The market rebounded smartly after a correction in the previous session and closed nearly 1 percent higher on May 4, after the US Federal Reserve hiked rates by 25 bps and signalled a potential pause in the rate hike cycle.

The BSE Sensex rallied 556 points to 61,749 while the Nifty50 jumped 166 points to 18,256, the highest closing level since December 20 last year, and formed a long bullish candlestick pattern on the daily charts.

"Two days' consolidation provided a much-needed breather before the further rally. The current uptrend might remain in force as long as it sustains above 18,200," Rupak De, Senior Technical Analyst at LKP Securities said.

On the higher end, the rally might extend towards 18,500, he feels.

The rally was driven by banking and financial services, metal, technology and pharma stocks, while the broader markets also participated in the run-up as the Nifty Midcap 100 and Smallcap 100 indices gained 0.6 percent and 0.8 percent respectively.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks in this article are the aggregates of three-month data and not just the current month.

Key support and resistance levels on Nifty

The pivot charts indicate that the Nifty may get support at 18,120, followed by 18,073 and 17,996. If the index advances, 18,273 is the initial key resistance level to watch out for followed by 18,321 and 18,397.

The Bank Nifty also bounced back, and surpassed the immediate hurdle of 43,500, rising 373 points to 43,685, the highest closing level since the record high day (December 14 last year), and formed a long bullish candlestick pattern on the daily charts.

"The index remains in a strong buying momentum and one should keep a buy-on dip approach with potential targets of 44,000-44,300 on the upside," Kunal Shah, Senior Technical & Derivatives Analyst at LKP Securities said.

The lower-end support is at the 43,400-43,300 zone which will act as a cushion for the bulls, he said.

As per the pivot point calculator, the Bank Nifty may take support at 43,345, followed by 43,221 and 43,020. Key resistance levels are expected to be 43,747, along with 43,871 and 44,072.

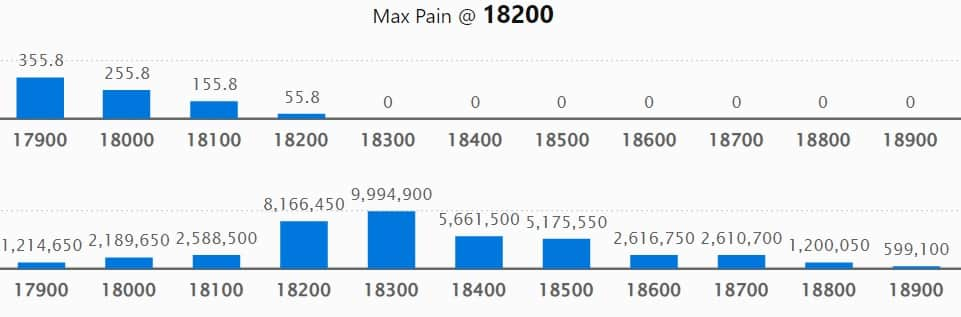

On the weekly options front, we have seen the maximum Call open interest (OI) at 18,300 strike, with 99.94 lakh contracts, which is expected to be a crucial resistance level for the Nifty in the coming sessions.

This was followed by 18,200 strike, comprising 81.66 lakh contracts, and 18,400 strike, with more than 56.61 lakh contracts.

Call writing was seen at 18,300 strike, which added 5.87 lakh contracts, followed by 19,100 strike, which accumulated 34,550 contracts.

Call unwinding was at 18,100 strike, which shed 59.64 lakh contracts, followed by 18,200 strike, which shed 59.11 lakh contracts, and 18,500 strike, which shed 30.03 lakh contracts.

