Alibaba: 2 Catalysts In Play For Over 50% Upside

Summary

- Alibaba is the "Amazon, PayPal, and YouTube of China."

- Amidst high geopolitical tensions, the stock trades with deep value.

- The stock trades at 10x earnings, even before accounting for net cash and equity investments worth 55% of the market cap.

- The company has been repurchasing shares for many quarters.

- Management has proposed a break-up of the company that may help realize tremendous shareholder value.

- Looking for a portfolio of ideas like this one? Members of Best Of Breed Growth Stocks get exclusive access to our subscriber-only portfolios. Learn More »

Andrew Braun

Alibaba (NYSE:BABA) is widely seen as an investment bellwether for Chinese equities and arguably, rightly so. The company has business units spanning across various secular growth sectors including e-commerce, fintech, and video streaming. After a brutal and sustained fall from all-time highs, BABA is trading at true value multiples, with a stock price at a low double-digit earnings multiple even before accounting for net cash and investments making up over 50% of the market cap. BABA has been buying back stock and has seen some strength after announcing plans to split the company into six segments. With various catalysts in place, I view BABA as being a top pick in the Chinese sector.

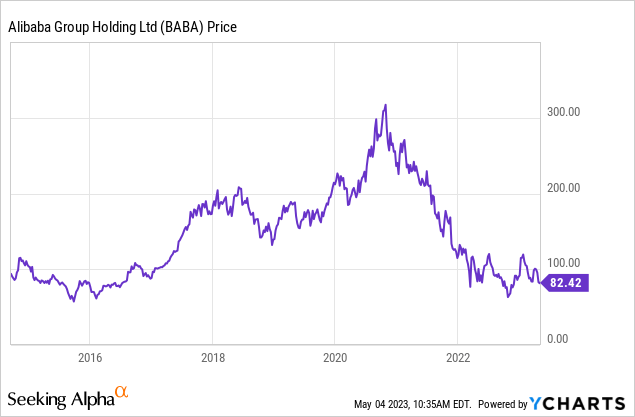

BABA Stock Price

BABA saw its stock surge in March after unveiling plans to split up its company. That helped the stock make up some of the year-to-date gains previously given up since February.

I last covered BABA in August 2022 where I discussed the stock's cheap valuation even before accounting for the cash and investments. The stock has since declined 8% but with visible catalysts now in play, I see an upside ahead.

BABA Stock Key Metrics

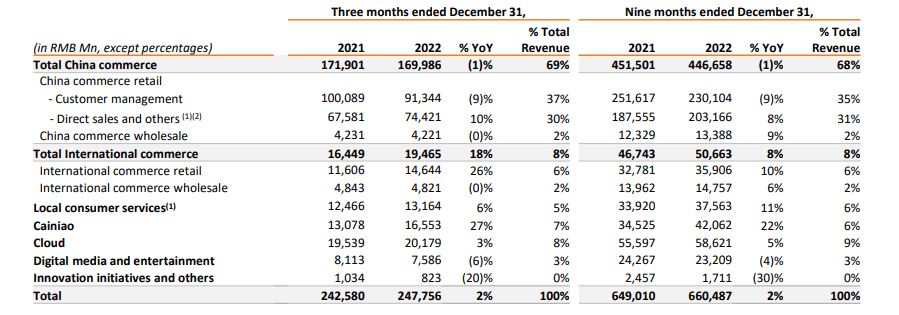

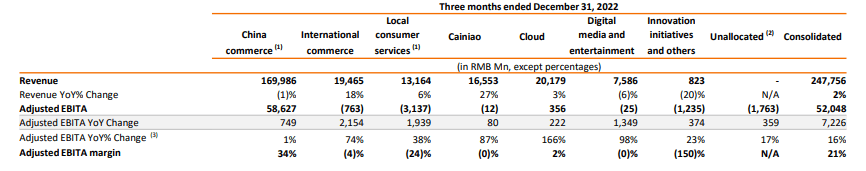

In its most recent quarter, BABA generated 2% overall revenue growth as strength in Cainiao and international commerce was offset by weakness in China commerce and cloud.

