BILL Holdings: Too Risky For Me

Summary

- BILL Holdings is an established leader in its niche, demonstrating immense revenue growth since the company went public in December 2019.

- The company is a champion in beating consensus estimates, but the last time earnings were released it did not prevent a massive stock selloff in early February 2023.

- My valuation analysis suggests the stock is undervalued but uncertainty over the underlying assumptions is very high.

Phiromya Intawongpan

Investment thesis

BILL Holdings (NYSE:BILL) has demonstrated skyrocketing revenue since the company went public in late 2019. The company still did not break even from the operating profit perspective and in terms of below P&L lines, although the gross margin is stellar. I believe the company is moving in the right direction and have high conviction that BILL will achieve its long-term financial goals at some point in the future. But the uncertainty regarding the timing of the company achieving important financial milestones does not give me enough conviction to invest. I prefer to wait on the sidelines for sustainable trends which will give me a hint that the company is on a path of sustainable and forecastable earnings.

Company information

BILL is a leading provider in the niche of cloud-based software for managing back-office financial functions for small and medium businesses. The company's software platform is artificial intelligence-backed and enables users to digitally integrate information flows between customers, suppliers, and clients. BILL's platform helps back-offices to streamline such routine tasks as generating and processing invoices and managing payments including approvals. All functions can be synchronized across accounting systems.

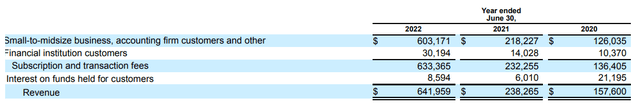

BILL generates revenue primarily from subscription and transaction fees. The company's fiscal year ends June 30. The company operates as one segment. BILL's sales from subscription and transaction fees are disaggregated by customer category. Revenue from interest on funds held for customers is also presented as a separate line in the disaggregated table below with amounts shown in thousands.

Financials and upcoming earnings preview

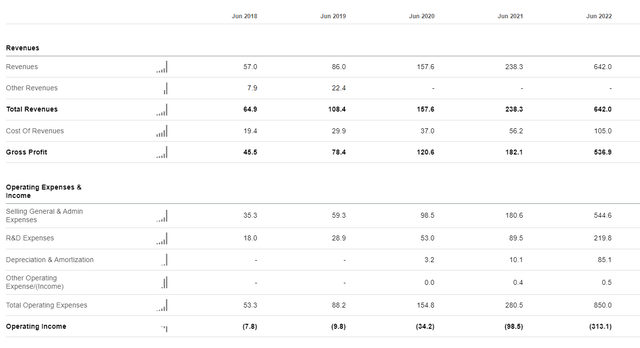

The company has demonstrated about a twelvefold revenue growth over the past five years representing a 62% CAGR, thanks to the low starting point. In the last FY 2022, the gross margin was a rockstar over 80% level. Though, the company still did not break even in terms of operating results and is a cash burner.

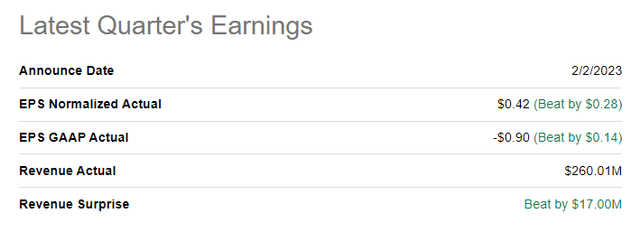

I will not pay much attention to the latest quarterly earnings, since fresh Q3 FY 2023 earnings are expected to be released today after the market close. I will just share the screenshot with the latest quarterly earnings summary and dig into more details to preview the upcoming earnings.

In the latest reported quarter, the company delivered a beat of consensus estimates both from the revenue side and from the EPS side. Revenue grew at an impressive 66% YoY rate and adjusted EPS demonstrated a second straight positive quarter for the first time in the company's history. Levered free cash flow [FCF] turned positive in Q2 FY 2023, but if we subtract stock-based compensation [SBC], BILL still did not break even in FCF terms.

Now let me move to the upcoming earnings preview. Consensus estimates forecast $247.21 million in quarterly sales indicating a sequential decline of about 5% and approximately 48% growth YoY. Adjusted EPS is expected to remain positive, though a sequential drop of 43% is expected.

If we look at the history of earnings surprises, the company has been strong in beating expectations since it went public. Altogether the company reported 13 previous quarters each time delivering a beat from the revenue side with only one time missing on EPS expectations. For me, this is a sign that the management is being very conservative in projecting growth.

Given the fact that a sequential decline is expected, it is highly likely that expectations are very conservative and BILL will beat them. But the last time the company reported its earnings big beat has been delivered also, but the stock price declined dramatically after the latest earnings were released. Price declined from almost $130 to approximately $95 dollars, representing a huge 27% single-day drop.

Such a massive selloff happened due to the decelerating spending of BILL customers, which was recognized by John Rettig, the company's CFO, who said that customer spending "deviate from typical seasonal patterns in this challenging environment."

Spending trends weakened throughout Q2 and notably in December when we typically see a seasonal spike in payment volume

This in turn led to stock target price downgrades by some of the investment banks, which also added reasons for investors to start dumping the stock.