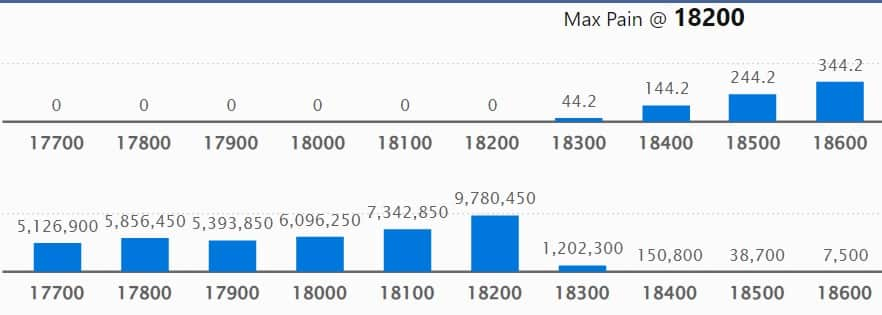

The maximum Put open interest was at 18,200 strike with 97.8 lakh contracts, which is expected to act as support in the coming sessions.

This was followed by the 18,100 strike, comprising 73.42 lakh contracts, and the 18,000 strike where we have 60.96 lakh contracts.

Put writing was seen at 18,200 strike, which added 69 lakh contracts, followed by 17,200 strike, which added 9.28 lakh contracts, and 18,300 strike, which added 5.63 lakh contracts.

We have seen Put unwinding at 18,000 strike, which shed 38.07 lakh contracts, followed by 17,900 strike, which shed 35.18 lakh contracts, and 17,800 strike, which shed 22.71 lakh contracts.

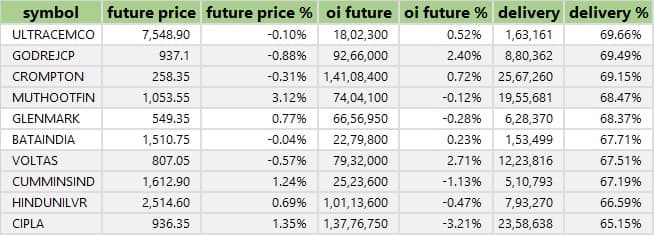

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in the stock. The highest delivery was seen in UltraTech Cement, Godrej Consumer Products, Crompton Greaves Consumer Electricals, Muthoot Finance and Glenmark Pharma among others.

An increase in open interest (OI) and price typically indicates a build-up of long positions. Based on the OI percentage, 73 stocks, including ABB India, Coromandel International, Cholamandalam Investment, LIC Housing Finance and Max Financial Services saw long build-ups.

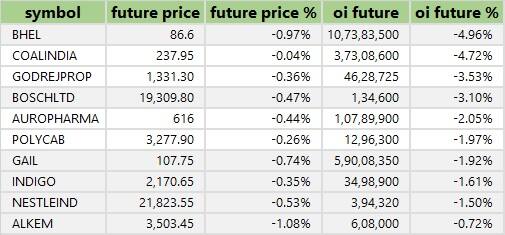

A decline in OI and price generally indicates a long unwinding. Based on the OI percentage, 20 stocks, including BHEL, Coal India, Godrej Properties, Bosch, and Aurobindo Pharma saw a long unwinding.

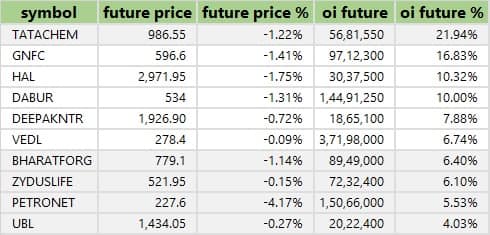

33 stocks see a short build-up

An increase in OI along with a price decrease indicates a build-up of short positions. Based on the OI percentage, 33 stocks, including Tata Chemicals, GNFC, Hindustan Aeronautics, Dabur India, and Deepak Nitrite saw a short build-up.