2022 Q3 Presentation

It is important to remember that China's economy has recovered much slower than others due to their longer and stricter pandemic restrictions. With China finally having eased those pandemic restrictions, BABA stands to be a clear beneficiary as consumers return to pre-pandemic spending habits.

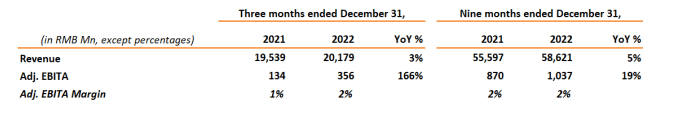

Readers may notice that their cloud division grew by only 3% in the quarter. I wouldn't count that business segment out just yet. On the conference call, management reiterated their confidence in that segment, pointing out that the proportion of IT spending within GDP in China was only 1% as compared to 5% in the United States. The proportion of cloud spending within IT spending was only 15% versus 21% in the United States. Over time, I expect those numbers to converge.

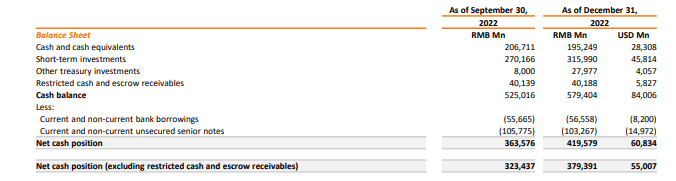

BABA ended the quarter with $55 billion in net cash as well as an additional $62 billion in equity investments. That made up roughly 55% of the recent market cap.

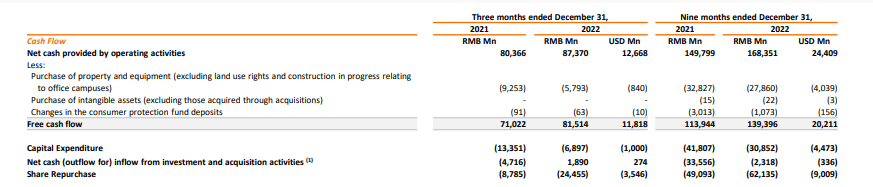

2022 Q3 Presentation

BABA had surprised me in late 2021 when the company significantly increased the aggressiveness of its share repurchase program. BABA continued to buy back stock in the quarter, with $3.5 billion in repurchases in the quarter and $9 billion over the past nine months.

2022 Q3 Presentation

On the call, management noted that they view the stock buyback as "a good way to return value to our shareholders" but are not considering expanding their share repurchase program, which has $21 billion remaining. While any increase in aggressiveness on that front would be quite bullish, I am already pleased with the current pace as it represents tangible progress towards improving investor sentiment.

Is BABA Stock A Buy, Sell, Or Hold?

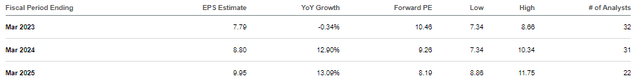

At recent prices, BABA was trading at around 10x earnings.

For a company owning the Chinese equivalents of Amazon (both the marketplace and AWS) (AMZN), PayPal (PYPL), Twitter (TWTR), YouTube (GOOGL), and more, that is arguably an excessively conservative valuation multiple. I previously discussed the net cash and investments making up around 55% of the market cap.

That valuation is also too cheap considering that most of the company's businesses are unprofitable, with most of the valuation being represented by the China commerce operations.

