The Dollar Is Weak, But My Income Is Rock Solid

Summary

- The U.S. Dollar is getting weaker.

- Interest rates are peaking.

- I am buying international closed-end funds for high income and potential for capital gains.

- Looking for a portfolio of ideas like this one? Members of High Dividend Opportunities get exclusive access to our subscriber-only portfolios. Learn More »

PeopleImages/iStock via Getty Images

Co-authored with Beyond Saving.

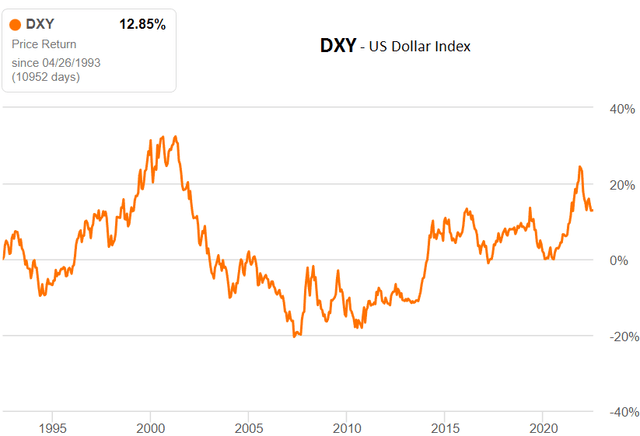

You have likely seen stories in the news about a weakening U.S. dollar. It's a topic that has garnered quite a bit of press coverage, discussing what it means for businesses, and the favorite topic today is the "threat" that the U.S. dollar might stop being the world's reserve currency. The "weakening" of the USD is allegedly evidence of that.

But let's keep things in perspective - relative currency values change. The current weakening of the USD is neither unusual nor extreme. The USD is in about the same place it was last year, which was, at that point, the strongest the USD had been in 20 years. In other words, out of the past 20 years, the USD today is stronger than it was in 19 of them. Source.

Keep that in mind when reading headlines about the "weakening" USD. They are discussing its strength relative to the past year, not the bigger picture of history, where it is still well above average. In the past year, the USD has been much stronger than historically.

From a stock perspective, fluctuations in the strength of the USD impacts certain investments. Last year, the weakness in many of the mega-cap giants was blamed on a stronger USD.

A strong USD is a headwind for companies that do a substantial portion of their business overseas. The reason is that money converted from other currencies to the USD is less valuable if the dollar is strong. A weaker dollar is beneficial for companies that do a lot of business internationally, and it is also beneficial for investors in non-U.S. companies.

The U.S. Remains An Economic Powerhouse

Regardless of the relative value of the USD, and even if it were to stop being the "reserve currency" of the world, the U.S. still has an incredibly powerful and influential economy.

U.S. companies are dominant on the international stage, and the voracious appetite of the U.S. consumer means that the U.S. is a highly desirable market for foreign companies to market to.

At HDO, the majority of our portfolio is U.S.-centric. This is an intentional strategy, as the risk-adjusted investment prospects for U.S. companies tend to be very attractive.

However, as investors, it is always essential to have a diversified portfolio. I like to have some international exposure at all times. With the strong USD, these holdings were underperformers last year. Today, the pendulum is swinging in the other direction, and the USD is weakening, making it an ideal time to add to our international investments.

Today, we look at a Closed-End Fund ("CEF") that invests in a combination of U.S. and non-U.S. real estate investment trusts, or REITs.

Aberdeen Global - Yield 11.9%

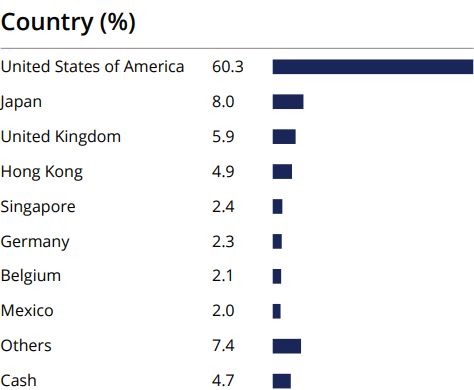

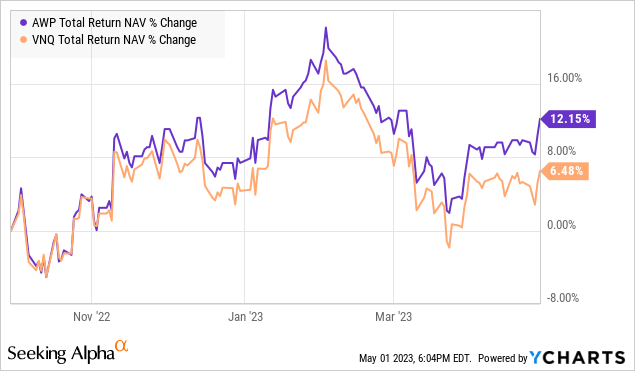

Aberdeen Global Premier Property Fund (AWP) is a CEF that invests in global REITs. With about 40% exposure to non-U.S. REITs, AWP saw its performance trailing more U.S.-focused funds last year. Source.