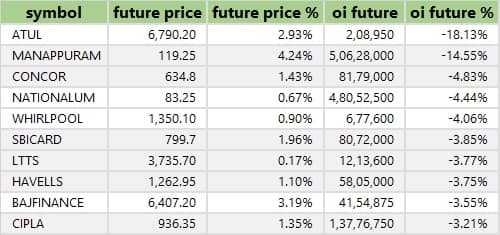

A decrease in OI along with a price increase is an indication of short-covering. Based on the OI percentage, 63 stocks were on the short-covering list. These included Atul, Manappuram Finance, Container Corporation of India, NALCO, and Whirlpool.

(For more bulk deals, click here)

Results on May 5, May 6, May 7

Britannia Industries, One 97 Communications, Adani Power, Ajanta Pharma, Alembic Pharmaceuticals, Bharat Forge, DCB Bank, Equitas Small Finance Bank, Federal Bank, Gujarat Fluorochemicals, Marico, Olectra Greentech, Piramal Enterprises, Sundaram-Clayton, Symphony, Tata Investment Corporation and Windlas Biotech will be in focus ahead of quarterly earnings on May 5.

Union Bank of India, Bank of India, 3i Infotech, ADF Foods, Aether Industries, Computer Age Management Services, Gujarat Ambuja Exports, Greenpanel Industries, Grindwell Norton, TVS Electronics, and Zen Technologies are going to be in focus ahead of quarterly earnings on May 6.

Coal India will release quarterly and full-year earnings on May 7.

Stocks in the news

Hero MotoCorp: The world's largest motorcycles and scooters maker has clocked a 37 percent year-on-year growth in profit at Rs 859 crore for the quarter ended March FY23, driven by healthy growth in operating performance and topline. Revenue from operations in Q4FY23 grew by 12 percent to Rs 8,307 crore compared to the year-ago period, with volume increasing 7 percent in the same period.

Tata Power Company: The power generation and distribution company has recorded a massive 48.5 percent on-year growth in consolidated profit at Rs 939 crore for March FY23 quarter on a low base and higher other income. Revenue from operations grew by 4.1 percent year-on-year to Rs 12,454 crore in Q4FY23, supported by its transmission and distribution business.

TVS Motor Company: The two-wheeler and three-wheeler manufacturer has reported a profit of Rs 410 crore for the quarter ended March FY23, a 50 percent growth over a year-ago period, beating analysts' estimates on all counts. Revenue from operations for the quarter at Rs 6,605 crore increased by 19.4 percent over the corresponding period last fiscal.

United Breweries: The alcoholic and non-alcoholic beverages maker has recorded a 94 percent year-on-year decline in profit at Rs 9.7 crore for the quarter ended March FY23, as operating performance dented due to continued inflationary pressures on the cost base, particularly on prices of barley and packaging materials. Revenue for the quarter grew by 3.4 percent to Rs 1,764.5 crore compared to the year-ago period.

Ceat: The RPG Group company has reported consolidated profit at Rs 133.7 crore for the March FY23 quarter, rising more than five-fold compared to Rs 25.3 crore in the same period last year due to healthy operating performance with a fall in input cost. Revenue from operations at Rs 2,875 crore grew by 11 percent over a year-ago period.

Zydus Life Sciences: The pharma company has received final approval from United States Food and Drug Administration (USFDA) to manufacture and market Sucralfate tablets USP, 1 gram. Sucralfate is used to treat and prevent ulcers in the intestines by forming a coating over ulcers, protecting the area from further injury.

Indraprastha Gas: Diversified renewable energy company ACME Cleantech Solutions and city gas distribution company IGL signed a memorandum of understanding (MoU) to jointly explore the potential business opportunities of green hydrogen.

Fund Flow

Foreign institutional investors (FII) bought shares worth Rs 1,414.73 crore, while domestic institutional investors (DII) purchased shares worth Rs 441.56 crore on May 4, provisional data from the National Stock Exchange showed.

Stocks under F&O ban on NSE

The National Stock Exchange has added GNFC and retained Manappuram Finance to its F&O ban list for May 5. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.