Vinci Partners: Private Equity Potential In Latin America

Summary

- Vinci Partners is a Brazilian asset manager that operates in eight segments, including private equity, public equities, and investment products and solutions.

- The private markets segment, which includes private equity and other private investments, generates the majority of Vinci Partners' revenue and income.

- Vinci Partner's high returns on capital, low valuation, insider ownership, and growth potential in private equity make it an attractive investment opportunity.

Hammad Khan

Introduction

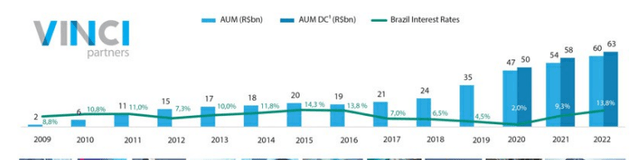

Vinci Partners (NASDAQ:VINP) is a Brazilian asset manager founded in 2009. As of Q4 2022, the company had R$63 billion (Reals) in AUM (Assets Under Management) or around $12 billion US. They operate in 8 segments with the main ones being private equity, public equities, investment products, and solutions. The private markets segment which includes private equity and other private investments makes up the majority of the revenue and income of the business and is the most interesting part of the business for me. The prospects for private equity are bright which I went over in my article on another private equity firm Onex Corporation (ONEX:CA). In Latin America, private equity has the potential to be even more appealing due to the under-penetration in this part of the world. What makes Vinci an attractive investment is their high returns on capital, ultra-cheap valuation, high insider ownership, and growth potential in private equity.

Currency Blurb

Vinci is a Brazilian company so it transacts in Reals. As a US-based investor, the exchange rate between the US dollar and the Real may affect my returns. The three biggest things affecting exchange rates are the valuation, trade surplus, and interest rate differentials of the respective countries. I base this on the book Currency Strategy by Callum Henderson. This is a pretty good book if you want to understand currencies.

The last decade started with the Real being extremely overvalued against the Dollar and between 2010 to 2020 the Real performed very poorly. Going from 1.9 Reals to 1 US Dollar to 4 Reals to 1 US Dollar. Which is a 10% CAGR, not too good for a currency. As of now, the currency is at around 5 Reals to 1 US Dollar.

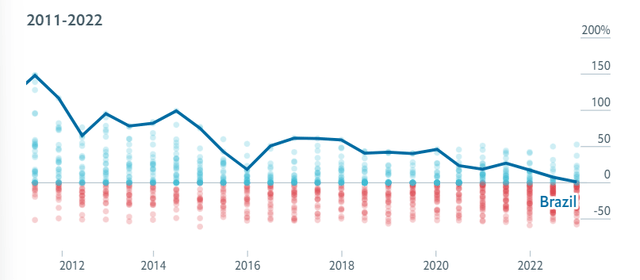

The overvaluation is now over as the Big Mac index only indicating a 1.1% overvaluation compared to the Dollar vs close to a 150% overvaluation back in 2012. Another positive is the interest rate differential, as the Brazilian 10YR government bond is at 12% vs the US yield of 3.5% giving a big reason for people to switch their US Dollars to Reals for that extra yield.

Brazil's Real Overvaluation Throughout Time

Trade wise though Brazil's current account surplus has been mostly negative since around 2008 with only short bouts of positive surpluses when commodity prices get going. If the current commodity price inflation we have experienced in recent years can sustain Brazil could tip into a current account surplus and the Real could begin a meaningful depreciation against the dollar. However, considering in my other article for Good Times Restaurants I'm actively betting against inflation and commodity prices due to the supply chain mostly being fixed by now. My base case on the Brazilian Real is negative. I don't expect the next 10 years to be as bad as 2010 to 2020 with a 10% CAGR against the US Dollar but I do expect a 0% to 5% appreciation of the Real against the US Dollar mostly due to trade imbalance.

Marco

I went over the growing PE (private equity) market in my last article on a PE company Onex so I'll only summarize it here.

Private Equity and other alternative asset management industries are expanding due to various factors, including higher returns and lower volatility than public markets.

The total assets under management (AUM) in the alternative asset space, including private equity, debt, real estate, and infrastructure, reached $45 trillion by the end of 2021.

AUM growth rates over the next 5 years are projected to range from 5% CAGR to nearly 15% CAGR.

The Private Equity industry is highly fragmented, with over 11,000 firms, and the top 25 players only control 2% of AUM.

I did find some interesting tidbits about the Latin American PE market which makes Vinci a little more attractive.

