Prologis: A Buffett-Style Ultra SWAN REIT Buy

Summary

- REITs have been hammered by rising rates, fears of recession, and investors' panic over the regional banking crisis.

- Prologis, Inc. went from 65% overvalued to 6% undervalued, and is the ultimate Warren Buffett-style "wonderful company at a fair price" REIT buy.

- The largest industrial REIT in the world is still growing at double-digits and management has a $40 billion growth plan.

- Prologis is one of just eight A rated REITs in America, and is on track to become the first A+ rated REIT in history in 2025 or 2026.

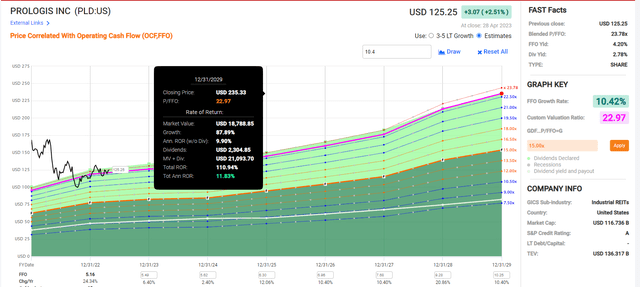

- Prologis offers about 40% total return potential over the next 3 years, 110% over the next six, and 13% to 14% long-term return potential, similar to what it's delivered over the last 26 years.

- Looking for more investing ideas like this one? Get them exclusively at iREIT on Alpha. Learn More »

Marcus Lindstrom

This article was published on iREIT on Alpha on Tuesday, May 2, 2023, and was coproduced with Dividend Sensei.

The recession is likely coming in July or August, and some economic data says it's already here.

This probably isn't a surprise, given that this is literally the most anticipated recession in history.

almost all CEOs expect a recession in 2023

80% of Americans do

the Fed does

the bond market says 100% chance of recession by October 2024.

The good news is that it's likely to be the mildest recession in history.

In fact, the current FactSet economist consensus is that full-year growth in 2023 will be 1% and 1.1% in 2024.

The mildest recession so far was 2001's -0.4% full-year growth.

What does this mean? That most of the incredible bargains you see today are safe to buy.

Let me show you why the real estate investment trust, or REIT, sector is one of the best dividend blue-chip bargain-hunting areas, and why Prologis, Inc. (NYSE:PLD) is the ultimate Buffett-style Ultra SWAN REIT buy.

REITs Are On Sale

While the S&P 500 (SP500) is now just 11% off its highs, including dividends, REITs are in a 25% bear market. Prologis recently fell into a 45% bear market. Prologis since has rallied strongly off its June 2022 lows, but remains in a 26% bear market.

The reason for the REIT bear market is easy to understand, and much of it is a market overreaction.

We've seen interest rates rise sharply, and for ten years, Wall Street thought of REITs as a "bond alternative."

In fact, REITs are nothing like bonds other than that they generate income that is taxed at ordinary income rates.

Another reason for the REIT bear market is memories of the Great Financial Crisis, when the overleveraged REIT sector was forced to slash dividends when credit markets seized up.

First Republic is being acquired by JPMorgan and is the 4th U.S. banking failure this year

it was the 12th biggest bank in America

and the 2nd biggest bank failure in history.

In the Great Recession, only 17 REITs avoided cutting their dividends. However, today the sector has the strongest balance sheet in history, with safe leverage ratios, high-interest coverage ratios, and the longest duration of its bonds ever.

67% to 80% of commercial real estate lending comes from regional or community banks, depending on the sector.

But guess what? Large REITs like PLD have nothing to worry about from the regional banking crisis.

Prologis Is One Of 18 A-Rated REITs

There are just 18 A-rated REITs, and seven with an A credit rating, the highest in the industry. Prologis has an A stable credit rating, upgraded from A- by S&P.

S&P upgraded PLD in August of 2022, right near its cycle bottom, citing strong industry tailwinds and the benefits of the Duke Realty merger that made PLD the titan of industrial REITs.

So why did PLD fall 45% in this bear market?

The Prologis Bubble Has Burst, It's Time To Start Buying If You Haven't Already

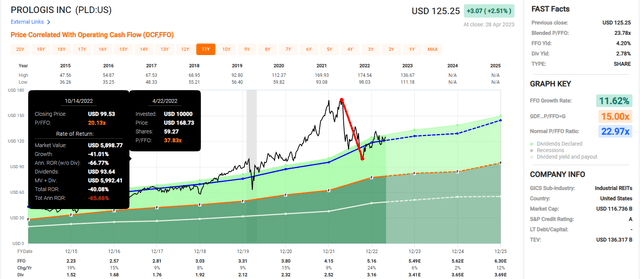

FAST Graphs, FactSet

After the Pandemic lockdowns triggered massive growth in online sales, PLD took off like a rocket. A REIT that normally trades around 23 times funds from operations, or FFO, hit a peak multiple of 38, a 65% historical premium.

