New Fortress Energy: Market Outlook, First FLNG Project, And Risks

Summary

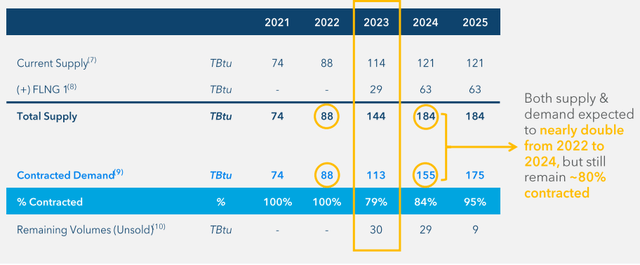

- The completion of New Fortress Energy's first FLNG unit is expected to happen soon, increasing the company's LNG supply by 29 TBtus and 63 TBtus in 2023 and 2024, respectively.

- Also, as we get close to the new winter season, the LNG market condition can become more favorable.

- With a higher LNG capacity and a more favorable market condition, NFE can achieve its adjusted EBITDA goal of $2 billion in 2023.

- The recent price drop just made NFE more opportunistic. At prices below $30 per share, the stock is a strong buy.

- However, the company's limited number of customers and lack of binding contracts to complete projects as expected can hurt NFE's cash generation potential.

sefa ozel/iStock via Getty Images

In the past three months, New Fortress Energy (NASDAQ:NFE) stock price dropped by about 25%, despite the company's growth potential, and its full-year 2022 strong financial results. For the year ended 31 December 2022, NFE reported an adjusted EBITDA of $1.1 billion, compared with $0.6 billion in 2021. The company expects its 2023 adjusted EBITDA to be about $2.0 billion, which if achieved by the end of the year, would be significantly higher than in 2022. Also, the company's cash, cash equivalents, and restricted cash increased from $264 million at the end of 2021 to $855 million at the end of 2022. The company's Fast LNG developments can be the main fuel of NFE's revenue growth in the following years. The mechanical completion of the company's first FLNG unit is expected to happen in the next few months. Thus, the operations in its first FLNG unit can start soon. The progress of the company's FLNG units means that we can expect incremental liquefaction capacity and more long-term contracts to supply LNG in the second half of 2023 and 2024. Thus, NFE's cash flow generation potential can improve considerably, increasing the company's ability to fund its FLNG units' developments, lowering the financial risks of its debt, and providing enough cash to reward the shareholders. Thus, the recent drop in the stock price has just made the investment in NFE more opportunistic than before. At prices around $30 per share, the stock is a strong buy.

2023 financial results

The company is going to report its 1Q 2023 financial results on 4 May. In the fourth quarter of 2022, NFE's actual EPS beat the consensus EPS by $0.33. For the first quarter of 2023, the consensus EPS is $0.83, and I expect the company's actual EPS in 1Q 2023 to be lower than the consensus EPS. Also, the company's EPS in the second quarter of 2023 may not be stronger than in 1Q 2023. However, in the second half of the year, driven by the operations in its first FLNG unit, NFE's earnings can jump significantly. Also, it is important to know that in the second quarter of 2023, the LNG market may become stronger, and NFE is expected to become well-positioned to benefit from better market conditions in the second half of the year.

On 17 March 2023, New Fortress Energy announced that it has entered into agreements with Weston Solution to provide 150 MW of additional fast power in Puerto Rico. Also, the company is getting close to the completion of the Barcarena and Santa Catarina terminals in Brazil. More importantly, the company's first Fast LNG unit (the first liquefier) is expected to start operations by July 2023. This business progresses can increase NFE's revenues significantly, supporting the 2023 adjusted EBITDA goal of $2.00 billion. The company's Board of Directors approved an update to NFE's dividend policy in December 2022. NFE declared a dividend of $3.00 per share in December 2022 and paid in January 2023. Higher revenue and adjusted EBITDA, especially in the second half of the year, could mean that NFE can reward its shareholders more than before.