From 2009 to 2019 private market AUM in Latin America grew 23% CAGR vs 11% for the entire market.

Low penetration of private markets' asset base to GDP in comparison to other more mature markets. For example, private market assets represent only 2.4% of the Brazilian GDP compared to an average of 8.3% of GDP globally

In conclusion, the Private Equity and alternative asset management industries are expanding due to numerous structural tailwinds. And Latin America should grow even faster.

Business

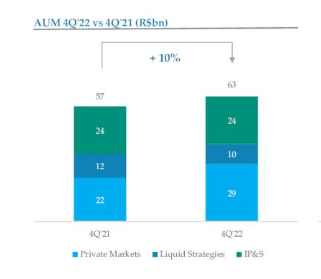

Vinci manages R$63B of AUM or around $12B as of the end of 2022. R$29B of that is in private markets, R$10B in liquid strategies, and R$24B in investment products and solutions.

Source: 2022 Presentation Vinci

This AUM has grown at a 22% CAGR from 2010 in Real's and a still impressive 12% CAGR in USD terms. Between 2018-2022 AUM growth was 25% CAGR vs 16% for the Brazilian alternatives market, so Vinci is gaining share. That growth in AUM is even more impressive when you consider that between 2014 to 2016 Brazil went through one of their worst economic downturns in history. Which they still haven't really recovered from.

Vinci serves a diverse set of clients including institutional both local and international, high-net-worth individuals, family offices, and retail. As of the end of 2022, 34% of our AUM came from local institutional clients followed by 24% from high-net-worth individuals, 23% from institutional offshore clients, and the remainder from public market vehicles and retail clients. Vinci has no large single-client concentration with the largest client representing only 3% of fees. 51% of AUM is committed for 5 or more years.

IP&S

The Investment products and solutions segment or IP&S segment offers clients tailor-made investment solutions. From what I can surmise it allows clients to invest in everything from fixed income, foreign exchange currency, public equities, derivatives, and outside of Brazil. It also offers to do the client's asset allocation and risk management. Basically, this segment offers whatever a client could want and also takes over all the decisions for them. It seems to be a pretty fast-growing segment as AUM has grown from R$8B in 2018 to R$24B in 2022. The average management fee is only .37% as of 2022.

Liquid Strategies

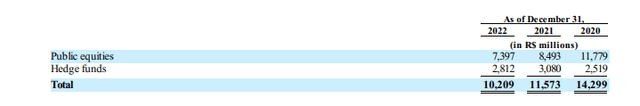

The liquid strategies division comprises Vinci's public equities and hedge funds. As of 2022, the average fee charged for these services is 0.79%. The segment's AUM has increased from R$4.8 billion in 2018 to R$10.2 billion in 2022, indicating strong growth. However, recent data shows that growth has slowed, and the segment's AUM has actually decreased from R$14.2 billion in 2020 to R$10.2 billion in 2022. This underperformance makes the liquid strategies unit Vinci's weakest division, albeit the smallest in terms of fee-related earnings, making it the least significant area of Vinci's business.

This segment should get going if Brazil gets sustained stock market performance. The Brazilian Stock market as measured by Franklin Brazil ETF (FLBR) is still down 40% from 2019. Though that's also partly due to the currency as FLBR is in USD.

Private Markets

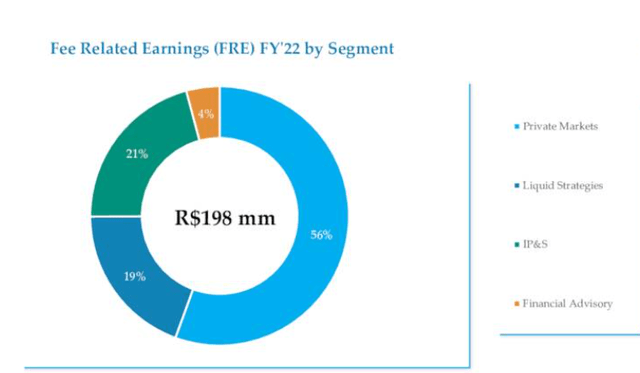

Vinci's most important segment is its Private markets segment which has grown from R$10B in 2018 to R$28B in 2022. Management believes the private markets segment will be the main contributor to growth in the long term. Private markets include Private Equity, Real Estate, Credit, and Infrastructure. The Management fees generated from the private markets segment represent 56% of FRE, compared to 19% for liquid strategies, and 21% for IP&S. The average fee for the segment comes in at 0.89%.