The S&P hit a 50% premium in the tech bubble for context. PLD was priced as if the Pandemic online sales boom would last forever, and obviously, it couldn't.

Here are the growth rates for retail e-commerce in the U.S. by year, according to Statista:

2018: 10%

2019: 10%

2020 (Pandemic): 28%

2021 (Record Stimulus): 23%

2022: 8%

2023: 18%

2024: 16%

2025: 16%

2026: 7%

2027: 8%

From 2022 to 2027, Statista estimates 13% annual sales in e-commerce sales, meaning PLD benefits from a very strong secular trend.

In 2023, 23% of retail sales are expected to be online, a figure that could easily go to 50% eventually. And PLD isn't just a great industrial REIT; it's the ultimate Buffett-style industrial REIT.

Prologis Is The Largest Industrial REIT

Founded in 1991 in San Francisco, Prologis is the largest industrial REIT in the world.

Its roots actually go back to 1983.

It operates in North America, Latin America, Europe, and Asia, with 5,495 properties representing 1.2 billion square feet on four continents.

It has 6,600 major tenants, and 2.8% of global GDP flows through its distribution centers.

In fact, in the 19 countries in which it operates, 4% of GDP flows through its distribution centers. 1.1 million employees work under PLD's roofs.

Prologis even has an asset management business that invests in industrial real estate for institutional clients. That business has $196 billion in assets under management that make up 17% of its revenue.

19% of its rent is from its top 20 customers, one of the most diversified REITs in the world.

And who are PLD's tenants? The biggest names in omnichannel and e-commerce.

UPS

Walmart

Amazon

Home Depot

BMW

Pepsi

3M

Samsung

FedEx

Maersk (the world's largest shipper)

J.B Hunt (the delivery giant).

In Q1, PLD reported 12% growth in FFO/share and 16% growth in core FFO (what it calls AFFO).

“As leases continue to roll to market, our portfolio should see 8-10% net effective NOI for several years." - PLD investor presentation.

Management thinks its organic growth rate should be about 9% for the next several years.

PLD's occupancy rate is 98% at the end of Q1, one of the highest occupancy rates in REIT sector history for any REIT.

What about the coming recession? It's expected to be the mildest in history. In fact, the FactSet economist consensus says there won't be a recession at all.

Q1 growth: 1.1%

Q2 consensus: 0.4%

Q3 consensus: -0.6%

Q4 consensus: 0%

2023 full year: 1.0%

2024 full year: 1.1%

2025 full year: 2.0%

How does the weakening GDP growth affect PLD's occupancy rate? It's expected to normalize to 97% long term, and come in at 97.5% in 2023, the year of the mildest recession in history.

PLD's asset management business consists of 140 institutional investors, and its assets under management, or AUM, have been growing at 17% annually since 2018. That's driven by 17% annual fee growth and 21% fee earnings growth. In 2022, PLD generated almost $500 million in net profit from its asset management business.

That's courtesy of 75% operating margins on that part of the business.

In the last 20 years, PLD has invested $20 billion and potentially could invest many times more over the next 20 years.

PLD's land bank, the land it has the legal ability to develop, is 220 million square feet and represents a potential $39 billion investment opportunity.

And that's just its current growth potential, never mind over the next 10 to 20 years.

How on earth is PLD going to fund such a mammoth growth backlog?

“In June, we terminated our global senior credit facility (the “2019 Global Facility”) and entered the 2022 Global Facility with a borrowing capacity of up to $3.0 billion and an extended initial maturity date of June 2026. We also upsized our second global senior credit facility (the “2021 Global Facility”), increasing its borrowing capacity to $2.0 billion. This resulted in increasing our total borrowing capacity under both facilities to $5.0 billion and modifying the base rate of the aggregate lender commitments in U.S. dollars from the U.S. dollar London Inter-bank Offered Rate to the Secured Overnight Financing Rate." - PLD 10K (emphasis added).

PLD has a $5 billion credit facility and a $417 million yen credit revolver. After Q1, its liquidity is $3.1 billion.