Overall, I believe that there is a high probability that BILL will be able to beat consensus estimates as it usually does, but this will not necessarily become the catalyst for stock price appreciation. I think it can be a fifty-fifty game for event-driven investors who might seek a favorable entry opportunity to time the price using upcoming earnings as a catalyst.

Valuation

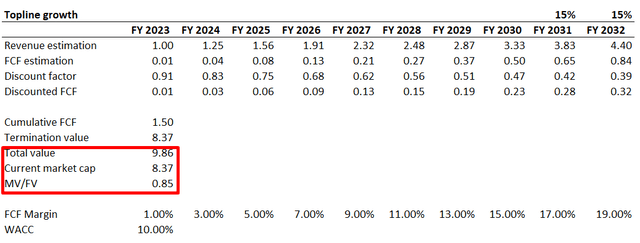

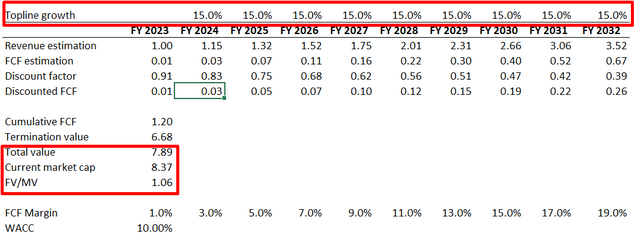

BILL is a rapidly growing company, so I use discounted cash flow [DCF] approach for valuation. To perform calculations, I need to select underlying assumptions. First, for the discount rate I use WACC provided by valueinvesting.io and round it up to 10%. For FCF I used consensus revenue growth projections. Revenue estimates are available up to fiscal 2030, so for 2031-2032, I use a 15% growth rate. As we have seen in the "Financials" section of the article, BILL still did not break even in terms of FCF ex-SBC, but the company already turned positive in terms of EPS in the last two quarters. To be conservative, I implement a 1% FCF margin for the fiscal year 2023 and expect it to expand by 2 percentage points each year.

Incorporating all the above assumptions into my DCF template gives me a slightly below $10 billion fair market value of the business which is about 15% higher than the current market cap.

The DCF model suggests the stock is attractively valued but here I would like to emphasize that the level of uncertainty over assumptions is very high. The company is still not generating sustainable positive FCF, so I believe undervaluation looks narrow, considering the level of optimism for my assumptions.

Please also note that DCF is substantially sensitive to the revenue growth pace changes. For example, for the base case scenario above, revenue CAGR over the next decade is projected at 16%. To demonstrate how sensitive to revenue growth model is, let me simulate a scenario with a 15% revenue CAGR with other assumptions untouched. As you can see below, just a percentage point of unfavorable change to revenue CAGR moves BILL stock from 15% undervalued to 6% overvalued.

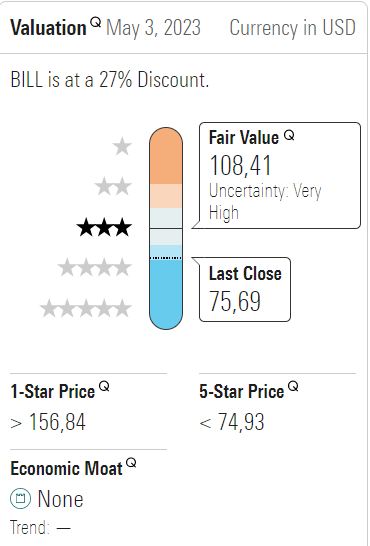

To cross-check myself I also refer to third-party opinion. I consider Morningstar Premium a reliable source of information, and they estimate that currently BILL is traded at a 27% discount. But the level of uncertainty is also set as "Very High".

Morningstar Premium

Risks to consider

For me as a potential investor, the most apparent risk is the fact that the company is still burning cash. While the company has delivered strong revenue growth in recent years, it has also incurred significant expenses related to sales and marketing, research and development, and general administrative costs. If the company is unable to achieve consistently positive cash flows before it runs out of liquidity, it will face the need to rely on new sources of financing which will undermine the business' value. Scarce liquidity might also lead to lost growth opportunities, which could negatively impact long-term prospects.

As a company that delivers services related to the clients' finance departments, BILL is operating with the clients' sensitive information. Therefore, I see cybersecurity risk as a significant one for the company. Any data breaches or security incidents could damage the company's reputation and lead to financial and legal liabilities.

I also consider entry barriers as low for potential new competitors of BILL. In recent years, several other companies have emerged in the back-office financial software market, offering similar solutions to BILL's platform. According to softwaresuggest.com, there are at least 20 alternatives to bill.com. Therefore, competition is fierce, and if the company fails to continue developing its platform it is highly likely to start losing market share to competitors.

Bottom line

To sum up, I prefer not to invest in BILL at the moment. For sure, stellar revenue growth over the last five years looks attractive but I have doubts about the timing of when BILL will achieve sustainable positive FCF, especially given the current challenging macro environment. Upcoming earnings look beatable but as the February 2023 history suggests this is not a guarantee that the stock will go up. I give the stock a neutral rating and prefer to wait on the sidelines for more evidence the company is able to sustain positive cash flows.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.