2022 Q3 Presentation

If only there was a way for the company to extract value from the unprofitable businesses, then this stock could soar, but how? Management has already come up with a plan, as they outlined plans to split up the company into six business segments. The six segments would be "Cloud Intelligence, Taobao Tmall Business, Local Services, Global Digital Business, Cainiao Smart Logistics, and Digital Media and Entertainment." The plan calls for each of these groups to be independently managed with their own CEO and board of directors. While that would undoubtedly add extra cost overhead, I see this plan as potentially creating shareholder value. The idea is that if one assigns the current 10x earnings multiple to the commerce operations, then any extra value in the remaining five business segments would be incremental to the stock price. The commerce operations generated $26 billion in annualized operating income over the past nine months. Assuming the same 13% tax rate, that amounts to $22.7 billion in net income. Based on a 10x earnings multiple, we arrive at $294 billion in equity value, already surpassing the current market cap (again, due to many of the other business segments generating operating losses).

The cloud division generated a slim 2% adjusted EBITA margin over the past nine months. But if we assign a conservative 6x sales multiple to this segment, then we arrive at $73 billion in equity value.

2022 Q3 Presentation

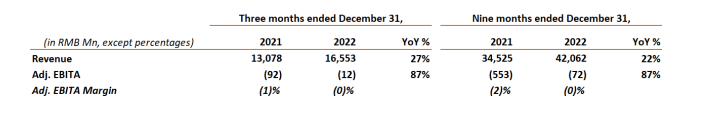

Cainiao generated a slight adjusted EBITA loss in the past three quarters but is estimated to have a $20 billion valuation.

2022 Q3 Presentation

Even before accounting for the remaining three segments, we already arrive at $387 billion in equity value, representing a stock price of $150 per share. Again, we have also not given any credit to the roughly $44 per share in value spread from the net cash and equity investments.

If BABA can execute on conducting IPOs on these business segments, then I can see the stock quickly converging towards fair value as greater investor attention would be placed on the remaining profitable commerce segment.

What are the key risks? The proposed catalyst may ironically be the most underappreciated risk. It is possible that the stock does not appreciate after the split up in businesses, and that shareholders are instead left with increased operating expenses. There is also the risk for foul play amidst the confusion. It is possible that some assets that were originally in the parent company disappear - long-time shareholders may be able to attest that the company has not always been very good at consistently listing out all of its assets year to year (the latter in itself is not an accusation of foul play but instead a reflection of the complexity of the VIEs). Regarding that point on VIEs, BABA is a variable interest entity which was designed to enable foreign investment in the company. The Chinese government does not explicitly allow foreign investors to own equity stakes in Chinese companies. BABA is a VIE incorporated in the Cayman Islands. Owners of BABA stock do not own the underlying company but instead have some sort of contractual obligations of the underlying earnings. For many years, this seemed to satisfy both sides of the table, as foreign investors felt comfortable with ownership of the earnings and the Chinese government seemed OK that foreign investors do not own the company. But any discerning eye will notice there is an inherent contradiction at play, and this has been an important reason why BABA is often the subject of delisting fears. There is also the overarching regulatory risk - investors might rightfully fear the potential for the Chinese government to exert shareholder-unfriendly actions on the company. The Chinese government has already acquired "golden shares" in some of the company's subsidiaries in January and may undertake similar actions in the future. That regulatory overhang may cause the stock to always trade at a discount valuation, and investors should keep this in mind when framing their bull cases. I rate BABA a buy in spite of these risks as the share repurchases and planned split-up appear to be attractive near-term catalysts.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Sign Up For My Premium Service "Best of Breed Growth Stocks"

After a historic valuation reset, the growth investing landscape has changed. Get my best research at your fingertips today.

Get access to Best of Breed Growth Stocks:

- My portfolio of the highest quality growth stocks.

- My best 10 investment reports monthly.

- My top picks in the beaten down tech sector.

- My investing strategy for the current market.

- and much more

Subscribe to Best of Breed Growth Stocks Today!

This article was written by

Julian Lin is a top ranked financial analyst. Julian Lin runs Best Of Breed Growth Stocks, a research service uncovering high conviction ideas in the winners of tomorrow.

Get access to his highest conviction ideas here.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BABA, GOOGL, AMZN, PYPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long all positions in the Best of Breed Growth Stocks Portfolio.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.