Those revolvers are provided by a consortium of banks, including:

PLD's risk from the regional banking crisis is nearly zero.

In fact, its A credit rating means its 30-year bankruptcy risk is 0.66%, tied for the lowest in the REIT sector.

Its net debt/EBITDA ratio is 4.0, and S&P says that if it sustains it below 4.5 for several years, it might get an upgrade to A+, the first REIT in America to enjoy such a rating.

Here are PLD's consensus leverage forecasts:

2023: 4.6

2024: 4.6

2025: 3.8

By 2026, PLD might become the highest-rated REIT in America (A+), with a 0.6% 30-year bankruptcy risk.

Management says its current investment capacity is $19.9 billion, half of its total growth potential.

Thanks to having just 30% of its clients exposed to cyclical parts of the economy, PLD's occupancy is very stable, even in severe recessions.

In the last seven years, it's never dipped below 96.2%.

This is likely why industrial real estate prices have held up so well in the last 12 months, falling 13% while office REITs are down 25%, apartments are down 22%, and malls are down 18%.

PLD's tenants are so strong that the worst rental default rate ever experienced was 0.55% during the Great Recession.

During the Pandemic, 0.4% of its rent defaulted.

In 2022 it was 0.15%.

Why is PLD's rent default so low?

Because 39% of its customers are consumer staples businesses.

And another 31% are in strong secular trends like e-commerce and healthcare.

Just 5% of supply chain costs are rent, compared to 50% for transportation, 27.5% for labor, and 22.5% for inventory.

This is why PLD has been able to raise its rent by nearly 10% annually on its large and very well-capitalized tenants.

It's why PLD has been able to grow its dividends at 12% annually for the last five years and yet retain $1 billion in post-dividend free cash flow in 2023 per management guidance.

“Chair and CEO Hamid Moghadam co-founded AMB Property in 1983 and led it through the 2011 merger with Prologis to form its current version. Almost all of Moghadam’s leadership team members have deep company experience and legacy roots before the merger. The current team has created much value for shareholders after the merger and managed turbulent times during the financial crisis. Prologis has substantially increased funds from operations over the past business cycle, exemplifying management’s resilience after a tough time in real estate."

- Morningstar.

That's a management team led by a CEO who has been with PLD since 1983, and its entire management team is extremely battle-tested, including with smart M&A like Duke Realty, DCT Industrial, and Liberty Property Trust.

They guided PLD through the Great Recession, the Pandemic, and five total recessions, including 2 of the worst economic catastrophes in 70 years.

It's a management team that Morningstar estimates has created $10 billion in shareholder value in the last 20 years and could deliver another $20 billion in the next 20.

The bottom line is PLD is the king of global industrial REITs and the ultimate Ultra SWAN in its space.

Sector-Leading Long-Term Growth Prospects

You might imagine that a global titan like PLD, with 5,500 properties, can't grow quickly. But you'd be wrong.

Metric | 2022 Growth | 2023 Growth Consensus (Recession) | 2024 Growth Consensus | 2025 Growth Consensus |

Sales | 18% | 2% | 11% | 15% |

Dividend | 25% | 10% (Official) | 7% | 5% |

FFO | 24% | 6% | 2% | 12% |

AFFO | 39% | -1% | 3% | 17% |

EBITDA | 17% | 22% | 5% | 19% |

EBIT (operating income) | 25% | 28% | 2% | 16% |

(Source: Fast Graphs, FactSet.)

After a slow year or two due to the recession, PLD's growth is expected to accelerate back to double-digits, including 12% FFO and 17% AFFO growth in 2025.

What about long-term growth?

Long-Term Total Return Consensus

Investment Strategy | Yield | LT Consensus Growth | LT Consensus Total Return Potential | Long-Term Risk-Adjusted Expected Return |

Vanguard Dividend Appreciation ETF | 2.0% | 11.3% | 13.2% | 9.3% |

Prologis | 2.8% | 10.4% | 13.2% | 9.2% |

Nasdaq | 0.8% | 11.2% | 12.0% | 8.4% |

Schwab US Dividend Equity ETF | 3.6% | 7.6% | 11.2% | 7.8% |

REITs | 3.9% | 7.0% | 10.9% | 7.6% |

Dividend Champions | 2.6% | 8.1% | 10.7% | 7.5% |

Dividend Aristocrats | 1.9% | 8.5% | 10.4% | 7.3% |

S&P 500 | 1.7% | 8.5% | 10.2% | 7.1% |

60/40 Retirement Portfolio | 2.1% | 5.1% | 7.2% | 5.0% |

(Sources: DK Research Terminal, FactSet, Morningstar.)

