USO Plunges For Worst 2-Day Drop Since June 2022, Oil Features Bearish Risks

Summary

- Oil prices have given back all of their gains (and then some) following a production cut announcement by OPEC+ last month.

- The USO oil-tracking ETF fell 9% between Tuesday and Wednesday, even with a weak U.S. dollar.

- While the near-term supply/demand balance shows oversupply, that will likely reverse - but not until later in 2023.

imaginima

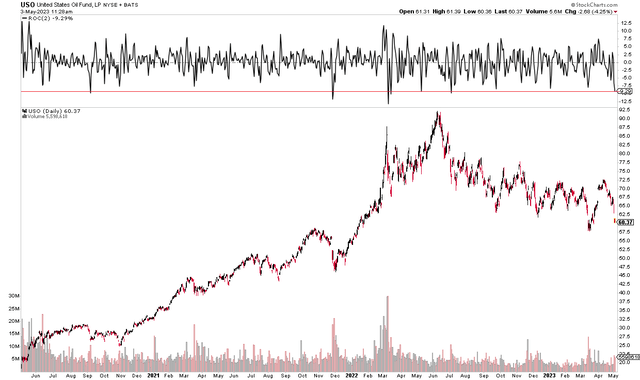

The hard-landing crowd has plenty of ammo these days. Amid renewed regional banking contagion and several contractionary manufacturing indicators, crude oil prices have cratered following a short-term spike in April following a surprise production cut orchestrated by OPEC+. The NYSEARCA:USO oil ETF plunged 9% between Tuesday and Wednesday - the worst back-to-back slide since June 2022.

I'm bearish on oil and the USO ETF based on near-term technical risks and a bearish current supply/demand balance.

USO ETF: Worst 2-Day Decline Since June 2022

Stockcharts.com

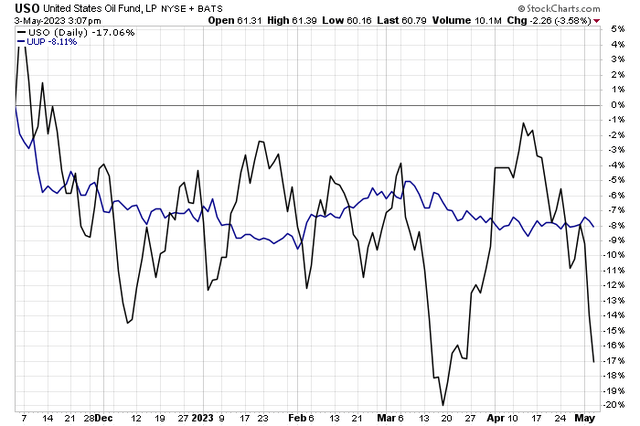

Fears of an imminent slowdown in global growth - despite China's reopening - have taken the prompt month of WTI down from above $80 just a few weeks ago to under $68 for a time earlier this week. What's more, a weakening U.S. dollar Index has not offered support for oil - that's a bearish tell, in my opinion. The Fed's latest rate hike is another stab at the domestic growth outlook.

Oil Weak Even With a Soft USD

Stockcharts.com

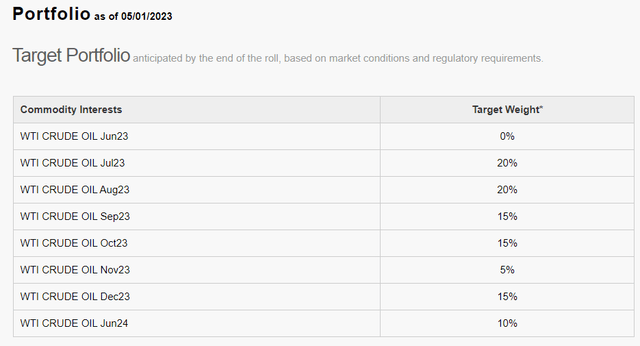

Let's review where things stand with perhaps the most popular "black gold" play: USO. For background, the United States Oil Fund's objective is for the daily changes, in percentage terms, of its shares' net asset value - NAV - to reflect the daily changes, in percentage terms, of the spot price of light sweet crude oil delivered to Cushing, Oklahoma, as measured by the daily changes in the Benchmark Oil Futures Contract, according to the issuer.

USO Holdings: Exposure to Oil Contracts within One Year of Expiration

USCF Investments

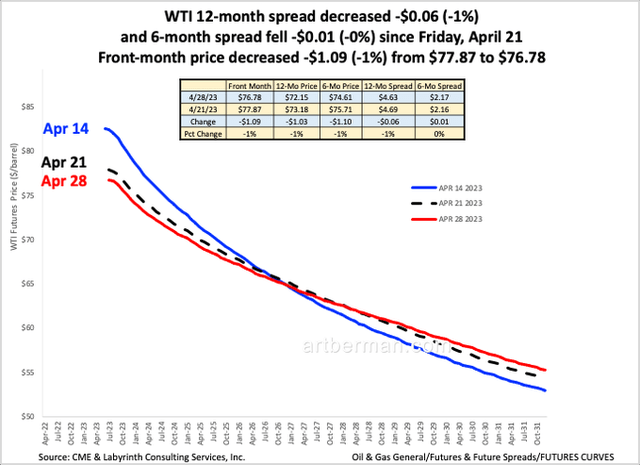

Importantly for prospective investors, USO is susceptible to "roll risk" - that's the notion that there is the possibility of loss due to the issuer selling out of near-dated oil futures contracts to later-dated contracts. During periods of "contango," this risk is seen - and that's a common term structure of oil futures contracts. When oil is in backwardation, however, then there's an inherent upside since the issuer continuously buys cheap contracts and sells them later in the month when the same contract is higher in price.