AWP Fact Sheet

This underperformance is likely due to the direct impacts of a strong USD and more bearish outlooks on recession risk in Europe. Since October, when the USD started weakening, AWP has outperformed Vanguard Real Estate Index Fund ETF (VNQ), a U.S. REIT index on a NAV basis.

We are bullish on REITs as we believe the market has been overestimating the headwinds caused by rising interest rates. Interest is the largest single expense for most REITs, and so the market tends to punish them when interest rates are going up.

Yet, this "rates up, REITs bad" reaction isn't backed up by the fundamentals. The most common structure for a REIT is to rely on 5-10 years of fixed-rate debt for most of their financing. REITs with quality balance sheets spent 2021 refinancing everything they could at historically-low interest rates. As a result, most REITs don't have significant variable debt or debt maturing in 2023. It won't be until 2026-2031 that most REITs will be looking at a material change in their interest rates as they are forced to refinance their debt.

Meanwhile, many REITs benefit from inflation, driving up the rent they can charge. Rent is frequently directly tied to inflation measures, and even when it isn't, rents are renegotiated as leases expire. The benefits of high inflation in 2021 and 2022 will continue to work through rental markets in favor of landlords.

In short, we expect that many REITs will report better earnings than the market expects. They will benefit from low levels of variable debt and rising earnings from properties they already own.

AWP will benefit from this and should also benefit relative to U.S. REIT funds if the USD continues to weaken.

Conclusion

The one constant in the economy is that it changes. The U.S. dollar is in constant flux versus other currencies - sometimes getting stronger and sometimes getting weaker.

For income investors like us, the market creates buying opportunities when it reacts to temporary headwinds. Interest rates going up and the dollar getting stronger have both been headwinds for AWP. Investors have sold off REITs, assuming that rising rates are negative for them, and they sold off AWP in particular because of its exposure to non-U.S. REITs. As a result, AWP is trading near 5-year lows, at about the same prices it was trading during COVID.

These negative pressures will likely let up. Interest rates are likely very close to their peak for this cycle, if not already there. Also, the dollar is starting to weaken.

Buying AWP at these rock-bottom prices now will provide us with substantial income and provide the potential for capital upside as the market warms back up to REITs and non-U.S. investments. AWP is currently part of our "model portfolio," which carries an overall yield of +9%.

If you want full access to our Model Portfolio and our current Top Picks, join us at High Dividend Opportunities for a 2-week free trial.

We are the largest income investor and retiree community on Seeking Alpha with +6000 members actively working together to make amazing retirements happen. With over 45 picks and a +9% overall yield, you can supercharge your retirement portfolio right away.

We are offering a limited-time sale get 28% off your first year. Get started!

Start Your 2-Week Free Trial Today!

This article was written by

I am a former Investment and Commercial Banker with over 35 years experience in the field. I have been advising both individuals and institutional clients on high-yield investment strategies since 1991. As author of High Dividend Opportunities, the #1 service on Seeking Alpha for the 6th year in a row.

Our unique Income Method fuels our portfolio and generates yields of +9% along side steady capital gains. We have generated 16% average annual returns for our members, so they see their portfolio's grow even while living off of their income! 7500+ members have joined us already, come and give our service a try! Join us for a 2-week free trial and get access to our model portfolio targeting 9-10% overall yield. No one needs to invest alone.

In addition to being a former Certified Public Accountant ("CPA") from the State of Arizona (License # 8693-E), I hold a BS Degree from Indiana University, Bloomington, and a Masters degree from Thunderbird School of Global Management (Arizona). I currently serve as a CEO of Aiko Capital Ltd, an investment research company incorporated in the UK. My Research and Articles have been featured on Forbes, Yahoo Finance, TheStreet, Seeking Alpha, Investing.com, ETFdailynews, NASDAQ.Com, FXEmpire, and others.

The service is supported by a large team of seasoned income authors who specialize in all sub-sectors of the high-yield space to bring you the best available opportunities. By having 6 experts on your side who invest in our own recommendations, you can count on the best advice!

In addition to myself, our experts include:

3) Philip Mause

4) PendragonY

We cover all aspects and sectors in the high yield space! For more information on “High Dividend Opportunities” please check out our landing page:

High Dividend Opportunities ('HDO') is a service by Aiko Capital Ltd, a limited company - All rights are reserved.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AWP either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Treading Softly, Beyond Saving, PendragonY, and Hidden Opportunities all are supporting contributors for High Dividend Opportunities. Any recommendation posted in this article is not indefinite. We closely monitor all of our positions. We issue Buy and Sell alerts on our recommendations, which are exclusive to our members.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.