PLD is expected to remain one of the fastest-growing REITs in the sector for the foreseeable future, with 10.4% growth driving around 13.2% long-term total returns.

That's potentially better than the aristocrats, S&P, and even the Nasdaq.

Total Returns Since 1997

Since 1997, PLD has delivered 1416% total returns compared to the S&P's 581%.

Its average 12-month rolling return is 14.8%, similar to what analysts expect in the future.

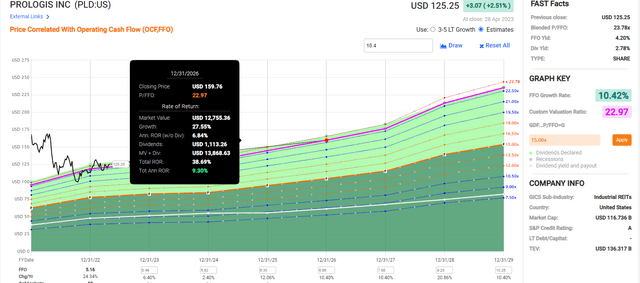

Prologis 2025 Consensus Total Return Potential

FAST Graphs, FactSet

PLD isn't a screaming bargain but still offers an attractive 38% upside over the next three years.

FAST Graphs, FactSet

PLD's 6-year return potential is 110%, as good as Microsoft's.

A Buffett-Style Wonderful Company At A Fair Price

"It's far better to buy a wonderful company at a fair price than a fair company at a wonderful price." - Warren Buffett

What is a fair price for PLD? Let's ask millions of income investors over time.

Historically, PLD trades at 22.5 to 24.5 times FFO, not anywhere close to the almost 40 it hit at the post-pandemic peak.

90% probability intrinsic value is within this range.

Metric | Historical Fair Value Multiples (11-Years) | 2022 | 2023 | 2024 | 2025 | 2026 | 12-Month Forward Fair Value |

5-Year Average Yield | 2.50% | $126.40 | $139.20 | $139.20 | $156.00 | NA | |

P/FFO | 22.97 | $118.53 | $126.11 | $129.32 | $149.08 | $165.15 | |

Average | $118.53 | $132.33 | $134.08 | $152.46 | $165.15 | $132.94 | |

Current Price | $125.25 | ||||||

Discount To Fair Value | -5.67% | 5.35% | 6.58% | 17.85% | 24.16% | 5.78% | |

Upside To Fair Value (including dividend) | -5.37% | 5.65% | 7.05% | 21.72% | 31.86% | 8.91% | |

2023 FFO | 2024 FFO | 2023 Weighted EPS | 2024 Weighted EPS | 12-Month Forward EPS | Historical Average Fair Value Forward P/FFO | Current Forward P/FFO | EV/EBITDA |

$5.49 | $5.63 | $3.59 | $1.95 | $5.54 | 24.0 | 22.6 | 23.8 |

PLD is historically worth about 24X cash flow, including the dividend yield, and today trades at 22.6 and 23.8 EV/EBITDA.

It's about 6% historically undervalued with about 9% upside to fair value.

Rating | Margin Of Safety For Very Low-Risk 13/13 Ultra SWAN | 2023 Fair Value Price | 2024 Fair Value Price | 12-Month Forward Fair Value |

Potentially Reasonable Buy | 0% | $132.33 | $134.08 | $132.94 |

Potentially Good Buy | 5% | $125.71 | $127.37 | $126.29 |

Potentially Strong Buy | 15% | $112.48 | $113.97 | $112.99 |

Potentially Very Strong Buy | 25% | $94.28 | $100.56 | $99.70 |

Potentially Ultra-Value Buy | 35% | $86.01 | $87.15 | $86.41 |

Currently | $125.25 | 5.35% | 6.58% | 5.78% |

Upside To Fair Value (Including Dividends) | 8.43% | 9.83% | 8.91% |

For anyone comfortable with its risk profile, PLD is a potentially good buy.

Risk Profile: Why Prologis Isn't Right For Everyone

There are no risk-free companies, and no company is right for everyone. You have to be comfortable with the fundamental risk profile.

Prologis Risk Profile Summary

“We view additional supply as the greatest threat to Prologis. Low barriers to entry in most markets should allow a significant increase in new construction to continue. The delivery volumes have increased from around 50 million square feet in the year 2012 to an expected 350 million in 2022. The quick response from developers to capitalize on excess demand gives us hesitation about Prologis’ growth prospects in a fiercely competitive industry. Our concerns include Prologis’ ability to secure and maintain tenants and increase rents, which are difficult in such a fragmented industry where the end product is relatively commoditized.