The market and the operations

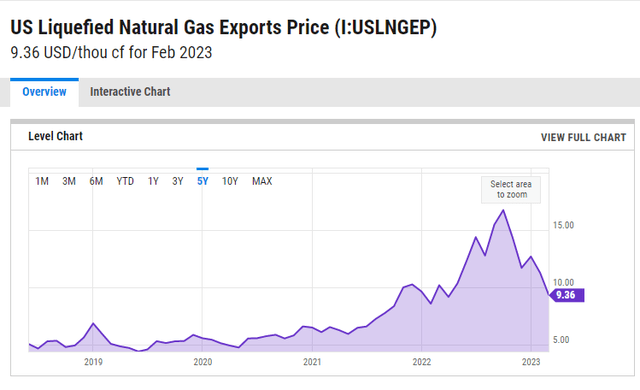

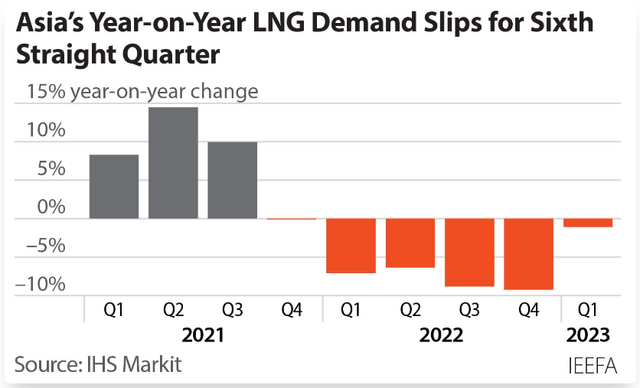

According to Figure 1, LNG prices decreased in the past two quarters. However, despite the lower prices, Asian LNG demand has not recovered yet. The higher LNG demand in South Korea, Taiwan, Thailand, and Singapore has been completely offset by lower LNG imports in Japan, China, and South Asia. According to Figure 2, Asia's year-on-year LNG demand decreased for the sixth consecutive quarter in 1Q 2023. With higher demand for LNG from China and Japan, Asia's LNG demand can increase in the second half of the year. The reopening of China can increase the country's demand for LNG. Also, as we get close to the winter season Japan's LNG imports may increase as its LNG imports follow a seasonal pattern. Moreover, as India and Pakistan's LNG purchases are price-sensitive, these countries are expected to continue their imports of LNG. In Europe, geopolitical tensions are still going on, and despite the mild temperatures last winter, European counties must get ready for the new winter season. The EU consumption of natural gas decreased by 18% in the last winter season, compared with the average of the last five years. The next winter may be colder and to avoid security of supply issues, I expect the EU to increase its LNG imports in the following months. As of March 2023, the EU gas storage filing level was 56%, which is significantly higher than 26% in March 2022. However, the EU needs to increase its gas storage filling level to 90% before October 2023.

Figure 1 - U.S. LNG exports price

Figure 2 - Asia's LNG demand

LNG prices are still significantly higher than the five-year average, and as New Fortress plans to increase its LNG supply by more than 100% to 184 TBtus from 2022 to 2024, the company can make huge profits. According to Figure 3, 79% of NFE's 2023 LNG supply is contracted to downstream customers. The company's FLNG 1 is expected to increase NFE's LNG supply by 29 TBtus in 2023. Furthermore, the demand from NFE's terminals is significant and increasing. In 2022, the demand from NFE's terminals was 40 TBtus, including 15 TBtus from the Puerto Rico terminal, 23 TBtus from the Jamaica terminal, and 2 TBtus from the Mexico terminal. In 2023, the demand from the company's terminal is expected to increase to 77 TBtus, driven by significantly higher demand from the Puerto Rico terminal. As a result of the completion of the Barcarena and Santa Catarina terminals in Brazil, combined with the increasing demand from its existing terminals, the demand through NFE's terminals is expected to increase to 175 TBtus in 2024. It is worth noting that New Fortress has 66 contracts, with a weighted average remaining term of 15 years. With higher capacity, the number of NFE's contracts increases, bringing more cash flow to the company.

As a result of the war in Ukraine, and Russia reduced the export of its natural gas to the European Union, the imports of LNG into the European countries jumped. European countries are trying to move toward more reliable and secure energy sources. However, the truth is that this is not going to happen in just a few years. Thus, I expect the European Union's LNG demand in the next few years to remain relatively high. As a result, FLNG can benefit from the favorable LNG market condition that is supported by increased demand from European countries and tight supply.

Figure 3 - NFE's LNG supply

Risks

The price of LNG is higher than the price of natural gas. The customers of NFE's LNG, including customers in developing countries, have not been traditional purchasers of natural gas. Thus, the credit risks of NFE's customers are higher than the companies that sell natural gas. The company admits that its credit procedures and policies may not be adequate to eliminate the risks of nonpayment from its customers. Also, the company's expanding operations are subject to various construction risks, as the company may involve with commercial and governmental negotiations, engineering and environmental problems, and construction accidents. Furthermore, the company has not yet entered into binding contracts for the construction, development, and operation of all of its facilities and assets. We cannot be sure that New Fortress can enter into binding contracts that are favorable. Thus, the company may not be able to complete its projects as they are planned.

Besides, even with entering into favorable contracts, and the completion of its projects as expected, we cannot be sure that LNG will remain a competitive source of energy in the markets that NFE operates. A large part of NFE's revenue is linked to its operations in the Caribbean and Latin America. NFE must be able to deliver LNG to its customers at costs that are lower than other energy sources. Thus, the failure of LNG to be a competitive source of energy in the Caribbean and Latin America may limit the company's ability to expand its operations and stick to its plans.

It is worth noting that NFE is relying on a limited number of customers, and its contracts with its customers are subject to termination under certain circumstances. In 2022, NFE's revenue from two of its customers accounted for 42% of its total revenue. Losing any of its customers can hurt the company's cash position in a significant way, as New Fortress may not be able to enter into new contracts on favorable terms. To mitigate these risks, the company needs to expand its customers and get into more long-term and big contracts. For the next few years, NFE has the opportunity to do so. However, you should know that a wave of new LNG export capacity is expected to come online after 2025, which can decrease NFE's competitiveness.

Summary

In the second half of 2023, NFE's financial results are expected to be significantly stronger than in the first half, as the LNG market condition may become more favorable, and the completion of New Fortress Energy's first FLNG unit increases the company's LNG capacity. The company can achieve its adjusted EBITDA goal of $2 billion in 2023, nearly double YoY, as its LNG supply can increase from 88 TBtus in 2022 to 144 TBtus in 2023. The stock is a strong buy.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.