PDD Holdings: Attractive Valuation, But Too Much Controversy

Summary

- PDD is growing quickly and has an attractive valuation.

- However, controversies over its Pinduoduo app spying on its customers, allegations against its Temu operations, and increased competition in China are all red flags.

- As such, it's best to stay on the sidelines with the stock.

Akaka Images/E+ via Getty Images

PDD Holdings (NASDAQ:PDD) has strong growth and an attractive valuation, but the controversies surrounding the company keep me on the sidelines.

Company Profile

PDD operates online e-commerce platforms. Its primary business is its Pinduoduo platform in China. The platform has a "team purchase" model where buyers are encouraged to reach out to friends, family, and anyone else to make group purchases at lower prices.

Merchants on the platform handle fulfillment and select third-party logistic providers to deliver the goods to buyers. Items on the platform include things such as agricultural produce, apparel, shoes, food and beverage, electronics, appliances, furniture, household items, cosmetics, sports & fitness items, and auto accessories, among other items. The firm actively promotes produce from smallholder farmers, and it also has a next day grocery pick-up service called Duo Duo Grocery as well.

PDD primarily generates revenue from online marketing services where it matches product listings appearing in search results to its online marketplace. Nearly 80% of its revenue comes from online marketing services. Over 20% of its revenue, meanwhile, comes from transaction services where it charges merchants fees for value-added services. Under 1% of its revenue in 2022 came from direct merchandise sales on its platform.

The company launched its Temu platform in September 2022. The platform is meant to help PDD expand beyond China and offer buyers the ability to purchase products directly from global sellers, manufacturers, and brands.

Opportunities and Risks

The re-opening of the Chinese economy from Covid lock-downs presents both a potential opportunity as well as risk. A stronger Chinese economy overall should bode well for consumer spending. However, much like the U.S. and other countries, the lock-down could have pulled forward some e-commerce adoption and sales. Overall, I think the benefits of a re-opening China economy likely outweigh the pull-forward effect it may have had on the business.

PDD's Pinduoduo platform has clearly resonated well with the Chinese consumer, as well as merchants. It's something unique that is not found in the U.S. and it certainly appears to have some solid network effects.

With success, however, can come competition. The company got more aggressive with offering coupons and promotions around holidays such as Double 11 and Chinese New Year. This did not sit well with investors, which sold the stock off following its Q4 earnings report.

Discussing the competitive landscape on its Q4 earnings call, CEO Lei Chen said (translated):

"The e-commerce market in China is huge and it is for energy. Also with the optimization in pandemic control measures, it continues to show strong resilience and I believe it is easy for everybody to see the opportunities in this market. Therefore, I think it is natural and also logical for e-commerce peers to choose to raise lending, which makes competition more intense as a result. Also, we have noticed the recent moves in the industry. And we saw that different companies may form different strategies in face of competition. And as I have mentioned in my remarks, we believe that healthy competition is beneficial to consumers and the entire industry. But when competition intensifies, sometimes peers reaction could go in a different direction. And we always keep our duty in mind, focus on our own healthy development and embrace industry competition, even when sometimes it involves sustainable practices from peers.

"For us, we believe that serving consumers better is the key to creating long-term value and we will continue to provide consumers with more savings, more fun shopping experience. Therefore, we start from our own unique value proposition. And our team and I are exploring how to provide more value to consumers. And towards this end, we will continue to focus on R&D so that we can better understand the new needs and preferences of consumers, improve their shopping experience. And in this way, we can increase consumer satisfaction. At the same time, we are fully aware that we still have a lot to improve. So as a result, we will further step up investments, especially in the areas of agriculture and manufacturing sectors, as well as improved supply chain efficiency so that we can create more value for consumers and deepen our more savings, more from proposition."

One knock on PDD is that its platform is largely predicated on group buys of relatively cheap products, like produce or toilet paper. However, the growth has certainly been there, and there appears to be a nice benefit to the merchants. Active merchants on the platform grew from 11.5 million in 2021 to 13 million in 2022. The firm only had 3.6 million merchants at the end of 2018, so it has grown the number exponentially over the years.

Temu is another interesting opportunity for the firm. PDD hasn't talked much about the platform on its earnings calls, but it did run a big Super Bowl ad, which helped it become one of the most downloaded apps in the U.S. in a few month after launching. The platform also offers large coupons and heavy discounts to first time visitors.

In effect, Temu is in the process of essentially buying users who it will hope sticks around. Right now, the first part of drawing in visitors seems to be working, as it had 70.1 million unique U.S. visitors in February, according to Insider Intelligence. How successfully this translates into a business is still up in the air. Just look at the issues at Wish, which is owned by ContextLogic (WISH), a stock currently with a large negative enterprise value. Fast-fashion retailer Shein shows the upside, with nearly $23 billion in 2023 revenue, but comes with its own controversies.

Last month, the U.S.-China Economic and Security Review Commission put out a report that raised concerns over Temu, as well as Shein, as two companies that are violating intellectual property rights, exploiting trade loopholes, have product safety issues, and using forced labor.

Meanwhile, PDD's Pinduoduo app has been accused of spying on its users.

"We haven't seen a mainstream app like this trying to escalate their privileges to gain access to things that they're not supposed to gain access to," Mikko Hyppönen, chief research officer at Finnish security firm WithSecure, told CNN. "This is highly unusual, and it is pretty damning for Pinduoduo."

These issues are two obviously big risks associated with the stock.

Valuation

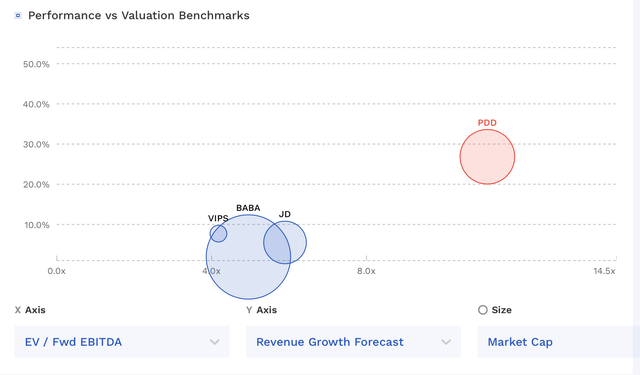

PDD trades at 11x the 2023 EBITDA of $5.88 billion and 8x the 2024 EBITDA consensus of $8.07 billion.

On a PE basis, it trades at 15.4x EPS estimates of $4.15. Based on the 2024 consensus for EPS of $5.29, it trades at 12.1x.

It's projected to grow revenue 26.8% in 2023 and 21.1% in 2024.

The stock trades at a much higher valuation than its Chinese e-commerce peers, but is projecting much stronger growth.

PDD Valuation Versus Peers (FinBox)

Conclusion

PDD looks attractively prices based on its growth projections and opportunities. However, when you throw in the recent controversies over its Pinduoduo app spying on its customers, the allegations against its Temu operations, and increased competition in China, it's a difficult stock to jump onboard.

While I think the growth story is interesting, it's just too spicy for me to get involved. I'd stay on the sidelines with this name.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.