On the demand side, macroeconomic conditions impacting the economy are our primary concern. Central banks around the globe have aggressively raised interest rates to combat high inflationary pressures. We think this presents a significant near-term macroeconomic challenge impacting consumer spending. In our opinion, an economic downturn will reduce consumer spending, reducing the demand for industrial space. The rise in e-commerce should continue to drive demand for warehouse space, but vertical integration among some of Prologis’ largest customers is a concern. Amazon and FedEx have made notable investments in distribution and logistics, so tenants taking distribution efforts in-house could lower demand for the firm's facilities. The company also exhibits more sensitivity to international political and trade tensions than some of its domestic competitors because of its sizable presence across various countries.

The company may face environmental, social, and governance, or ESG, risks that negatively affect the portfolio or cash flows. These include properly maintaining the safety of the buildings, paying a competitive wage, and meeting the sustainability requirements of their clients."

- Morningstar.

Prologis Risk Profile Includes

economic cyclicality risk (79% decline in FFO during the GFC)

oversupply risk (record amount of new industrial construction in recent years)

disruption risk (key tenants like AMZN and FDX could build their own warehouses, and replacing them might not be quick or easy)

global expansion risk: PLD operates in 19 countries and continues to expand, facing political and regulatory risks whenever it enters a new market

worker retention risk: still the tightest job market in 54 years.

How do we quantify, monitor, and track such a complex risk profile? By doing what big institutions do.

Long-Term Risk Management Analysis: How Large Institutions Measure Total Risk Management

DK uses S&P Global's (SPGI) global long-term risk-management ratings for our risk rating.

S&P has spent over 20 years perfecting their risk model

which is based on over 30 major risk categories, over 130 subcategories, and 1,000 individual metrics

50% of metrics are industry specific

this risk rating has been included in every credit rating for decades.

The DK risk rating is based on the global percentile of a company's risk management compared to 8,000 S&P-rated companies covering 90% of the world's market cap.

PLD scores 95th Percentile On Global Long-Term Risk Management

S&P's risk management scores factor in things like:

supply chain management

crisis management

cyber-security

privacy protection

efficiency

R&D efficiency

innovation management

labor relations

talent retention

worker training/skills improvement

occupational health & safety

customer relationship management

business ethics

climate strategy adaptation

sustainable agricultural practices

corporate governance

brand management

interest rate risk management.

PLD's Long-Term Risk Management Is The 47th Best In The Master List 91st Percentile In The Master List)

Classification | S&P LT Risk-Management Global Percentile | Risk-Management Interpretation | Risk-Management Rating |

BTI, ILMN, SIEGY, SPGI, WM, CI, CSCO, WMB, SAP, CL | 100 | Exceptional (Top 80 companies in the world) | Very Low Risk |

Prologis | 95 | Exceptional | Very Low Risk |

Strong ESG Stocks | 86 | Very Good | Very Low Risk |

Foreign Dividend Stocks | 77 | Good, Bordering On Very Good | Low Risk |

Ultra SWANs | 74 | Good | Low Risk |

Dividend Aristocrats | 67 | Above-Average (Bordering On Good) | Low Risk |

Low Volatility Stocks | 65 | Above-Average | Low Risk |

Master List average | 61 | Above-Average | Low Risk |

Dividend Kings | 60 | Above-Average | Low Risk |

Hyper-Growth stocks | 59 | Average, Bordering On Above-Average | Medium Risk |

Dividend Champions | 55 | Average | Medium Risk |

Monthly Dividend Stocks | 41 | Average | Medium Risk |

(Source: DK Research Terminal.)

PLD's risk-management consensus is in the top 9% of the world's best blue-chips, and is similar to:

Caterpillar (CAT): Ultra SWAN dividend aristocrat

Air Products and Chemicals (APD): Ultra SWAN dividend aristocrat

Toronto-Dominion Bank (TD): Ultra SWAN

Enbridge (ENB): Ultra SWAN global aristocrat

UnitedHealth Group (UNH): Ultra SWAN.

The bottom line is that all companies have risks, and PLD is exceptional at managing theirs, according to S&P.

How We Monitor PLD's Risk Profile

26 analysts

two credit rating agencies

28 experts who collectively know this business better than anyone other than management.

“When the facts change, I change my mind. What do you do, sir?"

