Ares Capital: Lowered Leverage On Purpose And Special Dividends Remain Likely

Summary

- Ares lowered its leverage between the December and March quarters.

- The lower leverage materially affected the March results, slightly lowering quarter-over-quarter results.

- The March results, coupled with prior quarterly results, places management in a situation to decide on paying tax or issuing special dividends.

- A special dividend by the end of the September quarter might equal $0.05 a quarter or more.

- Ares' management is playing the future with extreme caution.

AlexSava/E+ via Getty Images

Analysts and news headlines voiced out a common misguided narrative concerning Ares Capital (NASDAQ:ARCC) latest earning report, claiming it missed. The truth is that the professionals missed. During the January conference call, Ares' management informed investors and analysts that the company would de-lever during the March quarter. It kept its promise and dropped leverage significantly. Mountain climbers must leverage when climbing sheer rock faces and find ways to de-lever on the way down. It is clear that Ares feels a strong need to de-lever. The more important question might be why? Grab your helmet, pins and rope and let's climb up the face to see what Ares thinks. We should meet it on its way down.

Quarterly Results

The company reported the following for the March quarter:

- Core earnings of $0.57.

- NAVII average per share of $0.60.

- NAV of $18.45.

- Announced a dividend unchanged at $0.48.

- A weighted average yield of 10.8% up 0.3% from the previous quarter.

- Leverage of 1.09, down significantly from 1.26 in the December quarter.

The company experienced one of the lowest transaction rates in the last 5 years. Kipp deVeer, Ares' CEO, also, added,

"Both our core and GAAP earnings were well in excess of our regular quarterly dividend of $0.48 per share, which led to modest growth in NAV per share to $18.45. We're pleased with the results this quarter, especially when considering the relatively slow transaction environment."

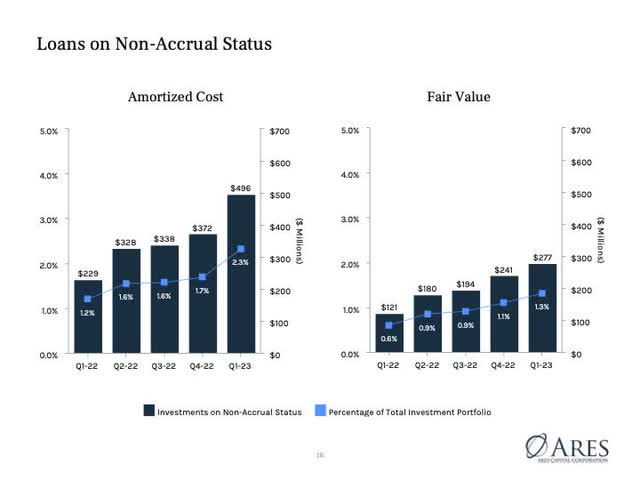

One important trend taken from one of the presentation slides, shows a very real increase in non-accruals from 1.75% to 3.5% during the last 5 quarters.

Ares

When considering the significant drop in activity primarily due to bank disruptions, Ares performed excellently in the March quarter. Increasing non-accrual rates should be monitored.

Management's Conservatism Trumps Strong Results

At the end of the prepared remarks, management restated its concern about coming "potential for economic challenges. . ." Continuing, deVeer answered a question from Casey Alexander, of Compass Point Research & Trading, about the significant drop in leverage, "I'd say, number one, we did have a stated objective to deleverage the balance sheet modestly, which we accomplished, and that's 1 way to do it."

The company has taken and is taking many steps for this preparation including: lowering leverage and maintaining constant dialogs with its portfolio. They believe that their experience in managing through unsettling periods offers investors a level of safety and confidence. In our view, this is perhaps the most important takeaway from the conference call.

Is a Special Coming?

First, let's dig in, pound those pins, attach the safety ropes and head upward, for better understanding of possible June quarter yields starting with a note from management during the last conference:

"Our 2022 earnings significantly benefited from the increase in market interest rates driving a 17% increase in net interest and dividend income per share as compared to 2021. The growth in these recurring earnings roughly offset the decline in capital structuring fees in 2022 relative to the higher fees earned during the more active 2021."

Clearly, Ares is benefiting from the higher interest rates. Next, we included a simple table outlining paid vs. earnings.

| Carryover | Mar. 23 | Dec. 22 | Sept. 22 | June 22 | Mar. 22 | Totals |

| Core Difference | $0.09 | $0.12 | $0.04 | $0.01 | -$0.03 | $0.23 |

| NAVII Difference | $0.12 | $0.17 | $0.11 | $0.07 | -$0.04 | $0.43 |

| Dividends Paid | $0.48 | $0.51 | $0.46 | $0.45 | $0.45 | $2.35 * |

* Spillover over the last five quarters equals 10% based on Core and 20% based NAVII.

Continuing, from our Seeking Alpha article, Ares Capital Blew Out Earnings,

"But first, from the prepared remarks, Penelope Roll, company CFO, stated, "We recognized that we had a strong level of core earnings for the year, which far outpaced the total dividends we paid." Ares rolled over $675 million in spillover."

With Ares share count at 545 million, the $675 million carryover appears to us as the total unpaid dividend slash fund accumulated for years. That slush fund exists to hold steady dividends during more difficult times, obviously a circumstance management is now much concerned with. What is also evident is that dividend cuts aren't either in management's view.

