after Q2, as Deliverr was expected to be a critical revenue driver for Shopify. Morningstar highlighted in a previous commentary that "SFN should continue to drive strong revenue growth over the medium term."

However, Deliverr's dilutive impact on Shopify's gross margins and FCF profitability should be mitigated markedly, as indicated by management's outlook.

Despite that, management was cautious in its Q2 guidance, as it guided "gross margin percentage in Q2 is expected to be similar to the Q1 level."

Accordingly, Shopify posted a GAAP gross margin of 48% for FQ1, below last year's 53% (pre-Deliverr). It's largely in line with the consensus estimates. However, the accretive impact should be felt after Q2, in line with the more optimistic FCF outlook moving ahead.

The other critical announcement was the shedding of about 23% of Shopify's headcount, which reached 11.6K at the end of 2022. While the company didn't disclose the exact contribution from its logistics business, we expect most of the impact should be attributed to that segment. Management also highlighted that "the sale of the logistics business will be a factor in the 23% reduction in Shopify's workforce."

The OpEx guidance for H2 (post-logistics disposal) is uncertain for now, as management was reticent to provide more clarity. However, management stressed that the company will see a "partial impact" in Q2, with "more guidance will be provided in the quarterly results next quarter."

Nevertheless, Shopify guided for sequentially lower OpEx in Q2, indicating a decrease of "mid-single-digit percentage versus Q1."

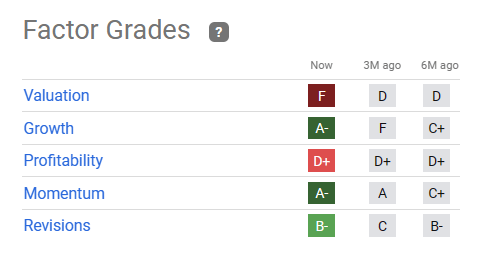

SHOP quant factor ratings (Seeking Alpha)

We assessed that SHOP's valuation has surged into highly unattractive zones, given the 25% post-earnings pop, as market operators attempt to price in the expected profitability improvement.

As such, by the time you read this update, the entry levels are already not constructive, even though SHOP is no longer mired in a medium-term downtrend.

Our assessment indicates that dip buyers have returned since late last year, buying significant dips, with momentum investors coming on board in early 2023 (as SHOP's trend reversed from negative to positive).

However, chasing momentum when SHOP's valuation is given an F grade by Seeking Alpha's Quant is probably not the smartest thing to do, no matter how tempting it is to jump on board.

Rating: Hold (Reiterated).

Important note: Investors are reminded to do their own due diligence and not rely on the information provided as financial advice. The rating is also not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have additional commentary to improve our thesis? Spotted a critical gap in our thesis? Saw something important that we didn't? Agree or disagree? Comment below and let us know why, and help everyone in the community to learn better!

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA's bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!

This article was written by

Seeking Alpha features JR Research as one of its Top Analysts to Follow for Technology, Software, and the Internet. See: https://seekingalpha.com/who-to-follow

JR Research was featured as one of Seeking Alpha's leading contributors in 2022. See: https://seekingalpha.com/article/4578688-seeking-alpha-contributor-community-2022-by-the-numbers

Unlock the key insights to growth investing with JR Research - led by founder and lead writer JR. Our dedicated team is focused on providing you with the clarity you need to make confident investment decisions.

Transform your investment strategy with our popular Investing Groups service.

Ultimate Growth Investing specializes in a price action-based approach to uncovering the opportunities in growth and technology stocks, backed by actionable fundamental analysis.

We believe price action is a leading indicator.

Price action analysis is a powerful and versatile toolkit for the informed investor because it can be used to analyze any publicly traded security. As such, it offers investors with invaluable insights into understanding market behavior and sentiments.

Plus, stay ahead of the game with our general stock analysis across a wide range of sectors and industries.

Improve your returns and stay ahead of the curve with our short- to medium-term stock analysis.

We not only identify long-term potential but also seize opportunities to profit from short-term market swings, using a combination of long and short set-ups.

Join us and start seeing experiencing the quality of our service today.

Lead writer JR's profile:

I was previously an Executive Director with a global financial services corporation. I led company-wide award-winning wealth management teams that were consistently ranked among the best in the company.

I graduated with an Economics Degree from National University of Singapore [NUS]. NUS is Asia's #1 university according to Quacquarelli Symonds [QS] annual higher education ranking. It also held the #11 position in QS World University Rankings 2022.

I'm also a Commissioned Officer (Reservist) with the Singapore Armed Forces. I was the Battalion Second-in-command of an Armored Regiment. I currently hold the rank of Major. I graduated as the Distinguished Honor Graduate from the Armor Officers' Advanced Course as I finished first in my cohort of Armor officers. I was also conferred the Best in Knowledge award.

My LinkedIn: www.linkedin.com/in/seekjo

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.