- John Maynard Keynes

There are no sacred cows at iREIT or Dividend Kings. Wherever the fundamentals lead, we always follow. That's the essence of disciplined financial science, the math behind retiring rich and staying rich in retirement.

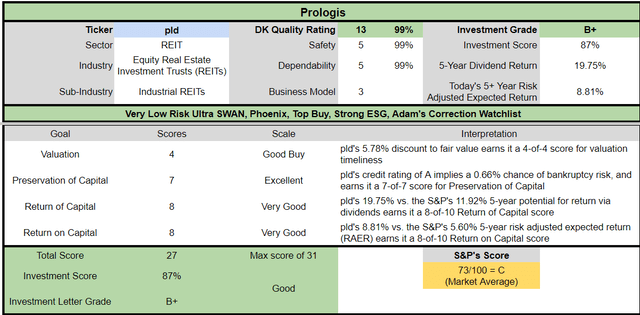

Bottom Line: Prologis Is Undervalued And A Buffett-Style Ultra SWAN REIT Buy

Dividend Kings Automated Investment Decision Tool

Let me be clear: I'm NOT calling the bottom in PLD (I'm not a market-timer).

Even Ultra SWAN kings can fall hard and fast in a bear market.

Fundamentals are all that determine safety and quality, and my recommendations.

over 30+ years, 97% of stock returns are a function of pure fundamentals, not luck

in the short term; luck is 25X as powerful as fundamentals

in the long term, fundamentals are 33X as powerful as luck.

While I can't predict the market in the short term, here's what I can tell you about PLD.

the highest-quality industrial REIT on Wall Street

the seventh highest quality company on the entire DK 500 Master List

one of just 8 A rated REITs in America

very safe 2.8% yield (1.05% risk of a dividend cut)

13% to 14% long-term return potential vs. 10.2% S&P

historically 6% undervalued

22.3X FFO vs. 22.5 to 24.5X historical

110% consensus return potential over the next six years, 12% annually, 2X more than the S&P 500

Almost 66% better risk-adjusted expected returns than the S&P 500 over the next five years

2X the income of the S&P over the next five years.

After five years of being overvalued, PLD is finally a good buy.

If you've ever wanted to own the world's premier industrial REIT, now is a potentially good to buy.

No, PLD isn't as good a deal as it was a few weeks ago. But it's the ultimate Buffett-style Ultra SWAN REIT "wonderful company at a good price."

One that could deliver 110% returns in the next six years, twice that of the S&P and equal to what Microsoft is expected to deliver, but with a 150% higher very safe yield.

Get My New Book For Free!

Join iREIT on Alpha today to get the most in-depth research that includes REITs, mREIT, Preferreds, BDCs, MLPs, ETFs, and we recently added Prop Tech SPACs to the lineup. Nothing to lose with our FREE 2-week trial.

And this offer includes a 2-Week FREE TRIAL plus my FREE book.

This article was written by

Brad Thomas is the CEO of Wide Moat Research ("WMR"), a subscription-based publisher of financial information, serving over 100,000 investors around the world. WMR has a team of experienced multi-disciplined analysts covering all dividend categories, including REITs, MLPs, BDCs, and traditional C-Corps.

The WMR brands include: (1) iREIT on Alpha (Seeking Alpha), and (2) The Dividend Kings (Seeking Alpha), and (3) Wide Moat Research. He is also the editor of The Forbes Real Estate Investor.

Thomas has also been featured in Barron's, Forbes Magazine, Kiplinger’s, US News & World Report, Money, NPR, Institutional Investor, GlobeStreet, CNN, Newsmax, and Fox.

He is the #1 contributing analyst on Seeking Alpha in 2014, 2015, 2016, 2017, 2018, 2019, 2020, 2021, and 2022 (based on page views) and has over 108,000 followers (on Seeking Alpha). Thomas is also the author of The Intelligent REIT Investor Guide (Wiley) and is writing a new book, REITs For Dummies.

Thomas received a Bachelor of Science degree in Business/Economics from Presbyterian College and he is married with 5 wonderful kids. He has over 30 years of real estate investing experience and is one of the most prolific writers on Seeking Alpha. To learn more about Brad visit HERE.Analyst’s Disclosure: I/we have a beneficial long position in the shares of PLD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Author's note: Brad Thomas is a Wall Street writer, which means he's not always right with his predictions or recommendations. Since that also applies to his grammar, please excuse any typos you may find. Also, this article is free: Written and distributed only to assist in research while providing a forum for second-level thinking.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.