- News

- City News

- Hyderabad News

- As farmers count losses, experts pitch for Telangana's own insurance scheme

Trending Topics

As farmers count losses, experts pitch for Telangana's own insurance scheme

Experts suggest state should create own insurance scheme

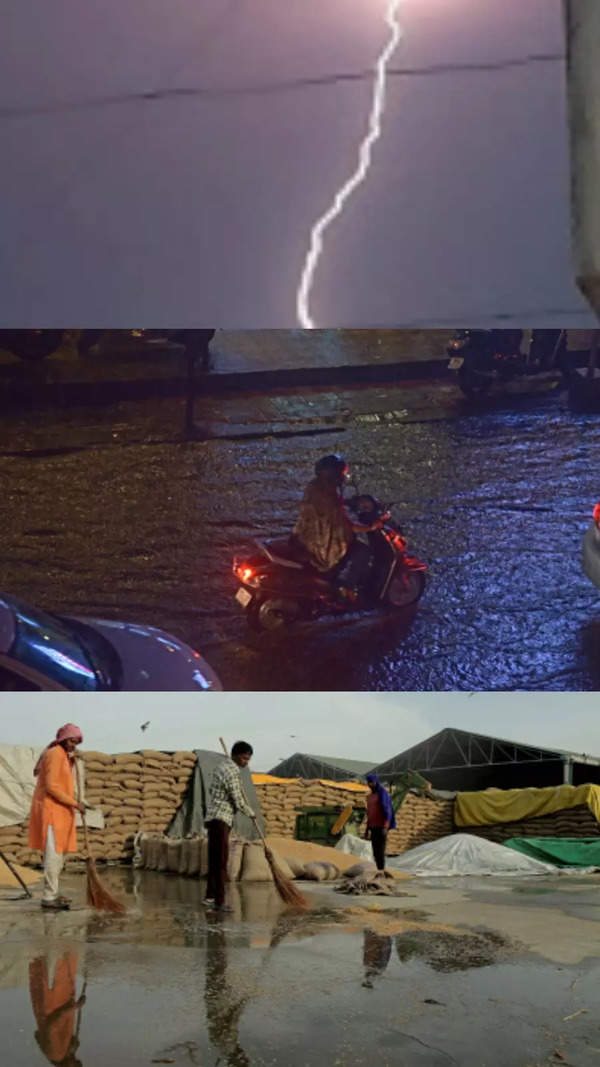

HYDERABAD: In the midst of massive crop damage caused by heavy rains and hailstorms in the state, call for implementation of a crop insurance scheme is growing louder. Telangana was part of the Centre's Pradhan Mantri Fasal Bima Yojana (PMFBY) until 2020, but opted out after the Centre gave the states the option to withdraw or continue in the scheme.

Experts and activists argue that the state can create its own insurance scheme with its own guidelines, free of the conditions that exist in Fasal Bima Yojana.

Fasal Bima Yojana covered a total of 9.9 lakh farmers in the state in 2018-19, compared to 8.2 lakh farmers in 2016-17 and 10.52 lakh farmers in 2017-18.

In 2019, it was announced that the Centre had almost halved its contribution to the schemes, reducing its share of the premium subsidy from 50% to 25% in irrigated areas and 30% in unirrigated areas. Few states, including Telangana and BJP-governed Gujarat, opted out of the scheme, as the Centre also provided an opportunity for states to frame their own schemes without any support from the Centre.

The Centre said that there will be no change in the rate of premium payable by farmers, which will remain at 2% for all kharif crops, 1.5% for all rabi crops, and a maximum of 5% for annual commercial and horticultural crops. "If the Centre reduces its share of the premium to 25% from 50%, it would mean that either farmer will now have to pay a total of 27% (25%) plus 2% or it will increase the burden on state governments, rendering the scheme unviable for farmers and states." Telangana Rythu Rakshana Samithi president Pakala Srihari said.

Experts said states such as Chhattisgarh, Gujarat, Andhra Pradesh, Jharkhand, Bihar and West Bengal have devised their own crop insurance schemes. "Andhra Pradesh is a good example where farmers do not have to pay any premiums and all farmers should be covered, as opposed to the central scheme where only farmers who take farm loans are covered." Ravi Kanneganti, a member of the Rythu Swarjya Vedika state committee, said. There is also a demand to implement weather-based crop insurance instead of measuring crop yield in a specific area of farming owned by the beneficiary farmer. "In the Fasal Bima Yojana, the guidelines on paying the insurance were such that farmers would get insurance only if crop yield was less than 80% of the average regular yield calculated, and farmers would get only about insurance amount equalling 10% to 20% of crop loss," Suresh Yadav, a farmer from Rangareddy district, said.

Weather-based crop insurance seeks to protect insured farmers from financial loss due to crop loss caused by adverse weather conditions such as rainfall, temperature, frost, humidity and others, an expert explained.

Experts and activists argue that the state can create its own insurance scheme with its own guidelines, free of the conditions that exist in Fasal Bima Yojana.

Fasal Bima Yojana covered a total of 9.9 lakh farmers in the state in 2018-19, compared to 8.2 lakh farmers in 2016-17 and 10.52 lakh farmers in 2017-18.

In 2019, it was announced that the Centre had almost halved its contribution to the schemes, reducing its share of the premium subsidy from 50% to 25% in irrigated areas and 30% in unirrigated areas. Few states, including Telangana and BJP-governed Gujarat, opted out of the scheme, as the Centre also provided an opportunity for states to frame their own schemes without any support from the Centre.

The Centre said that there will be no change in the rate of premium payable by farmers, which will remain at 2% for all kharif crops, 1.5% for all rabi crops, and a maximum of 5% for annual commercial and horticultural crops. "If the Centre reduces its share of the premium to 25% from 50%, it would mean that either farmer will now have to pay a total of 27% (25%) plus 2% or it will increase the burden on state governments, rendering the scheme unviable for farmers and states." Telangana Rythu Rakshana Samithi president Pakala Srihari said.

Experts said states such as Chhattisgarh, Gujarat, Andhra Pradesh, Jharkhand, Bihar and West Bengal have devised their own crop insurance schemes. "Andhra Pradesh is a good example where farmers do not have to pay any premiums and all farmers should be covered, as opposed to the central scheme where only farmers who take farm loans are covered." Ravi Kanneganti, a member of the Rythu Swarjya Vedika state committee, said. There is also a demand to implement weather-based crop insurance instead of measuring crop yield in a specific area of farming owned by the beneficiary farmer. "In the Fasal Bima Yojana, the guidelines on paying the insurance were such that farmers would get insurance only if crop yield was less than 80% of the average regular yield calculated, and farmers would get only about insurance amount equalling 10% to 20% of crop loss," Suresh Yadav, a farmer from Rangareddy district, said.

Weather-based crop insurance seeks to protect insured farmers from financial loss due to crop loss caused by adverse weather conditions such as rainfall, temperature, frost, humidity and others, an expert explained.

Start a Conversation

FOLLOW US ON SOCIAL MEDIA

FacebookTwitterInstagramKOO APPYOUTUBE