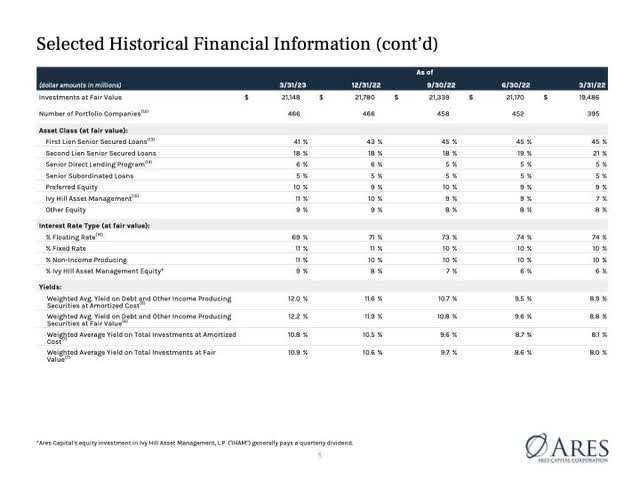

An estimate for June continues our process. Two important factors from the next two slides shows investors that two tailwinds likely influencing the coming quarters results exist beginning with increased rates lifting the overall yield primarily from increases in the floating loans followed with investment turnover rates.

Ares

In the past three quarters, the yield jumped from 9.7% to 10.9%. With the latest Fed rate increase in March, and one likely in May, an average yield at or above 11% is coming. Each 0.1% equals a 1% improvement in cash generation.

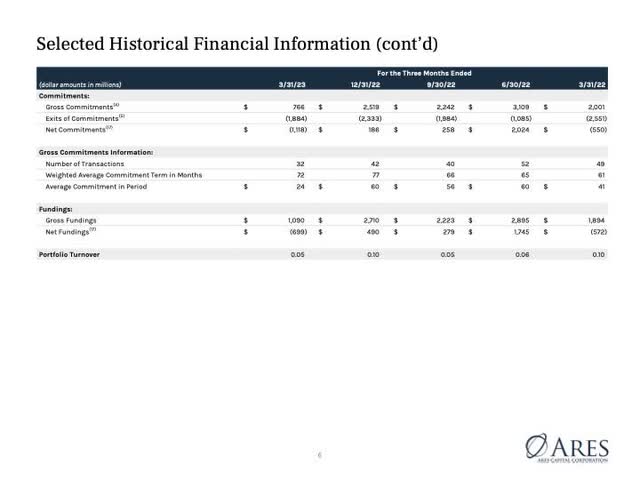

The next slide, in the last line, shows the turnover rate at approximately 7% per quarter.

Ares

With the two tailwinds certain, a last parameter, leverage, is still, in our view, undecided, but it will be most likely slightly higher with leverage significantly below the target of 1.2. Again, we believe that earnings for June will be between the last two quarters and likely closer to December. Included below is a table showing possible results.

| Carryover | June 23 * | Mar. 23 | Dec. 22 | Sept. 22 | June 22 | Totals |

| Core Difference | $0.11 | $0.09 | $0.12 | $0.04 | $0.01 | $0.37 |

| NAVII Difference | $0.15 | $0.12 | $0.17 | $0.11 | $0.07 | $0.62 |

| Dividends Paid | $0.48 | $0.48 | $0.51 | $0.46 | $0.45 | $2.38 |

* Our estimate.

Estimated differences for the two measures equal 16% and 26% respectively. We should note that our experience with excesses suggests most managers base specials off of NAVII not core. Nevertheless, in either case, one more quarter will change the excess significantly. The core difference after September is likely to be 20% higher than the dividend paid creating approximately $0.20 excess over the customary 10% pay taxes or pay dividend levels.

Still the company remains conservative and, in our view, it will not make a decision about increasing dividends until forced. Penni Roll, Ares' CFO, stated,

"We continue to believe that having a healthy level of spillover income is beneficial to the long-term stability of our dividend. We will continue to monitor our undistributed earnings and balance these levels against prudent capital management considerations.

Regardless of Ares conservatism, it has in excess of a dollar in rollover earnings and at least $0.20 more coming by September. In our view, at least 4-5 cent extras per quarter are coming later in the year. We welcome any comments providing clarity with the differences between core and NAVII.

Stocks Head Scratching Reaction

Although, it has since traded up, the stock traded off several percent the day after earnings. We have to admit, this left us scratching our head. It made no sense with the price less than the NAV at $18.45 and a safe yield above 10%

Risks

Risks begin with management's view. Obviously, Ares strongly believes that an unsettled lending and performance environment for its portfolio are more than likely and is preparing. Its plan includes preparation including more than a $1 of unpaid earnings collected over the years. In our view, we also are worried at some level with regard to the steady increase in non-accruals. It has been steady. Ares' model employs 2nd liens, an approach that adds non-accrual risk. But Ares' conservative approach coupled with a lot of stashed cash equals a buy in today's trading range. The company is paying $1.90 in yearly dividends making it a buy at any price under $19 with its 10% or greater yield. The company's purposeful drop in leverage seems to offer investors a buying bargain while adding to the investment safety.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ARCC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.