Source: 2022 Q4 Presentation Vinci

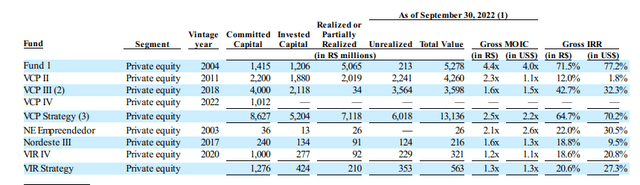

Vinci Private equity funds have historically performed quite impressively. Funds under the VCP and VIR Strategies have generated an average annual gross IRR of 64.7% and 20.6% respectively (All IRRs in USD). This fund performance compares favorably to Vinci's main publicly traded peer Patria Investments (PAX) which has a Net IRR of 13% averaged over all funds (Vinci is gross IRR vs Patria is a net, I assume that the difference is greater than the fee). Even Vinci's Infrastructure funds have performed quite well with their latest one VIAS achieving an 18.8% gross IRR.

Adding to their private markets segment in 2022 Vinci acquired SPS, a smaller private equity manager which had R$2.1B in AUM. Over the last three funds, Gross IRR has averaged 27.6% which is quite good. All this good performance will more than likely help Vinci out when they raise their next funds.

In terms of growth 2023 will be a major year for fundraising. Vinci is planning several fundraisers including VICC which is an infrastructure fund, a credit fund, VCP IV, VRE V, and a new Vinci SPS fund. Overall Vinci is targeting over R$10B in fundraising for 2023 between these funds.

New Segment

In Q4 2022 Vinci announced they were approved to operate life insurance and open-ended pension plans in Brazil. With this announcement, Vinci will launch a new segment VRS or Vinci Retirement Services which they will begin fundraising for in 2023. The VRS segment will have the potential to generate revenue from two sources: fee revenue from managing assets and potential income from insurance underwriting. This represents a great growth opportunity with significant AUM potential. The bigger PE firms like Blackstone, Apollo, and KKR have all acquired insurance operations due to this opportunity and it looks like Vinci will follow in their footsteps.

Financials

In terms of financials Vinci has a strong balance sheet and high returns on capital. Revenue though seemed to go the wrong way this year.

Vinci's balance sheet is very pristine. Most of the assets are cash which was acquired during the IPO. Debt is very minimal which is attractive in the current interest rate environment. The cash is earmarked mostly for co-investment in Vinci's own funds promoting organic growth. So far, the company has committed R$309 million into private market funds. But Vinci has also said they are open to acquisitions and especially now that multiples in the PE space have contracted and fundraising actually declined in 2022 for the whole PE market.

2022 Vinci Condensed Balance Sheet (In R$) | |

Cash and Equivalents | 1.4B |

Total Assets | 1.8B |

Total Liabilities | .4B |

Equity to Shareholders | 1.4B |

Equity per share in USD | $5.0 |

Source: Author Created table, data from Q4 2022 Vinci Presentation

Vinci like other asset managers are asset-light businesses that tend to have high returns on capital. Netting out the cash the return on invested capital is clocking in at the 90% range.

Return on invested capital is a financial performance ratio that measures how efficiently a company uses its capital to generate profits. Most companies are lucky to have a 10% ROIC so 90% is very good.

ROIC Calculation

Year | 2022 | 2021 |

Total Assets | 1.77B | 1.76B |

Cash | 1.38B | 1.40B |

Current Liabilities | .155B | .14B |

Invested Capital | .235B | .22B |

Net Income | .219B | .208B |

ROIC | 93% | 94% |

Source: Author Created table, data from Q4 2022 Vinci Presentation

Revenue was down in 2022 mostly due to a large reduction in advisory fees which is unrelated to AUM. EX advisory fees revenue was up 3%. Revenue is heavily tied to AUM, as AUM grows so does revenue.

Year | 2022 | 2021 | 2020 | 2019 |

Revenue (In R$) | 408m | 466m | 340m | 297m |

Source: Author Created table, data from Vinci annual reports.

Overall, Vinci demonstrates a strong financial position with a pristine balance sheet, minimal debt, and a high return on invested capital, surpassing most companies. Additionally, the company has a significant amount of cash earmarked for co-investment, promoting organic growth and potential acquisitions. While revenue declined in 2022 due to a reduction in advisory fees, the company's revenue growth is closely tied to AUM, and with the expanding private equity market in Latin America, Vinci's prospects appear promising.