Oil Term Structure: Backwardation

Art Berman

With that risk acknowledged, how do the oil fundamentals look? There are many variables at play, but the bottom line is that the near-term outlook is skewed bearish given the U.S. slowdown, but I expect the mood to improve by late 2023. A key risk to that thesis is if the U.S. experiences a protracted economic dip.

According to Goldman Sachs, the current bearish net oversupply is likely to reverse back to a bullish undersupply. Should that happen, the oil futures curve would hypothetically turn into great backwardation. Moreover, if the U.S. emerges from recession next year, then that demand uptick would put upward price pressure on the front end of the WTI curve, helping USO.

Bearish Oversupply Currently, Bullish Undersupply Later in 2023

Goldman Sachs

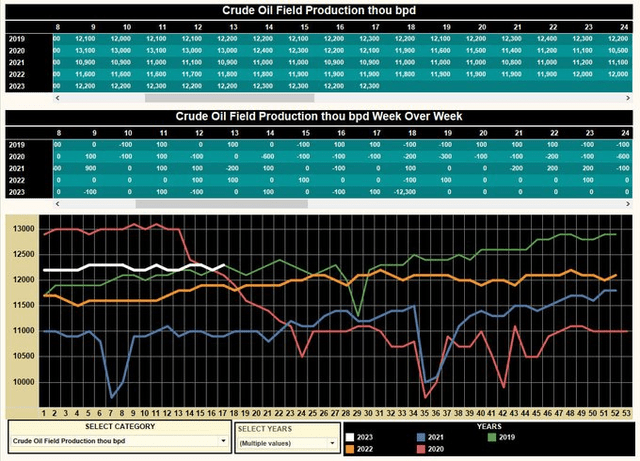

On the supply front, U.S. oil supplies are kept strong care of ample field production. The graph below illustrates that production is at very high levels given the time of year.

Multi-Year High in Crude Oil Field Production for Week 18

Ronh999

The Technical Take

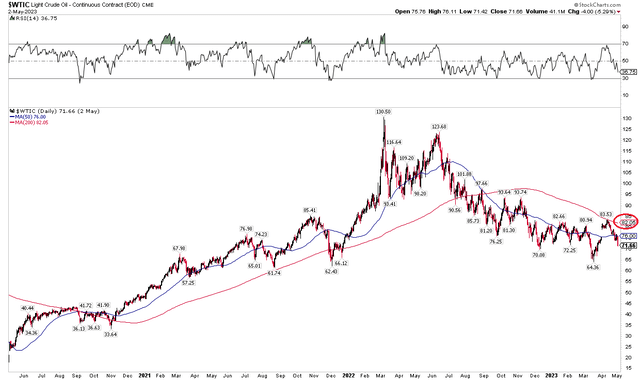

So, here we are back in the high $60s on oil. Notice in the chart below that WTI is back near a key support range from $62 to $65, so I would expect dip-buyers to enter the picture there. Resistance is seen in the low $80s.

WTI: Support from Previous Pivot Spots in the Low/Mid-$60s

TradingView

The low $80s also is where the falling 200-day moving average comes into play. A negatively sloped long-term trend indicator like that tells me the bears are in control. Thus, a few dollars lower with the current bearish momentum appears likely.

WTI: Bearish Downward-Sloping 200-Day Moving Average, Resistance in April

Stockcharts.com

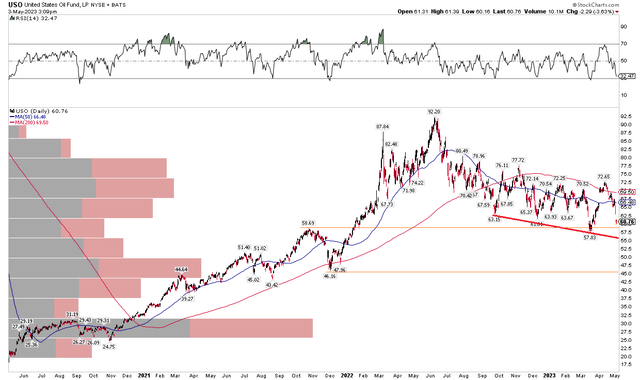

As far as USO goes, my technical opinion is to follow what the underlying commodity does, then translate that into important levels on the ETF. I notice a downtrend support line suggesting $55 may be tagged before long. Under that, the late 2021 low is near $45 - that would be a drop into the low to mid-$50s on WTI. That could happen if WTI falls below $61.

USO: Downtrend Support Line Likely to be Tested

Stockcharts.com

The Bottom Line

I expect more weakness in USO. A bearish oil oversupply at the moment is paired with downside momentum on the chart of WTI. The bulls had their chance to sustain elevated prices last month, but they dropped the ball. A break under $61 (on WTI) would be particularly concerning.

For USO, key price levels to watch are $55 and potential longer-term support near $45. Risks to my bearish call include further draws from storage and any additional unexpected OPEC+ supply cuts. On the demand side, continued growth out of China would tighten the supply/demand balance.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.