Management

Vinci is still led by its founding members as Gilberto Sayão da Silva, Alessandro Monteiro Morgado Horta, and Paulo Fernando Carvalho de Oliveira all remain in top management roles. Gilberto is the Chairman of the board Alessandro is the CEO and Fernando is the Director.

Insiders and employees own a large percentage of the company. Management alone owns around 50% of the company with employees owning about 25%. Between the three founding members I listed above they own 44% of the company. With these large ownership stakes management is well incentivized to make the company as well as the stock work long term.

In terms of compensation Vinci does not disclose specifics as it relates to how much compensation is variable and fixed and what the variable compensation is tied to. However, Vinci does disclose total management compensation which was R$16.8 million and R$21.0 million in 2022 and 2021. Compensation dropped in 2022 which coincided with business performance which is what you want to see. If compensation increases while business performance decreases then that's usually a red flag.

Vinci's compensation in 2022 was around 3.2M in USD. Comparing Vinci's compensation to its peer Patria which had executive compensation of 11.2M. Patria is around 1.5 times bigger than Vinci so it does make sense for Patria to be paid more. But looking at this in Vinci's context, even adjusting for size, Vinci's management seems to be paying themselves reasonably.

Management for Vinci is founder-led with a large ownership stake in the company. Also, Vinci management doesn't seem to be overpaying themselves and if you look at past fund performance they seem to know what they're doing. So I think Vinci's management is quite good.

Valuation

In some of my past articles, I did scenario analysis trying to forecast the future. But in Vinci's case, Vinci is so cheap I didn't bother.

The company is currently trading at $8 a share. As mentioned earlier Vinci's book value is $5 a share which comprises mostly cash. Subtracting the book value from the share price gets you around $3 a share. Vinci's EPS is around .70 cents a share giving Vinci a multiple of 4 times earnings which is insanely cheap for a capital-light asset manager, with high returns on capital growing at over a 10% CAGR. Brookfield Asset Management (BAM) trades at 10-15 multiple and even Patria, Vinci's closest peer trades at around 11 times earnings ex-book.

The market seems to be saying that Vinci's cash is worth zero. But as mentioned earlier most of the cash will be used to fund organic growth through co-investment in Vinci's own funds which have had a great performance.

Another reason for the undervaluation is Vinci isn't a pure private equity manager. Over half of AUM is in public markets and IP&S which is mostly public market exposure. But most of Vinci's fee income comes from the private markets over 50% which would mean you're paying 8 times the PE segment earnings if you assume the other segments are worth zero. But those segments are growing and highly profitable.

So in summary it's just too damn cheap. Vinci is also paying close to a 9% dividend and is buying back stock.

Risks

- Lockups: Vinci has a significant portion of AUM with no lockup. In Vinci's 2022 Annual Report Vinci mentioned that 51% of their AUM is locked up for 5+ years. That leaves 49% of AUM that has no formal lockup. Most of this is in the IP&S segment. The risk here is that clients can pull out capital at any time which would be big for fees if they all did it at the same time.

Emerging Market Risk: Brazil's economy is mostly commodities which makes their economy much more cyclical. Between 1996 and 2019 Brazil had 6 recessions to the US's three. On top of that the currency is very volatile and usually appreciates against the dollar. Not to mention that Brazil has had 8 other failed currencies before the Real. Vinci as a Brazilian company is subject to these conditions. Vinci as mentioned above has been able to grow since its founding in USD terms through the 2010s which included one of Brazil's worst recessions. So I'm confident Vinci can manage.

Performance Risk: The goal of an asset manager is to collect more assets to charge fees to. If the performance of the asset manager's fund dips too low Vinci clients may pull money out instead of put money in. The performance of Vinci funds will be key to watch.

Interest Rates: Private Equity competes with numerous other asset classes for investor dollars. If interest rates rise investors may keep their money in bonds rather than give it to Vinci. In the last five years, the Brazilian SELIC Rate fell from 14.25% to as low as 2.0% and is now back to 12.75% as of the end of 2022. The high current interest rates in Brazil may hurt fundraising in the short term. But in the long run interest rate should normalize.

Conclusion

In conclusion, the prospects for private equity are bright, particularly in Latin America where there is significant potential for growth. What makes Vinci an attractive investment is their impressive returns on capital, low valuation, high insider ownership, and growth potential in private equity. Overall, Vinci Partners presents a compelling investment opportunity with significant potential for growth in the future.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of VINP either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.